Spot Bitcoin ETFs extended their inflow streak by another day on Thursday, marking the fifth consecutive day of net positive flows. The total inflow for the day stood above $440 million.

The continued inflows come amid a modest market rebound over the past 24 hours.

Bitcoin ETF Inflows Hit $2.68 Billion for the Week

Bitcoin ETFs recorded another day of net inflows on Thursday, extending their streak to five consecutive days. The latest addition of $442 million brought the week’s total to $2.68 billion, the highest weekly net inflow since the first week of December 2024.

On Thursday, BlackRock’s ETF IBIT recorded the largest daily net inflow of $327.32 million, bringing its total cumulative net inflows to $40.96 billion.

Ark Invest and 21Shares’ ETF ARKB followed in second place with a net inflow of $97.02 million, pushing its total historical net inflows to $3.09 billion.

BTC Futures Show Uptick in Demand

The crypto market has witnessed a modest rebound over the past 24 hours, pushing BTC’s price up by 1% over the past day. During the same period, open interest in BTC futures has also risen, signaling a slight uptick in investor demand.

At press time, this is at $65.31 billion, up 1% today. The gradual rise in BTC’s price and open interest signals growing market participation and increasing confidence in the ongoing trend.

This simultaneous uptick suggests that new positions are being opened to support the price movement, often interpreted as a bullish indicator.

Moreover, call volumes have outpaced puts in the options market, reflecting a tilt toward bullish sentiment. As of this writing, the coin’s put-to-call ratio is at 0.74.

When an asset’s put-to-call ratio is below 1, more call options are being purchased than puts, reflecting a bullish sentiment among options traders. This suggests that investors are positioning for a sustained upside in BTC’s price.

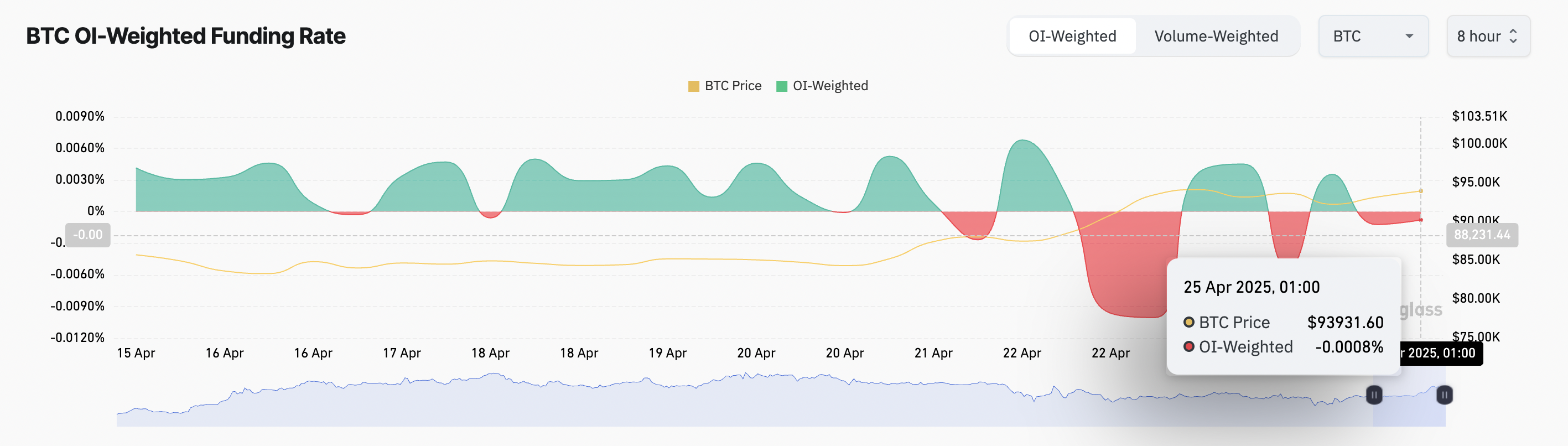

However, despite these positive indicators, BTC’s funding rate remains negative. At press time, the metric is at -0.0008%.

The funding rate is a periodic payment between long and short positions in perpetual futures contracts. It keeps the contract price in line with the spot market. When the funding rate is negative, it indicates bearish sentiment, as more traders are betting on a price decline.

This suggests that some futures traders are still betting on BTC’s short-term downside, even as ETF demand and market metrics show renewed strength.

The post BlackRock Leads as Bitcoin ETFs Inflow Streak Hits Day 5 | ETF News appeared first on BeInCrypto.