Will 7-Day Golden Cross Finallly Trigger Ethereum Price Rally?

Ethereum price struggles below $1,800, as geopolitical risks overshadowing bullish sentiment from the Petra upgrade protocol.

Ethereum Golden Cross Holds for 7 Days, ETH Price $1,900 Target in Sight

Ethereum price forecast today leans bullish as ETH sustains a seven-day Golden Cross, reinforcing near-term upside potential.

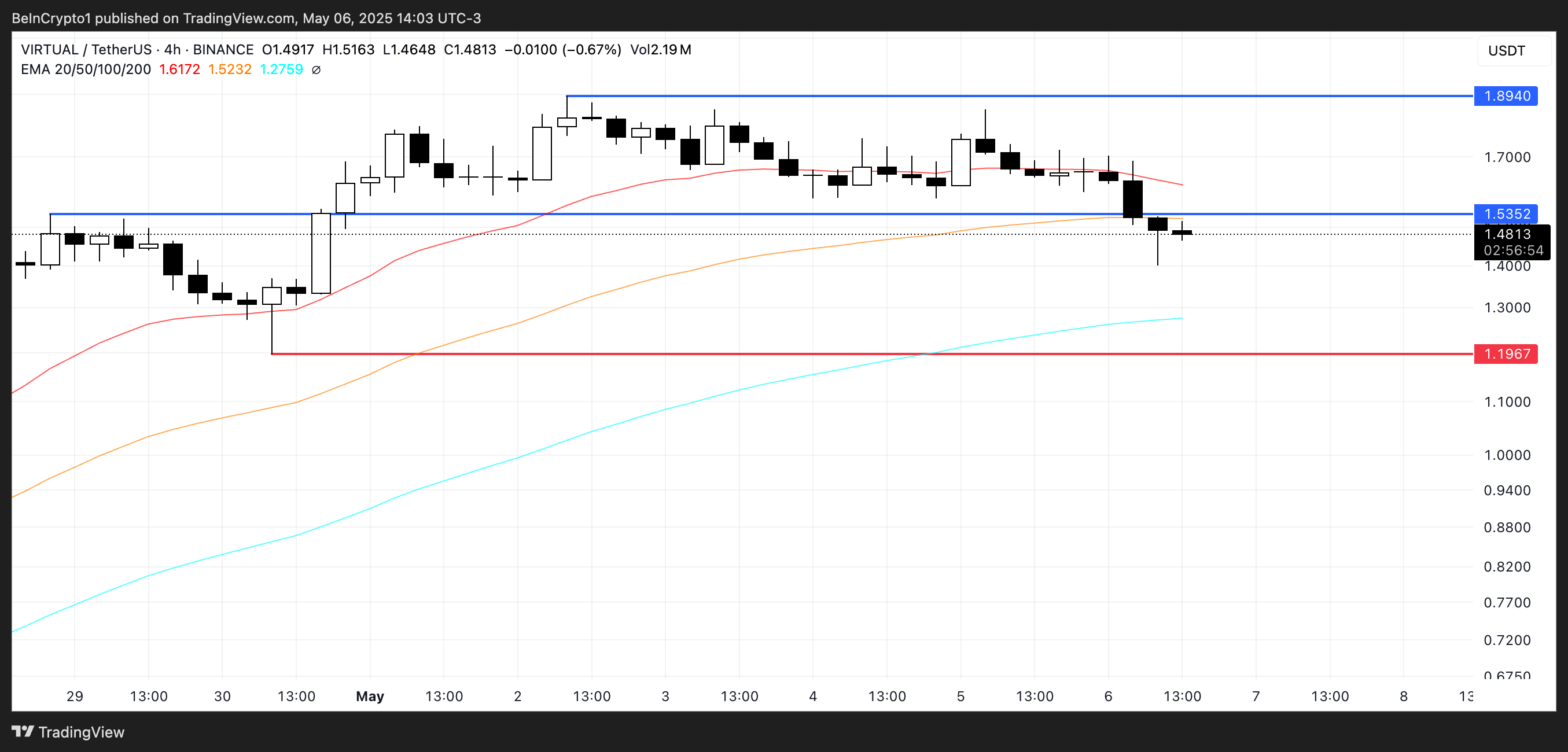

The price remains above the key 50-day Simple Moving Average (SMA) at $1,779 and has hovered closely under the 7-day SMA at $1,818.13. This crossover, where the 7-day SMA moved above both the 30-day, and 50-day average price leves, historically signals short-term bullish momentum in place.

As long as ETH price closes above the 50-day SMA ($1,779), the bullish structure could remains intact.

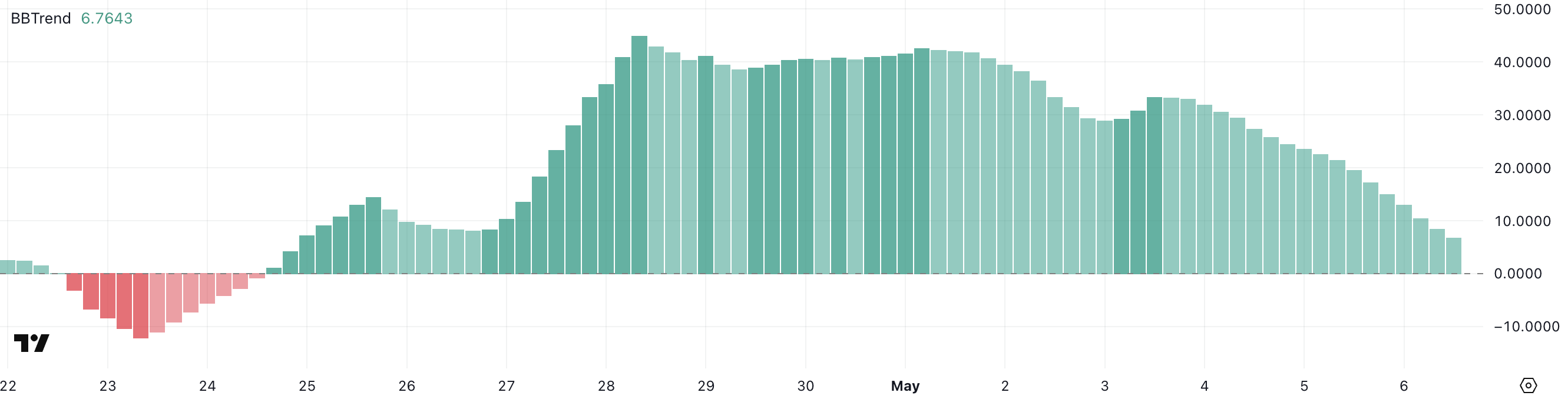

The Moving Average Convergence Divergence (MACD) reinforces this upside bias. With the MACD line at 11.17 and the signal line at 10.04, the histogram remains in bullish territory, though momentum has slightly faded from its April peak.

However, failure to defend $1,779 would shift bearish focus to $1,693, where the 50-day SMA offers deeper support.

Ethereum Price Tumbles Under $1,800 Despite Pectra Optimism

Though lacking the narrative splash of the Ethereum merge in 2022, Pectra’s technical depth is drawing praise from within the ecosystem.

Despite this, Ethereum price has dropped below $1,800, posting a 2.4% daily loss and a 2.3% weekly decline, according to Coinckeco data.

The correction coincided with rising geopolitical instability and temporary liquidity constraints, pulling market sentiment into risk-off territory.

On Tuesday, May 6, unconfirmed reports emerged that India had launched a missile strike on Pakistani military targets, triggering a surge in regional tension and unsettling global risk markets.

The news broke just hours before Ethereum’s scheduled upgrade, casting a shadow over one of the protocol’s most consequential milestones.

The pullback was further compounded by Coinbase’s temporary suspension of ETH deposits and withdrawals. Although a standard safeguard during network transitions, the pause could heighten market panic, with traders and institutional market-makers already on alert due to the South Asia conflict.

Ethereum briefly touched a 24-hour low of $1,757, neutralizing the positive sentiment surrounding the Pectra upgrade. While developers remain focused on long-term protocol health, traders appear hesitant to deploy capital amid global uncertainty and short-term volatility.

Ethereum Pectra Upgrade Marks a New Era for Scalability

Ethereum is set to network the highly anticipated Pectra Upgrade on May 7, 2025, marking its most significant technical overhaul since the Merge.

The update combines the Prague execution layer and Electra consensus layer, introducing 11 Ethereum Improvement Proposals (EIPs) aimed at improving scalability, validator operations, and end-user functionality.

A centerpiece of the upgrade is EIP-7702, proposed by co-founder Vitalik Buterin, which enables account abstraction for externally owned accounts (EOAs).

The feature allows EOAs to temporarily function like smart contracts, supporting programmable wallet logic and gasless transactions, key to mass adoption and wallet innovation.

Ethereum core developer Tim Beiko emphasized the impact of EIP-7594 and EIP-7691, which optimize blob transactions for rollup chains and improve data availability for Layer 2s.

“Pectra boosts validator UX and doubles blob count for Layer 2 scaling. This is our biggest upgrade since the Merge… EIP-7251 enables efficient solo staking, and EIP-7702 allows EOAs to act like smart contracts—unlocking account abstraction-style features in a backwards-compatible way.” Tim Beiko said.

Major infrastructure players are preparing accordingly. Coinbase will pause ETH deposits and withdrawals from 2:50 AM to 3:45 AM PT on May 7 to ensure user fund safety during the transition.

Experts are weighing the impact of this upgrade to Ethereum price as traders expect it to finally boost ETH stalling price action.

The post Will 7-Day Golden Cross Finallly Trigger Ethereum Price Rally? appeared first on CoinGape.