With over 20 million users and seven years of operation under its belt, crypto exchange BingX is carving out a unique path through user-focused innovation and institutional-grade infrastructure. BingX is positioning itself as a hybrid exchange that balances ease of use for retail traders with the sophistication institutional investors need.

At the center of this evolution is Vivien Lin, Chief Product Officer and Head of BingX Labs, who is spearheading the platform’s product innovation and strategic direction. In an exclusive interview with BeInCrypto, Lin sheds light on BingX’s scaling efforts, regulatory adaptations, and expansion into emerging sectors like Real World Assets (RWA) and AI.

Ensuring Scalable Growth Amidst Expanding User Base

This year marks our seven-year anniversary, and to date, we’ve proudly served over 20 million users worldwide.

Scalability has always been a significant challenge for platforms with a large retail user base. At BingX, we’ve addressed this by continuously upgrading our core systems. We’ve streamlined and simplified the entire process—from order placement to execution.

We consistently optimize our underlying infrastructure and database architecture and apply the latest technologies to enhance the overall user experience. We also actively listen to our community. Whenever users highlight areas for improvement, our dedicated product team takes their feedback seriously and investigates those needs. By doing all this, we ensure two things: first, that our product team stays closely connected with our users, always listening to their voices; and second, that our technology evolves to meet the growing and dynamic demands of our global user base.

Innovative Product Initiatives for 2025

One of our key strategies is to stay aligned with trending products and the evolving needs of our user base. At BingX Labs, our approach is more targeted: when we identify a sector with strong potential, we invest in small companies or emerging teams to test the market.

Throughout this process, we don’t just invest—we also actively support these projects by helping them acquire users, refine their go-to-market strategies, and even advise them on their tokenomics. This allows us to both explore new market opportunities and help our portfolio projects grow successfully.

What sets BingX apart from other global exchanges is our focus on specific areas where we see a strong advantage. One of those areas is Real World Assets (RWA). We have several major partners from the trade sector with deep access to valuable assets. By collaborating with them, we’re able to combine our user base and regional resources to advance the RWA space effectively.

Another area of focus is AI. Internally, we consistently explore how AI can enhance our operational efficiency and improve user experience. In fact, BingX is likely one of the most active exchanges investing in AI. We’re launching a dedicated AI fund to invest in AI-driven projects, technologies, and strategic partnerships.

Improving Trust and Security Post-FTX

Post-FTX, we’ve taken several key measures to reinforce transparency and user protection.

First, we regularly publish our Proof of Reserves to help the public clearly understand the scale of our reserves and to build greater trust. It demonstrates that our operations are fully backed by assets—100%.

Second, we recently launched our Shield Fund, a $200 million protection fund designed to safeguard user assets in extreme or unforeseen situations. Of course, we hope such events never occur, but we’re prepared.

Third, we’ve invested heavily in how we structure our wallets. Our layered security system includes hot, warm, and cold wallets—with the majority of assets stored securely in cold wallets.

Given the rise in hacker activity, especially the number of DEX platforms hacked in the past 12 months, we take these risks seriously. Every incident in this industry serves as a valuable lesson. We use these events as learning opportunities to strengthen our technology and enhance our security measures, ensuring a safer system for our users.

Enhancing Copy Trading for Diverse User Levels

Actually, there are two parts to this question.

First, who are the copy trading users? Based on our experience and observations, most of them are retail customers. That’s because the crypto space can be overwhelming for newbies and everyday users. It’s complex, and many people find it difficult to navigate on their own.

That’s why we aim to onboard institutional or professional traders as master traders—the leaders others can follow.

Second, how we make copy trading more effective and rewarding for retail users, we’ve developed a rigorous screening process through our Elite Traders Program. Master traders must pass specific filters and evaluations before being granted more exposure and benefits on the platform.

After going through this process, these traders typically demonstrate stronger skills and better risk management. This helps retail users easily identify and follow trustworthy and capable master traders, giving them a seamless and more rewarding trading experience.

Insights into Institutional Adoption Trends

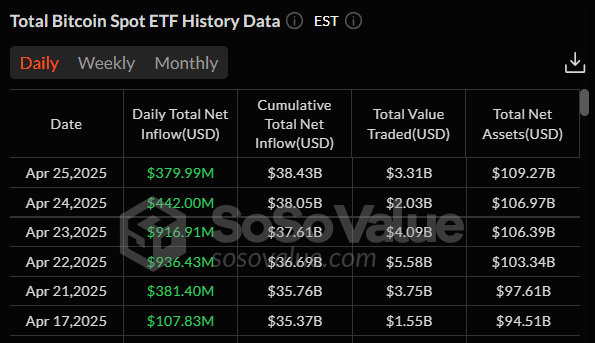

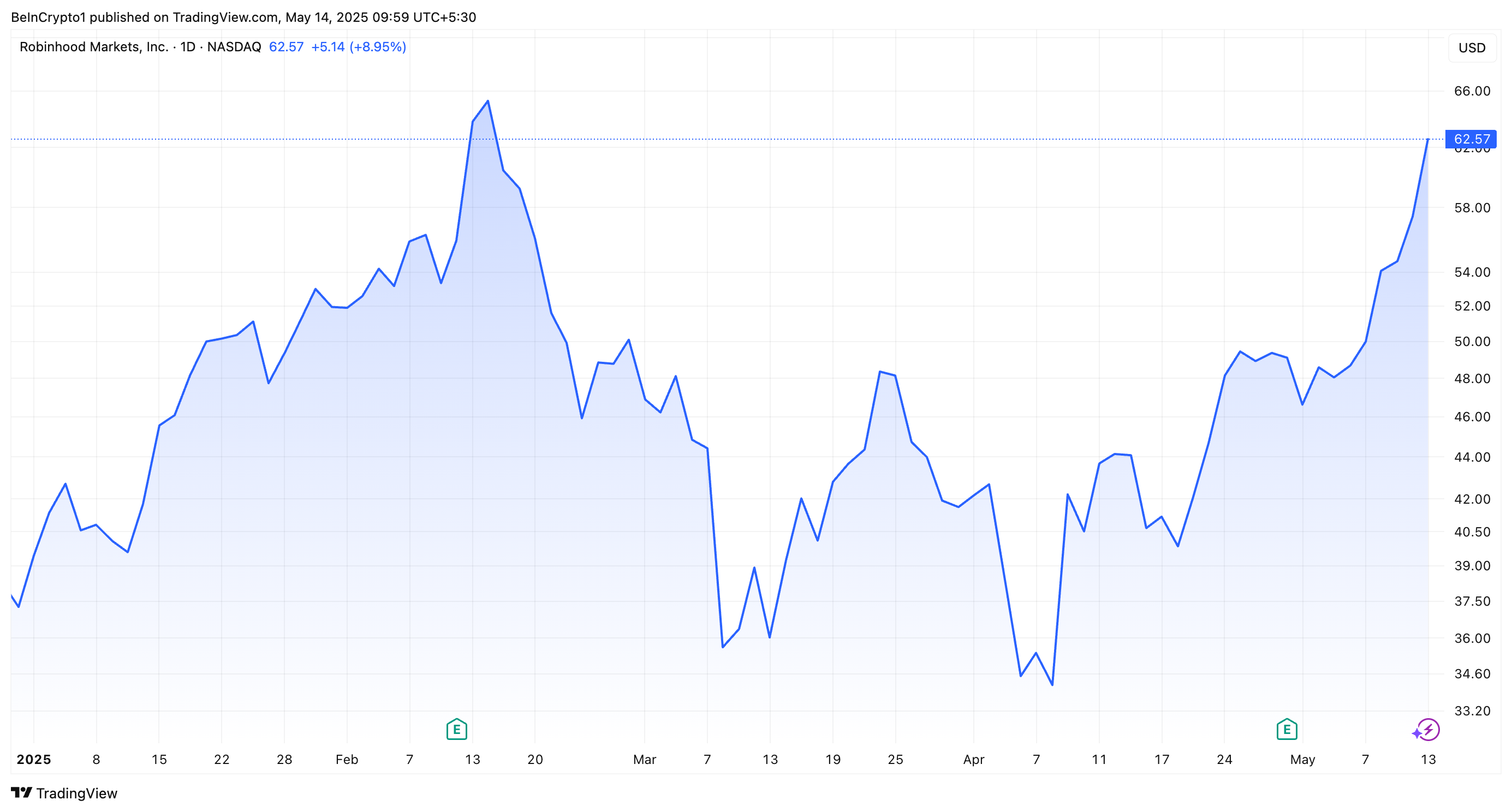

We’ve seen a significant influx of institutional customers, especially following the approval of crypto ETFs. Many traditional finance (TradFi) traders and institutions are now actively entering the crypto market.

When these institutions look for partners, they typically start with a shortlist of trusted exchanges. Then, they examine each platform’s micro-dynamics. We’ve had many reputable TradFi institutions approach us expressing interest in forming trading partnerships with our exchange. This has become a notable trend in the current market.

Of course, this trend also presents challenges. One of the biggest is upgrading our core systems to meet institutional demands. These clients expect faster execution speeds, lower latency, etc.

At the same time, this shift has pushed us to elevate our service quality. We now have a dedicated VIP team that caters specifically to institutional clients, family offices, and high-net-worth individuals. We offer them tailored solutions, including asset and wealth management services, as well as other customized features designed to meet their unique needs.

Differentiating BingX in a Competitive Market

On the one hand, we run a variety of engaging campaigns. Some are fun and interactive—like “share your life” or “share your habits,” where users can retweet or reply to our posts on X for a chance to get lucky.

We also have our big campaign, our Super 7 Anniversary, which features a substantial prize pool. By participating, users have a great chance to earn rewards through different campaign activities.

On the other hand, what truly differentiates BingX from other major exchanges is our effort to understand our users’ needs deeply. We recognize that even when offering the same functionality, exchanges often execute it differently. These differences often reflect subtle variations in trader behavior.

Take our Standard Futures product, for example. It’s incredibly simple and beginner-friendly, which is why it’s popular among newcomers. Other platforms may focus more on advanced features for professional traders and might overlook this kind of offering.

This is just one example of how we tailor our products to specific user segments. We also offer many other features designed for niche user groups. That’s how we continue to capture and grow our market share.

BingX on Convergence Between CeFi and DeFi

I believe CeFi and DeFi are complementary to each other. CeFi typically offers a better user experience, while DeFi excels in transparency.

However, we’re observing a clear trend: CeFi platforms are becoming increasingly transparent, and DeFi platforms are actively working to improve their user experience, moving closer to what CeFi offers.

In the end, the differences or competition between CeFi and DeFi will likely come down to the fundamental characteristics of their underlying technologies, such as trading speed, latency, and the level of security each can provide.

Focus Areas for Partnerships in 2025

We’ve always focused on infrastructure, but in this cycle, we’re seeing fewer truly innovative infrastructure projects emerging. That said, we’re still actively looking for teams with strong technical backgrounds who are working on new infrastructure solutions.

That’s one area of focus. Another is the RWA (Real World Assets) space—we’re exploring new partnerships there, as well as in the AI space.

Personally, I’m also diving deeper into PayFi and related sectors. There are quite a few emerging projects in this space—like PayFi itself, and hardware-focused solutions like Wary—and these are the kinds of areas we’re currently paying close attention to.

We’re actively exploring opportunities in DeFi and DEX. We’re particularly interested in partnering with high-performance mainnets. Additionally, we’re looking for mainnets that already have a strong user base, which we believe are especially well-suited for sectors like GameFi and SocialFi.

These are the areas we see as having high potential in the next cycle.

Expansion Beyond Trading

We’ve just launched a new product called ChainSpot, designed to bridge the CeFi user experience with DeFi liquidity.

What this means is that when a user has a BingX account, they can seamlessly access DEX liquidity. This gives them early access to tokens as soon as those tokens have an active on-chain pool.

And this is just the beginning—we have many similar initiatives coming in the next few months. So stay tuned, we’ll be announcing more very soon.

Navigating Web3 as a Female Leader

I think there’s a common misconception that women working in the Web3 industry are too soft or unwilling to take on technical roles.

But based on my own observations and experience working in crypto and Web3 firms, I’ve seen that women are incredibly clear-minded, determined, and hardworking.

One piece of advice I’d offer to female leaders—or women looking to enter this industry—is to learn something technical, whether it’s coding, AI technologies, or even marketing and customer service. Gaining skills in these areas will help you become a more well-rounded professional.

That kind of versatility builds a sharper understanding of what the market needs and what people truly want. When you’re in Web3—and especially when you grow into a leadership role—all these skills and insights connect.

Final Thoughts

Personally, I’ve been hearing a lot of talk about whether we’re in a bull or bear market, and how market value is low, and so on.

From my perspective, I believe the market is actually forming a bottom, and I’m quite optimistic about the future—especially when it comes to the price of BTC and other major coins.

That said, I’d advise anyone looking to trade meme tokens during this time to be very cautious about volatility. The correlation between meme tokens and BTC—or other mainstream assets—has diverged significantly.

The post Vivien Lin on How BingX Is Bridging CeFi and DeFi With User-Centric Innovation appeared first on BeInCrypto.