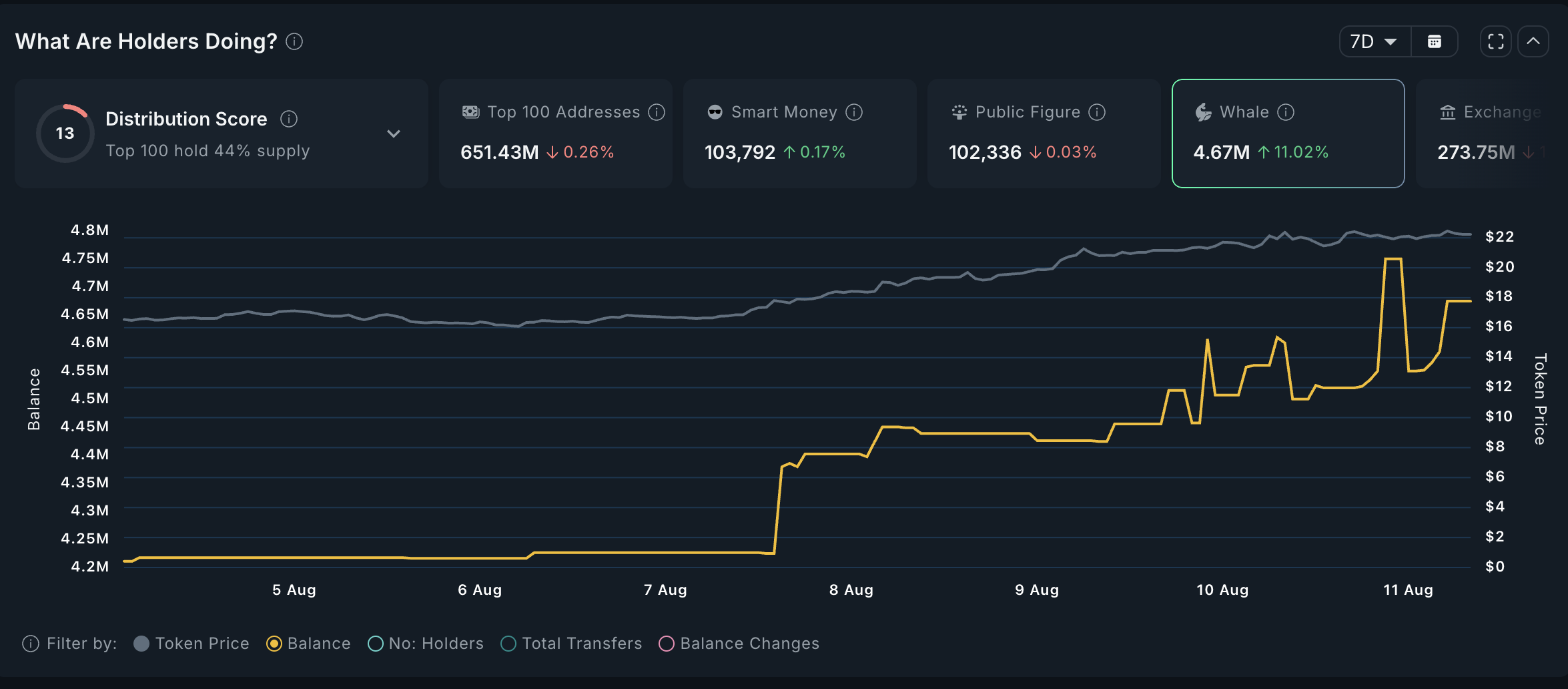

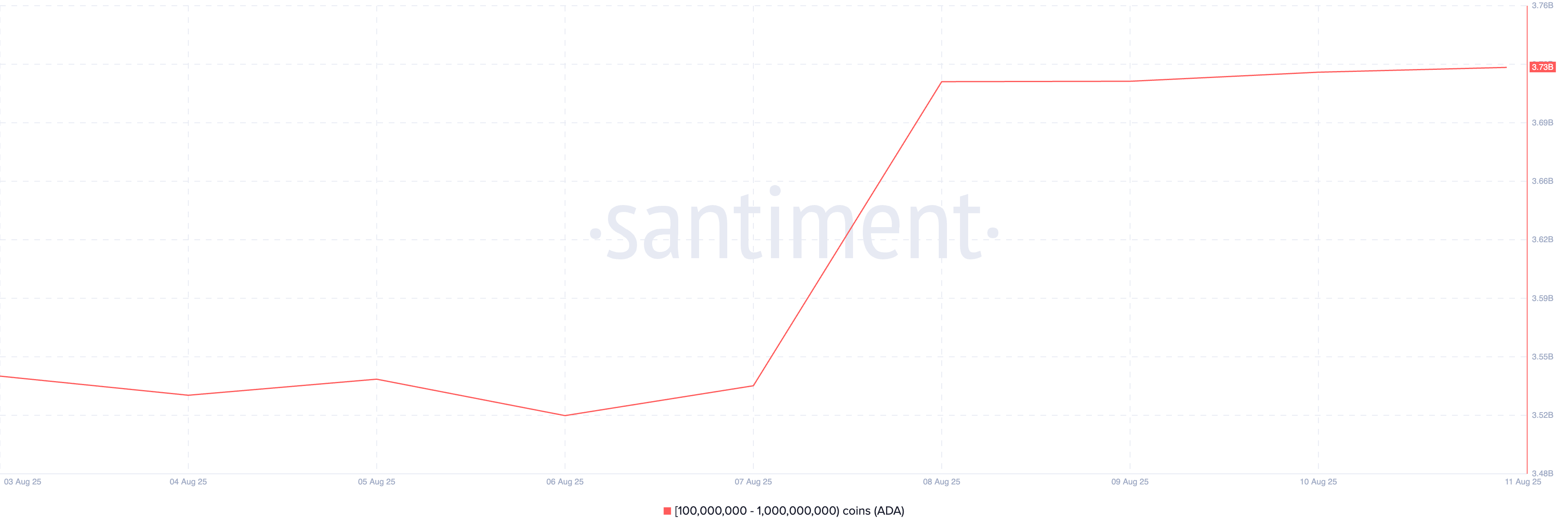

According to a new analysis, the character of the current crypto bull market has changed. Institutional participation is paving the way for a longer, more sustained period of growth at the expense of the explosive gains seen in past cycles.

On-chain data analyst ‘Yonsei_dent’ of CryptoQuant argued Wednesday that key metrics show the market is maturing. He pointed to the Net Unrealized Profit/Loss (NUPL) indicator, explaining that it shifts toward “longer, more sustainable cycles” that may feature fewer sharp, short-term rallies that defined previous bull runs.

Institutional Investors Transformed the Market Nature

The NUPL metric essentially gauges the market’s overall profitability. When it’s high, many investors hold significant unrealized profits, which increases the temptation to sell and take profits.

“Historically, NUPL peaks have been a remarkably accurate signal for market cycle tops. The 2017 cycle had one massive peak. The 2021 cycle had two. In the current cycle, NUPL appears to be attempting a third peak. What we’re seeing now is new.”

Yonsei_dent attributes this fundamental shift to the influx of institutional capital, particularly through the successful US-based spot Bitcoin ETFs. This new source of demand is more consistent and less speculative than the retail-driven frenzy of past cycles.

“The ETFs have been a game-changer,” the analyst noted. “They bring a stabilizing force and immense liquidity.”

This new stability, however, comes at a price. While the market is larger and less volatile, the analysis shows that the percentage gains during each successive rally in this cycle have gradually decreased.

“The era of frenzied, 100x rallies in a short period might be behind us. The data suggests we are entering a new paradigm. Bull markets may last longer and be built on a more solid foundation, but investors should adjust their expectations for the kind of sharp, overheated gains we saw in the past.”

The post Bitcoin’s New Bullish Nature: Long Climb Without Sharp Surges appeared first on BeInCrypto.