Netflix is Making a Series on FTX – Who is Playing Sam Bankman-Fried?

According to Hollywood rumors, Netflix is planning to make a movie based on the 2022 FTX collapse. Julia Garner is rumored to be finalizing negotiations to play Caroline Ellison, but Bankman-Fried’s actor is less certain.

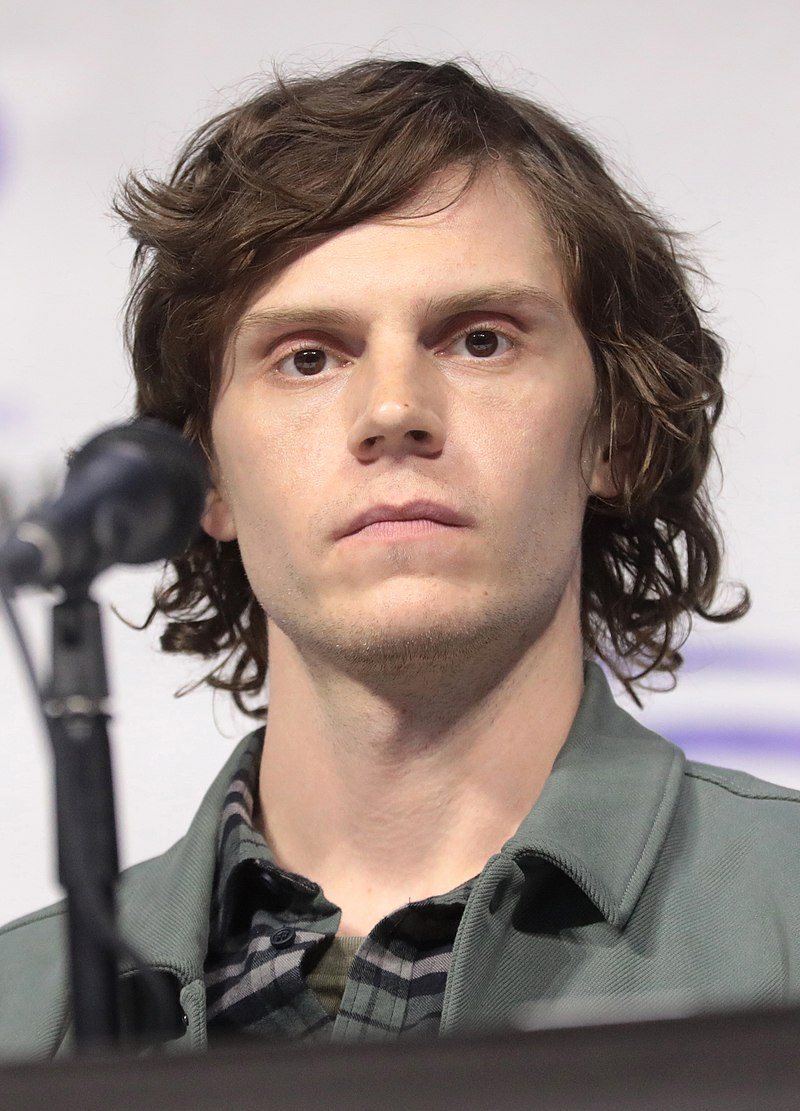

Several outlets have claimed that Evan Peters, who starred in Netflix’s award-winning series DAHMER, is in talks to play SBF. However, this is presumably even less certain than Garner’s role. Graham Moore, an Oscar-winning screenwriter, is also in talks to write the series.

Netflix’s Take on the FTX Collapse

The FTX collapse in 2022 was one of the most dramatic events in financial history, not just crypto. So, it makes sense that Netflix is planning a movie about it. After all, several studios were fighting to get the film rights the same month that the collapse happened.

Variety recently published rumors about the casting, claiming that Julia Garner is nearly set to play Caroline Ellison.

Garner previously played digital con artist Anna Delvey and received an Emmy nomination for her performance. This relevant experience could add color to her portrayal of another convicted fraudster in Netflix’s FTX adaptation.

However, Garner’s largest role was Ozark, an acclaimed Netflix show that earned three Emmy awards. Variety further claimed that she may become an executive producer on this series, but again, nothing has been finalized.

Netflix will reportedly use a love story as a framing device for the FTX series’ plot, so the actor playing Sam Bankman-Fried will be essential.

Other industry publications have alleged that Evan Peters is in talks for this role. He has also won awards for a previous Netflix production in 2022.

A Netflix adaptation of the FTX story could be highly entertaining, but it’s important to stress that no contracts have been signed. The crypto industry has produced many famous events, after all.

The 2016 Bitfinex hack was allegedly getting a movie adaptation last year, but there hasn’t been an update on the project in around six months.

That is to say, “development hell” is a popular term in the film industry for a reason. Hopefully, the crypto community will soon enjoy Netflix’s dramatized take on the FTX collapse. Today, it’s still in the very early stages.

The post Netflix is Making a Series on FTX – Who is Playing Sam Bankman-Fried? appeared first on BeInCrypto.