Top 3 Crypto Narratives to Watch For the Second Week of March

Perpetuals, Made In USA coins, and meme coins are the top three crypto narratives to watch for the second week of March. Perpetuals tokens like HYPE and WOO are down over 12%, but strong trading activity and high revenue suggest a potential rebound.

Made In USA coins, including PI, ADA, and HBAR, have suffered major losses amid broader market turmoil, but the recovery could be near if market conditions stabilize. Meme coins have been hit hard, but their history of sharp rebounds suggests they could lead the next rally if sentiment shifts.

Perpetuals

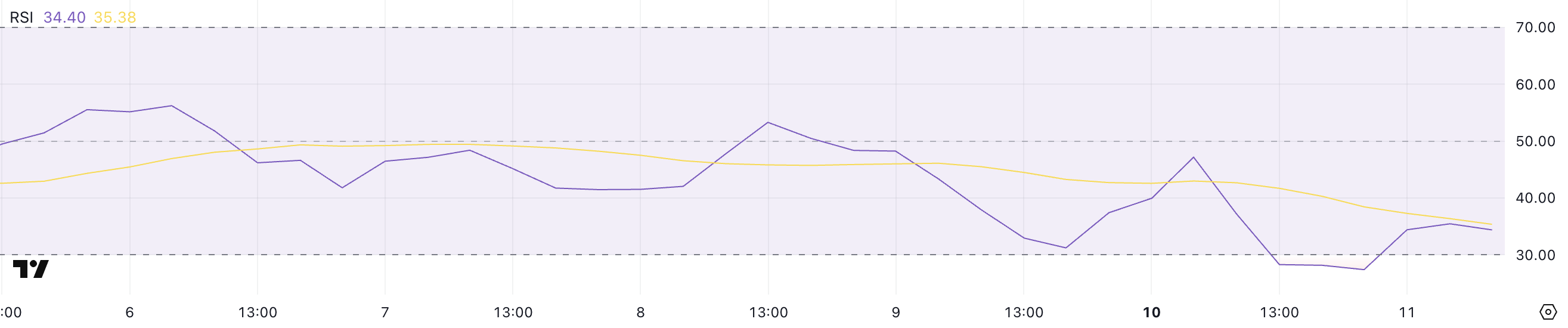

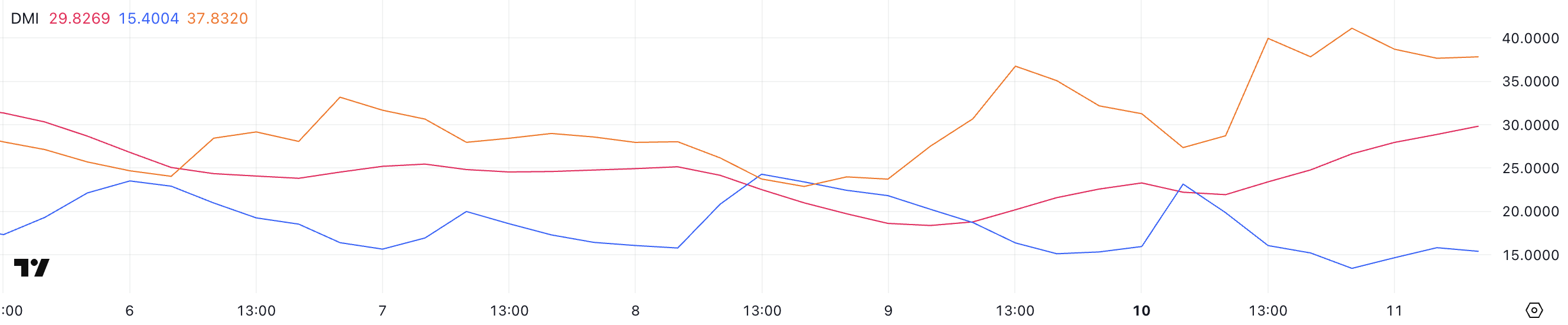

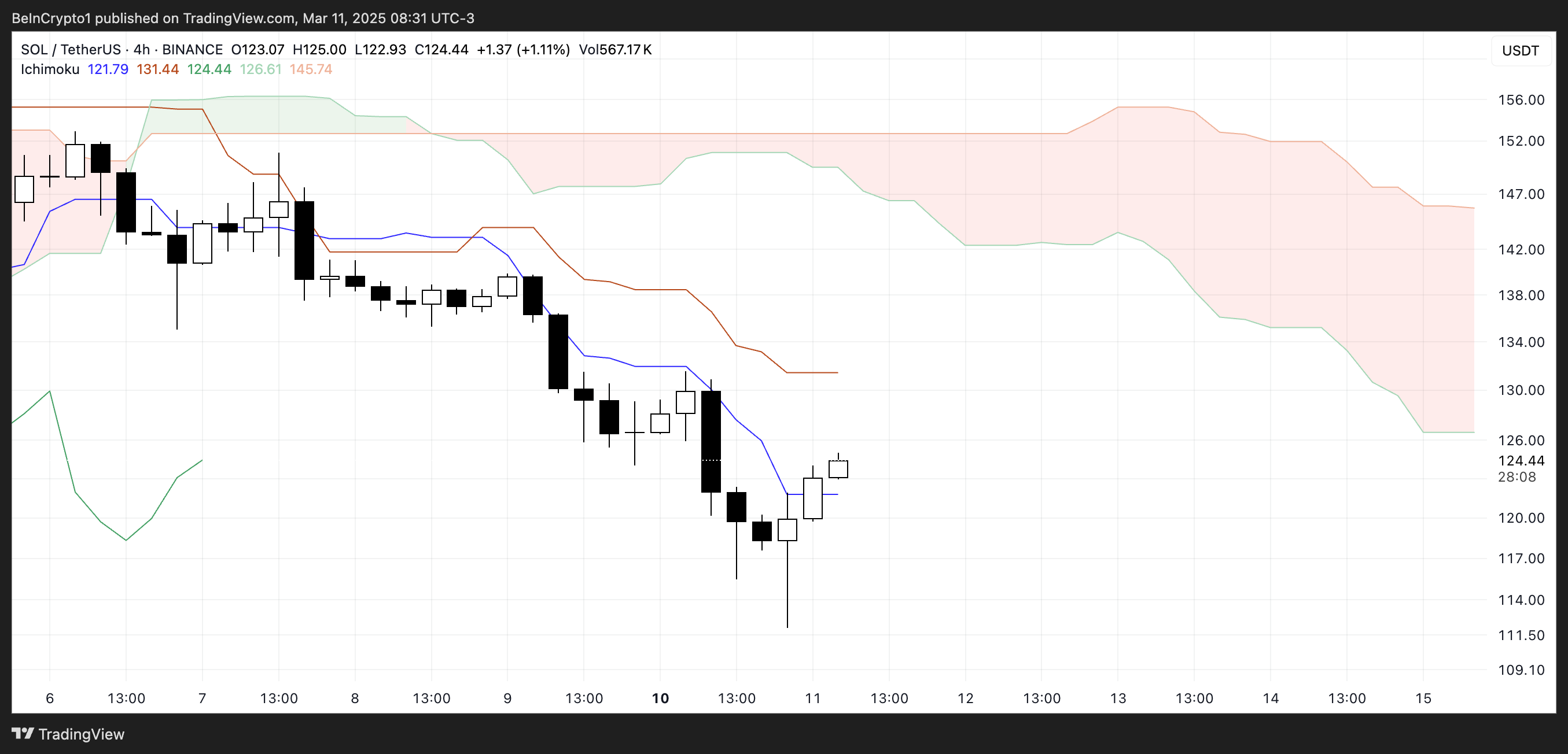

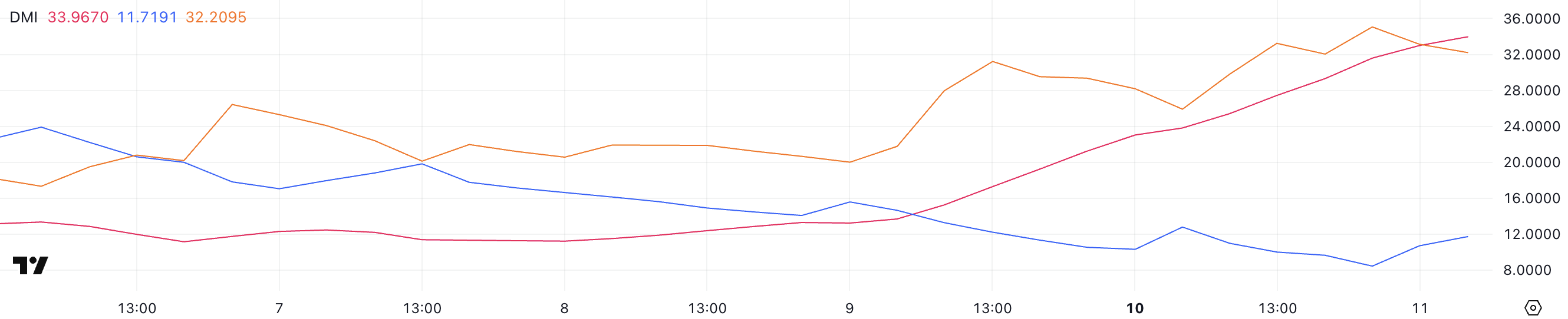

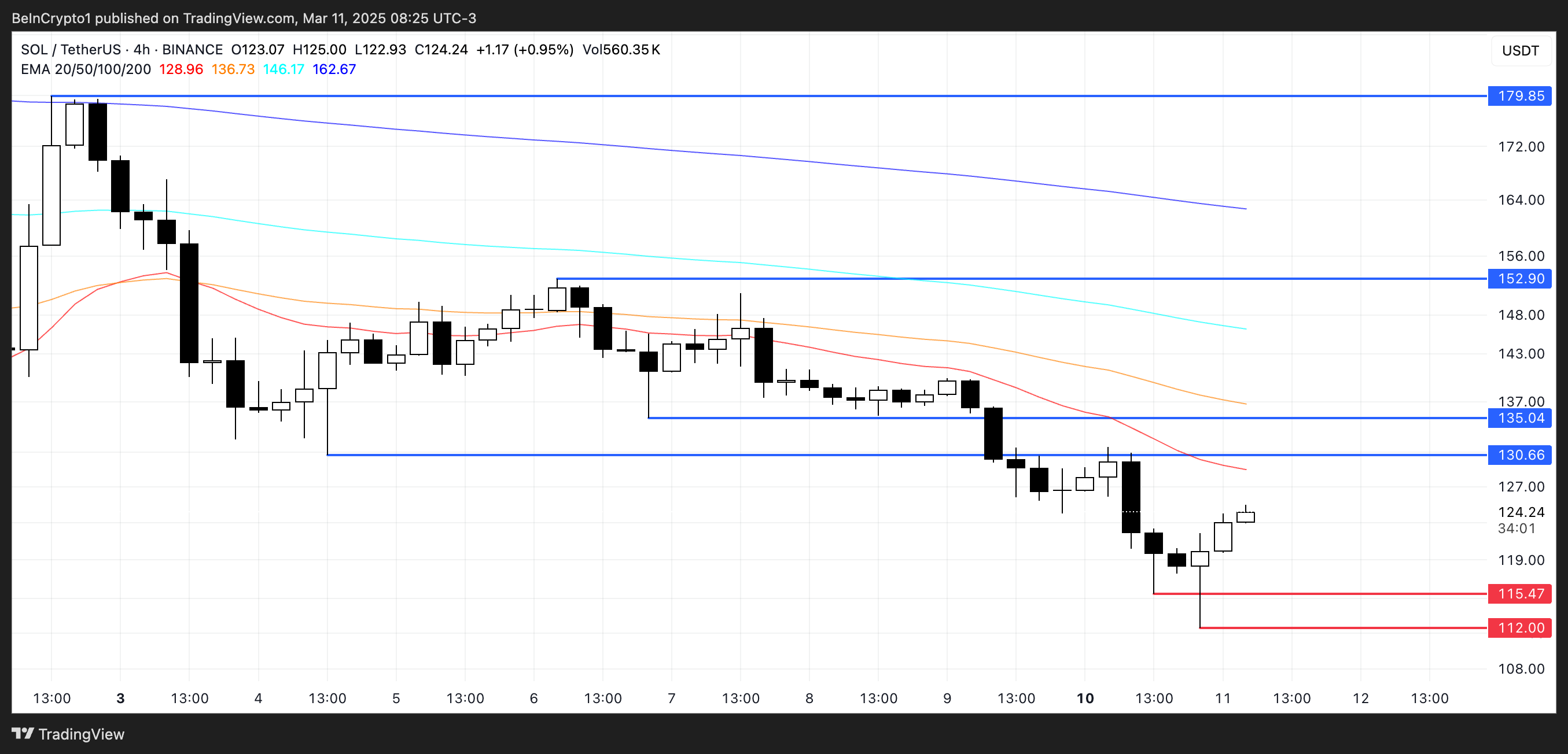

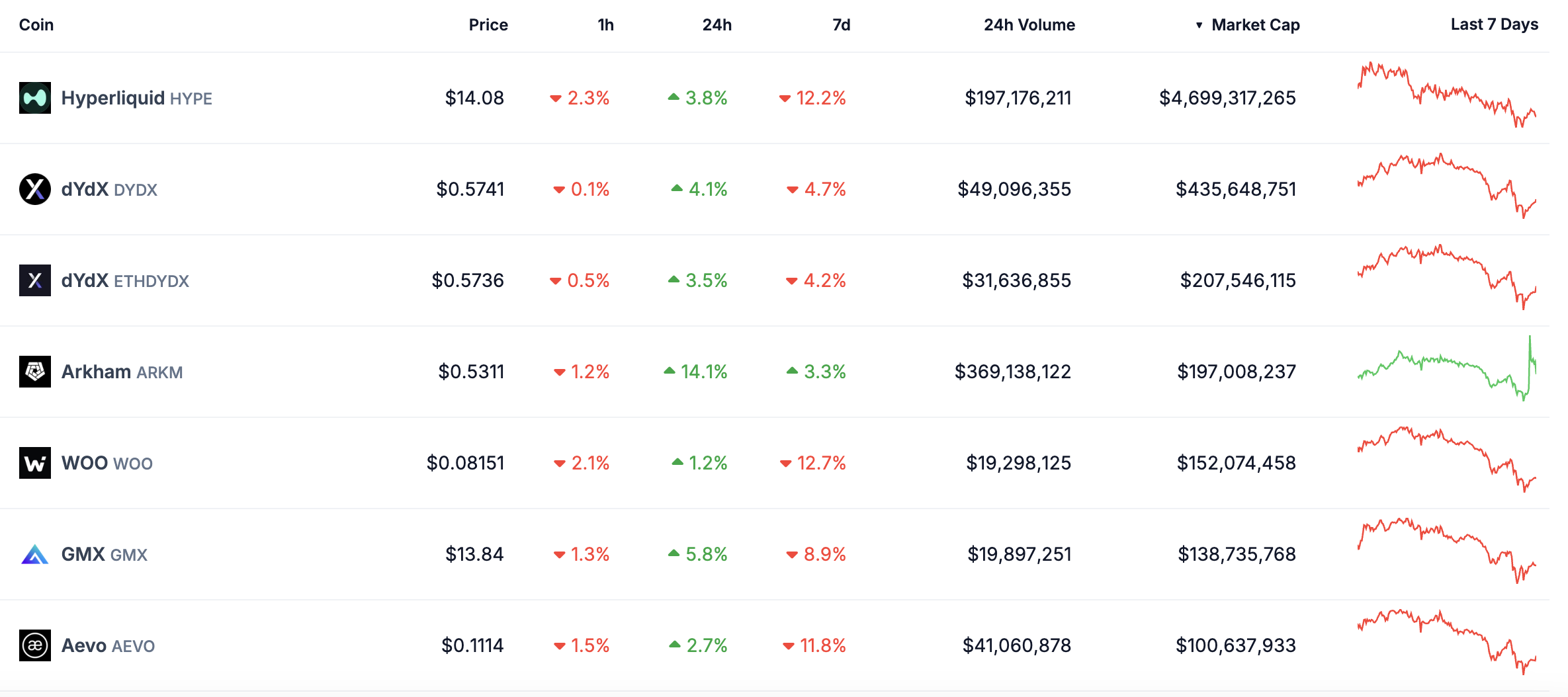

Perpetuals coins appear to be setting up for a rebound after a rough week, with HYPE and WOO both down more than 12% in the last seven days. Perpetuals platforms are exchanges that allow traders to buy and sell perpetual futures contracts, which have no expiration date.

These platforms use a funding mechanism to keep contract prices aligned with the spot market while enabling traders to take long or short positions with leverage.

Despite the recent downturn in some perpetuals tokens, the sector continues to see strong activity, with high trading volumes and fees generated across key platforms.

Hyperliquid remains the dominant force in the perpetuals space, generating an impressive $12 million in fees over the past week, outperforming major DeFi apps like Jito, Maker, Solana, Ethereum, Raydium, and Pumpfun.

However, this level of dominance also suggests that the market has room for competitors to emerge and challenge its position. Arkham, for instance, has surged 14% in the last 24 hours. That signals that some traders are betting on alternative projects within the perpetuals ecosystem.

Overall, these trends make perpetuals one of the must-watch crypto narratives of the week.

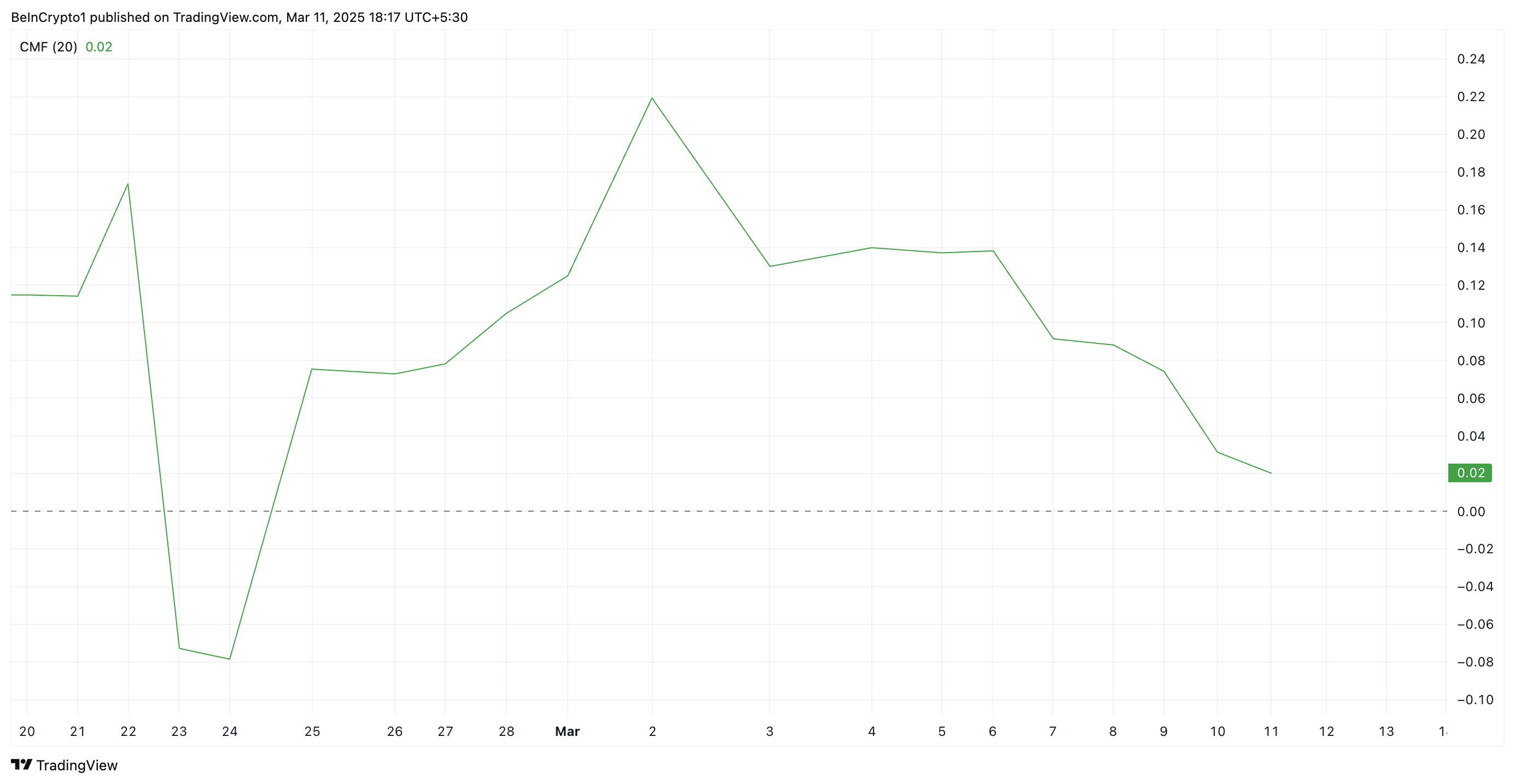

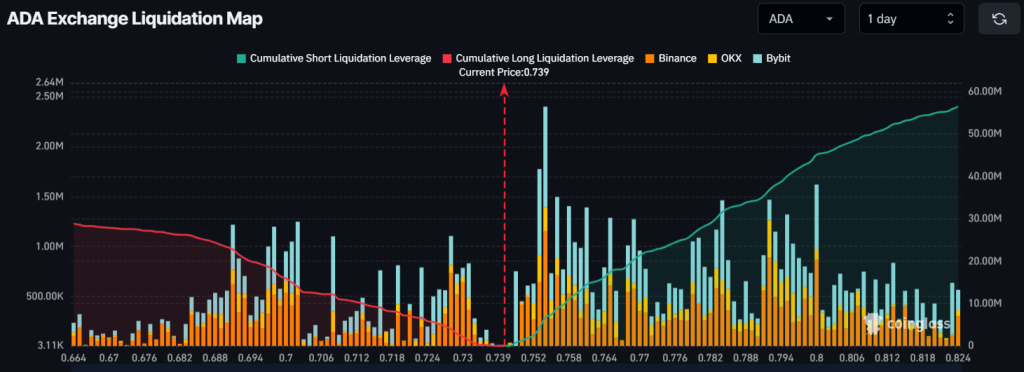

Made In USA Coins

The biggest Made In USA coins have all suffered significant losses in the past week, with PI dropping 22.6%. ADA and HBAR both down 18.9%. Made In USA coins refer to cryptocurrencies that have strong ties to the United States, whether through their founding team or company headquarters.

This category includes projects that often attract regulatory scrutiny or benefit from US-based institutional backing. The latest downturn aligns with broader market weakness, as both the crypto and stock markets have been hit hard in the past 24 hours.

The US stock market saw a massive $4 trillion wipeout following Trump’s push for new tariffs. Given the scale of this correction, a potential rebound could be on the horizon if investors view the recent dip as an overreaction. That could positively impact crypto, driving a new surge.

Historically, sharp declines in both crypto and equities have been followed by strong recoveries, especially when macroeconomic fears subside.

While the downtrend remains intact for now, a shift in sentiment could trigger a bounce for Made In USA coins if market conditions stabilize.

Meme Coins

Meme coins remain one of the most volatile crypto narratives. They often experience the biggest surges during bullish phases and the sharpest corrections during downturns.

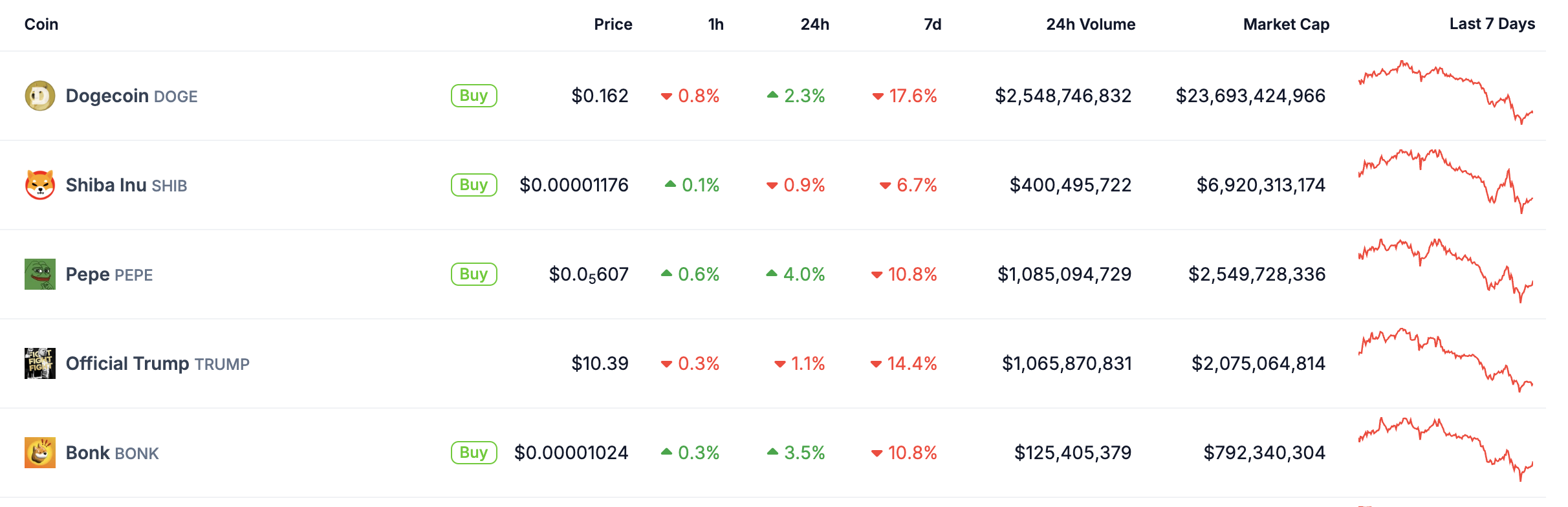

This volatility has been evident in the past week, as the biggest meme coins have taken a heavy hit. Dogecoin (DOGE), the largest meme coin by market cap, has dropped more than 17% in the last seven days.

TRUMP is down over 14%, and PEPE and BONK have both lost more than 10% during the same period.

However, if the crypto market stages a rebound this week, meme coins could see some of the strongest recoveries. Historically, these assets tend to outperform in fast-moving uptrends due to their speculative nature and the rapid inflow of retail interest.

The last major surges in meme coins occurred after broader market rebounds reignited hype and aggressive buying activity.

If sentiment shifts and liquidity returns, DOGE, TRUMP, PEPE, and BONK could quickly reclaim lost ground. That could potentially lead to another wave of explosive gains in the meme coin sector.

The post Top 3 Crypto Narratives to Watch For the Second Week of March appeared first on BeInCrypto.