Today is poised to be a pivotal moment for both traditional financial markets and the cryptocurrency landscape, as noted by the well-regarded analyst, Ash. In a recent tweet, he emphasized the imminent release of critical job data in the United States U.S, a key economic indicator that has the potential to ignite significant market movements. The figures are expected within the next few hours, and Ash has raised the stakes—investors should prepare for either a substantial rally or a sharp downturn.

The Job Data Impact – Pump or Dump?

Ash’s insights highlight the tight correlation between traditional markets and cryptocurrencies, especially as the job data release approaches. The implications of this data could lead to a pronounced effect on the U.S. stock market, translating into direct consequences for crypto prices. With traders on high alert, today’s job data has become a double-edged sword, where positive figures could send markets soaring, while disappointing results might lead to a swift sell-off.

Geopolitical Tensions Add to Market Volatility

In addition to economic indicators, Ash has also pointed to rising geopolitical tensions as a critical factor influencing the market. Reports indicate that Israel is considering a counterattack against Iran today, an escalation that could further destabilize the already tense situation in the Middle East. Such developments typically lead to increased volatility as investors weigh geopolitical risks alongside economic data.

Bitcoin at a Crucial Crossroads

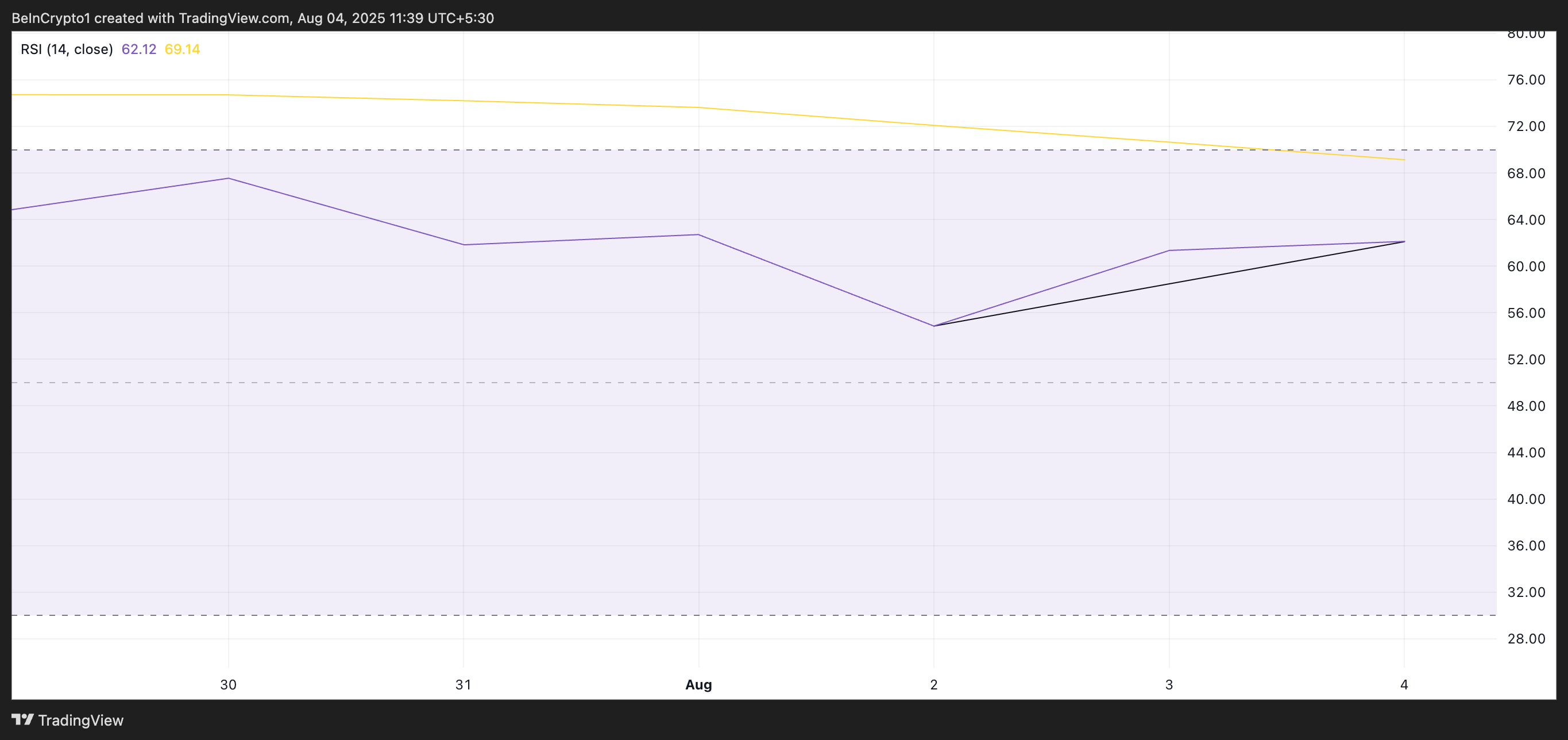

Among the myriad factors affecting the crypto market, Bitcoin (BTC) finds itself at a crucial turning point. Ash notes that for BTC to sustain its recent bullish momentum, it must hold support at $60,000. Failure to maintain this level could trigger a rapid decline to the $56,000-$57,000 range, a prospect that is concerning for many investors who have witnessed the volatility of late.

Despite recent fluctuations, Bitcoin’s outlook had been promising, peaking at $66,400 in recent days. However, the market’s erratic nature saw it dip as low as $59,000 before recovering to the $61,000 mark at the time of writing. This highlights the fragile balance BTC is currently navigating amid external pressures.

As the combined forces of potential geopolitical conflict, upcoming U.S. elections, and critical economic data create a perfect storm of market uncertainty, Ash urges investors to remain vigilant. His advice to hold positions and resist being shaken out by short-term movements is crucial. In times of volatility, the temptation to react impulsively can lead to missed opportunities or significant losses.

With just hours to go until the job data release, traders and investors are on the edge of their seats. The potential for a market pump or dump looms large, making today a crucial day for both stocks and cryptocurrencies. As the situation unfolds, all eyes will be on the numbers—and the subsequent reactions across markets.

Also Read: Bitcoin Surges Past $61K – 82% Of Addresses In Profit—Is A $57K Correction Coming?

As the financial world braces for impact, the blend of economic indicators and geopolitical developments underscores the complexity of today’s market dynamics. Investors must stay informed and strategically navigate these turbulent waters.