3 Altcoins to Watch in the Fourth Week of July 2025

The crypto market is showing bullish signs of an imminent altcoin season this week. Meanwhile, several altcoins are going through notable network developments, adding to the optimism.

BeInCrypto has analysed three such altcoins that present the best chances of a rise in the coming week.

Cronos (CRO)

Cronos price is showing signs of sustained growth as anticipation builds for the upcoming POS v6 upgrade on July 28. This significant update will enhance cross-chain compatibility and overall performance.

The development has generated positive sentiment among investors, potentially pushing CRO into a stronger uptrend over the coming weeks.

CRO is currently trading at $0.124 and attempting to secure $0.121 as a reliable support level. A successful bounce could send the altcoin toward $0.133. Notably, the 50-day EMA is nearing a crossover above the 200-day EMA, signaling the possibility of a bullish Golden Cross forming soon.

However, broader market shifts could challenge the bullish outlook. If bearish momentum rises, Cronos could lose its current support and drop to $0.108. Such a decline would negate the current positive structure.

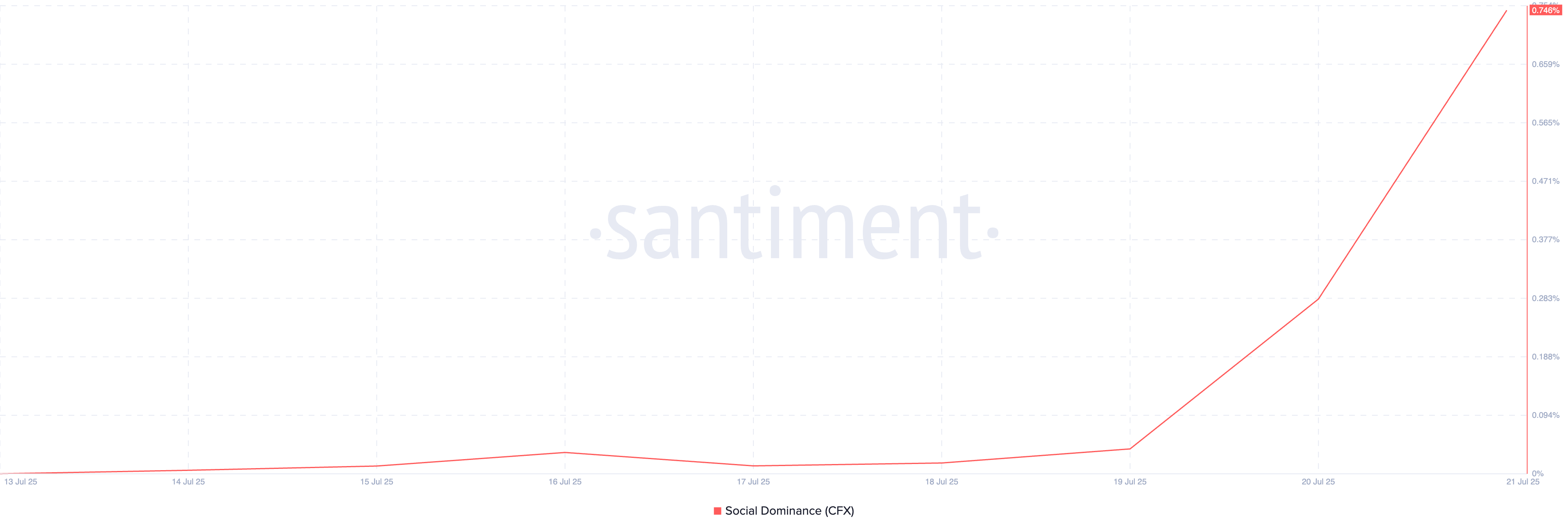

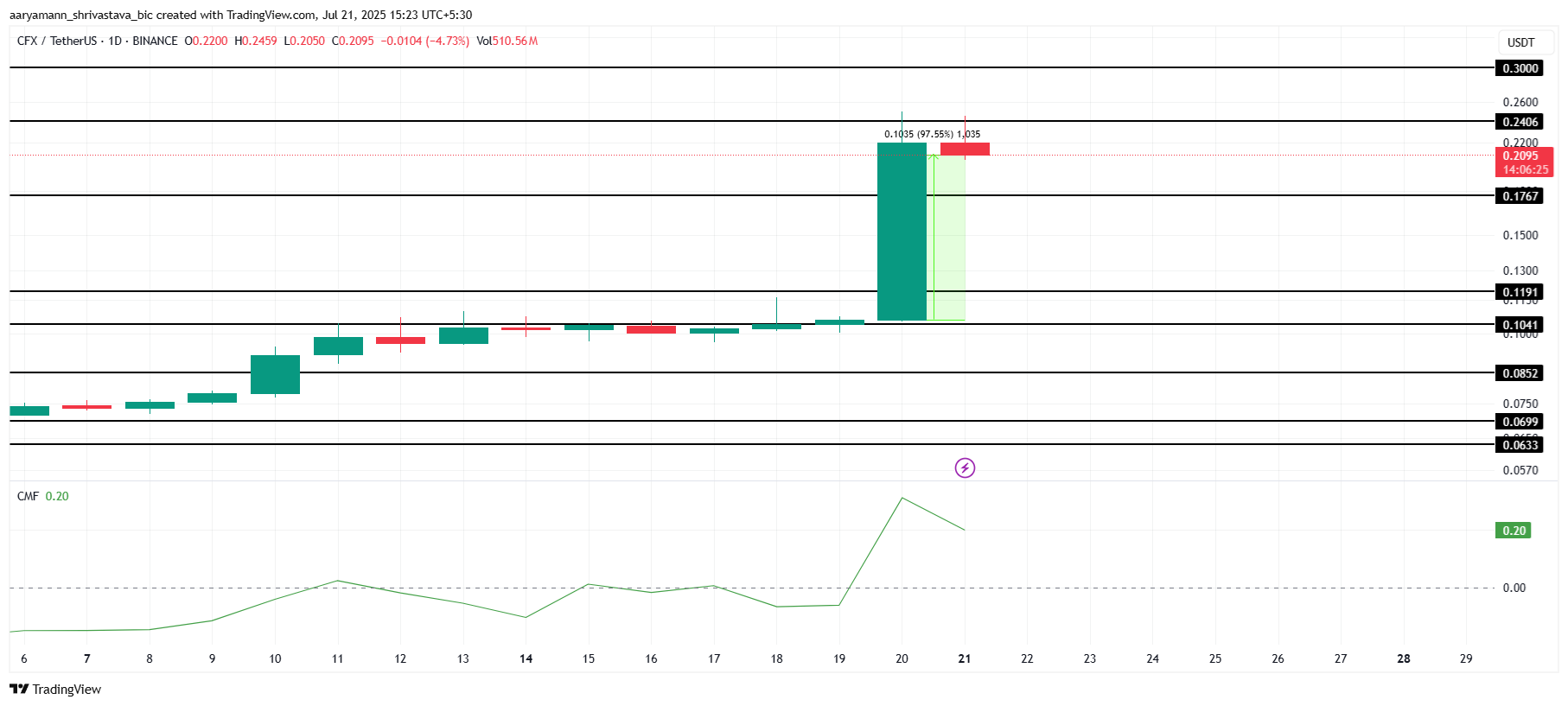

Conflux (CFX)

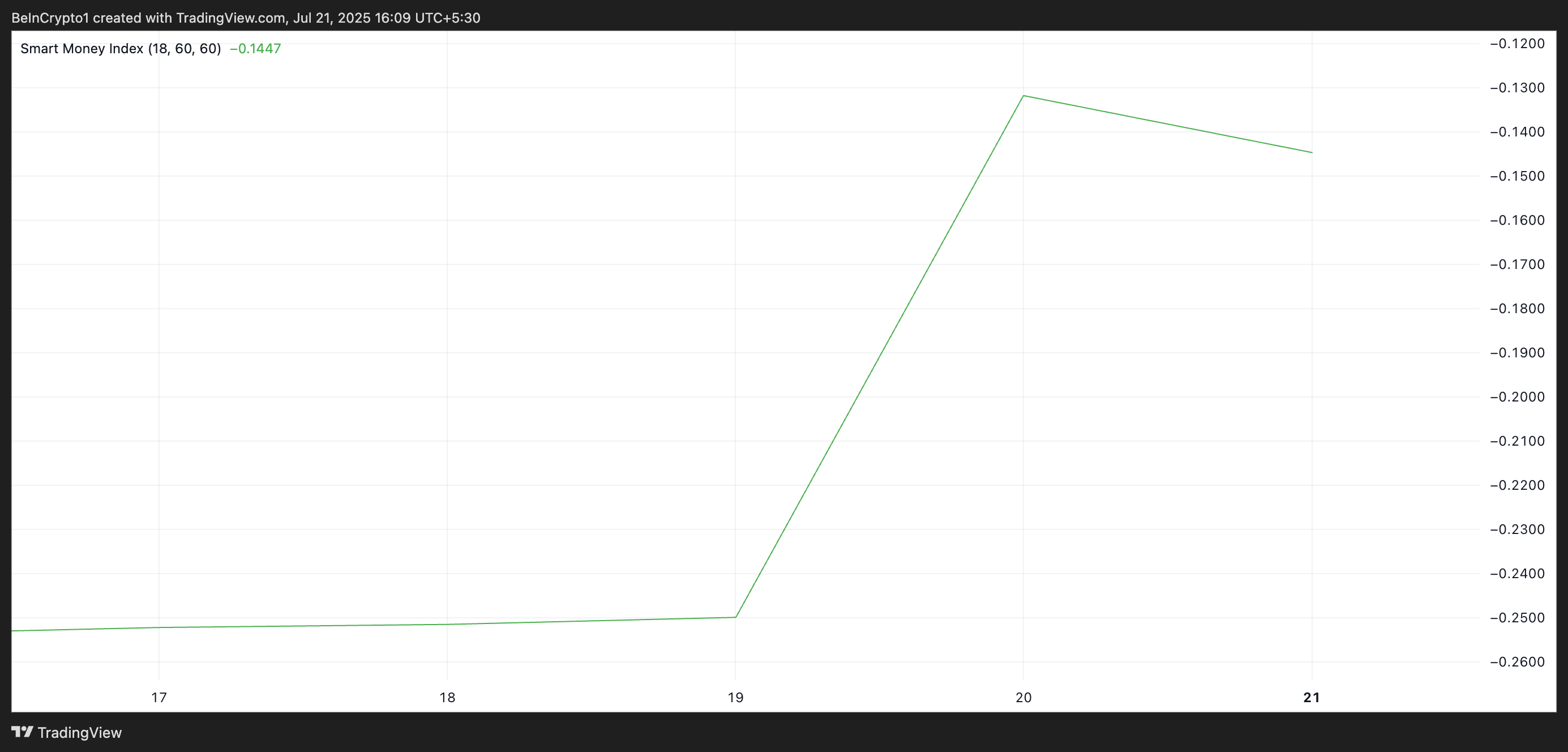

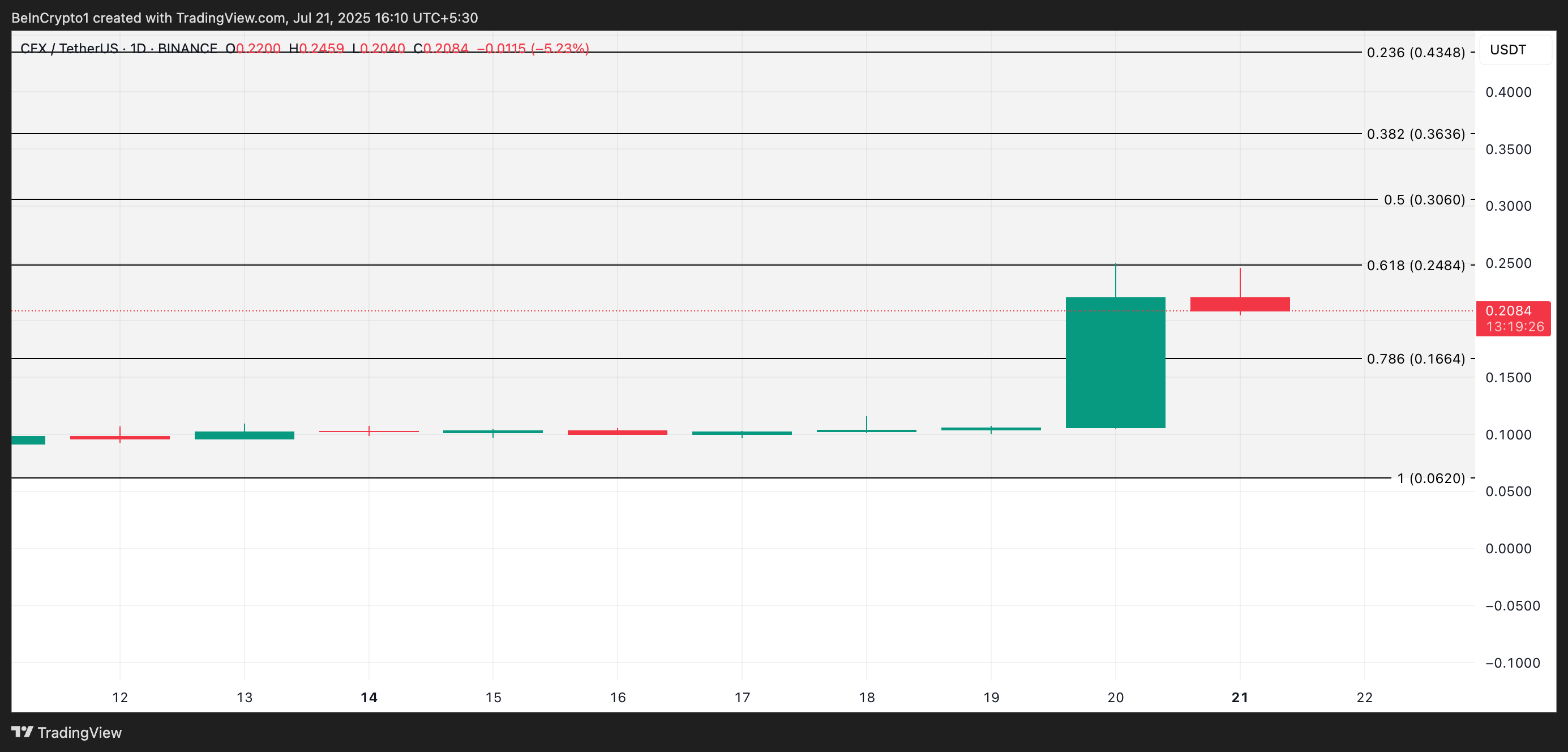

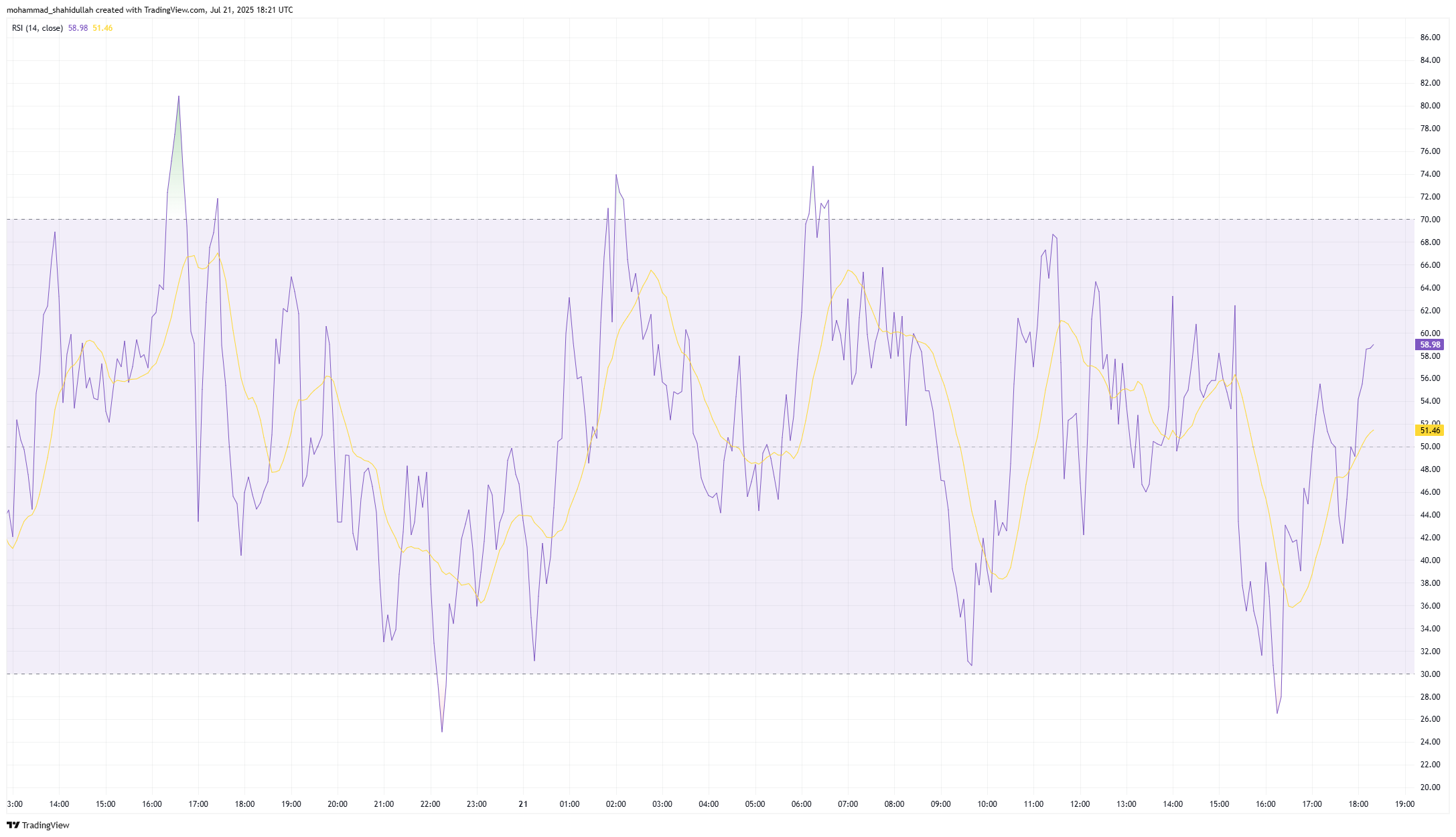

Conflux (CFX) has seen a major rally, becoming one of the top-performing altcoins in recent days. Boosted by the recent Conflux Conference in Shanghai, CFX surged 97.5% in the last 24 hours. The altcoin is now trading at $0.20, drawing investor attention amid heightened momentum and renewed community optimism.

Excitement continues to grow as Conflux gears up for its 3.0 upgrade, scheduled for early August. This major milestone could act as a bullish catalyst. If CFX rebounds from the $0.17 support level, the altcoin may breach $0.24 and potentially rise toward the key psychological mark of $0.30 in the short term.

However, risk remains if investors begin securing profits after the significant gains. A drop below the $0.17 support could drive CFX lower toward $0.11. Such a move would reverse current bullish momentum, causing traders to reassess expectations as bearish sentiment overtakes the altcoin’s rally.

Bitget Token (BGB)

Bitget, a leading crypto exchange, announced a partnership with Pudgy Penguins for a wellness escape in Kuala Lumpur this week.

Although the event isn’t directly crypto-related, such collaborations often pave the way for more impactful partnerships, potentially enhancing brand visibility and investor interest across meme coin and exchange ecosystems.

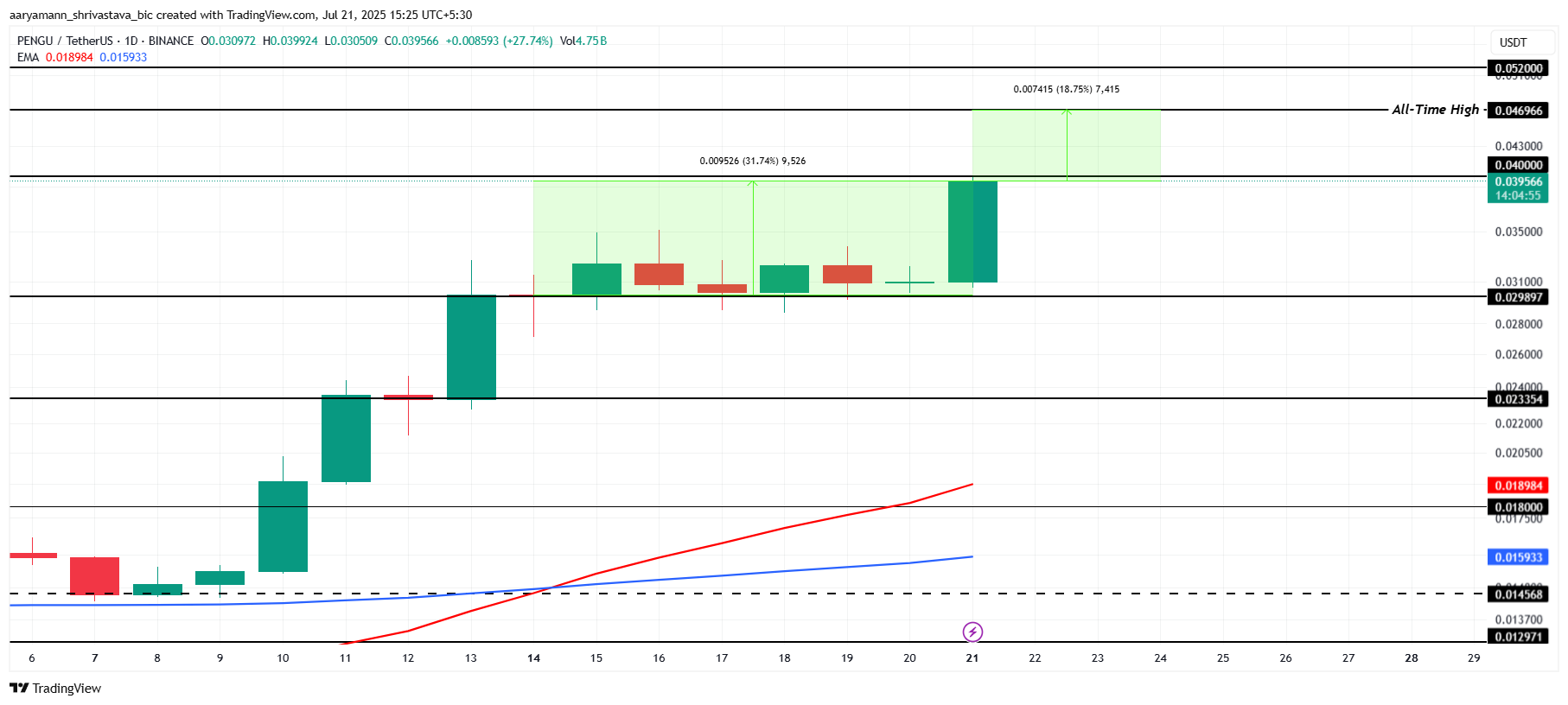

BGB price could see gains following this news, especially as technical indicators support a bullish outlook. The Parabolic SAR positioned below the candlesticks confirms an active uptrend.

If momentum holds, the altcoin could push past $5.05, helping Bitget’s token recover losses sustained during the May market correction.

However, bearish pressure may still weigh on BGB in the short term. If prices slip below the key support level of $4.83, further losses could drag the token to $4.46. Such a move would invalidate the bullish outlook and indicate weakening investor sentiment despite the positive market developments.

Want more token insights like this? Sign up for BeInCrypto Editor Harsh Notariya’s Daily Crypto Newsletter here.

The post 3 Altcoins to Watch in the Fourth Week of July 2025 appeared first on BeInCrypto.

Blockchain infrastructure

Blockchain infrastructure

Meet the New Shepard NS-34 crew: Arvi Bahal, Gökhan Erdem, Deborah Martorell, Lionel Pitchford, J.D. Russell, and H.E. Justin Sun. Read more:

Meet the New Shepard NS-34 crew: Arvi Bahal, Gökhan Erdem, Deborah Martorell, Lionel Pitchford, J.D. Russell, and H.E. Justin Sun. Read more:  (@justinsuntron)

(@justinsuntron)