Avalanche (AVAX) price has been unable to reclaim the $20.00 support level after falling through it in the recent correction. The altcoin is now trading well below that key mark despite a noticeable decline in selling pressure.

However, bullish momentum has not been strong enough to counter prevailing bearish cues.

Avalanche Investors Are Not Selling

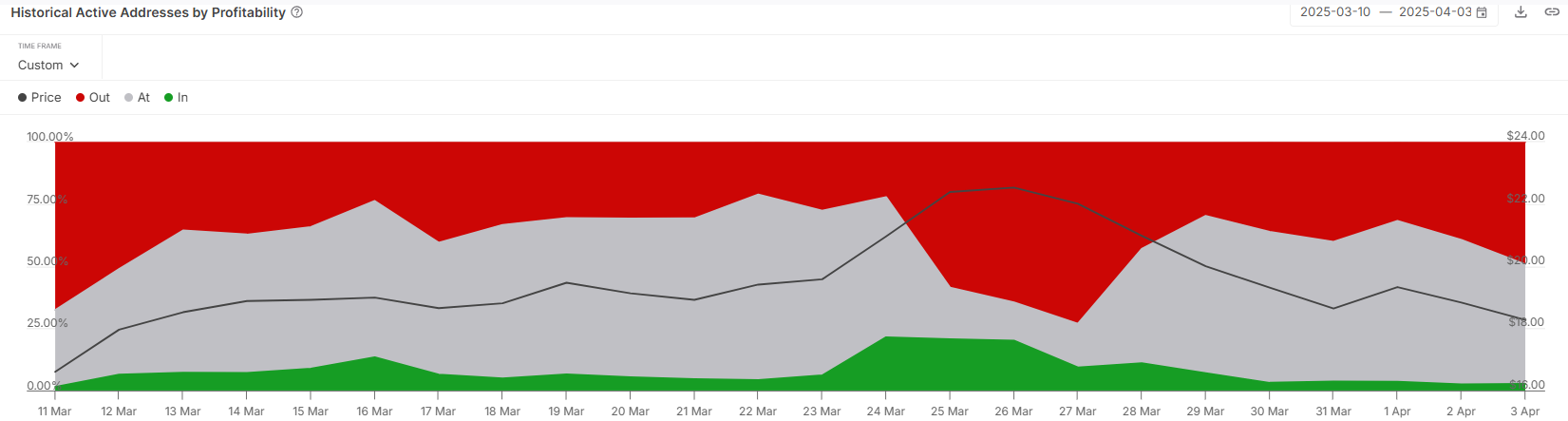

Analyzing the active address profitability reveals that less than 3% of current participants are in profit. This data highlights a crucial detail: most AVAX holders are unwilling to sell at a loss. Instead, they appear to be HODLing in anticipation of a recovery. This lack of selling is a bullish indicator.

The patience shown by investors during this downturn could help Avalanche establish a stronger base once broader market conditions stabilize. As fewer holders are actively selling, downward pressure on AVAX’s price is reduced. Given the right market catalysts, this opens a window for the altcoin to bounce back.

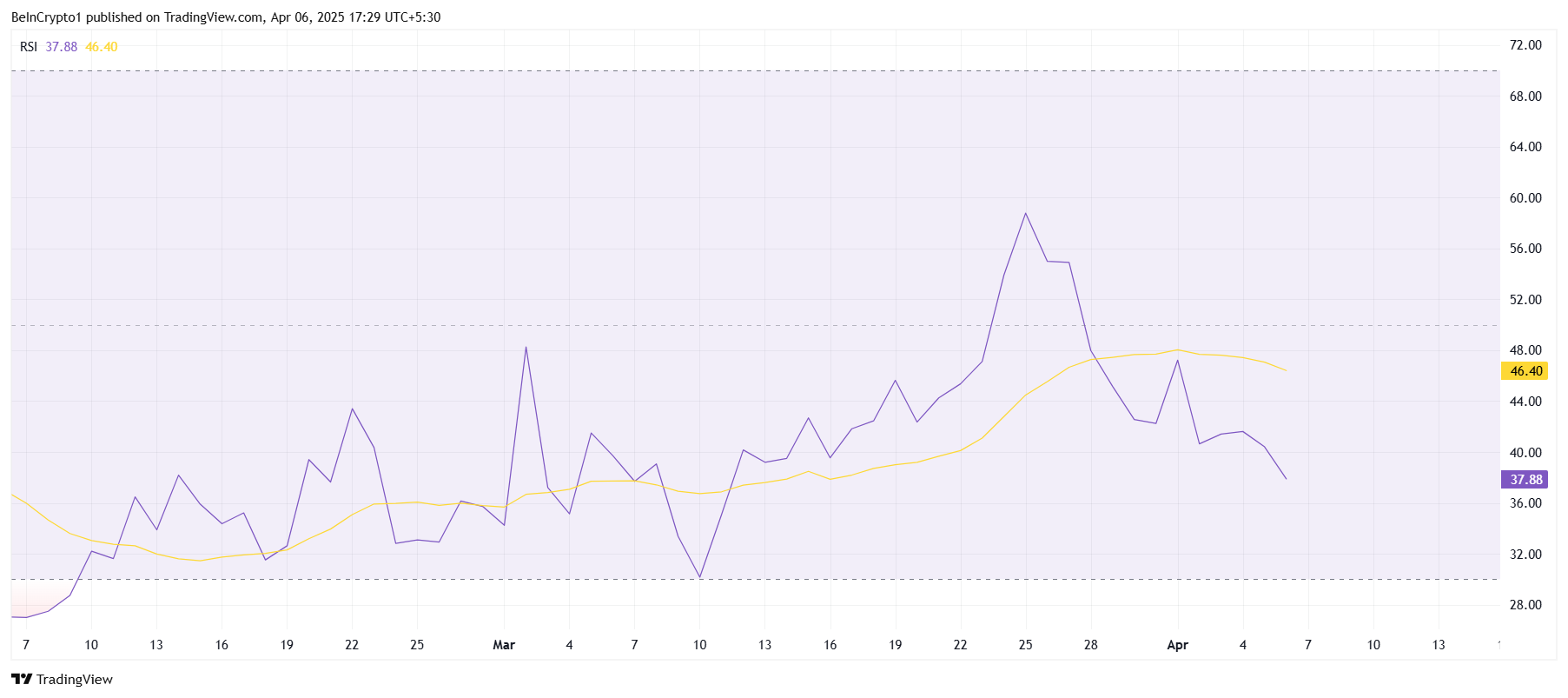

Despite low selling activity, the technical indicators continue to signal weakness. The Relative Strength Index (RSI) has dropped back into the bearish zone after a brief recovery attempt. This suggests a lack of buying pressure and continued uncertainty among investors.

Market support has been lacking for AVAX in recent sessions, preventing a meaningful rebound. The altcoin is facing consistent resistance and has failed to generate strong upward momentum.

The RSI trend reinforces that the macro environment is still leaning bearish, keeping Avalanche subdued.

AVAX Price Is Vulnerable

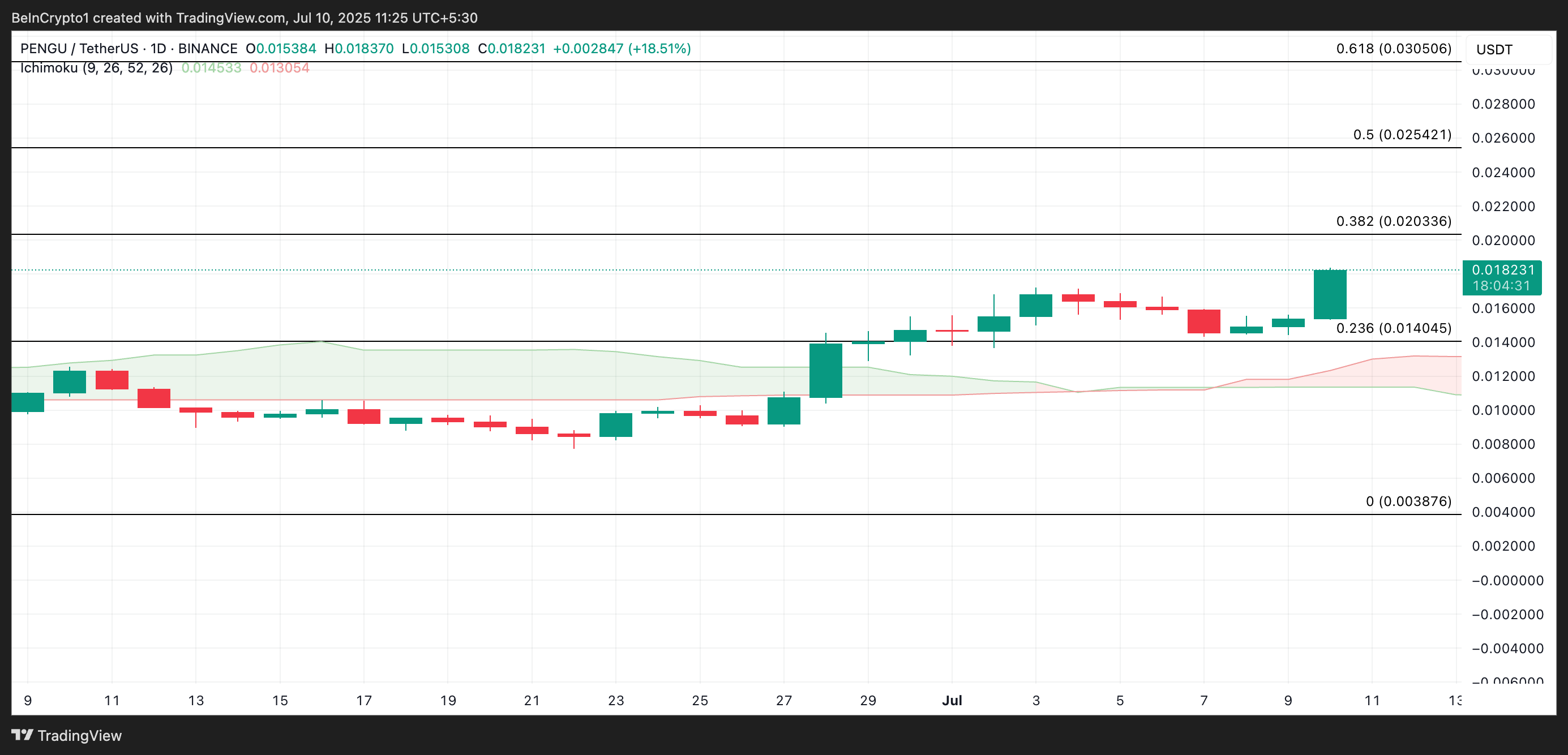

Avalanche is currently priced at $17.19, marking a 25% decline over the past two weeks. The sharp drop came after AVAX failed to break through the $22.87 resistance level. This rejection led to the current consolidation below $20.00, with bulls unable to reverse the trend.

Given the existing market cues, Avalanche may struggle to reclaim $18.27 as a support level. If the altcoin fails to secure this level, it risks dropping further to $16.25. This would deepen investor losses and delay any chances of recovery.

On the upside, a key shift would occur if AVAX can flip $19.86 into support. This would suggest strengthening bullish sentiment and open the door for a rally toward $22.87. Reclaiming this level could allow Avalanche to recover some recent losses and restore investor confidence.

The post Avalanche (AVAX) Price Stuck Below $20 as Bearish Cues Prevent a Strong Rebound appeared first on BeInCrypto.