The post Chainlink (LINK) Consolidates Near $14: Is a Breakout on the Horizon? appeared first on Coinpedia Fintech News

Chainlink (LINK), a leader in decentralized oracle networks, is currently witnessing a crucial consolidation phase. With major institutional integrations and on-chain accumulation by whales, LINK appears poised for a significant move. As the crypto market regains traction, all eyes are on Chainlink’s technical structure and the expanding use cases around its CCIP protocol.

Chainlink Ecosystem Growth Accelerates with Institutional Adoption

Chainlink has been one of the major DeFi platforms and is called the oracle of the dApps, which connects the chains with the real world. Its utility continues to expand across DeFi and institutional-grade platforms.

- CCIP Integrations: Leading projects like Maple, Spiko, and Matrixdock are leveraging Chainlink CCIP for secure, compliant cross-chain asset movement.

- Compliance Engine Launch: In collaboration with Apex Group and GLEIF, Chainlink introduced the Automated Compliance Engine (ACE), boosting real-world asset tokenization infrastructure.

- Major Partnerships: Projects like Coinbase’s “Project Diamond” and Mastercard are tapping Chainlink’s secure data feeds and infrastructure for tokenized settlements and card payments.

These developments reinforce Chainlink’s role as a backbone of decentralized finance and institutional blockchain infrastructure.

LINK Price Analysis: Consolidation Near Critical Resistance

LINK price is trading in a narrow range between $13.50 and $14.10, forming a symmetrical triangle pattern on the charts. This pattern often precedes major breakouts, either to the upside or downside. A decisive move above $14.10 could set the stage for a rally toward $15.60 and even $17.30, while a failure to hold support at $13.10–$13.30 could expose downside risk to $12.

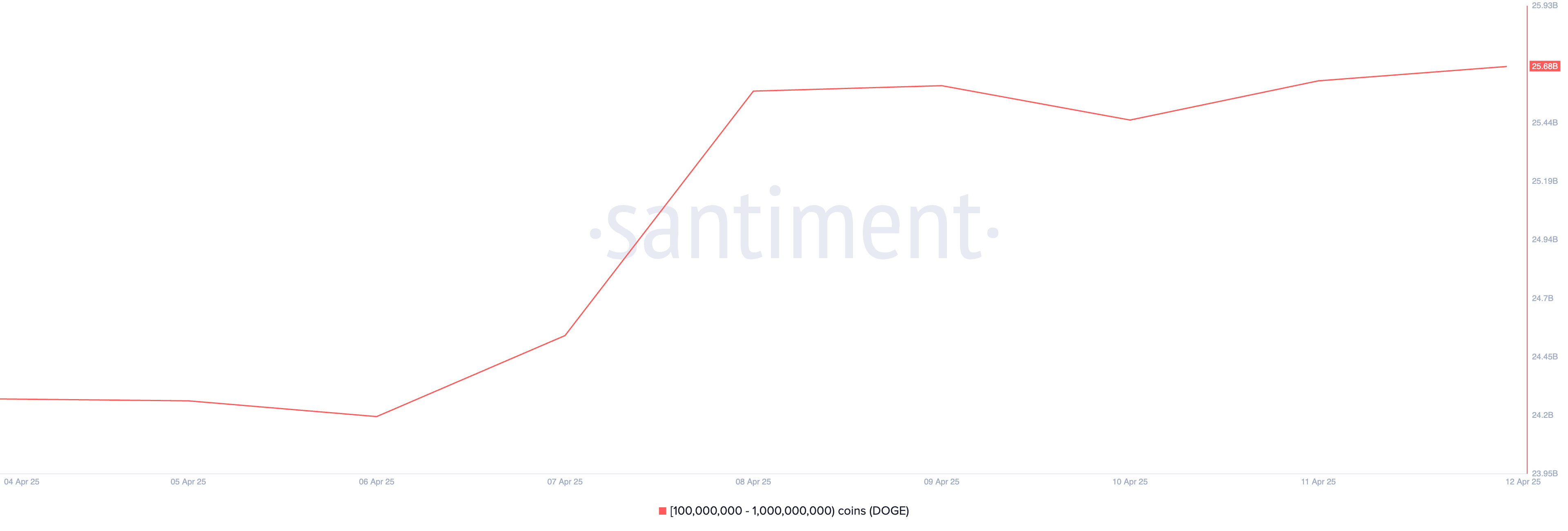

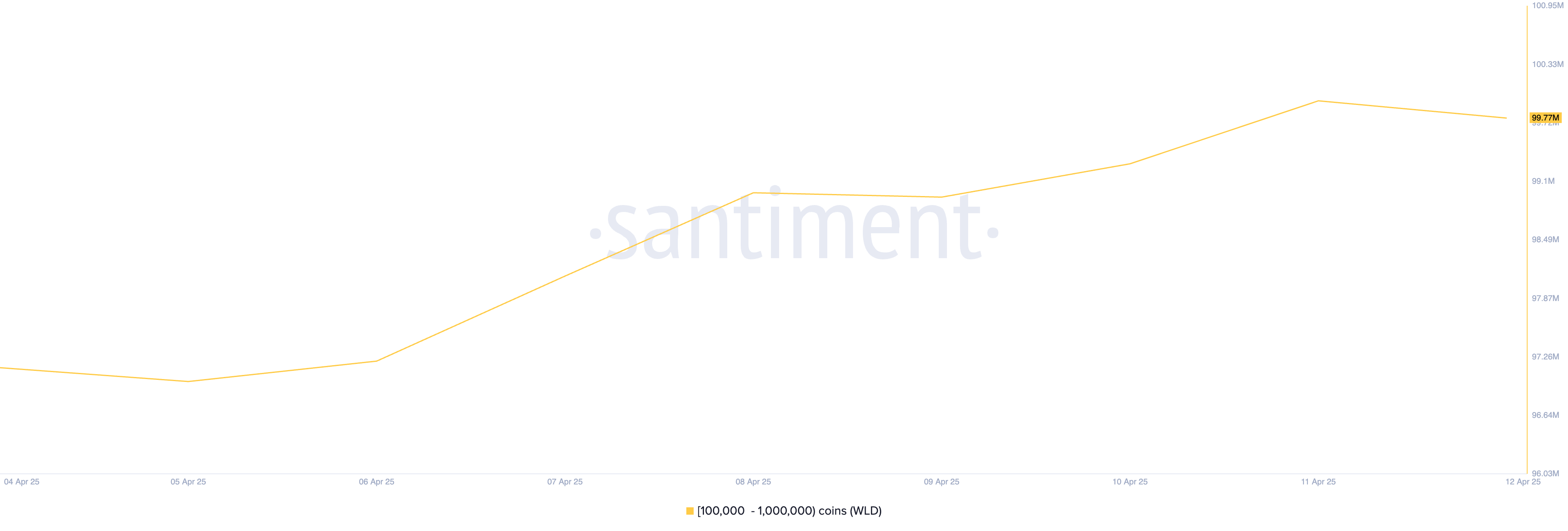

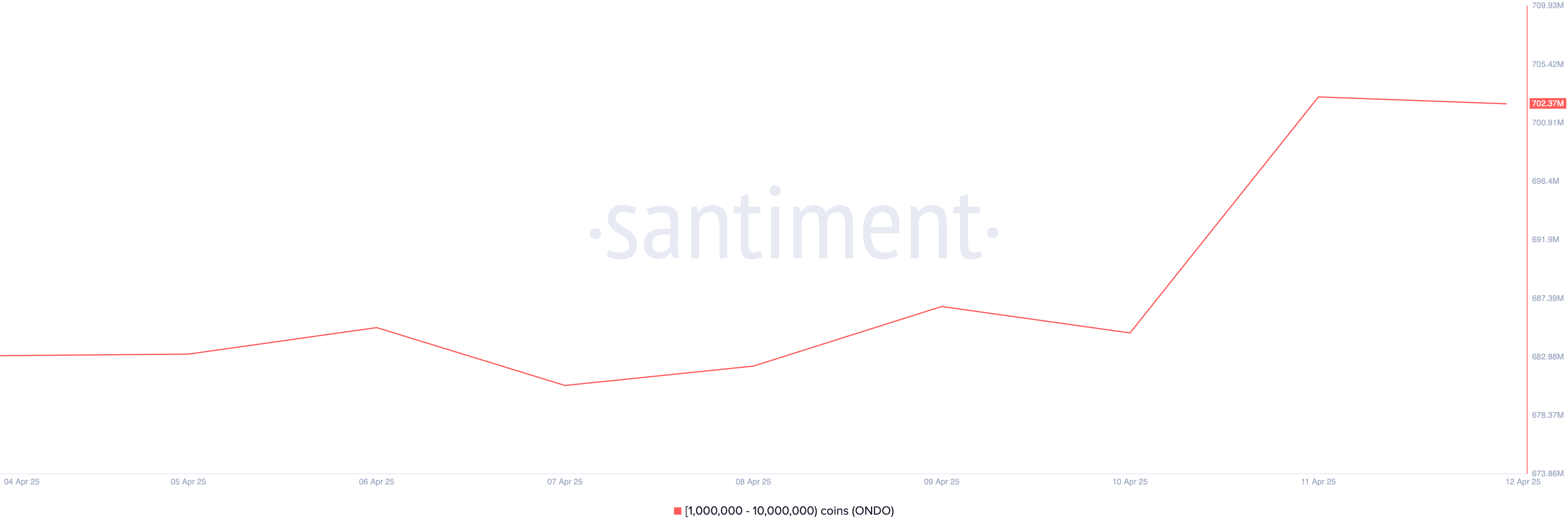

On-chain signals show increasing whale accumulation near the $13–14 range, supporting a bullish thesis.

As seen in the above chart, the LINK price has broken above the falling wedge, which is expected to offer a strong upside potential for the token. The rebound from the support around $11, which pushed the levels above the psychological barrier at $12.7. Meanwhile, the token is testing the Supertrend. If it rises above the range, it may flip to bullish, which could signal the start of a fresh bullish trend.

However, a rise above $15 could only squash the bearish possibility, and till then, both the traders and long-term holders need to monitor the breakout levels and upcoming ecosystem launches.