XRP Up 35%, Eyes $5 Target While FX Guys Just Hit a Major Milestone

The post XRP Up 35%, Eyes $5 Target While FX Guys Just Hit a Major Milestone appeared first on Coinpedia Fintech News

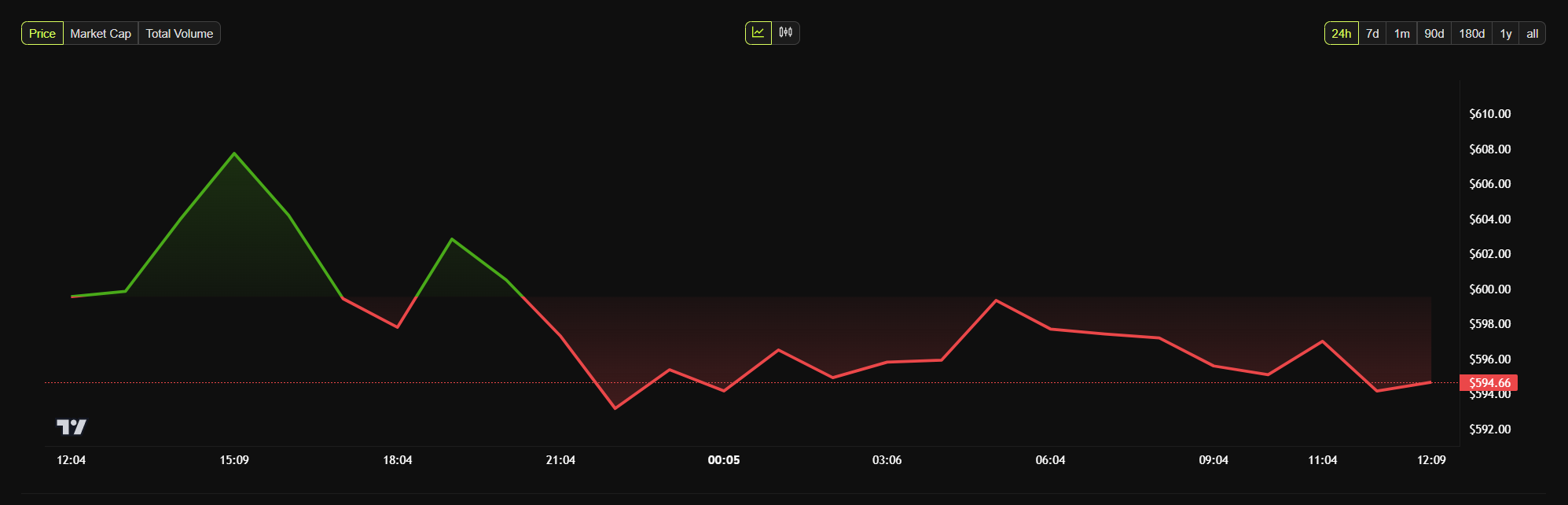

XRP moved upward strongly, rising 35 % over the past few weeks as positive market actions brought the token near the long-awaited $5 goal. Investor trust in XRP grew much because of more users growing interest from large firms and new progress in Ripple’s legal case. With market trends set for more gains, XRP shows again why it stays a strong player in the crypto area.

While XRP’s rise grabs notice, another project makes its mark in the crypto field. FXGuys reached an important step by collecting over $4 million during its Stage 3 presale. This result shows the rising appeal of FXGuys as a top project in the trader besides investor scene and it opens new chances for deals.

FXGuys: The Breakout Altcoin That Investors Are Watching

As XRP reaches new heights, FXGuys becomes known as a promising altcoin with high potential. In comparison to many tokens made for guessing, FXGuys joins DeFi with its own trading system giving traders solid funds moreover clear staking rewards.

A main part of FXGuys is its Trader Funding Program and Trader Development Ecosystem, which helps top retail traders earn up to $500,000 in trading funds. With an 80/20 profit share that favors traders, it gives people a chance to move forward in trading without the money issues of usual funding models. This part alone puts FXGuys among the top firms in store-bought trading.

Also staking the $FXG token brings a 20 % cut from broker trading profits making it one of the best staking plans. Instead of tokens that depend only on price guessing, FXGuys brings plain money benefits through its Trade2Earn program giving traders $FXG tokens for their trading work. This method raises both liquidity and trading volume making the system even stronger.

Why FXGuys Is Gaining Momentum Amidst XRP’s Rally

XRP’s rising trend grabs notice, yet FXGuys stands out as an upcoming name in altcoins. The project works to clear obstacles in trading by giving fast access to funds, a major help for traders who need quick funding. This option lets experienced traders begin work right away without long waiting times adding to FXGuys’ charm for both experts and newcomers.

Besides its funding benefits, FXGuys works as a broker-backed crypto trading firm letting traders use different systems such as MT5, Match-Trader, cTrader along with DXtrade based on where they live. This kind of choice is uncommon plus gives traders high-quality tools without limits.

Another important point that makes FXGuys special is its system with no tax on buying or selling, moreover a model that does not require identification checks for trade. At a time when rules are tightening, FXGuys lets traders work without revealing their identity and still enjoy advanced features.

By offering same-day options for using over 100 local currencies or crypto for deposits in addition to withdrawals, FXGuys makes moving money simple making it one of the easiest platforms to use. This focus on easy access and support for traders is a key reason why FXGuys draws strong interest from investors along with big names like XRP.

Final Thoughts: XRP’s Bullish Outlook and FXGuys’ Rapid Growth

XRP jumped 35 % showing the crypto market prepares for another upward move and the token now aims for a $5 value. While established assets such as XRP continue to rise, new projects like FXGuys prove to be serious players in the altcoin world.

FXGuys gathered over $4 million in its presale furthermore offers a system that mixes trading, staking along with funding chances, so investors clearly notice it. With 2025 near FXGuys stands out as one of the most promising tokens in decentralized finance furthermore proprietary trading making it a top option for those seeking altcoins with strong potential.

To find out more about FXGuys follow the links below:

Presale | Website | Whitepaper | Socials | Audit

The post XRP Up 35%, Eyes $5 Target While FX Guys Just Hit a Major Milestone appeared first on Coinpedia Fintech News

XRP moved upward strongly, rising 35 % over the past few weeks as positive market actions brought the token near the long-awaited $5 goal. Investor trust in XRP grew much because of more users growing interest from large firms and new progress in Ripple’s legal case. With market trends set for more gains, XRP shows …