Standard Chartered Forecasts Corporate Treasuries Holding 10% of Ethereum’s Supply

After Bitcoin (BTC), Ethereum (ETH) has emerged as the next institutional favorite. According to Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, corporate treasuries have purchased 1% of all ETH in circulation since the beginning of June.

This highlights the growing appetite among firms to increase their ETH exposure. Kendrick also shared with BeInCrypto that these corporate treasuries could eventually hold 10% of all ETH.

Institutions Aggressively Accumulate ETH in June

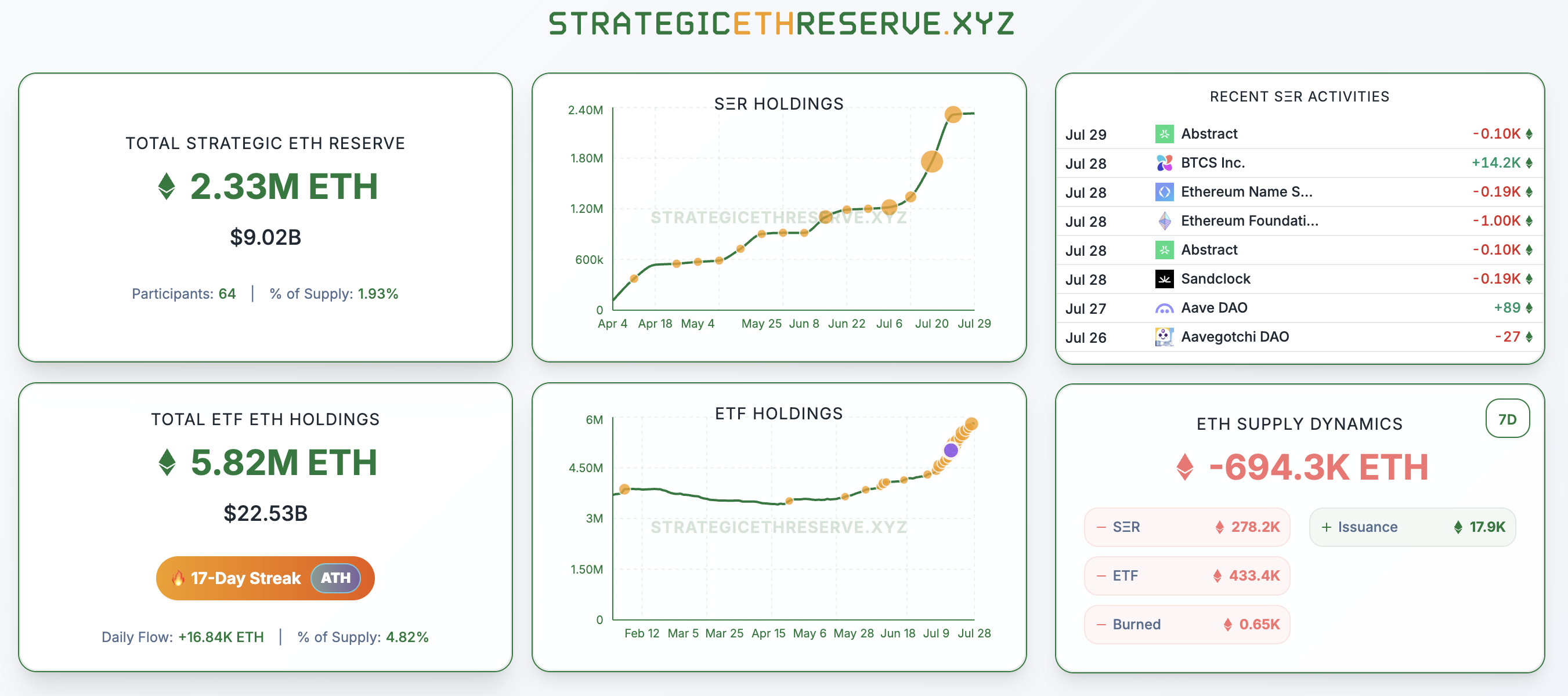

BeInCrypto previously reported that firms are accelerating their efforts to acquire ETH as part of their treasury strategy. According to the latest data, the Strategic ETH Reserve, which tracks entities holding Ethereum in their treasuries, now totals 2.33 million ETH, valued at over $9 billion.

These holdings, distributed among 64 entities, account for 1.93% of Ethereum’s supply. This marks a significant rise from the 789,705 ETH held in mid-May. In just over two months, the entities’ ETH holdings have surged by approximately 195%.

Notably, 113,000 ETH (approximately $409 million) is held by companies that revealed their positions for the first time this quarter.

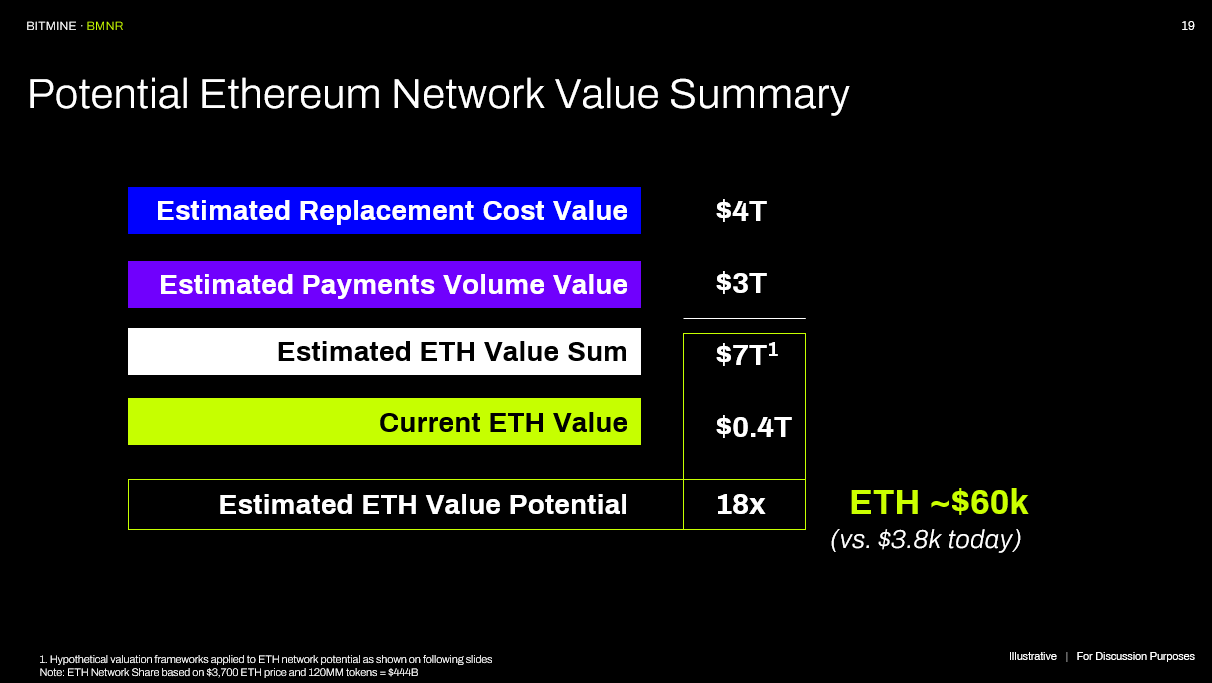

Meanwhile, a few firms stand out for their massive holdings. For instance, BitMine Immersion Technologies, which initially committed $250 million to an ETH reserve, has already topped over $2 billion in ETH holdings in a month.

Furthermore, the firm plans to increase this stake to $4.5 billion, with the long-term vision of owning 5% of ETH’s supply. Similarly, SharLink Gaming has also increased its holdings to $1.7 billion in ETH.

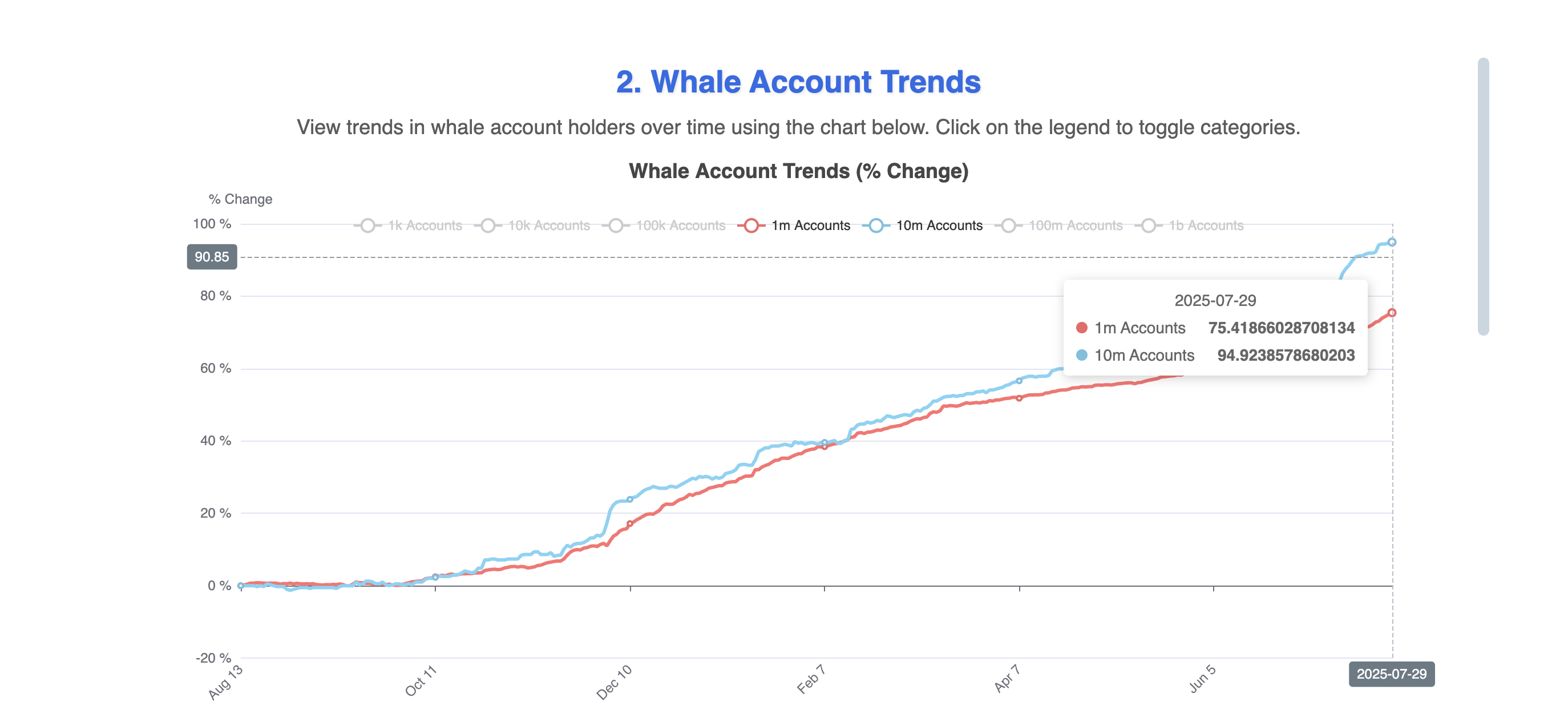

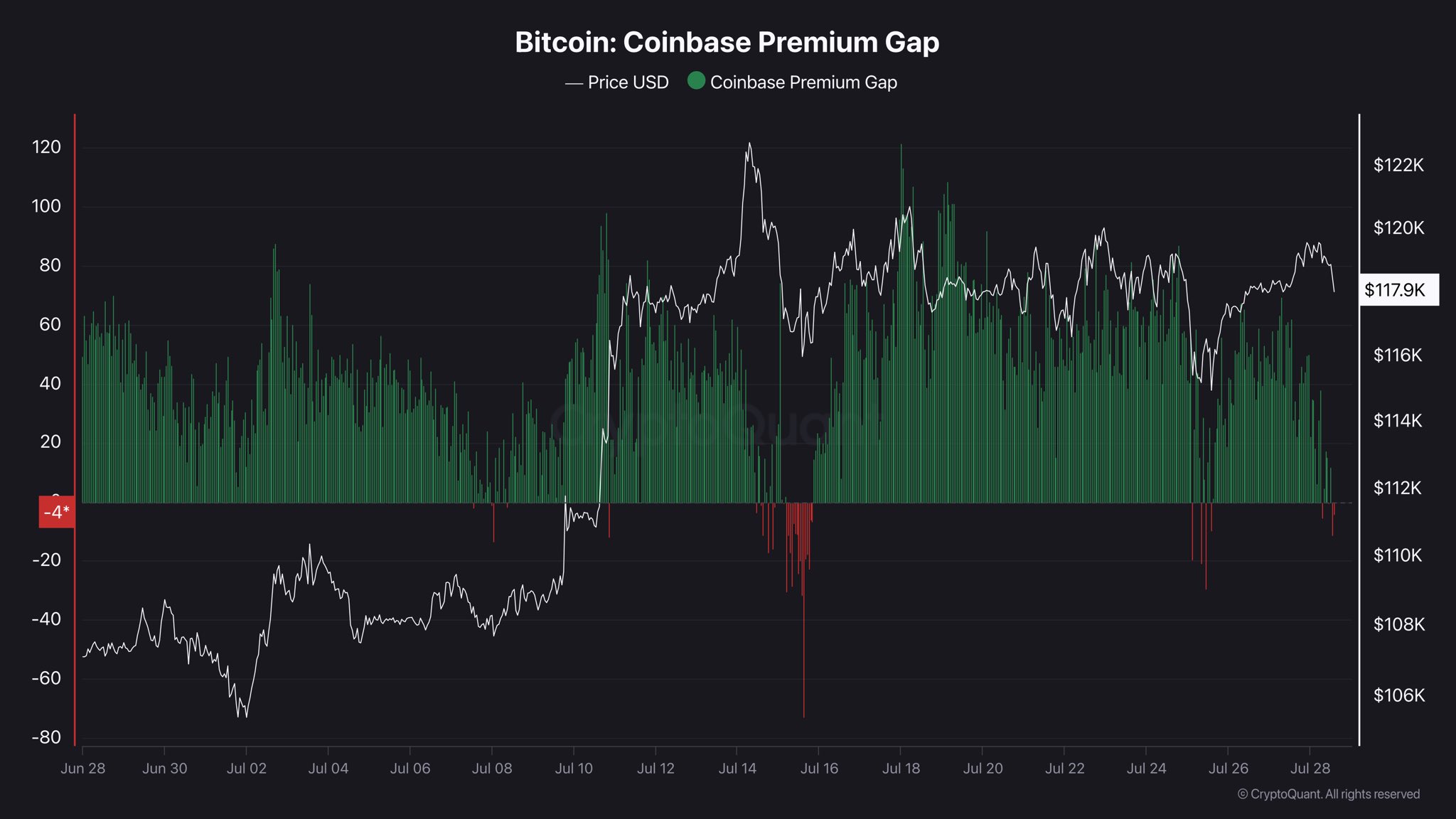

Standard Chartered’s Geoff Kendrick highlighted that public companies with digital assets on their balance sheets have acquired 1% of ETH’s circulating supply in just two months. What’s particularly noteworthy is the pace of acquisition—this rate is double that of Bitcoin purchases by corporate treasuries.

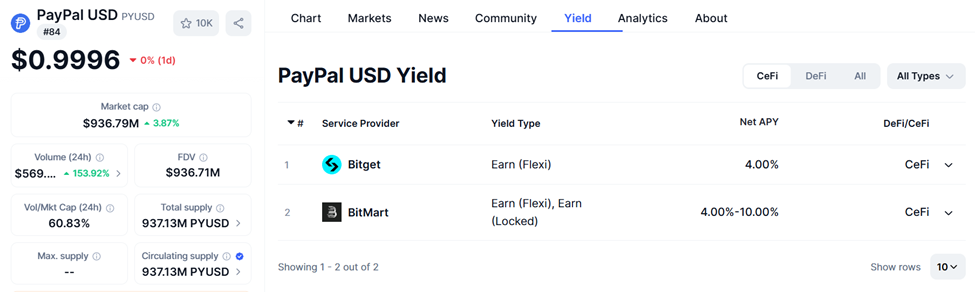

“This buying was almost as strong as ETH ETF buying, which has also been the strongest on record. We expect ETH treasury companies to eventually own 10% of all ETH, a 10x increase from here,” Kendrick told BeInCrypto.

He stressed that in terms of flows, ETH treasury companies are becoming more important than their BTC counterparts.

“ETH treasury companies make more sense than their BTC equivalents due to staking yield, DeFi leverage. And from a regulatory arbitrage perspective, they make more sense than their BTC equivalents, too,” he said.

Why Corporate Firms Are Increasing Their Ethereum Holdings?

The executive explained that corporate treasury investments in ETH are appealing due to the financial system’s inefficiencies, which are largely driven by regulatory barriers.

Additionally, ETH treasuries can benefit from staking rewards and leverage opportunities within decentralized finance (DeFi). These are currently unavailable through US Ethereum ETFs.

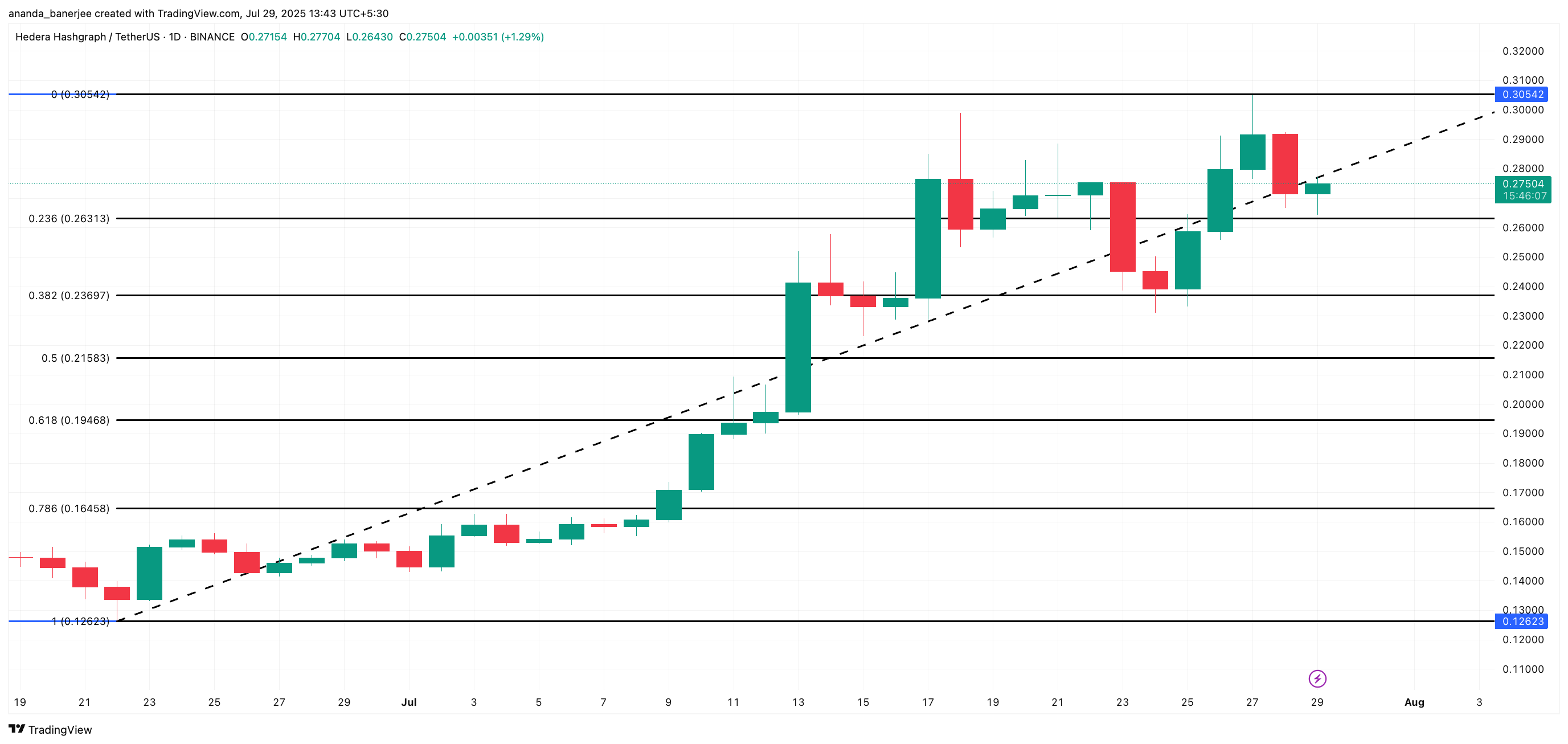

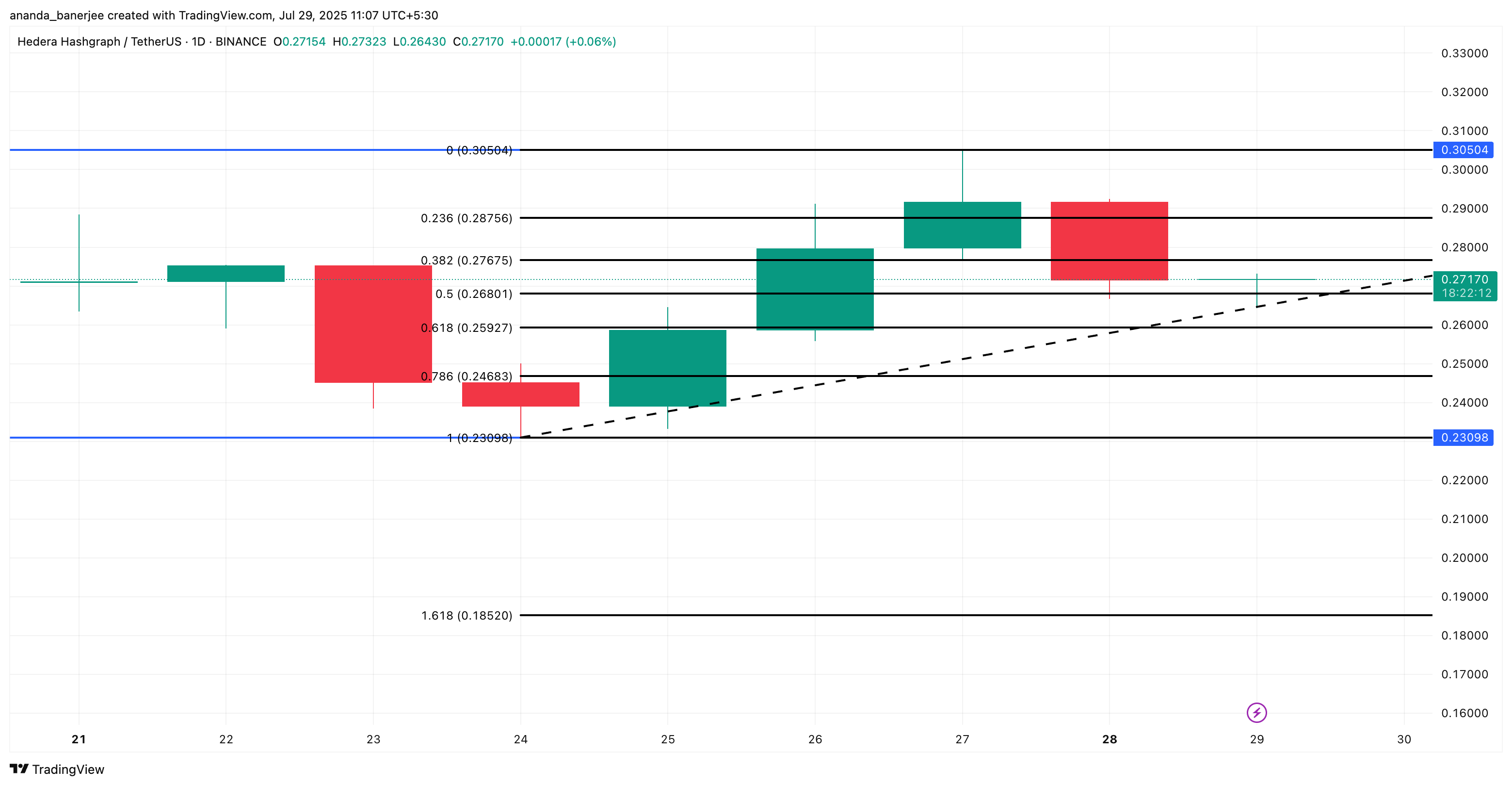

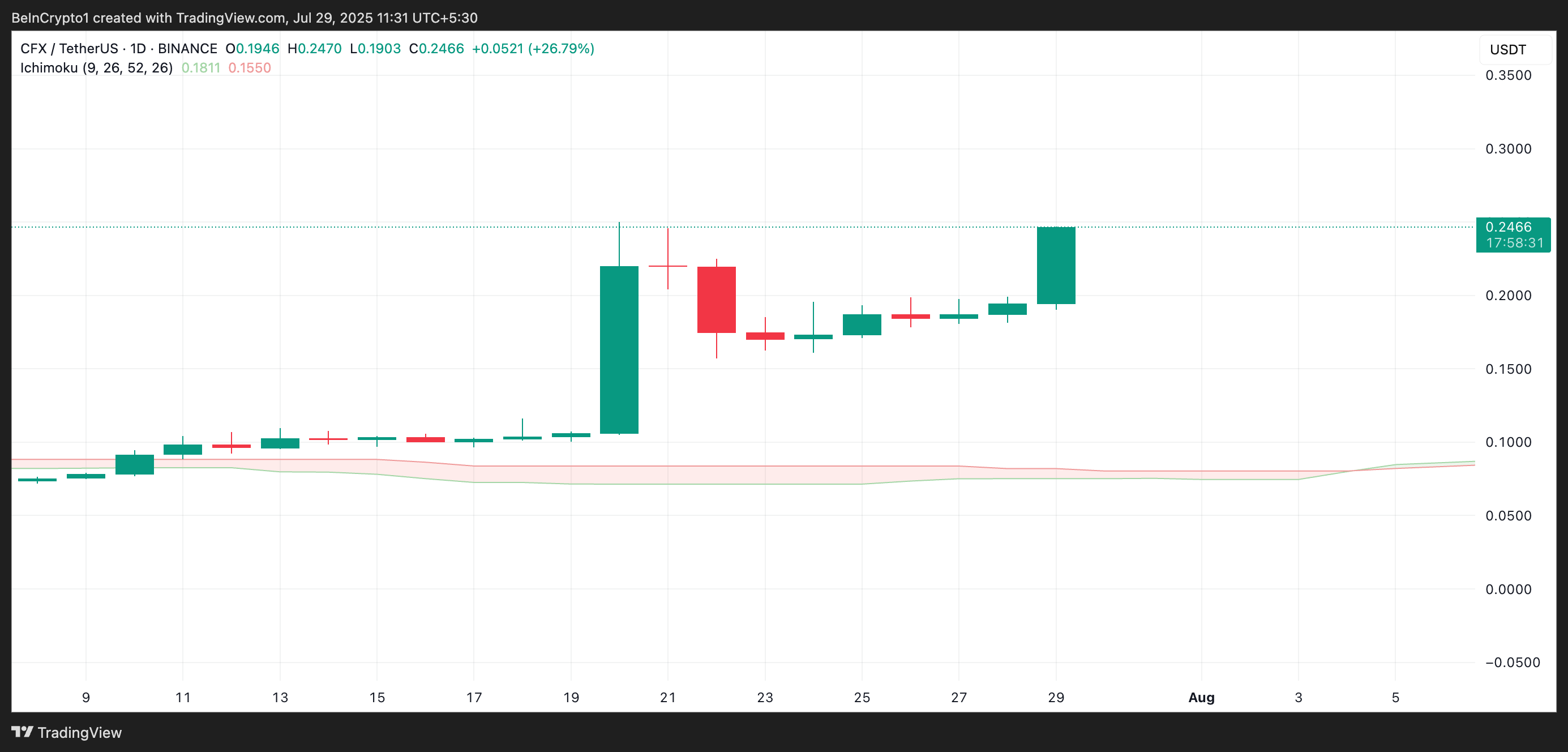

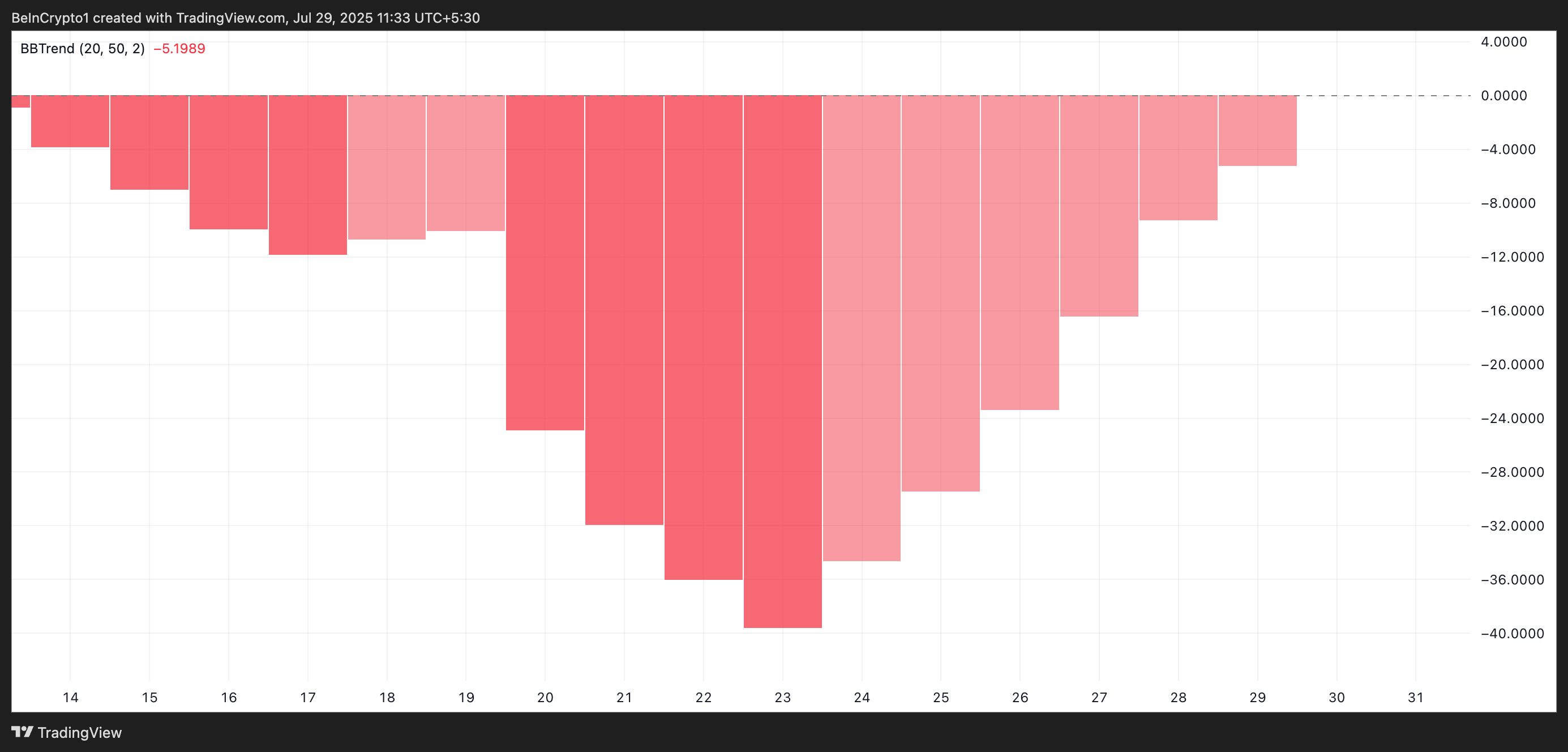

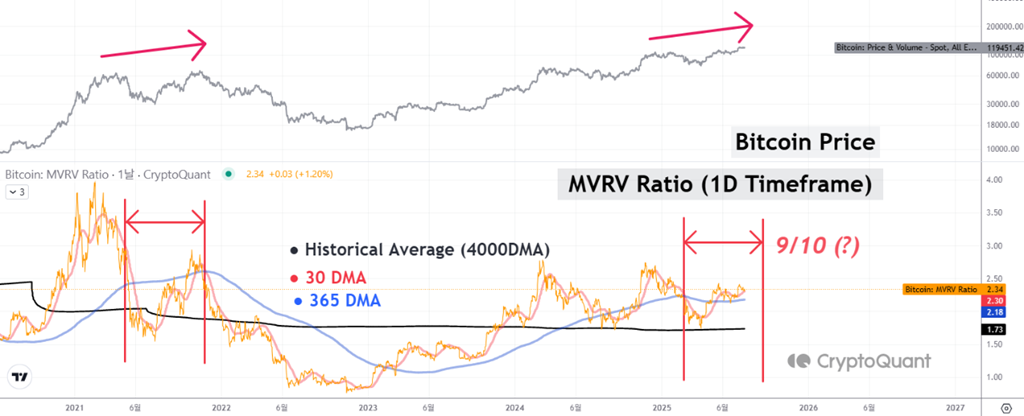

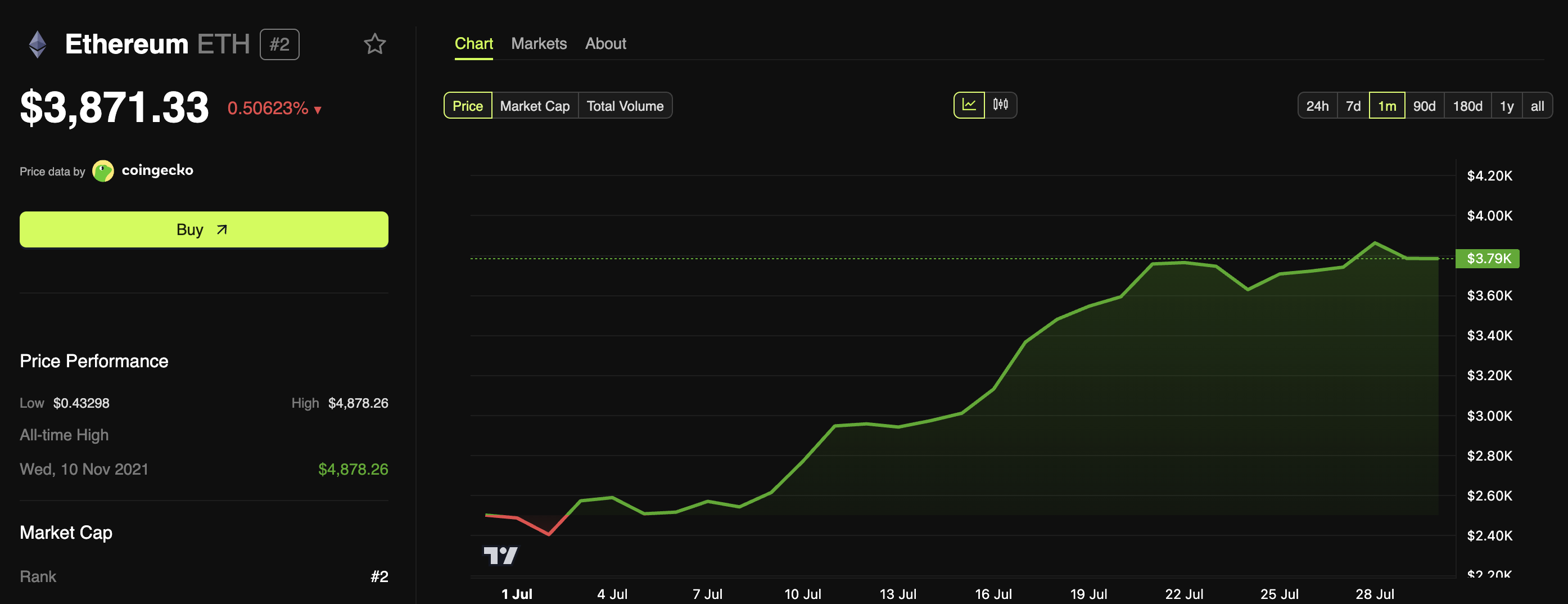

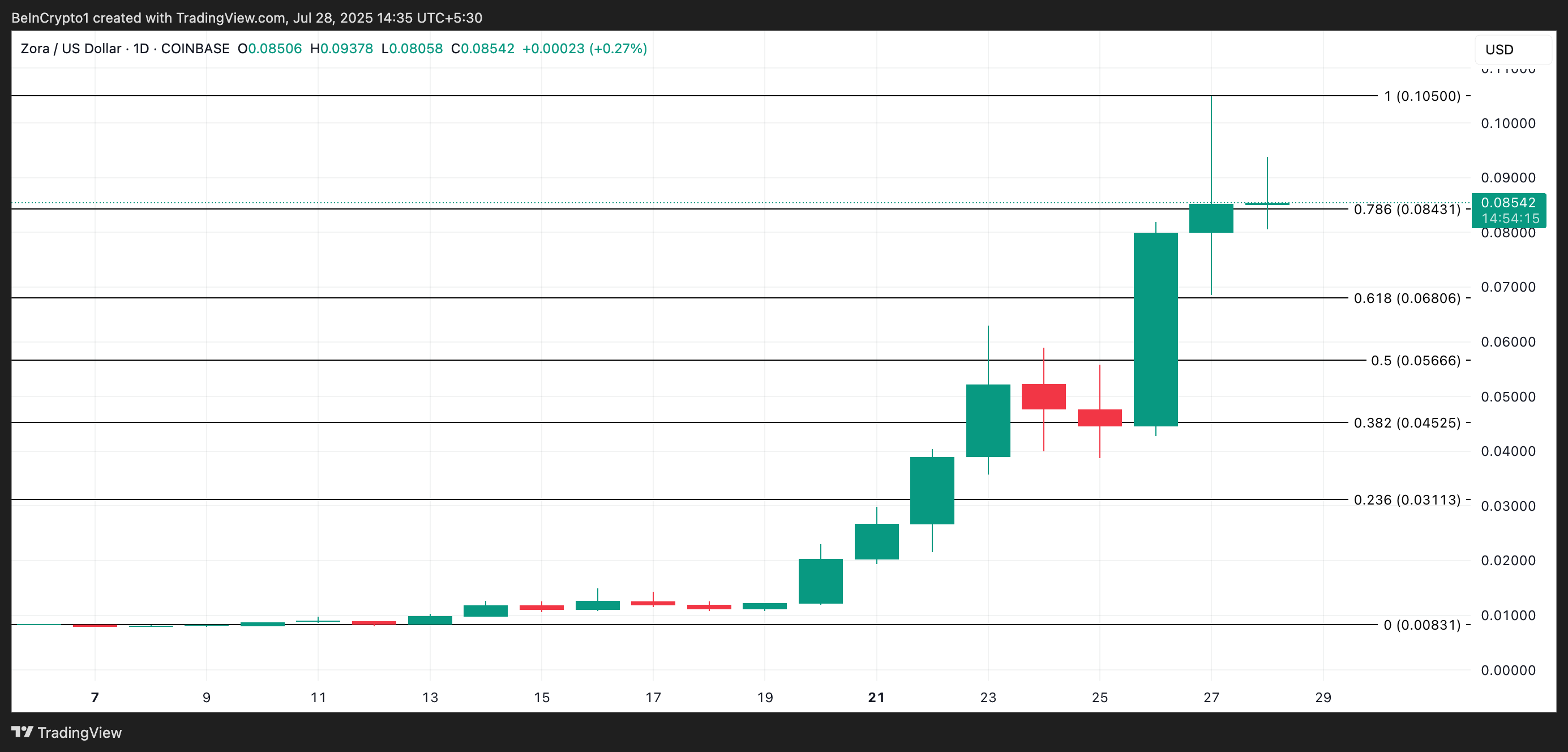

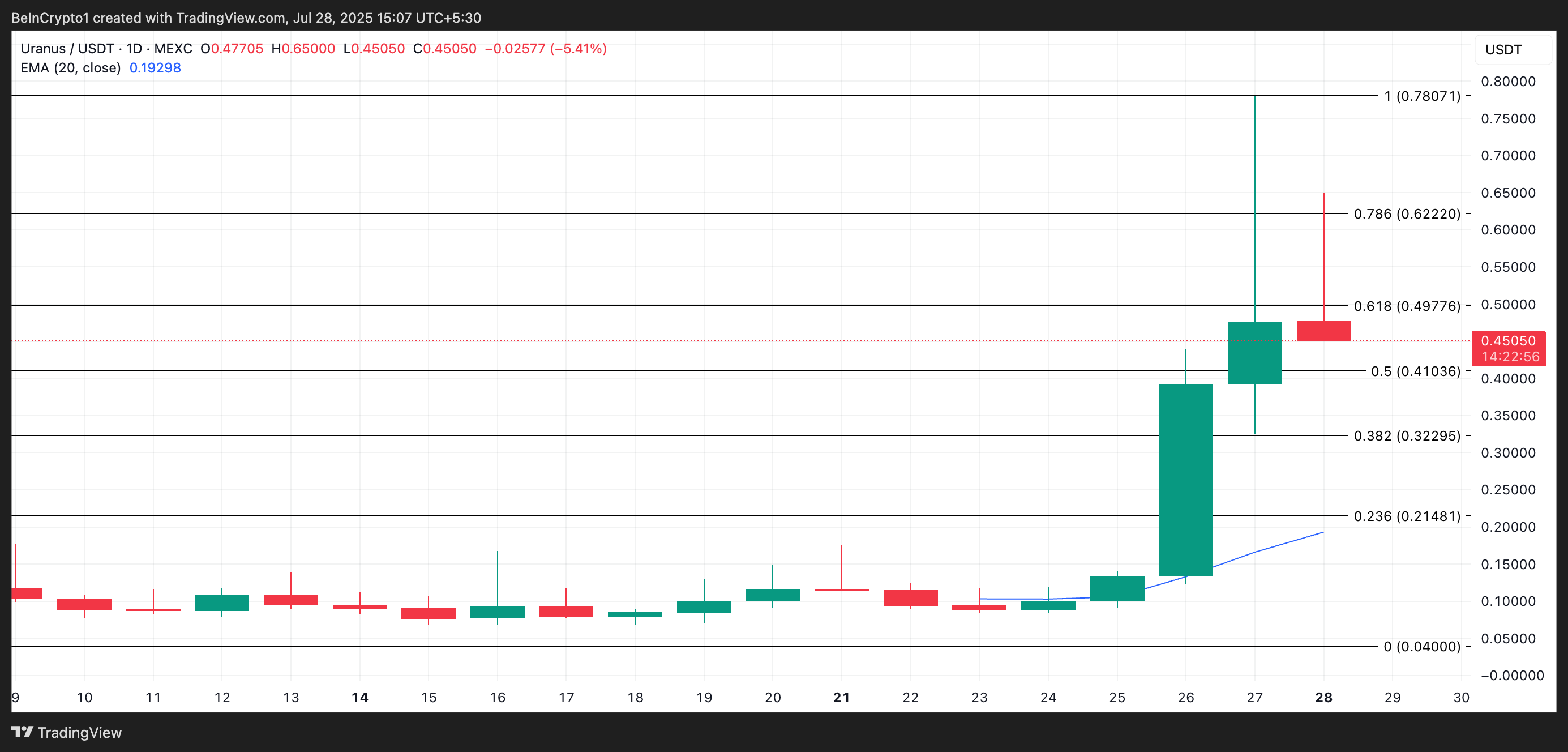

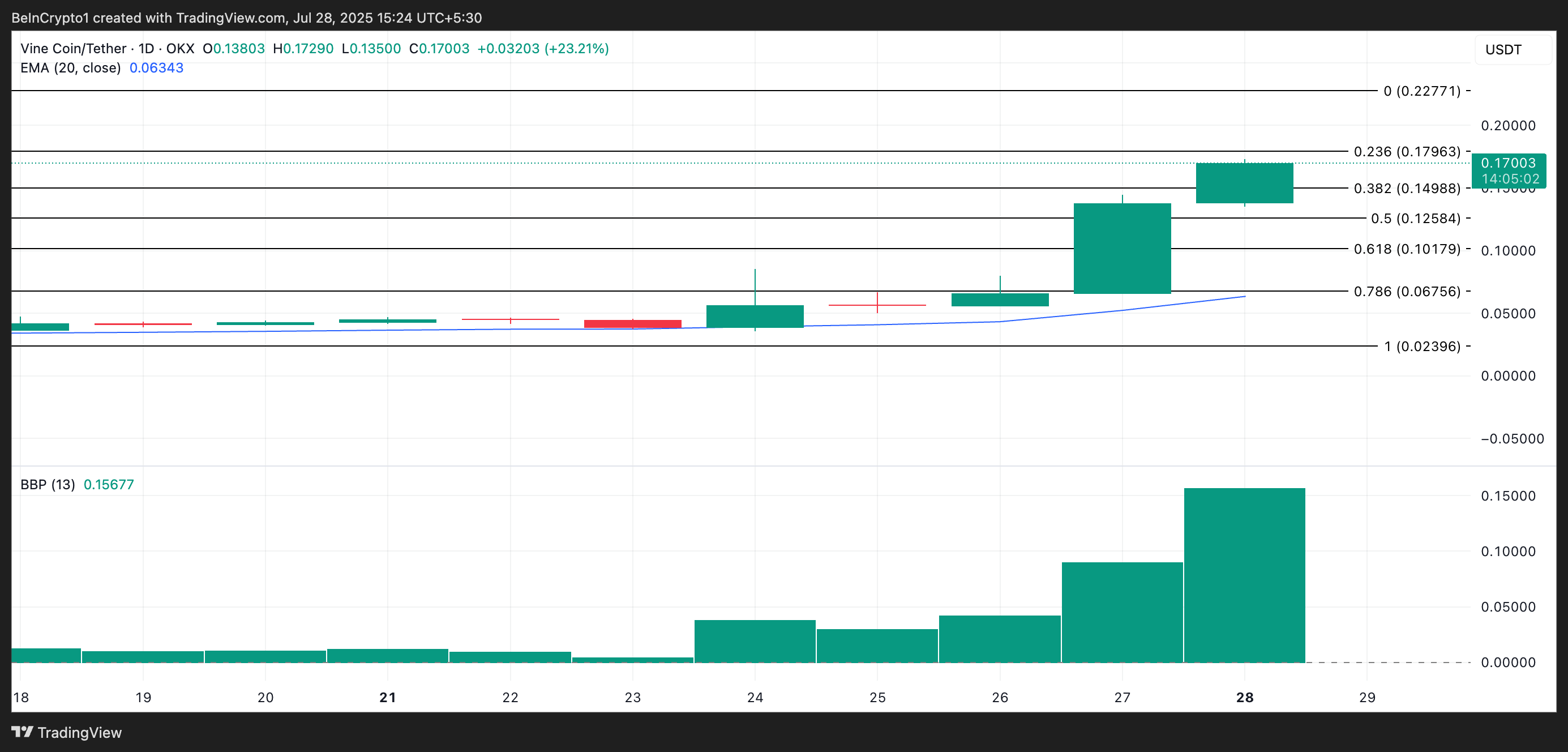

Kendrick also noted that the momentum has contributed to ETH’s latest price rally. BeInCrypto Markets data showed that the price appreciated 56.9% over the past month, and peaked at highs last seen many months ago.

“ETH has significantly outperformed BTC since ETH treasury companies took hold in early June, with the ETH-BTC cross up from an April low of 0.018 to 0.032 now. Buying by these companies, along with the best period for ETH ETFs on record, has certainly contributed to those gains. If the flows can continue, ETH may be able to break above the key USD 4,000 level (our current end-2025 forecast),” Kendrick disclosed to BeInCrypto.

Thus, Ethereum’s growing appeal among corporate treasuries highlights its potential for long-term growth. Now, how the asset will actually perform remains to be seen.

The post Standard Chartered Forecasts Corporate Treasuries Holding 10% of Ethereum’s Supply appeared first on BeInCrypto.