Crypto Price Today: Dogecoin Dips While Bitcoin Price Steadies Amid Tariff News

The post Crypto Price Today: Dogecoin Dips While Bitcoin Price Steadies Amid Tariff News appeared first on Coinpedia Fintech News

The crypto market today experienced a pullback, with major cryptocurrencies slipping as profit-taking kicked in after a solid run earlier in the week.

Dogecoin (DOGE) was hit the hardest, falling more than 5%, while Bitcoin (BTC) maintained its stability around the $93,000 mark.

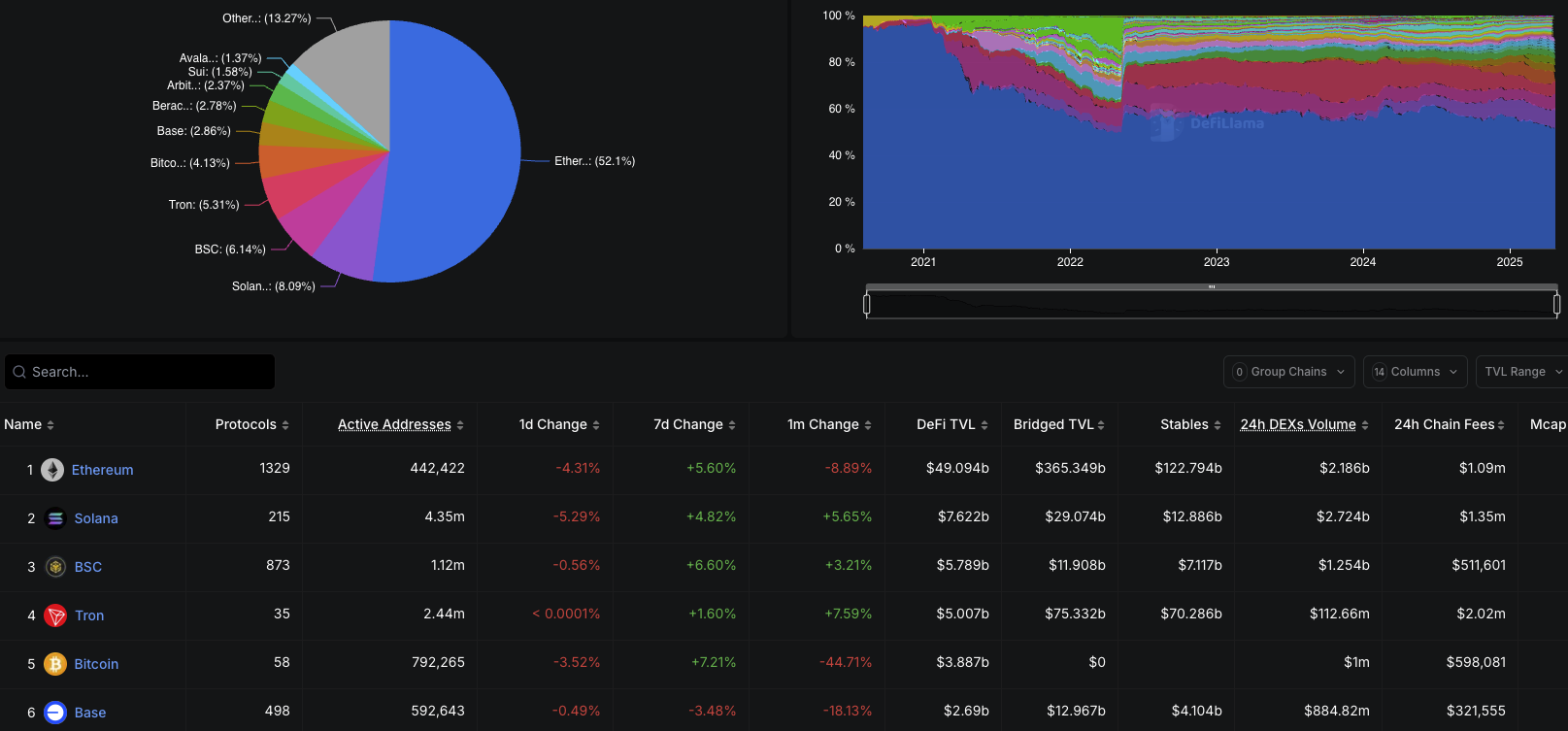

Other large-cap tokens such as XRP, Solana (SOL), and Binance Coin (BNB) experienced losses of over 2%, with Ether (ETH) seeing a milder dip of 1.5%.

Why the Sudden Crypto Sell-Off?

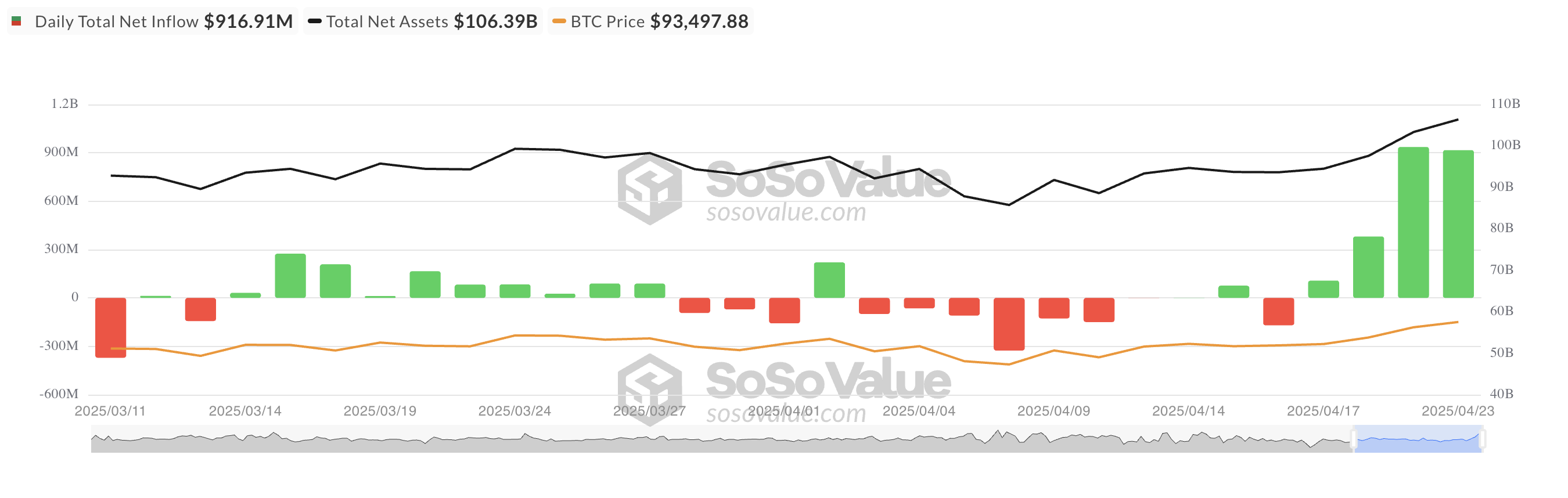

The crypto market dropped by a modest 2.5%. This sell-off was not triggered by any negative news but rather by profit-taking after earlier gains. While global economic risks and political uncertainties continue to impact sentiment, Bitcoin stood resilient, attracting over $916 million in ETF inflows. Investors are increasingly viewing Bitcoin as a safe-haven asset amid volatile market conditions.

According to Vugar Usi Zade, an analyst at Bitget, Bitcoin’s correlation with stocks continues to weaken, while the U.S. dollar’s decline adds to its appeal as a store of value. However, short-term market movements remain heavily influenced by macroeconomic signals.

Global Politics and Macro Tensions Fuel Volatility

The global political landscape adds another layer of uncertainty. Although President Donald Trump recently reassured the market by stating that he does not intend to fire Fed Chair Jerome Powell, easing some bond market nerves, the ongoing trade war with China remains a wildcard.

Some Chinese goods face tariffs as high as 245%, keeping tensions high. Meanwhile, QCP Capital notes that Powell’s statement removed a key risk factor, but geopolitical instability and unclear regulations continue to weigh on the market sentiment.

As a result, the market remains in a “wait-and-watch” phase. Bitcoin’s steady price action and growing ETF demand offer optimism, but the broader crypto market, particularly meme coins like DOGE, remains vulnerable to sentiment shifts.

Dogecoin: Analysts Spot Breakout Potential

Despite the current market dip, DOGE analysts remain optimistic about the coin’s long-term prospects. Crypto analyst Javon Marks believes that Dogecoin is still in an uptrend, despite its recent dip. He highlights that the price has been forming higher lows and higher highs, a classic pattern that indicates continued upward momentum. Marks predicts that DOGE could potentially reach $0.6533 or even $1.25 in the future if the bullish momentum continues.

On the other hand, analyst Ehsan Zeydabadi identifies a symmetrical triangle pattern forming for DOGE, a setup often indicative of an impending breakout. If DOGE breaks above its resistance levels soon, it could move towards $0.194, but if it fails to break out, the price could drop to around $0.146 or lower.

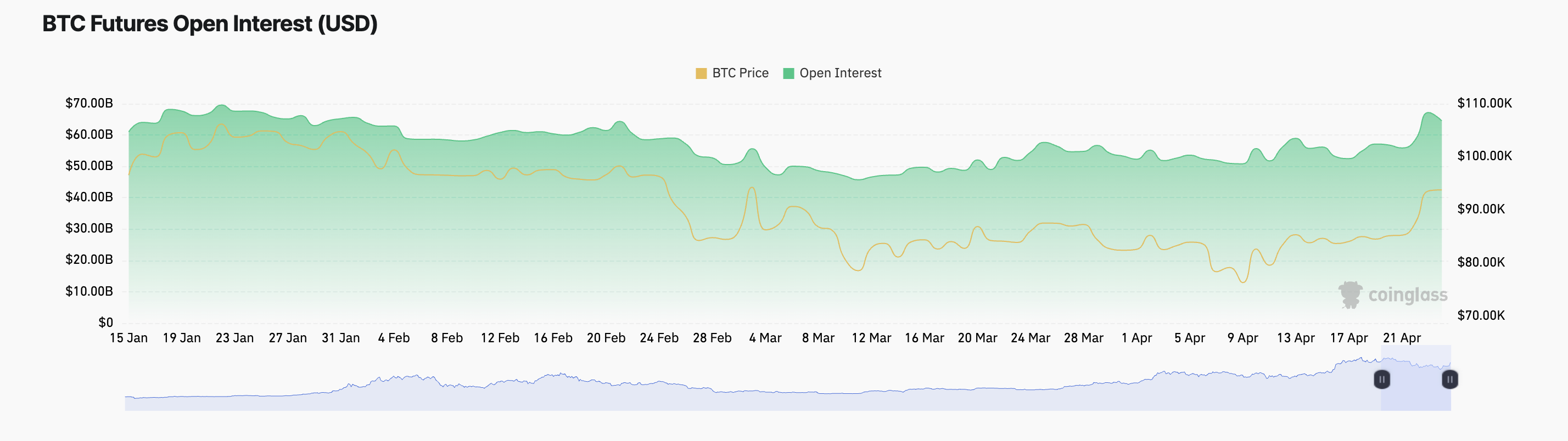

Bitcoin Price Today: Market Resilience Amid Volatility

While other cryptocurrencies face uncertainty, Bitcoin (BTC) has proven to be a resilient asset, attracting growing interest from institutional investors. Today, Bitcoin remains strong, holding near the $93,000 mark, as it benefits from its safe-haven appeal in uncertain economic times.

This, coupled with its weakening correlation with traditional stocks and the declining U.S. dollar, positions Bitcoin as a potential store of value for the long term.

The post Crypto Price Today: Dogecoin Dips While Bitcoin Price Steadies Amid Tariff News appeared first on Coinpedia Fintech News

The crypto market today experienced a pullback, with major cryptocurrencies slipping as profit-taking kicked in after a solid run earlier in the week. Dogecoin (DOGE) was hit the hardest, falling more than 5%, while Bitcoin (BTC) maintained its stability around the $93,000 mark. Other large-cap tokens such as XRP, Solana (SOL), and Binance Coin (BNB) …