Pi Coin Gains CoinEx Listing Amid Market Woes and Transparency Demands

Pi Network’s cryptocurrency, Pi Coin (PI), has secured another exchange listing with CoinEx, marking a notable milestone for the project.

However, the listing comes at a turbulent time for the project, as pioneers push for clarity on Pi Network’s funding sources.

Pi Coin Listed on CoinEx Exchange

PI officially launched for trading on CoinEx on March 18, 2025. The deposit and withdrawal window opened at 11:00 UTC, followed by trading at 11:30 UTC, allowing Pi holders to trade against Tether (USDT).

“After rigorous reviews, CoinEx will list PI (Pi) on March 18, 2025,” the exchange stated in its announcement.

With this latest listing, Pi Coin is now available on 12 exchanges, as per Coinranking data. Despite this expansion, the possibility of a Binance listing remains uncertain.

Although 86% of the Pi community voted in favor of a Binance listing, the exchange has yet to confirm if or when it will list PI. This has raised concerns about the project’s credibility.

“The failure to get listed on Binance, despite 86% of the community voting in favor, raises serious concerns about public trust in the project,” a pioneer wrote on X.

Pioneers Demand Transparency on Pi Network’s Funding Sources

As concerns surrounding Pi Network continue to rise, the project is now embroiled in another controversy. A growing number of users are calling for transparency about the network’s funding sources.

An investigation by one of Pi Network’s pioneers uncovered that SocialChain Inc., the company behind Pi Network, has received investments from three firms: 137 Ventures, Ulu Ventures, and Designer Fund. However, the investigation revealed a key issue: two of these investors have not included Pi Network in their official investment portfolios.

Additionally, none of these firms have disclosed the amount of money they have invested in Pi Network despite being forthcoming with investment details for other companies.

“Why is Pi Core Team keeping this under wraps? Pioneers deserve transparency. If Pi Network aims for long-term sustainability, the team must be more open about its financial backing and key partnerships,” the post read.

Notably, a previous lawsuit by former co-founder Vince McPhillip against Pi Network offers additional insight into the project’s funding methods. The complaint outlined a series of claims, including wrongful termination, intentional and negligent infliction of emotional distress, and breach of fiduciary duty.

Nonetheless, it detailed that the project had raised funds by selling financial instruments called SAFE (Simple Agreement for Future Equity).

According to the lawsuit, Pi Network sold SAFE agreements in September 2019 with a maximum valuation of $20 million. During this fundraising round, the project raised $500,000. A few months later, in February 2020, Pi Network conducted another fundraising round at the same $20 million valuation, raising an additional $300,000.

Despite these fundraising efforts, the lack of clear financial disclosure continues to fuel concerns within the Pi Network community.

Pi Coin Sees Double-Digit Price Decline

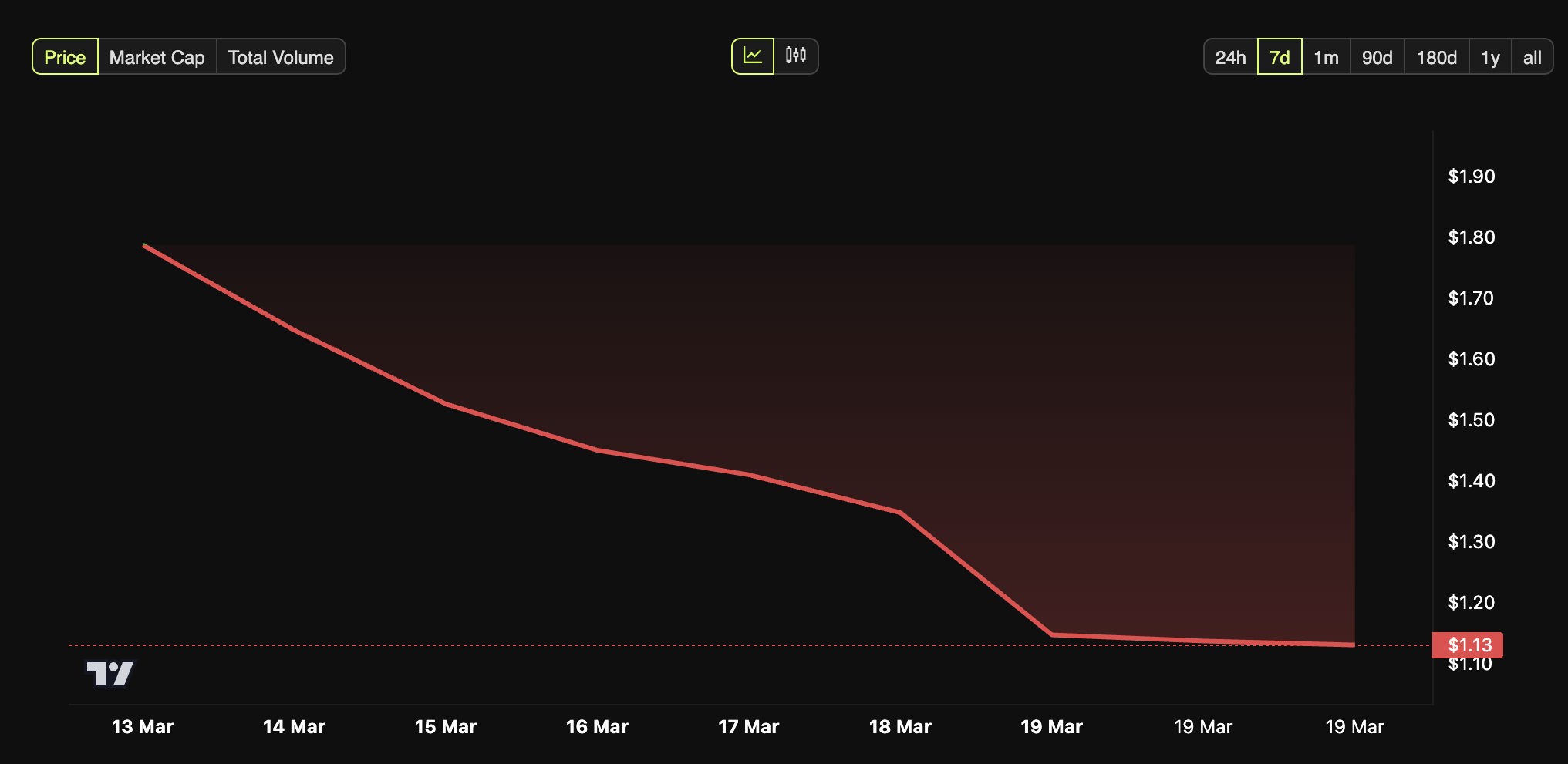

Amid these challenges, PI’s price performance has also taken a hit. The altcoin has seen a sharp decline in value, shedding 19.3% of its gains over the past week.

This drop has pushed the coin further down the cryptocurrency rankings, with PI falling from 12th to 21st place on CoinGecko. While the broader cryptocurrency market has also faced a downturn, PI’s losses have been more pronounced. At press time, PI was trading at $1.1, down 16.5% in the past 24 hours.

Despite this, Pi Network’s community engagement remains vibrant, particularly through PiFest 2025. The event has attracted 100,000 registered sellers worldwide, including 49,000 active participants on the Map of Pi.

Social media posts highlight strong participation from communities in Vietnam, Indonesia, and beyond, where users exchange goods and services using PI tokens.

Notably, the Pioneer Korea community has reported a consensus valuation of 1 PI at $50 —starkly contrasting its current market price on exchanges.

The post Pi Coin Gains CoinEx Listing Amid Market Woes and Transparency Demands appeared first on BeInCrypto.

0.56%

0.56%