Notcoin (NOT) Launches Not Games Amidst a Sharp Decline in TON Users

Open Builders, the team behind Notcoin, Lost Dogs, and Not Pixel, has announced the launch of Not Games in March. The project aims to revitalize the Notcoin (NOT) ecosystem by introducing games where players can earn tokens for free.

Open Builders revealed this plan at a time when interest in Telegram-based mini-games has dropped significantly, and TON’s user base has fallen to its lowest level in a year.

Notcoin (NOT) Seeks to Renew User Interest Through Not Games

In a press release shared with BeInCrypto, Open Builders clarified that Not Games is not a standalone game on Telegram. Instead, it is an interconnected gaming ecosystem that links multiple titles.

Within this ecosystem, Open Builders will introduce Game Profiles, shared inventories, and an in-game marketplace where players can trade with each other. This system gives the NOT token a broader use case, and it’s expected to transform the token from a simple tap-to-earn reward into a valuable asset within the gaming economy.

“Instead of fragmented tokenomics, Not Games will integrate NOT as the primary currency for purchases, upgrades, and rewards across all games. Every three weeks, the most skilled players will compete for rewards in NOT, ensuring a play-to-win experience, rather than a pay-to-win model.” – the Notcoin team told BeInCrypto.

Currently, Open Builders has already launched a game called VOID and confirmed that at least five more games are in development.

Tap-to-Earn and TON’s Shrinking User Base

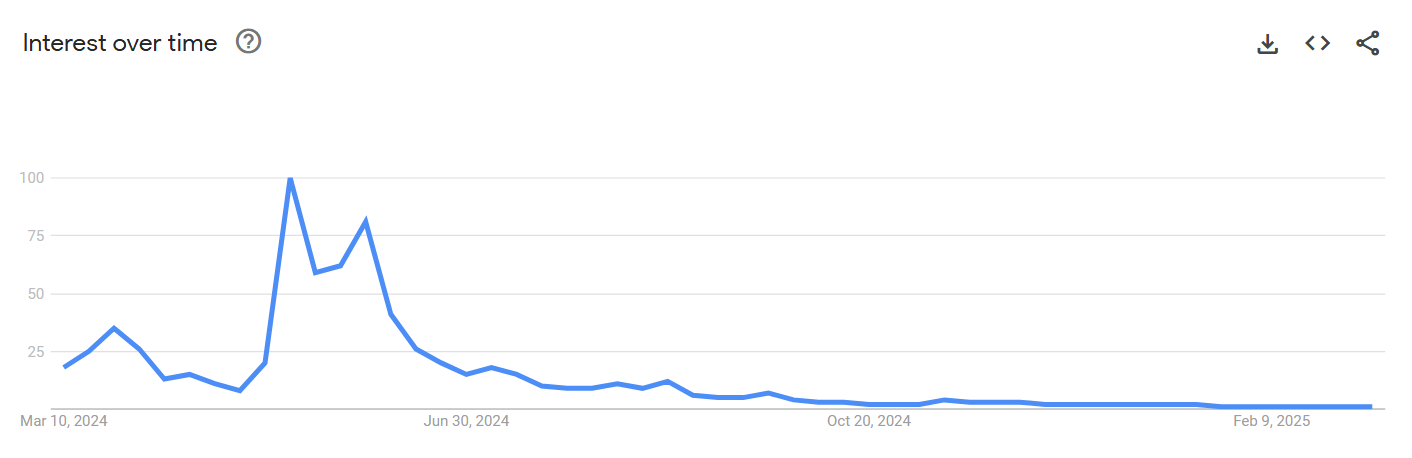

Notcoin (NOT) gained massive popularity in 2024, driven by the tap-to-earn trend alongside projects like Hamster Kombat (HMSTR) and Yescoin, TapSwap, and Blum. Within the first six months of 2024, Notcoin attracted 35 million players.

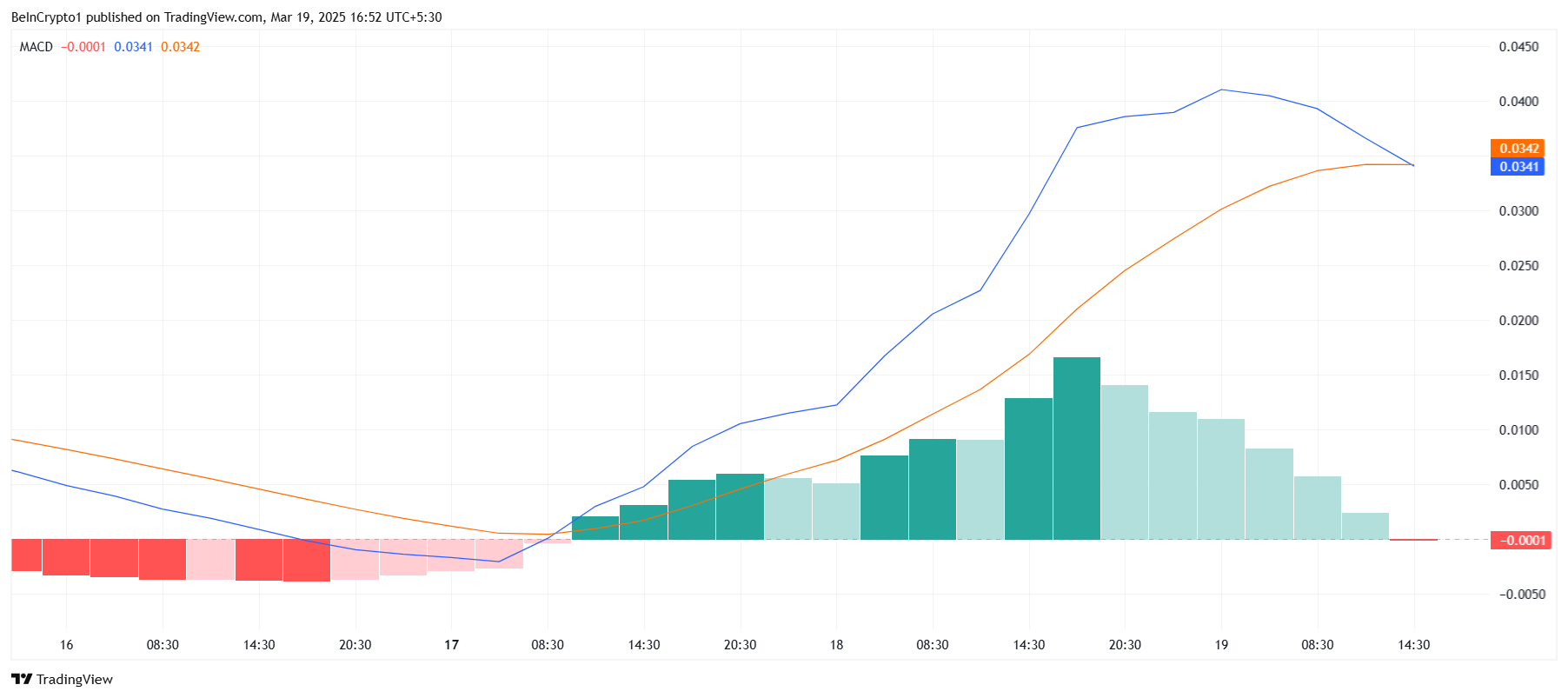

However, Google Trends data indicates that interest in Notcoin has sharply declined and has nearly faded by 2025.

Additionally, Tgstat data reveals that the Notcoin Community’s Telegram membership has dropped by nearly 2 million since the beginning of the year.

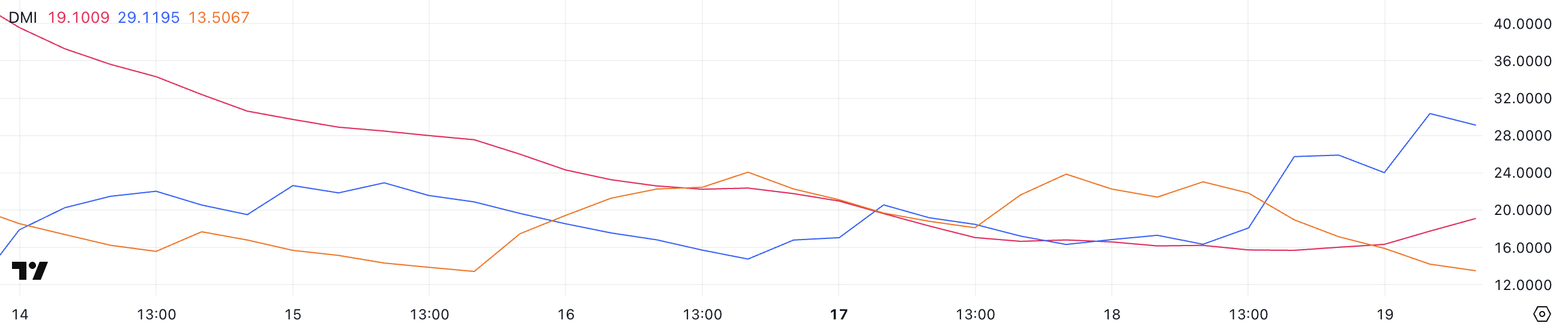

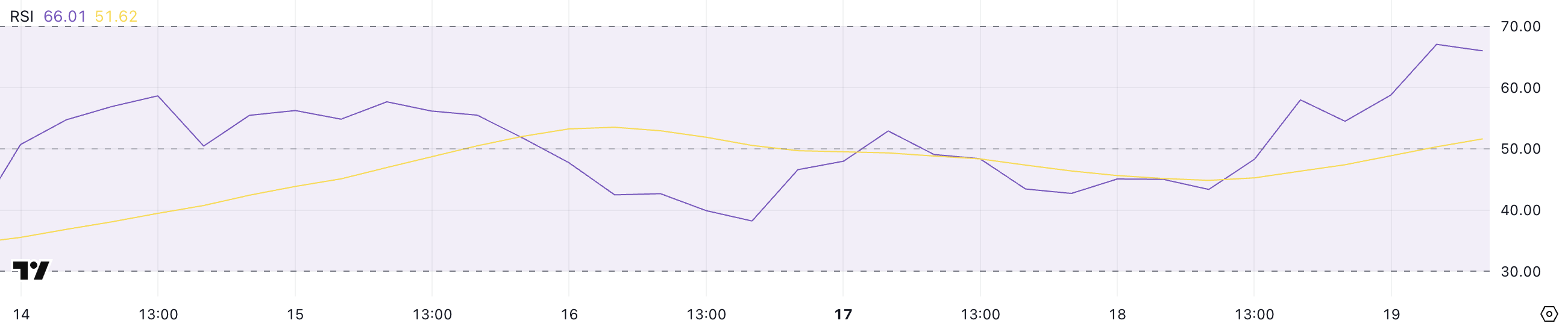

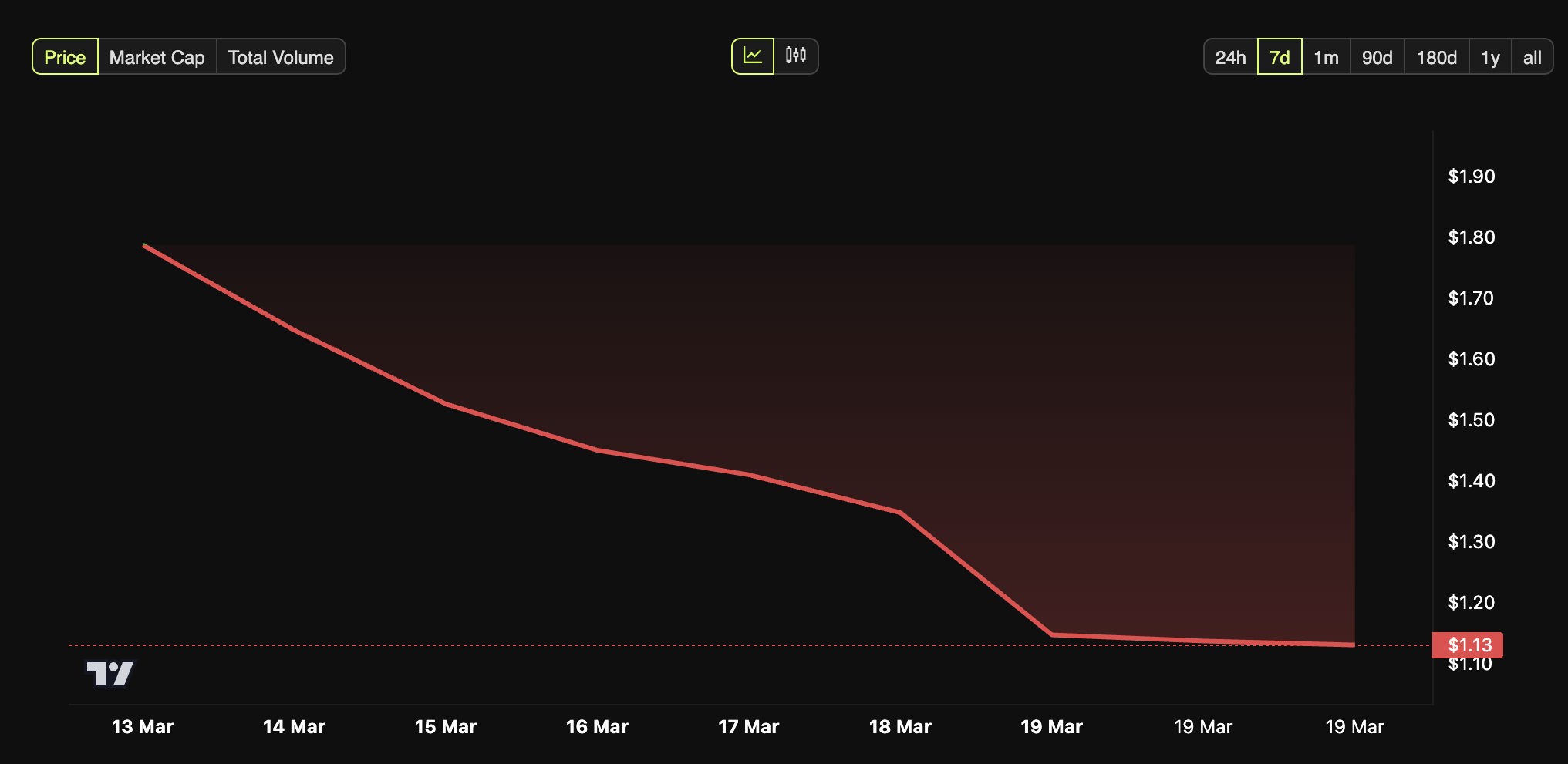

Even after NOT’s listing on Kraken in mid-February, its price only surged briefly on the listing day before continuing its downward trend, hitting new lows in 2025. This suggests that investor interest in NOT has faded.

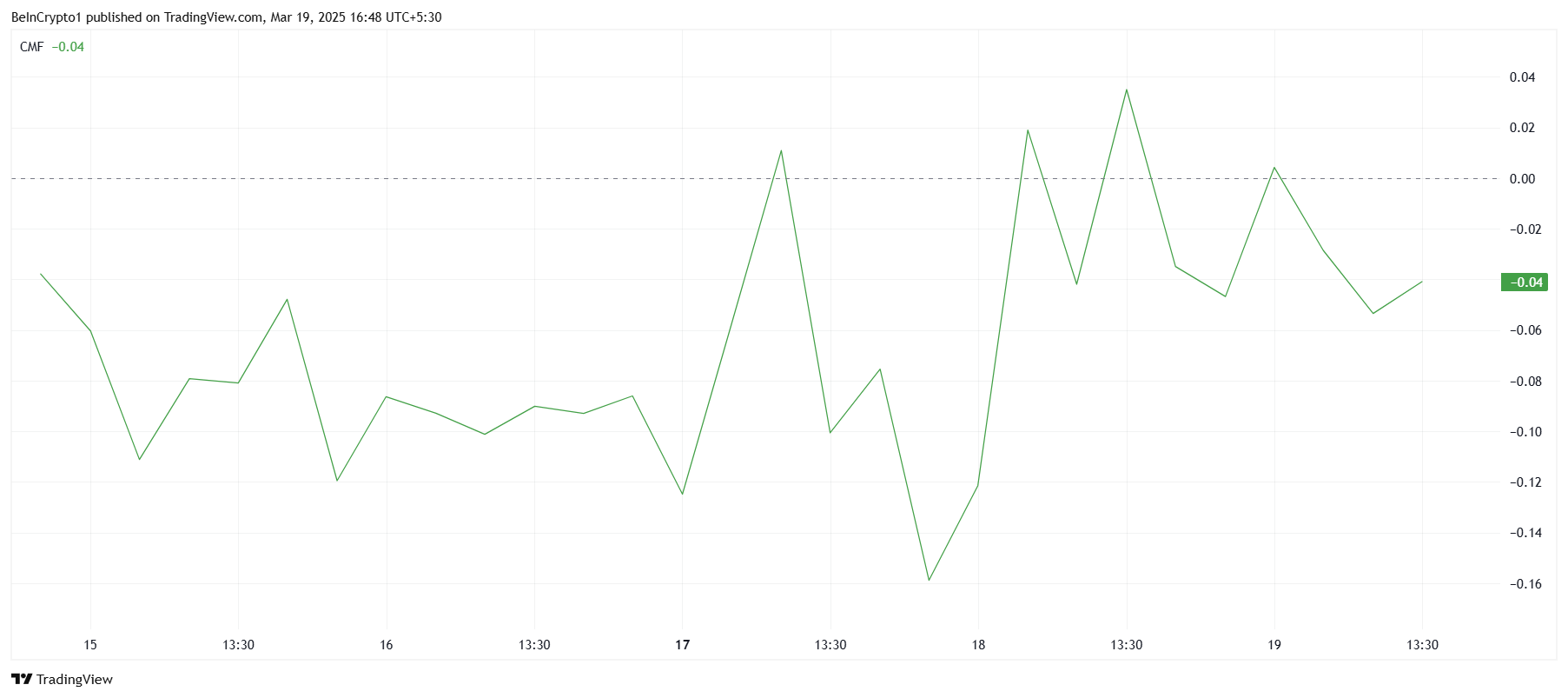

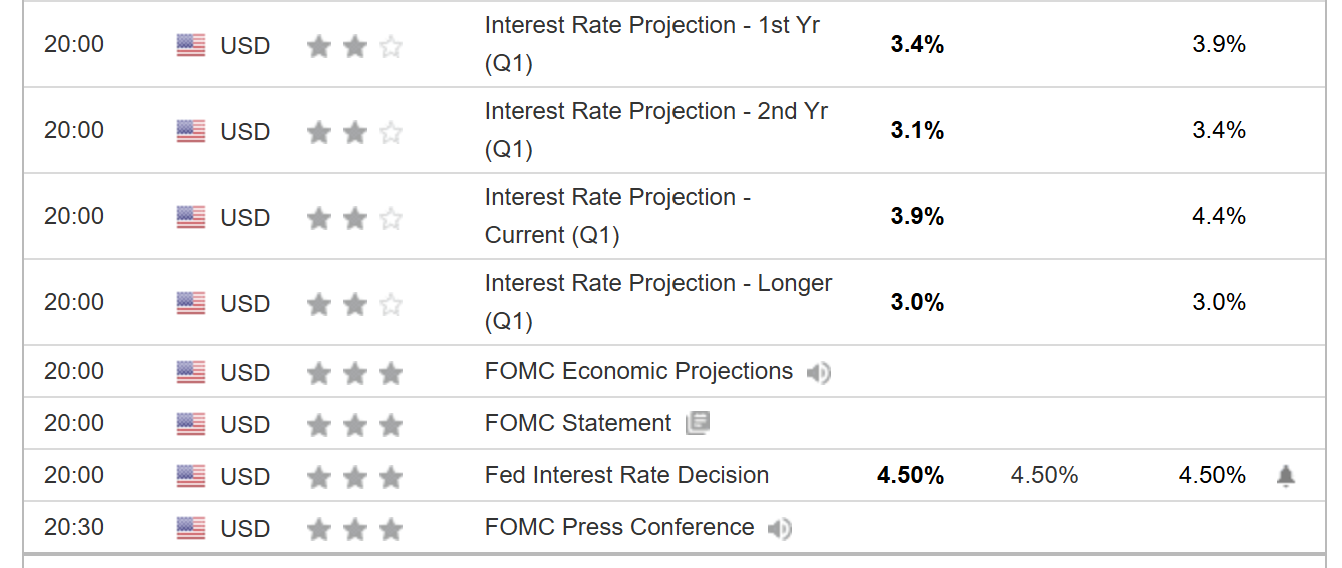

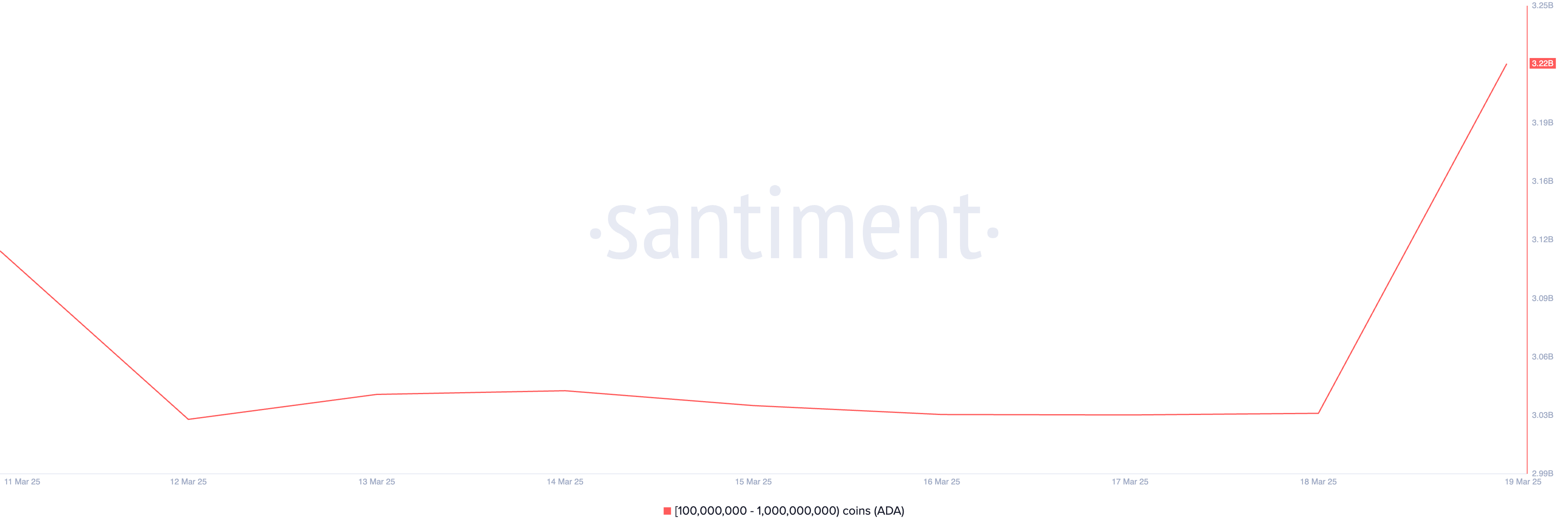

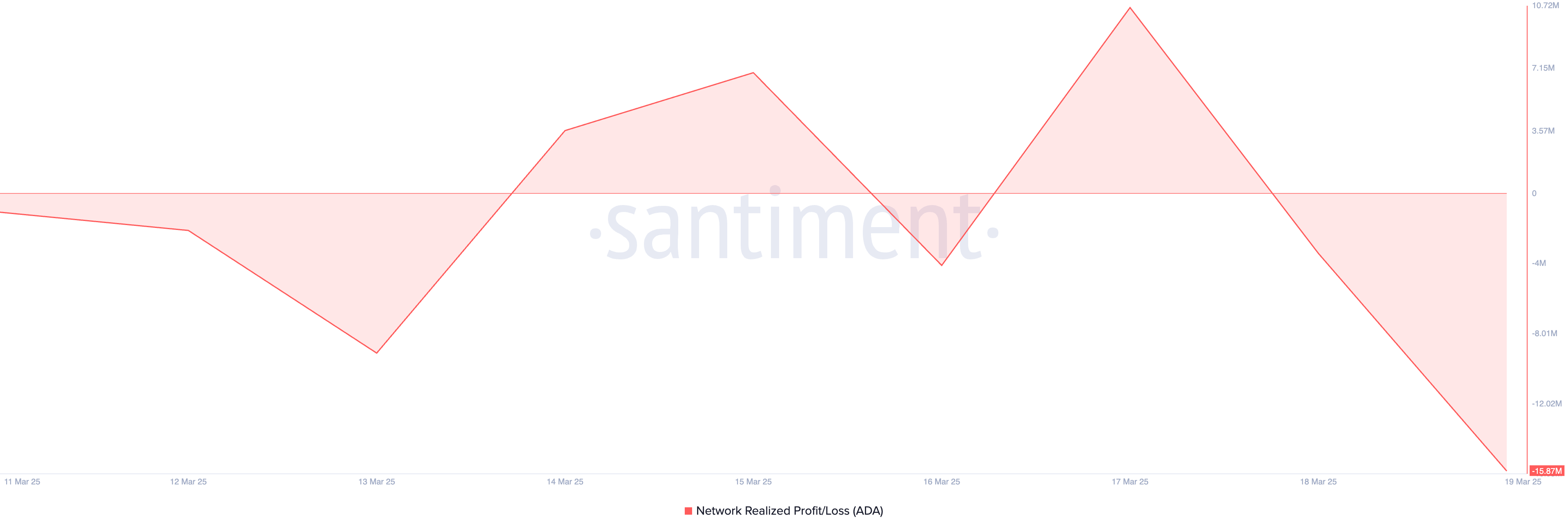

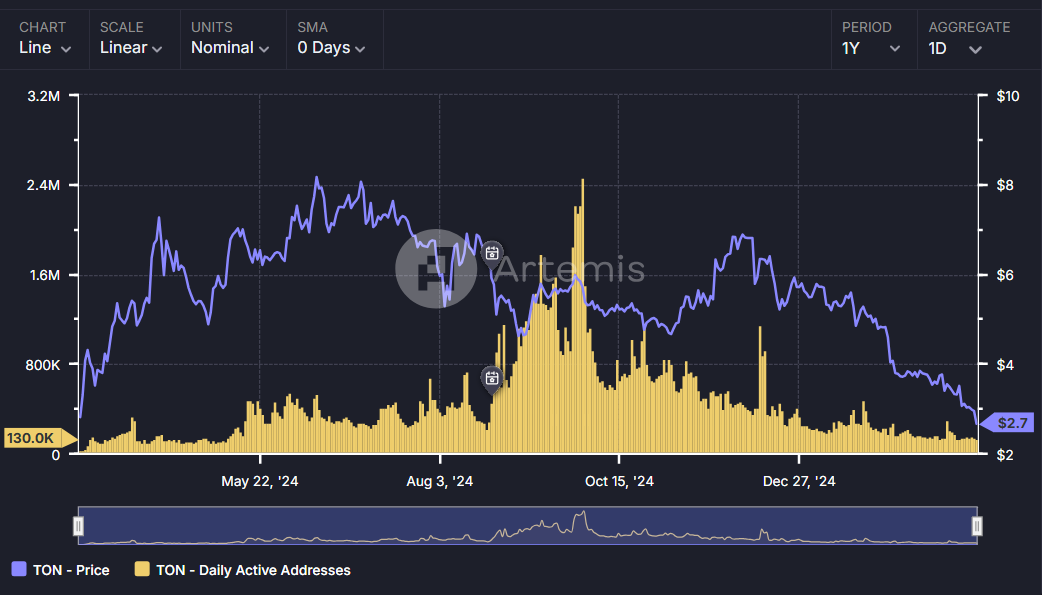

Moreover, Artemis data shows that daily active addresses on The Open Network (TON) have dropped from 2.4 million in October 2024 to just 130,000 at the time of writing.

The declining TON user base poses a major challenge for Notcoin (NOT) and its efforts to build a sustainable ecosystem.

The post Notcoin (NOT) Launches Not Games Amidst a Sharp Decline in TON Users appeared first on BeInCrypto.