Along with the rest of the market, the Ethereum price has experienced a significant recovery over the last few days. The recovery took place under the settling influence of the Donald Trump tariff news on the investors’ sentiments. However, despite that, the token remains far away from being bullish, concerning investors. Recently, the Ethereum crypto whales’ activity has increased; one simply moved $43.2M from exchanges. Why? Let’s discuss that and its potential impact on the ETH price.

Crypto Whale’s $43.2M ETH Move Hints at Building Confidence

According to The Data Nerd Guy, a crypto whale (Cumberland) has moved 23,733 ETH, equivalent to $43.2M on the current Ethereum price. Interestingly, the whale has withdrawn massive ETH holdings from the Coinbase crypto exchange, signaling their rising confidence in the asset as they aren’t selling anymore.

The ETH price chart shows a 12% recovery in the last 24 hours, currently trading at $1,823. As a result, whale activity has increased. Lookonchain’s post also highlighted whales’ high activity on this altcoin, with one whale buying 14,994 ETH. However, they soon sold, signaling that fear of volatility is still persistent around its price trajectory.

Bullish or bearish on $ETH?

This whale can’t pick a side on $ETH — buying one minute, selling the next.

He bought 14,994 $ETH($27M) at an average price of $1,801, and just 3 hours later, he sold 4,491 $ETH($8.07M) at an average price of $1,797.

Address:https://t.co/fLSaQPOYjc… pic.twitter.com/tgpGBtD99g

— Lookonchain (@lookonchain) April 29, 2025

Ethereum Price Walks on Bullish Track

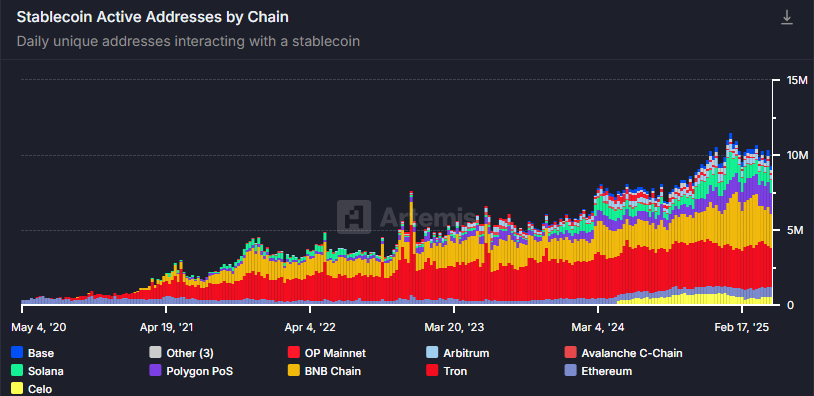

The technical and on-chain factors reveal a bullish case for Ethereum. Despite earlier declines, the active addresses are rising, hitting a new ATH of 15.4M after a 62.7% surge in a week.

Crypto analyst Blanc points out that the ETH is breaking above the 50-day moving average, with the key support between $1,812 and $1,857. Notably, this is an important sign of recovery, but it’s not confirmed yet.

Regardless, the long-term outlook is bullish, as it forms the bull flag. If a breakout happens, the Ethereum price could hit $10,000 in the long term. However, in contrast, the weakness still lies in the ETHBTC case.

Although it has improved, it’s still near a multi-year low (0.019). Experts claim that the bottom is close, but unless Ethereum starts outperforming Bitcoin, the bullish momentum is poor.

What’s Next?

Ethereum’s trajectory depends on various key factors, including key resistance and whale activities. Experts’ Ethereum price prediction reveals a potential consolidation soon due to the key resistance between $1,850 and $1,900.

However, as the macro-economic conditions shift, especially Fed interest rate cuts, they anticipate recovery in the next quarter before anticipating ETH price hitting $11k in the long term. However, the Bitcoin price trajectory to $200k needs to form before this.

The post What Does a Crypto Whale’s $43M ETH Move Mean for Ethereum Price? appeared first on CoinGape.