The post Best Meme Coin to Buy in June – Top Picks with 50x Potential for Early Adopters appeared first on Coinpedia Fintech News

June presents fresh opportunities for investors aiming for substantial gains in cryptocurrency. Emerging meme coins are catching attention, offering the potential for significant returns to those who act early. This article uncovers these promising tokens that might be on the verge of explosive growth, possibly multiplying investments many times over.

$XYZ Unlocks the G.O.A.T. Status, Early Investors Positioned for Massive ROI

XYZVerse ($XYZ) has brought a brand-new concept to the memecoin niche by blending the excitement of sports with the fast-moving energy of crypto. Designed for hardcore fans of football, basketball, MMA, and esports, this project goes beyond just being another token—it’s a growing community built around passion for the game.

With the bold Greatest of All Time (G.O.A.T.) vision, XYZVerse is aiming higher than the average meme coin. And people are taking notice—it has recently earned the title of Best New Meme Project.

What sets $XYZ apart? It’s not a short-lived trend. This project has a clear roadmap and a dedicated community focused on long-term growth.

Fueled by the sports mentality, the $XYZ token has emerged as the ultimate contender ready to crush competitors. $XYZ is on its way to the winner’s podium to become a badge of honor for those who live and breathe sports and crypto.

$XYZ Already Delivers Even Before Hitting the Market

The $XYZ presale is underway, providing access to the token at a special pre-listing price.

Launch Price: $0.0001

Price Now: $0.003333

Next Stage: $0.005

Final Presale Price: $0.02

Following the presale, the $XYZ token will be listed on major centralized and decentralized exchanges, with a target listing price of $0.10. If the project raises enough capital to support this valuation, early investors could see returns of up to 1,000x on their presale entries.

So far, over $13 million has been invested, reflecting strong market interest. Notably, securing tokens at a lower presale price offers the potential for higher ROI upon launch.

Demand for $XYZ is surging, driving rapid progress in the presale. Early buyers secure the lowest prices, maximizing their potential returns.

Join $XYZ Presale Now and See Your Pennies Grow Into Millions!

Dogecoin: From Meme to Major Cryptocurrency

Dogecoin (DOGE) was launched in 2013 as a playful alternative to traditional cryptocurrencies. It features the Shiba Inu dog from the “Doge” meme as its logo. Unlike Bitcoin, which has a limited supply, Dogecoin has no maximum supply. There are 10,000 new coins mined every minute, making it abundant. Created by software engineers Billy Marcus and Jackson Palmer as a joke, it quickly gained a dedicated community and became known for its friendly and humorous vibe.

In 2021, Dogecoin’s value increased significantly, making it one of the top ten cryptocurrencies by market capitalization with a total value exceeding $50 billion. This surge was influenced by social media attention and endorsements from public figures like Elon Musk. Dogecoin’s potential lies in its strong community support and high visibility in the crypto market. In the current market cycle, it remains an attractive option for those interested in cryptocurrencies with active communities and ongoing development.

Shiba Inu (SHIB): An Ethereum-Based Memecoin with Expanding Utility

Shiba Inu (SHIB) is a cryptocurrency inspired by Dogecoin but operates on the Ethereum blockchain. Launched in August 2020 by the anonymous developer Ryoshi, SHIB began with a supply of 1 quadrillion tokens. Half of these tokens were sent to Ethereum co-founder Vitalik Buterin to establish trust within the crypto community. Buterin donated a substantial portion to the India Covid Crypto Relief Fund and burned 40% of the total supply, reducing the number of tokens in circulation.

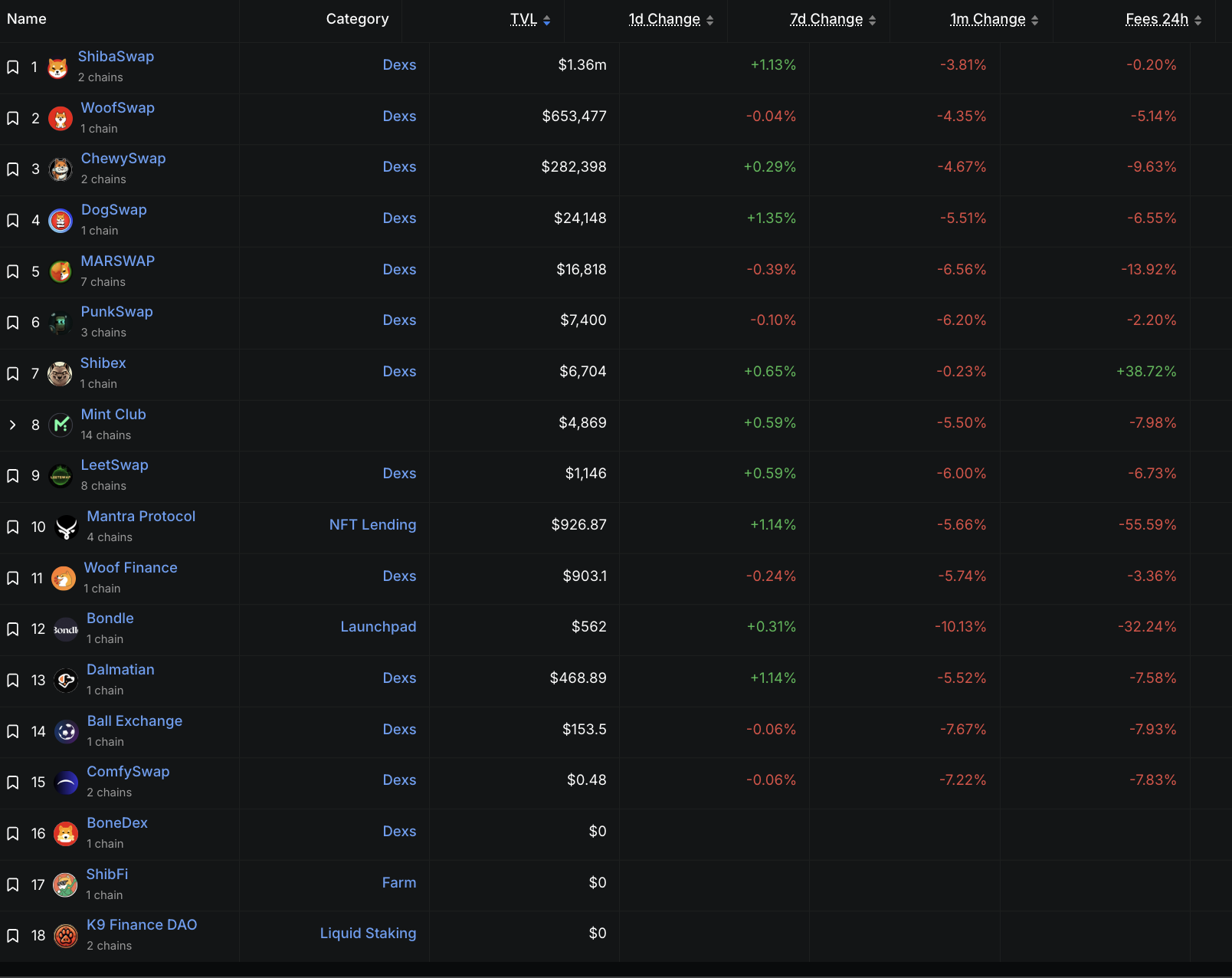

Operating on Ethereum allows SHIB to benefit from the blockchain’s smart contract capabilities. This integration has led to the creation of ShibaSwap, a decentralized exchange for SHIB and other tokens. Future developments include plans for a non-fungible token (NFT) platform and a governance system based on decentralized autonomous organization (DAO) principles. These features position SHIB for broader use within the cryptocurrency ecosystem. Considering these developments, SHIB’s potential utility may appeal to those interested in emerging blockchain applications in the current market cycle.

FARTCOIN: A Memecoin Blending Internet Humor with Crypto Culture on Solana

FARTCOIN is a memecoin built on the Solana blockchain that combines internet humor with crypto culture. Users can earn tokens by submitting fart-themed memes, jokes, or short content within the ecosystem. The coin offers a playful and participatory experience, engaging the community through humor.

A unique feature of FARTCOIN is the Gas Fee mechanism. Every transaction triggers a digital fart sound effect, making token transfers a memetic experience. This is a humorous nod to blockchain terminology and appeals to meme enthusiasts. The project is supported by the Terminal of Truth, an AI-powered content engine that helps generate creative material and drive community engagement. By merging user-generated content with artificial intelligence, FARTCOIN aims to turn viral humor into a decentralized social movement. In the current market cycle, its distinctive approach may attract users looking for entertainment in the crypto space.

Trump Coin: A Memecoin With Political Roots

Launched on January 18, 2025, Donald Trump’s memecoin, TRUMP, quickly gained attention, peaking at $75.35 shortly after its release. The coin, based on the Solana blockchain, can be used to purchase Trump-related memorabilia. However, its value has since fallen, hitting an all-time low of $7.14 by April 2025.

While its price shows signs of recovery, TRUMP’s future remains uncertain. With 80% of its supply held by one wallet and no official whitepaper, concerns about its long-term potential linger. The coin’s recent price movement suggests it may rise toward the $10.50 resistance, but investors are cautious as its future unfolds.

Conclusion

While DOGE, SHIB, FART, and TRUMP are promising, XYZVerse (XYZ) uniquely combines meme culture and sports, offering early adopters significant growth potential in the 2025 bull run.

You can find more information about XYZVerse (XYZ) here:

https://xyzverse.io/, https://t.me/xyzverse, https://x.com/xyz_verse

The post Best Meme Coin to Buy in June – Top Picks with 50x Potential for Early Adopters appeared first on Coinpedia Fintech News

June presents fresh opportunities for investors aiming for substantial gains in cryptocurrency. Emerging meme coins are catching attention, offering the potential for significant returns to those who act early. This article uncovers these promising tokens that might be on the verge of explosive growth, possibly multiplying investments many times over. $XYZ Unlocks the G.O.A.T. Status, …