Stablecoin Summer: Hong Kong and US Regulatory Convergence Sparks Market Euphoria

Global stablecoin infrastructure undergoes unprecedented transformation as Hong Kong’s Stablecoin Ordinance approaches August 1 implementation and the U.S. GENIUS Act catalyzes institutional adoption.

Consequently, synchronized regulatory frameworks across both jurisdictions trigger extraordinary market responses and strategic institutional positioning.

Market Euphoria Meets Regulatory Scrutiny

Traditional financial institutions in Hong Kong position themselves within the emerging digital asset infrastructure. Market dynamics reveal significant speculation surrounding regulatory opportunities. Over fifty companies express licensing interest, spanning mainland Chinese state enterprises to technology giants. However, most applicants lack substantive use cases or technical capabilities.

Meanwhile, Hong Kong Monetary Authority Chief Eddie Yue warns against excessive market optimism. Initial licensing approvals will remain highly selective, potentially numbering single digits. Regulatory standards emphasize anti-money laundering compliance and robust technical implementation.

Strategic Positioning Beyond Immediate Gains

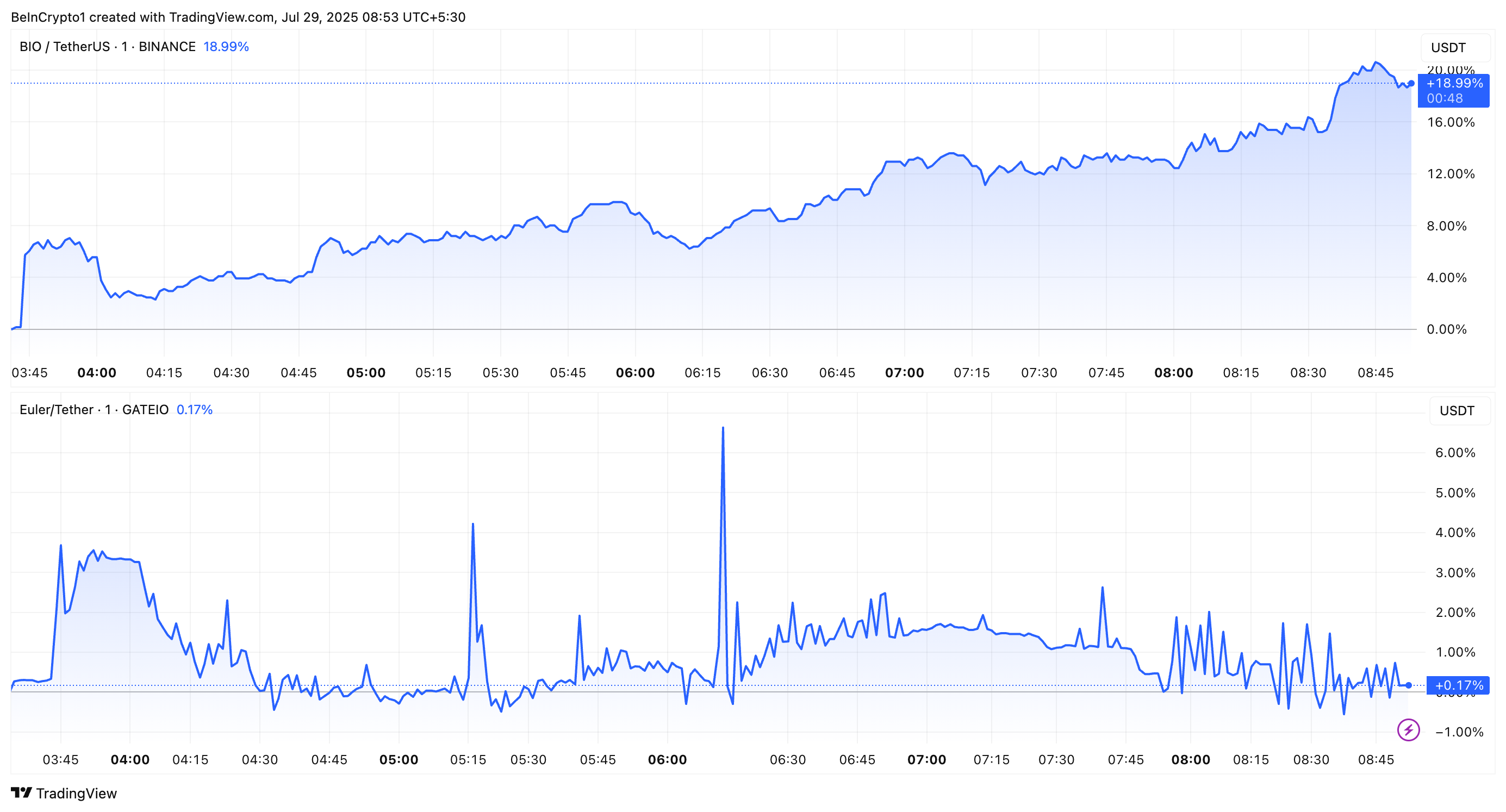

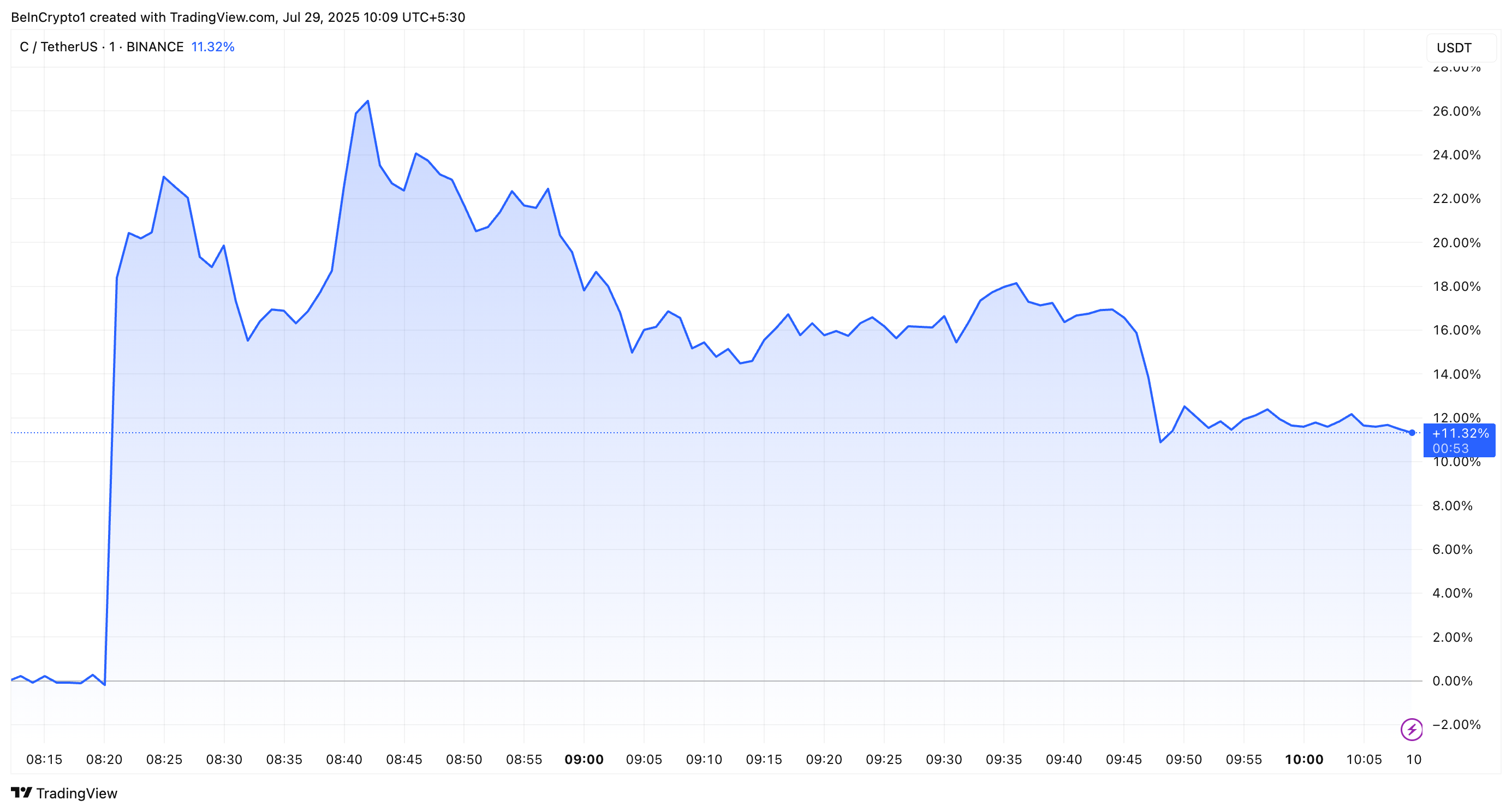

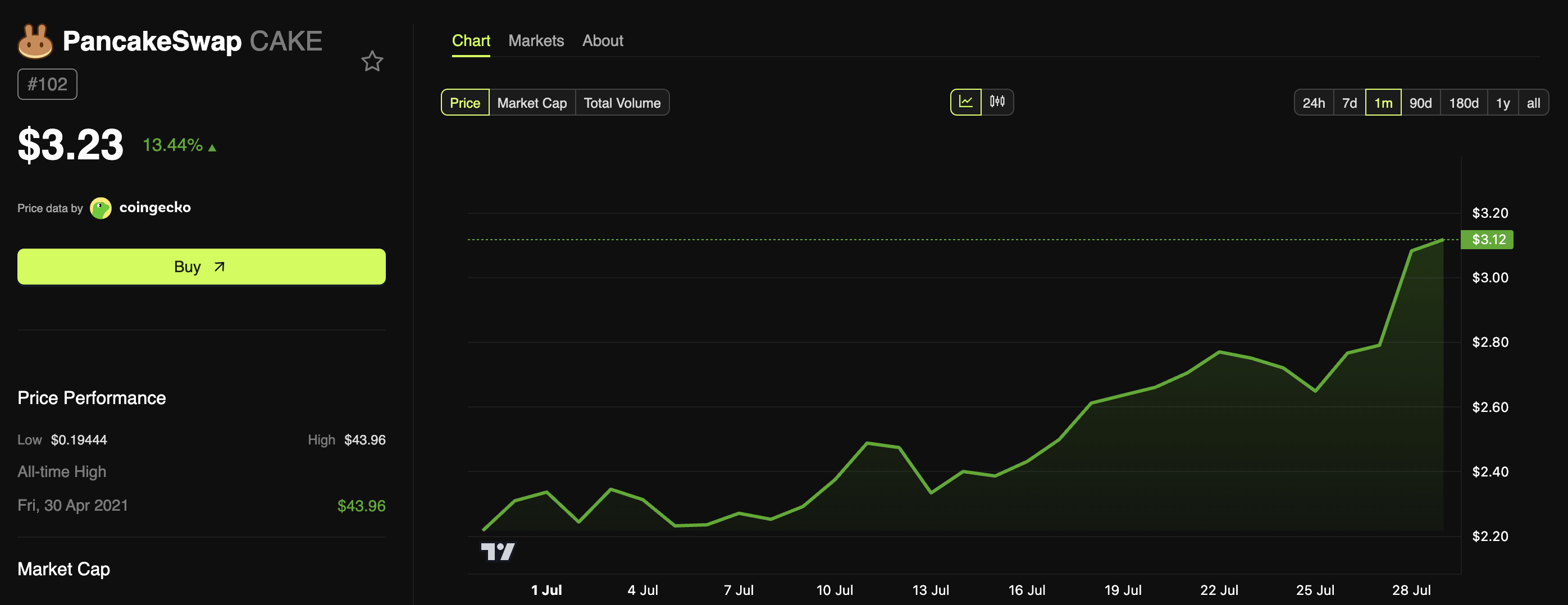

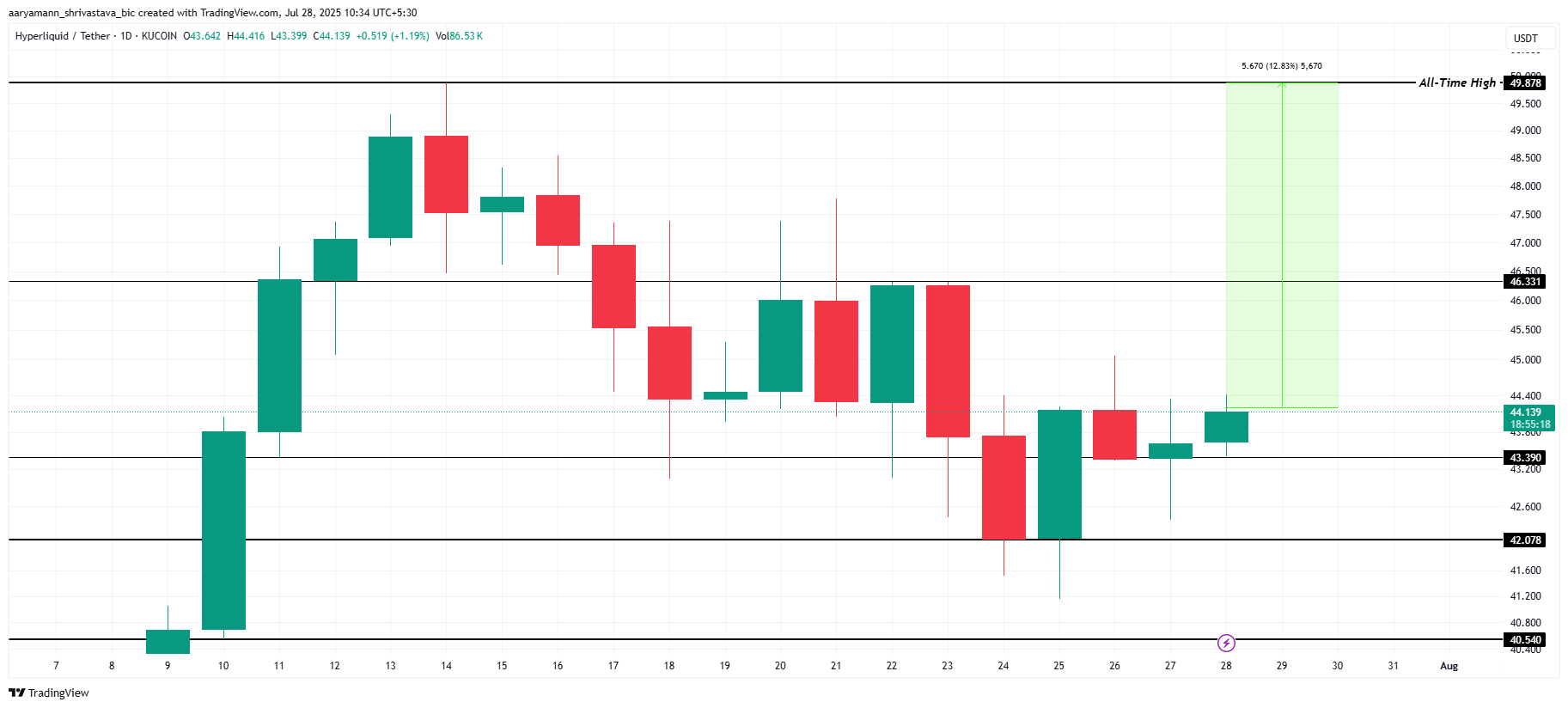

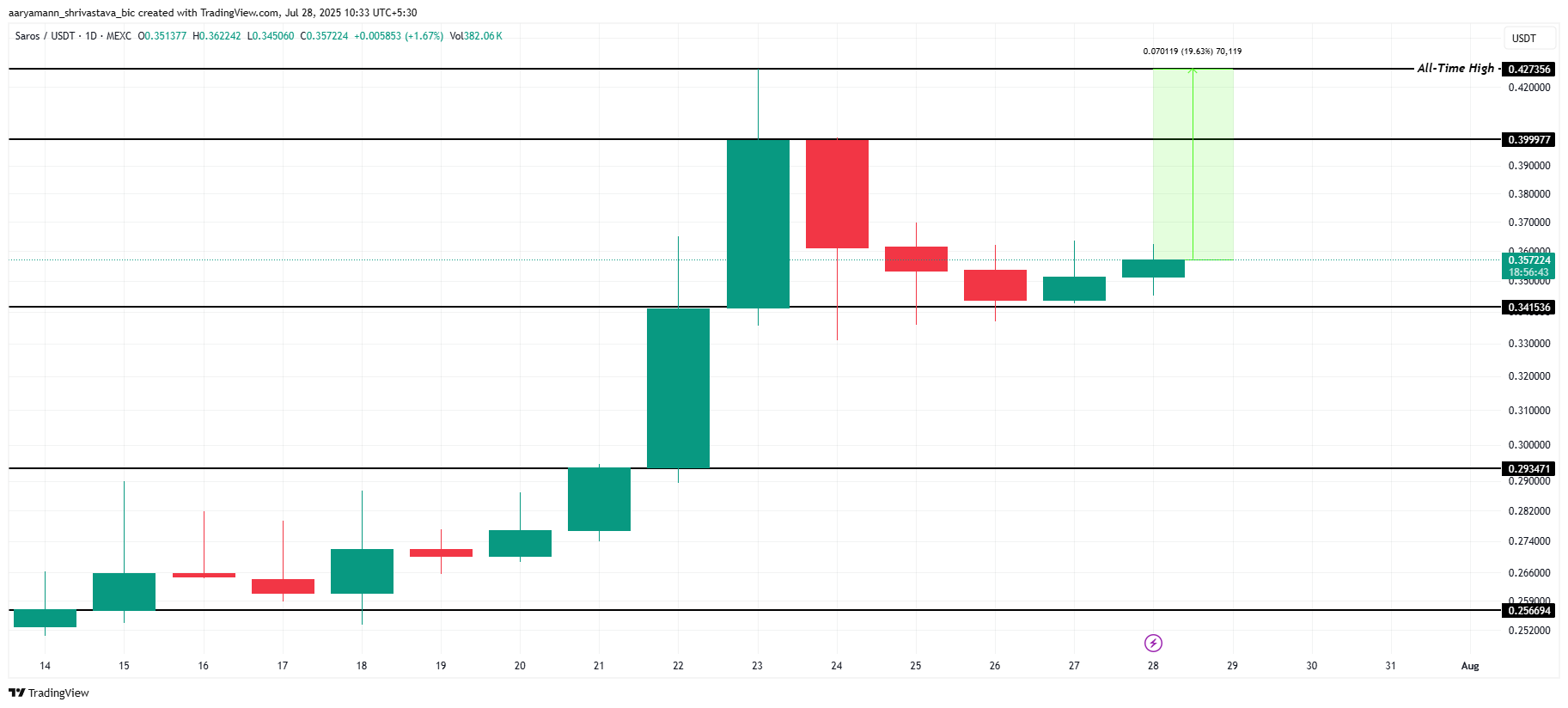

Nevertheless, the Stock market performance demonstrates stablecoin narrative power. Companies announcing licensing preparations experience dramatic price increases, with some achieving multi-fold gains. OSL Group, OKX Chain, and Winsway Enterprise lead sector appreciation.

Strategic considerations extend beyond Hong Kong dollar implementations toward yuan-denominated infrastructure. Chinese tech giants JD.com and Ant Group actively lobby Beijing for offshore yuan stablecoin authorization, viewing dollar-dominated markets as strategic threats. These discussions reflect growing urgency around yuan internationalization amid expanding USDT adoption by Chinese exporters.

The licensing framework demands substantial capital commitments and ongoing compliance costs. Companies require HK$25 million paid-up capital alongside comprehensive risk management systems. Market observers anticipate continued speculation until licensing clarity emerges.

US GENIUS Act Catalyzes Global Momentum

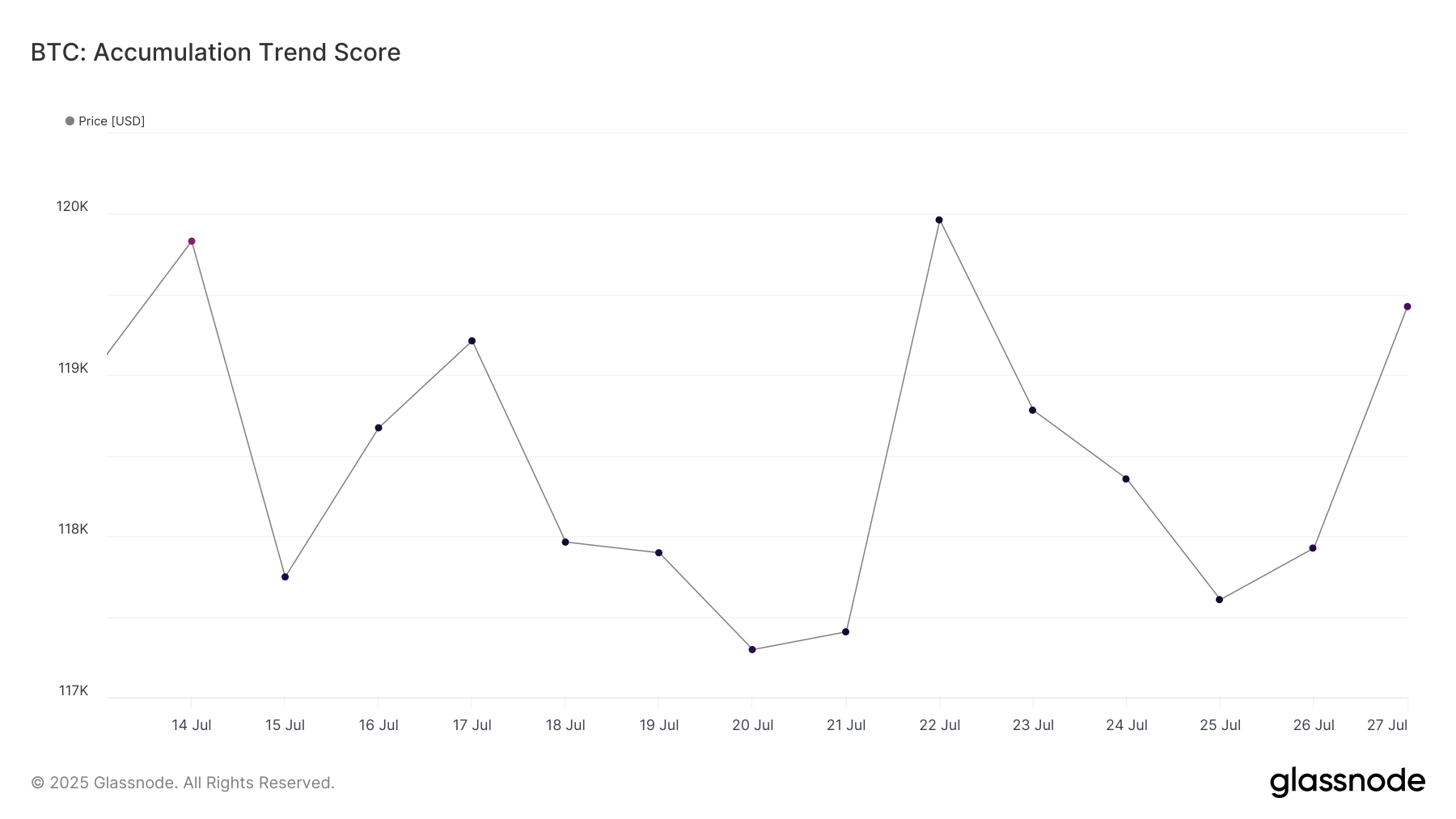

The United States provides additional catalyst through President Trump’s July 18 signing of the GENIUS Act. This comprehensive stablecoin legislation establishes dual federal-state chartering pathways and monthly attestation requirements. Market capitalization surged $4 billion within one week, demonstrating institutional confidence in regulatory clarity.

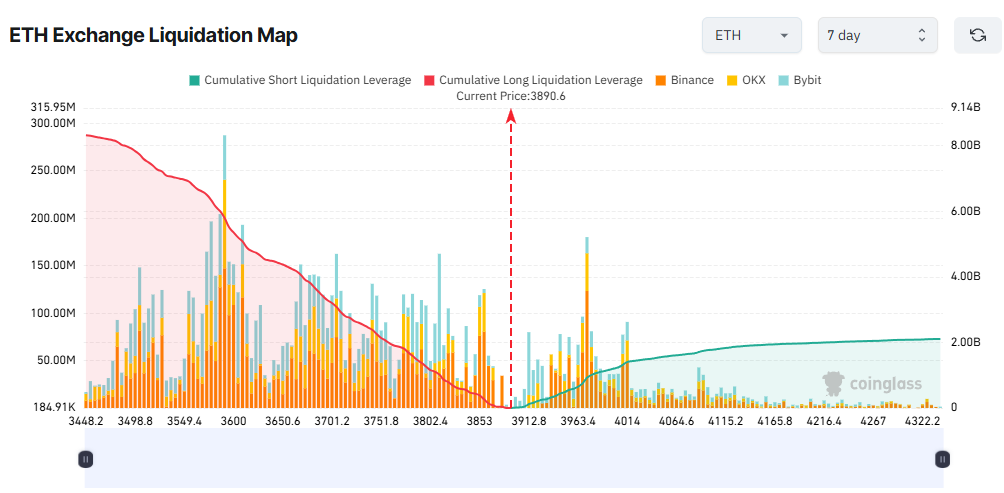

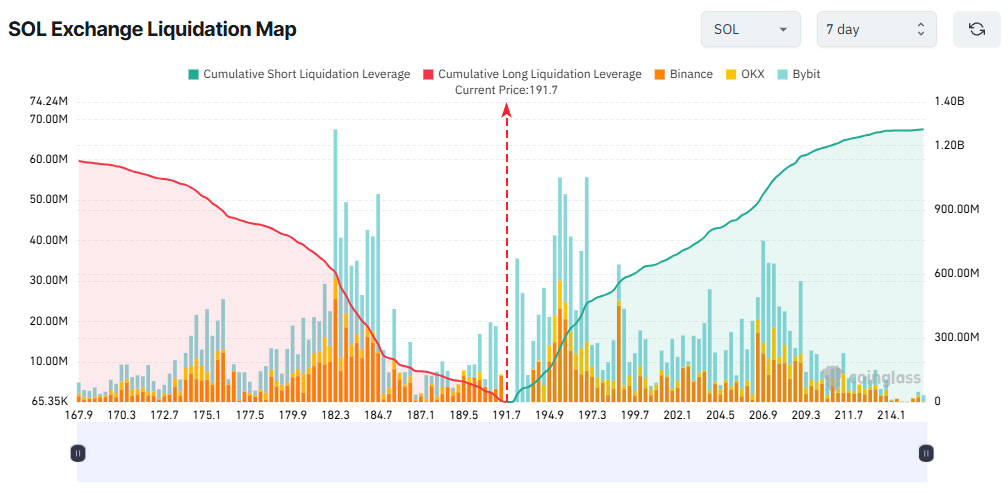

The legislation enables broader institutional participation through bank-chartered stablecoin issuance. Circle, Paxos, and JPMorgan’s Kinexys position themselves as primary beneficiaries under new frameworks. Cross-venue liquidity expansion across Base and Solana networks reflects enhanced compliance infrastructure.

Stablecoins already process more annual settlement volume than Visa and Mastercard combined. With formal regulatory rails established, traditional financial institutions can integrate tokenized cash solutions. The Treasury must publish technical reserve-report schemas within 180 days, while CFTC oversight encompasses automated compliance mechanisms.

Sangho Hwang contributed.

The post Stablecoin Summer: Hong Kong and US Regulatory Convergence Sparks Market Euphoria appeared first on BeInCrypto.