Standard Chartered Predicts Bitcoin to Hit $500,000, Here’s Why | US Crypto News

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee as we analyze Standard Chartered’s Bitcoin (BTC) price projections. According to the bank, Bitcoin price could hit $500,000 as global institutions accumulate Strategy’s MSTR stock for indirect exposure to Bitcoin.

Crypto News of the Day: Standard Chartered’s Bold Bitcoin Prediction

Bitcoin was trading for $105,178, up by a modest 2.27% in the last 24 hours. In recent developments, the pioneer crypto market capitalization has ascended to an all-time high of $2.09 trillion.

To some extent, macro factors such as PBOC rate cuts and Moody’s US credit downgrade provide tailwinds.

However, analysts hold that institutional interest has much to do with Bitcoin’s value surge. Firstly, Bitcoin ETFs (exchange-traded funds), which offer Traditional Finance (TradFi) players indirect exposure to BTC, drive institutional interest.

In the same way, institutions are gaining indirect exposure to Bitcoin via Strategy’s MSTR stock. A recent US Crypto News publication indicated that Strategy (formerly MicroStrategy) held 576,230 BTC as of May 19.

Holding a significant amount of Bitcoin on its balance sheet, Strategy’s MSTR stock price correlates closely with Bitcoin’s price movements.

Analysts ascribe this correlation to a dynamic where Bitcoin is the base layer while MSTR operates as a vehicle with different risks, mechanics, and rewards.

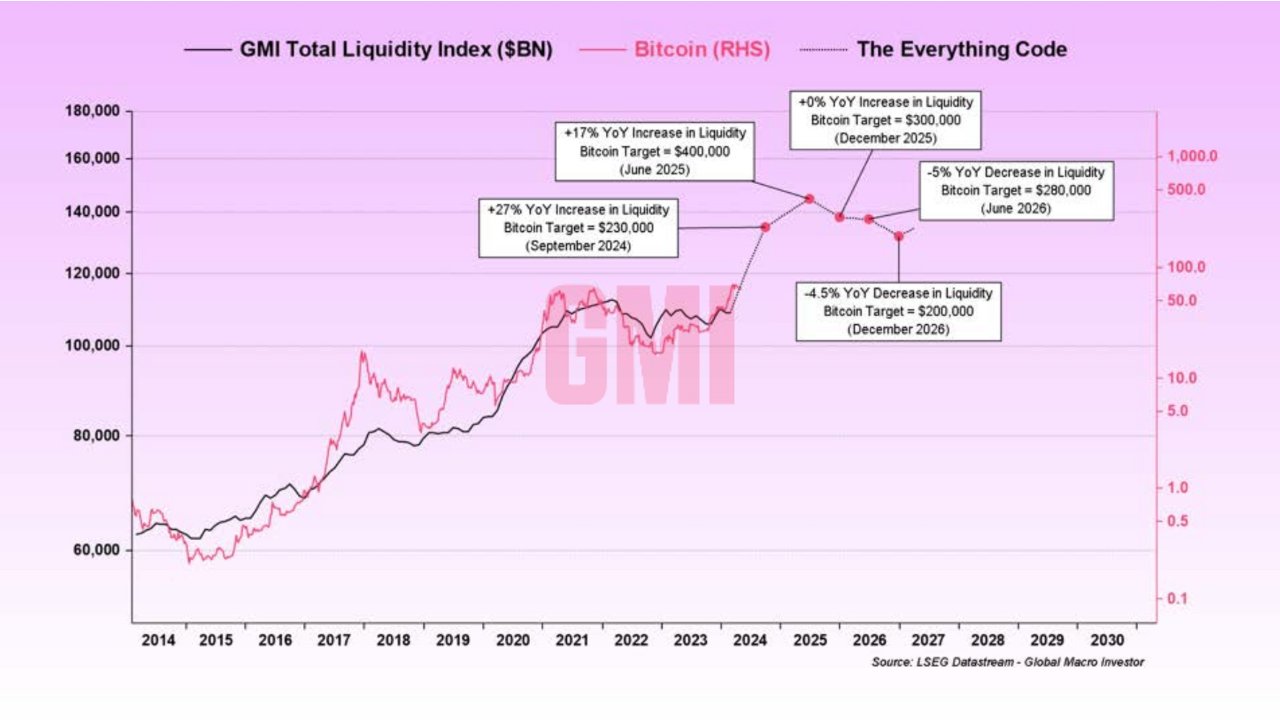

Against this backdrop, BeInCrypto contacted Geoff Kendrick, Head of Digital Assets Research at Standard Chartered. According to Kendrick, Bitcoin is still on course to hit $500,000 before the end of Trump’s second administration.

Kendrick ascribes this to deepening institutional adoption, particularly through indirect exposure via MicroStrategy’s MSTR shares.

Standard Chartered Says Increasing Allocations to MSTR Is Bullish for Bitcoin

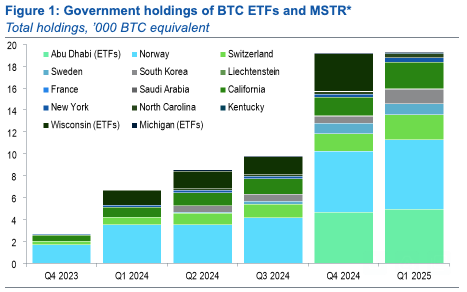

Newly released Q1 2025 13F filings from the US SEC (Securities and Exchange Commission) support the bank’s bullish thesis. Specifically, Strategy saw increasing allocations to MSTR by a range of global sovereign and quasi-sovereign entities.

“As more investors gain access to the asset and as volatility falls, we believe portfolios will migrate towards their optimal level from an underweight starting position in Bitcoin,” Kendrick said in an email to BeInCrypto.

While direct holdings of Bitcoin ETFs declined slightly overall, largely due to the State of Wisconsin Investment Board selling its entire 3,400 BTC-equivalent position in BlackRock’s IBIT ETF, other entities quietly increased exposure via MSTR, which Kendrick described as a “Bitcoin proxy.”

“Government entities increased their holdings of Strategy Incorporated (MSTR), which typically trades like a Bitcoin proxy. Entities in Norway, Switzerland, and South Korea reported significant MSTR increases, and Saudi Arabia added a very small position for the first time,” Kendrick told BeInCrypto.

The Standard Chartered executive emphasized that while Bitcoin ETF flows were “unexciting,” the MSTR accumulation trend was the real story this quarter.

“The MSTR ownership detail was where the excitement was,” he added.

Geoff Kendrick went further, detailing Standard Chartered’s analysis of the filings. Based on their analysis:

- Norway added 700 BTC-equivalent via MSTR, now holding 6,300 BTC-equivalent.

- Switzerland also added 700 BTC-equivalent, reaching 2,300 BTC-equivalent.

- South Korea added 700 BTC-equivalent, bringing its total to 1,300 BTC-equivalent.

- US state funds (California, New York, North Carolina, Kentucky) added 1,000 BTC-equivalent collectively, now at 3,300 BTC-equivalent.

- Saudi Arabia’s Central Bank opened a small MSTR position—its first.

Meanwhile, Abu Dhabi’s quasi-sovereign wealth fund Mubadala added 300 BTC equivalent via ETF holdings, increasing its position to 5,000 BTC equivalent.

“SEC 13F data for Q1 supports our thesis that Bitcoin is attracting a wider range of buyers. While data on Bitcoin ETF holdings was disappointing, MSTR – a Bitcoin proxy – saw increased buying. Overall sovereign positions were unchanged due to the Wisconsin pension fund selling its ETF holdings,” Kendrick concluded.

BeInCrypto reported how the MicroStrategy effect is spreading worldwide, with TradFi companies building Bitcoin war chests.

The data reinforce Standard Chartered’s outlook that institutional and sovereign flows—both direct and indirect—will be a key driver of Bitcoin’s ascent to $500,000 in the coming years.

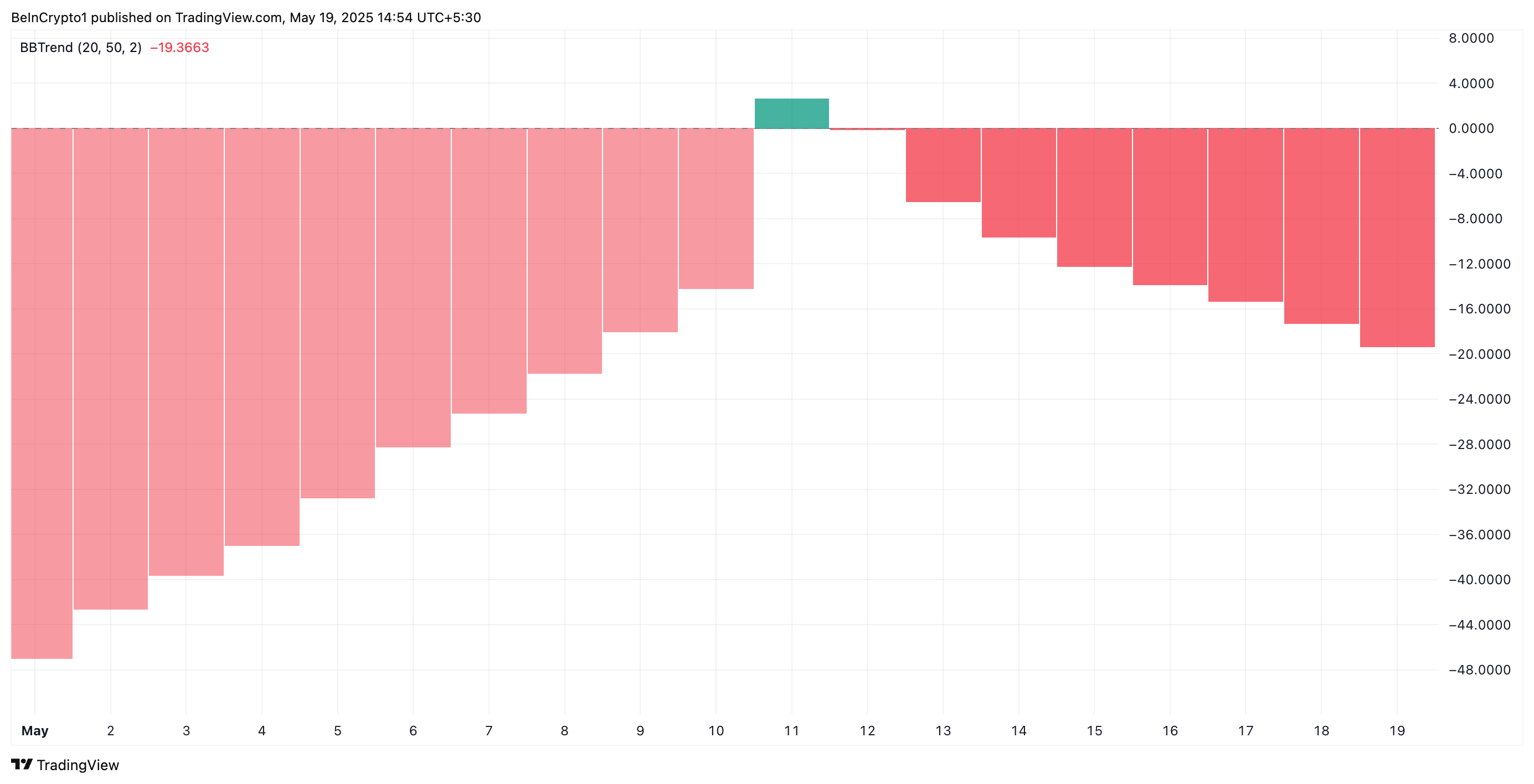

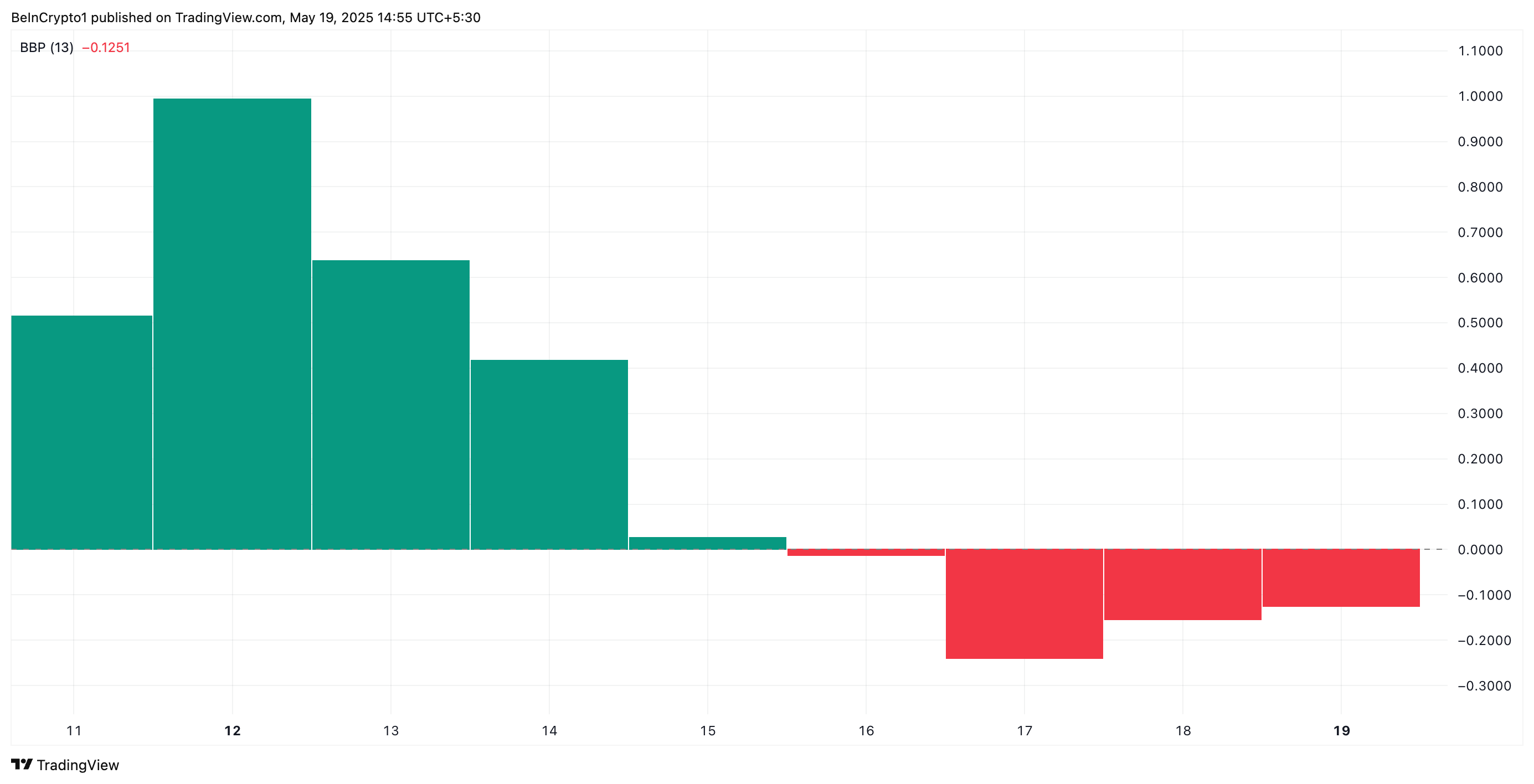

Chart of the Day

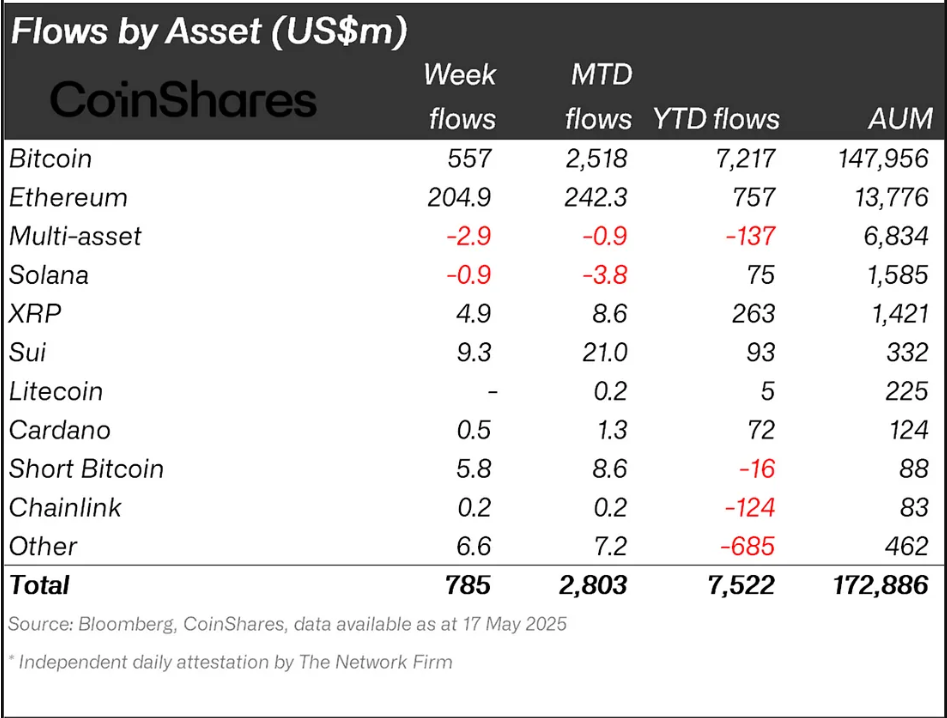

This chart illustrates the total government holdings of Bitcoin ETFs and MicroStrategy’s MSTR stock from Q4 2023 to Q1 2025, measured in ‘000 (thousands) BTC equivalents. Based on the chart, holdings have grown steadily, peaking in Q1 2025 at around 18,000 BTC.

The chart shows that key contributors include Abu Dhabi (ETFs), Norway, Sweden, South Korea, France, New York, Wisconsin (ETFs), Michigan (ETFs), Switzerland, Liechtenstein, California, North Carolina, Saudi Arabia, and Kentucky, with varying contributions across quarters.

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Bitcoin benefits from macroeconomic shifts, including China’s rate cuts and the US credit downgrade, boosting its appeal as a hedge against instability.

- Bitcoin price surpassed $105,000, driving institutional interest and triggering over $667 million in ETF inflows.

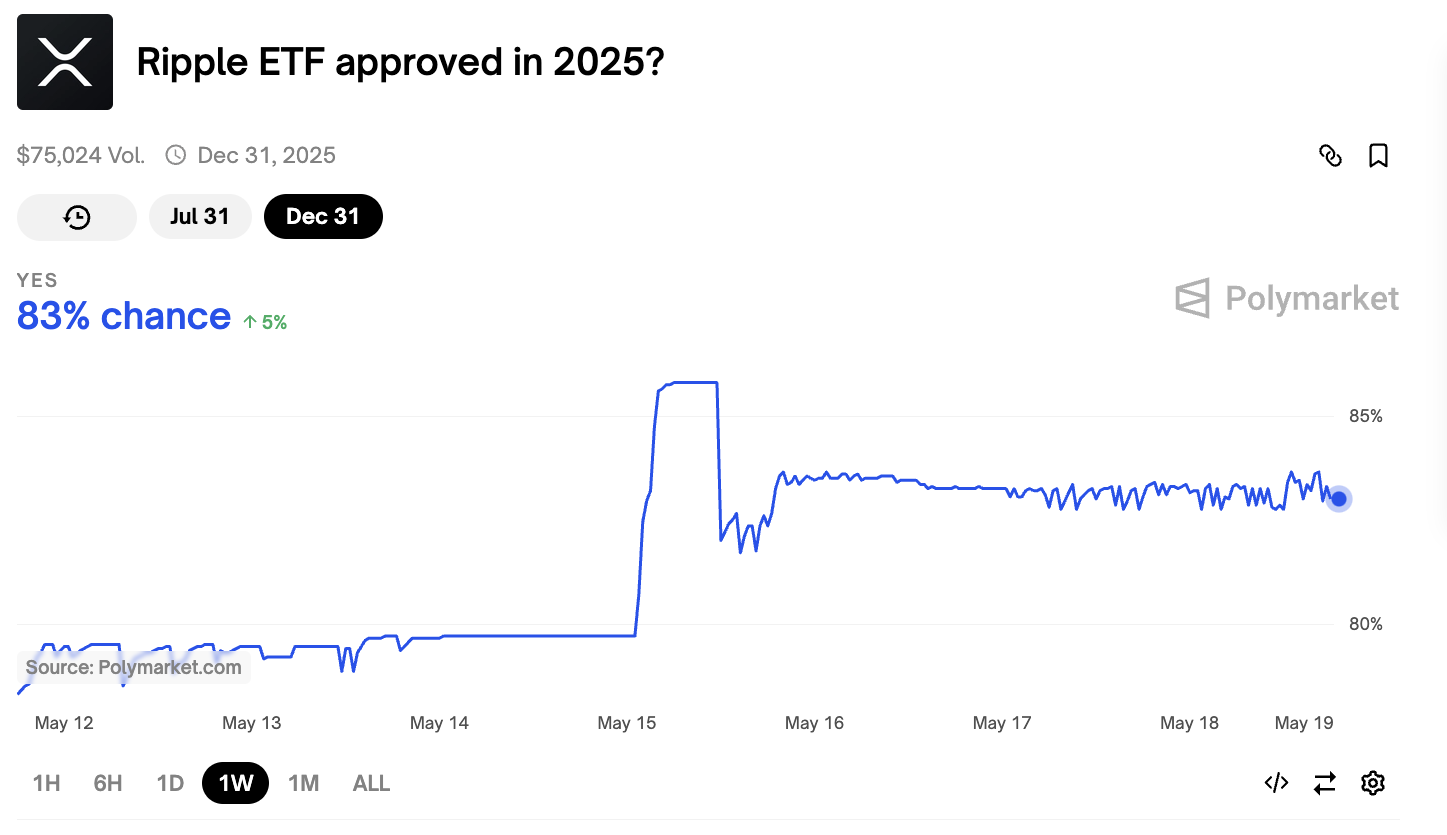

- Analysts warn XRP Futures could lead to price manipulation, using strategies like naked shorting and rehypothecation.

- Tron has surpassed Ethereum in total USDT supply, with $75.8 billion in circulation, making it the leader in stablecoin payments.

- The SEC seeks public comments before ruling Solana ETFs, highlighting a cautious regulatory approach.

- The ETH/BTC pair jumped 34% in a week, sparking hopes of an altcoin season, though only 18% of the top 50 coins currently outperform Bitcoin.

- Blockchain analysis exposes bots manipulating Pump.fun token markets, flooding trades to create fake momentum.

- Abraxas Capital’s aggressive Ethereum accumulation signals growing institutional confidence, with $837 million invested in ETH.

- Binance Alpha will list Tokyo Games Token (TGT) on May 21, making it the first platform to offer TGT trading.

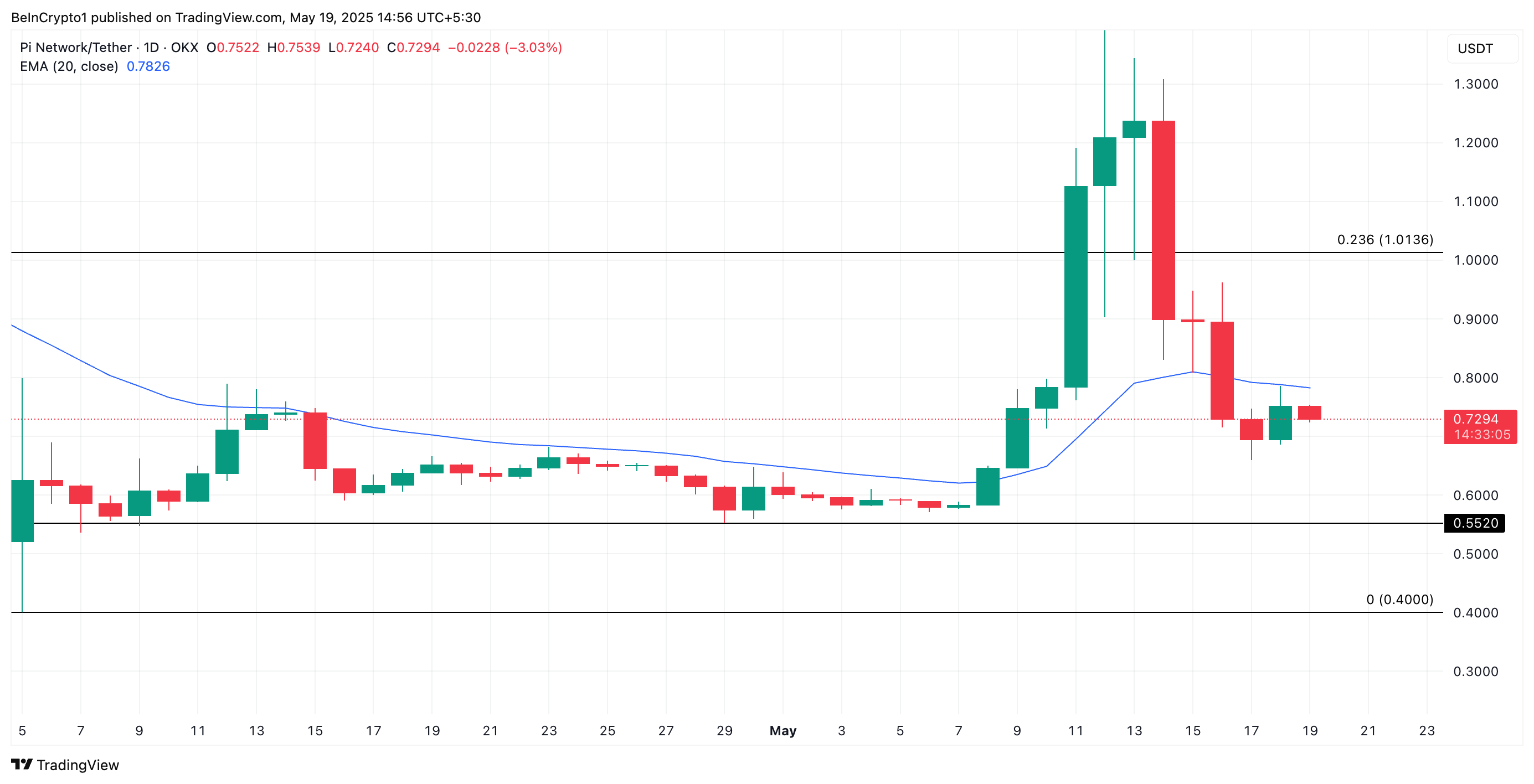

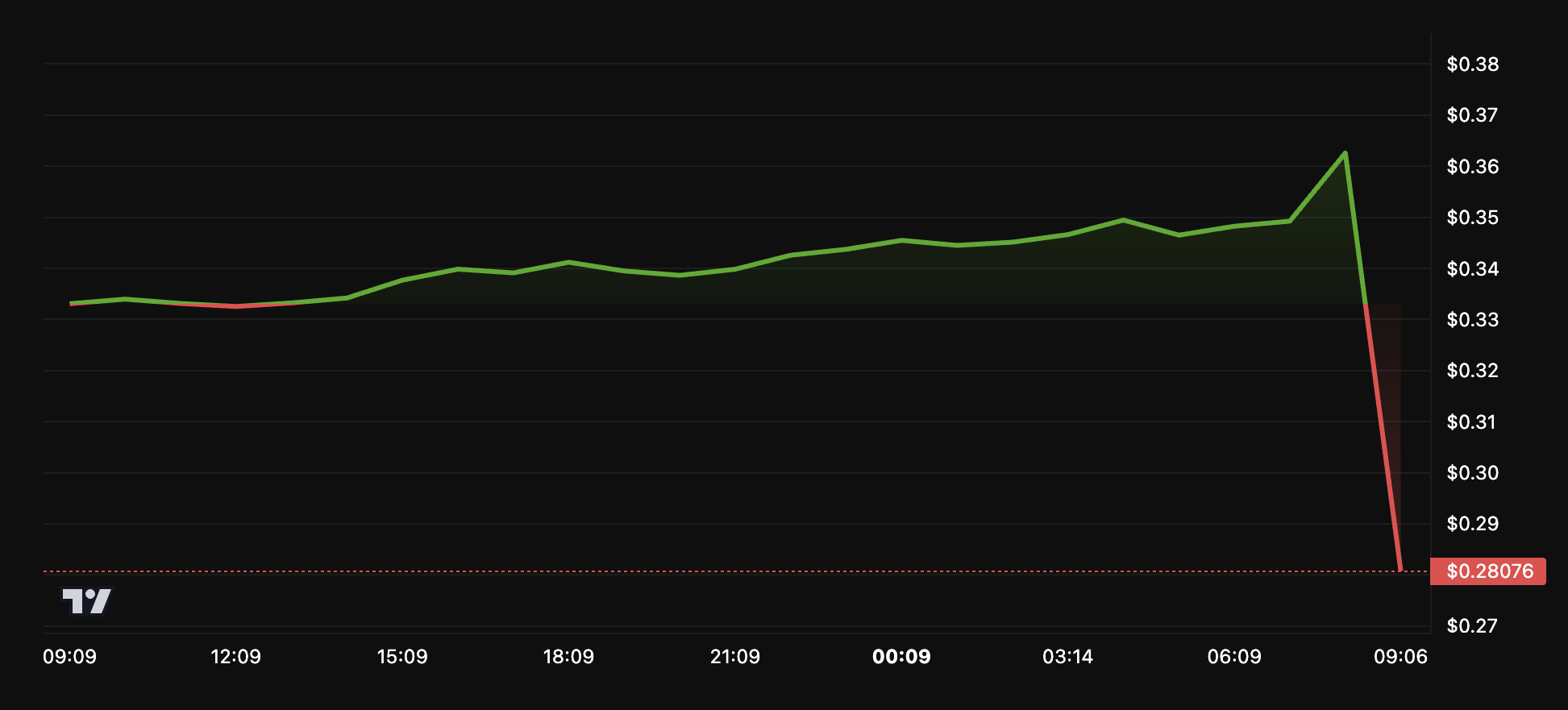

- Pi Network faces a 40% crash, with its price currently at $0.73, decoupling from Bitcoin and showing a negative correlation.

Crypto Equities Pre-Market Overview

| Company | At the Close of May 19 | Pre-Market Overview |

| Strategy (MSTR) | $413.42 | $412.95 (-0.11%) |

| Coinbase Global (COIN) | $263.99 | $267.22 (+1.22%) |

| Galaxy Digital Holdings (GLXY.TO) | $31.49 | $32.44 (+3.01%) |

| MARA Holdings (MARA) | $16.32 | $16.37 (+0.31%) |

| Riot Platforms (RIOT) | $8.97 | $9.02 (+0.56%) |

| Core Scientific (CORZ) | $10.85 | $11.06 (+1.94%) |

The post Standard Chartered Predicts Bitcoin to Hit $500,000, Here’s Why | US Crypto News appeared first on BeInCrypto.