The post Bitcoin Nears Record High as Analysts Predict $130K Breakout Ahead of Key CPI Data appeared first on Coinpedia Fintech News

Monday has brought a bullish surge for Bitcoin, with the entire crypto market trading in the green. The world’s largest cryptocurrency jumped 3.5% in the last 24 hours, lifting its market value to $2.42 trillion.

Now, all eyes are on BTC as it nears an all-time high, with analysts eyeing a push toward $130K in this post-halving year ahead of the U.S. CPI report.

Bitcoin Nears All-Time High

Bitcoin kicked off the week on a strong note, climbing 5% to reach $122,000. The rally followed US President Donald Trump’s order allowing retirement savings plans, like 401(k)s, to invest in alternative assets, including cryptocurrencies.

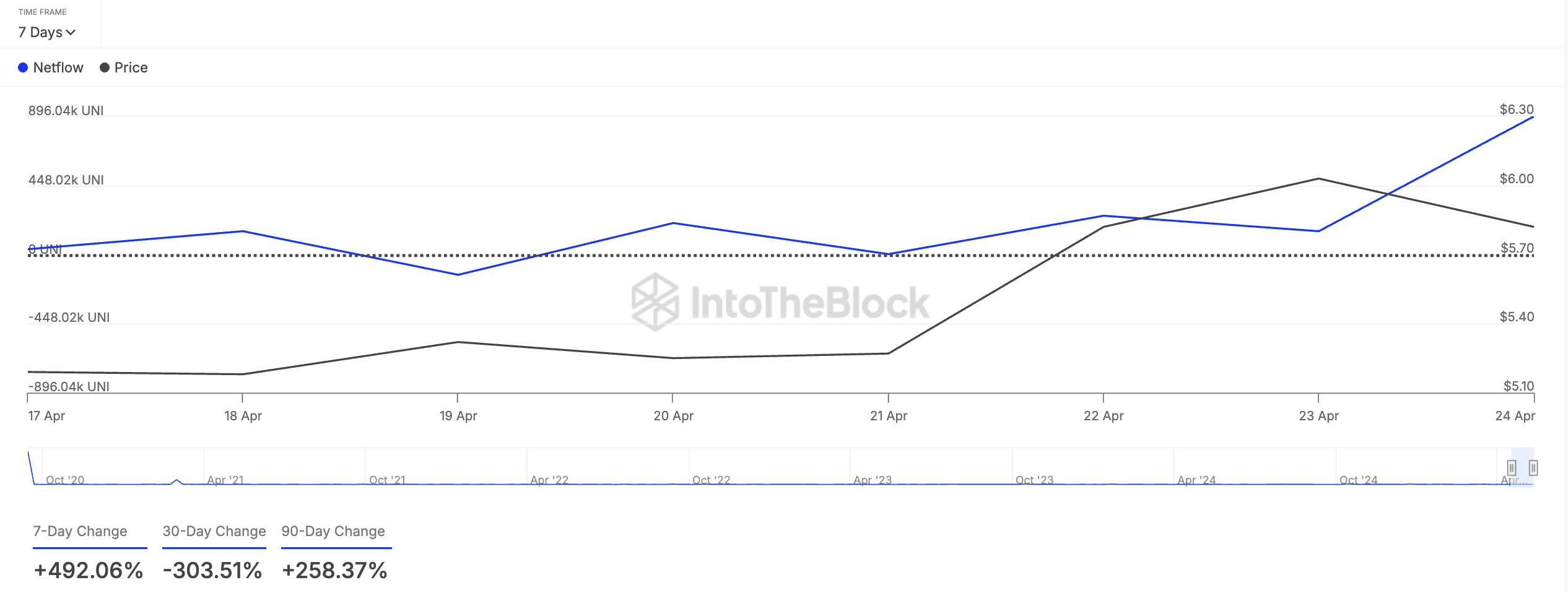

This policy shift sparked a surge in US Bitcoin ETF inflows, marking three consecutive days of gains. On August 8 alone, BTC ETFs saw a record $403.9 million in inflows, led by BlackRock, Fidelity, and Grayscale.

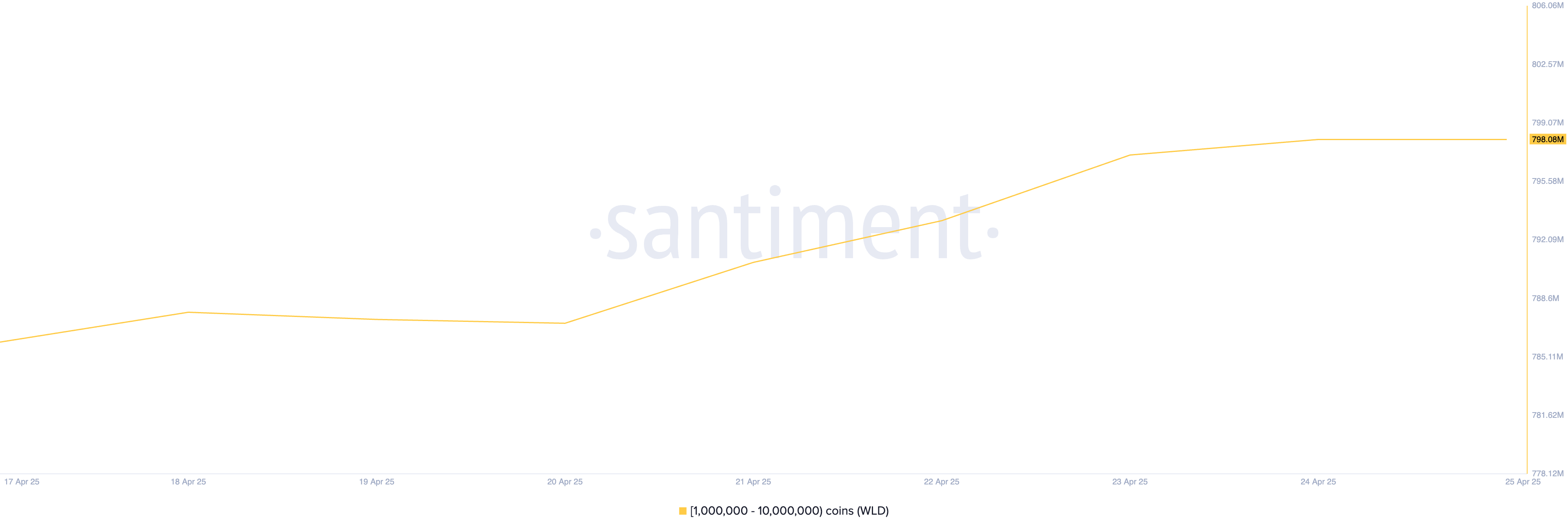

On chain data suggest shows that trading activity is heating up. More investors are betting on higher Bitcoin prices, with open interest, the total number of active futures contracts, rising by 7,834 BTC.

Post-Halving Trends Point BTC Toward $130K

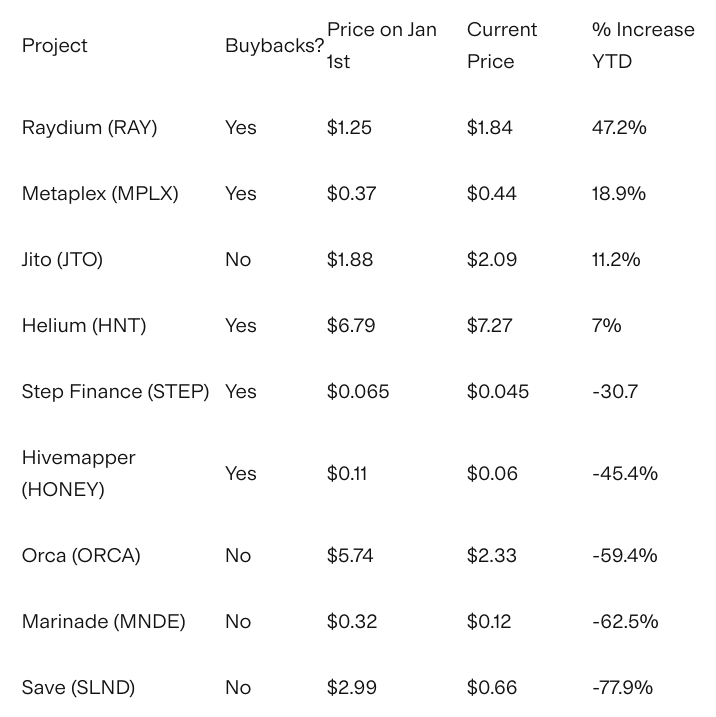

While bitcoin is seeing a bullish rally, analysts are optimistic about Bitcoin’s outlook because 2025 is a post-halving year, a period that has historically brought big rallies.

According to crypto analyst Benjamin Cowen, BTC tends to climb in July and August after each halving, sometimes pulling back in September before rally strongly again later in the year. As of now, Bitcoin is trading just under its all-time high of $123,000.

Meanwhile, BTC bullish chart signals, like the “Golden Cross,” suggest the price could push toward $130,000 or even higher if the current momentum holds.

CPI Data Expected to Rise

Looking ahead, all eyes are on the upcoming US inflation reports on 12th august and Producer Price Index (PPI) due this week. Economists expect July’s CPI to rise to 2.8%, up from 2.6% in June, partly because of new tariffs introduced under Trump.

Higher inflation often drives investors toward assets like Bitcoin, which is seen by some as a “safe haven.” If inflation comes in high, demand for Bitcoin could increase even further.

Meanwhile, markets currently see a strong chance of two rate cuts in September, with the possibility of even bigger cuts gaining traction.