Cardano (ADA) has recently experienced a significant decline, bringing the altcoin to near its monthly low. The potential end of its Golden Cross has raised concerns, as it could signal further bearish price action for the cryptocurrency.

Despite these factors, long-term holders (LTHs) may help prevent a severe downturn by maintaining their positions.

Cardano Ends Its Golden Cross Short

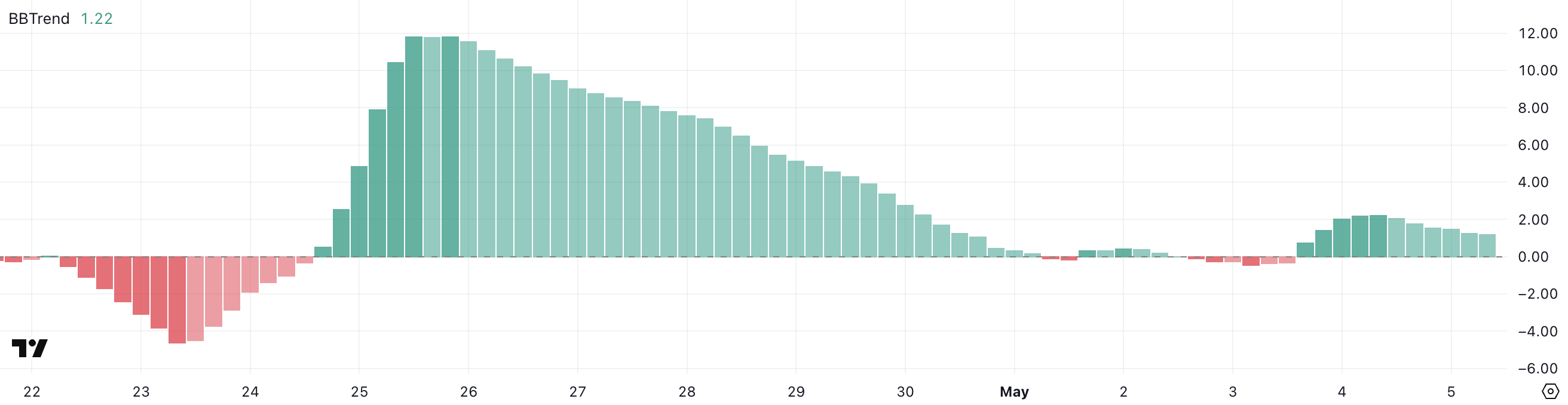

The current market sentiment for Cardano points to the potential formation of a Death Cross. This happens when the 50-day exponential moving average (EMA) slips below the 200-day EMA.

If confirmed, it will mark the end of the ongoing Golden Cross, which has only lasted for three weeks. This short-lived Golden Cross is even shorter than the previous Death Cross, which lasted for over a month.

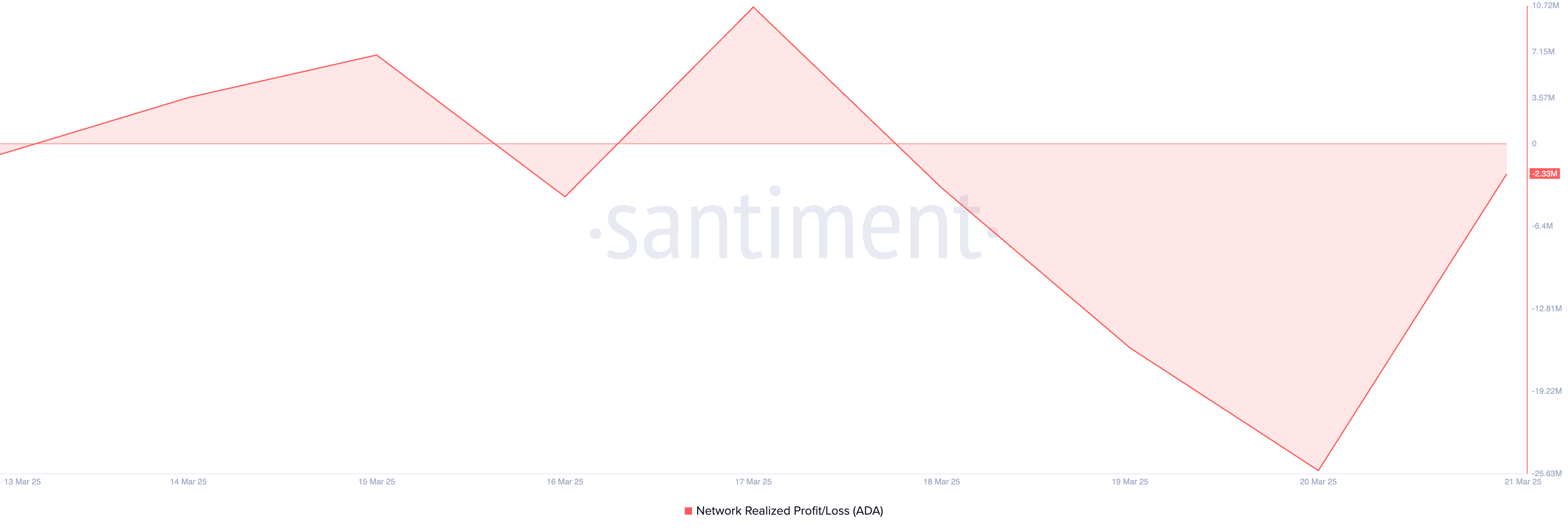

The relatively brief Golden Cross has left traders with a sense of uncertainty. A reversal in trend may trigger more sell-offs, amplifying the downward momentum. Therefore, Cardano’s price is in a critical phase, with any further bearish developments likely causing a deeper correction.

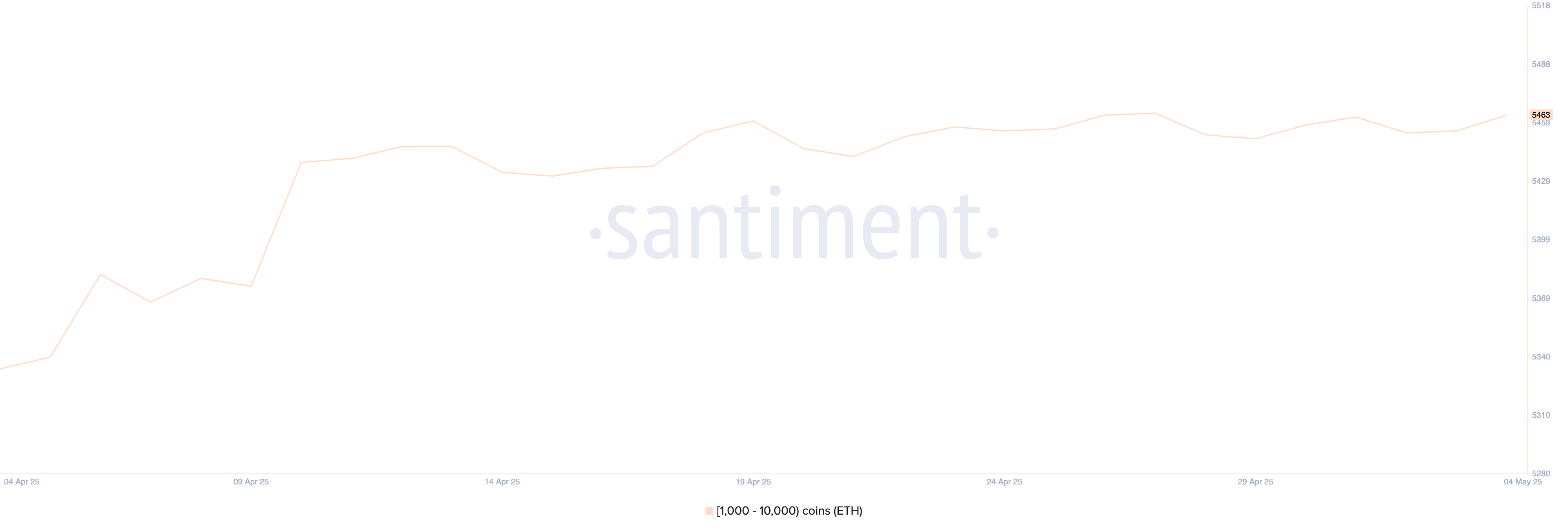

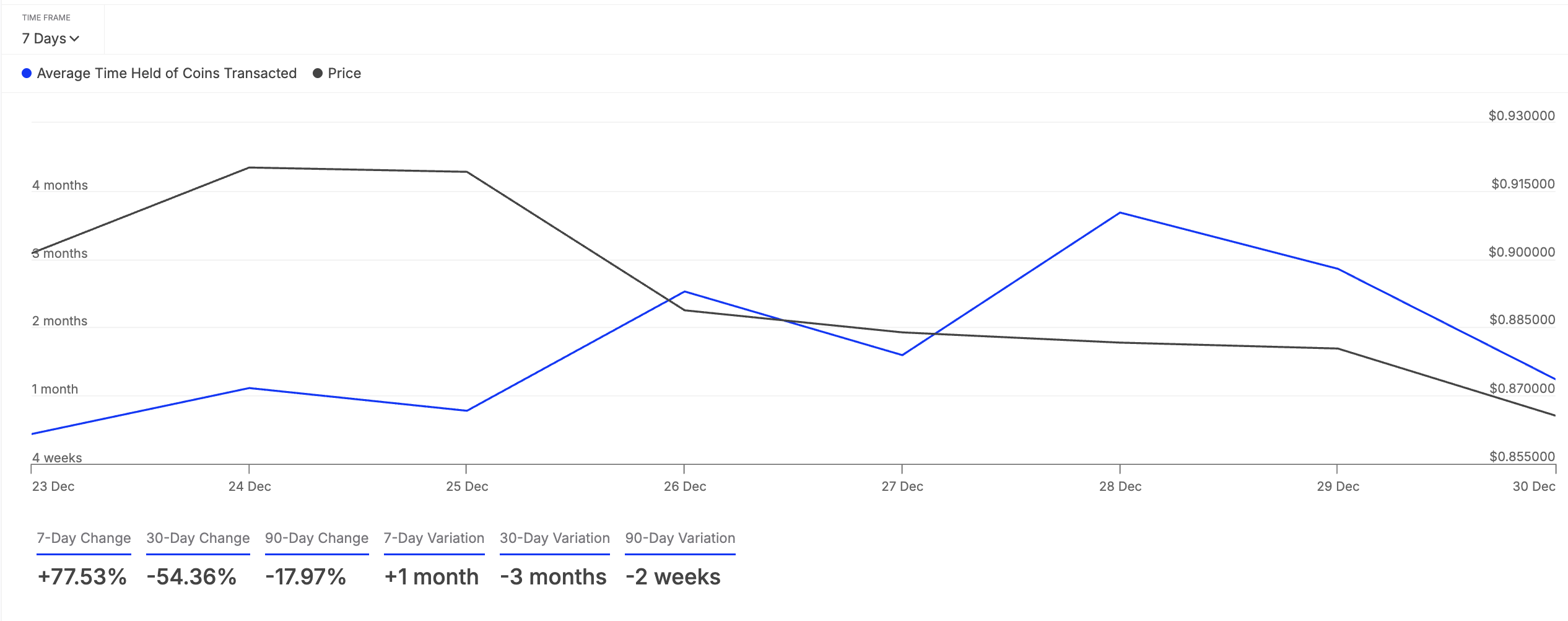

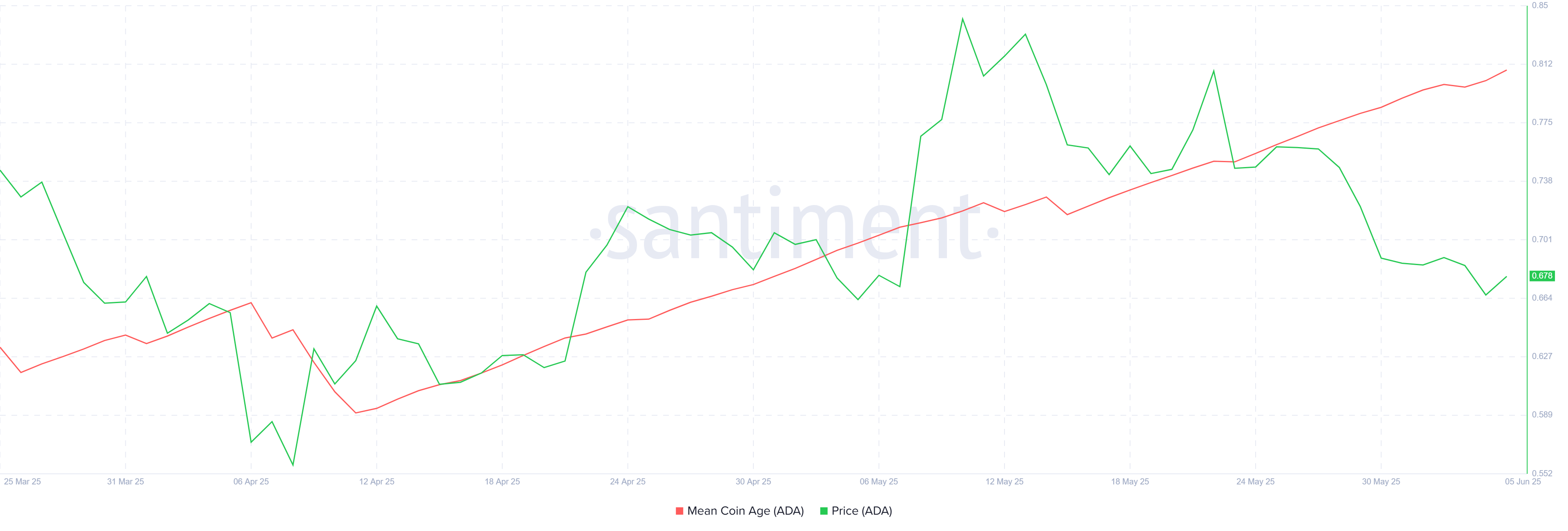

On the macro level, the Mean Coin Age (MCA) shows signs of an uptick, indicating that long-term holders (LTHs) are holding steady instead of selling. This behavior is crucial for stabilizing Cardano’s price, as LTHs typically resist selling in the face of short-term volatility. Their commitment to holding ADA strengthens the support levels, which could cushion the impact of the bearish trends from the broader market.

The resilience of LTHs provides an important counterbalance to the negative signals emerging from technical indicators. As long as LTHs maintain their positions, it’s possible that Cardano can withstand some of the bearish pressure and limit the downside risk.

ADA Price Could Bounce Back

Cardano’s current price is at $0.67, holding above the crucial support of $0.66. If the price fails to maintain this support, ADA could experience a further drop, possibly testing the $0.60 level. The loss of this key support could pave the way for additional losses, extending the ongoing downtrend.

The potential formation of the Death Cross would likely exacerbate the situation, bringing ADA to a month-and-a-half low. In such a scenario, the pressure on Cardano could intensify, making a recovery more difficult. Should the technical indicators align with broader market conditions, the risk of further declines increases significantly.

On the other hand, if Cardano price can hold above $0.66 and bounce back, a rise above $0.69 is possible. A successful breach of this level would position ADA for a push toward $0.74, potentially invalidating the bearish thesis. LTHs’ support and a reversal in the broader market could fuel this recovery.

The post Cardano Golden Cross Ends In Under A Month; Price Drop Ahead appeared first on BeInCrypto.