3 Reasons Why Pi Coin Price Will Skyrocket 100% This Week

Pi Network (PI) price at $0.73 takes a small breather with a 2% intraday drop after two days of a 30% bull run. Despite the pause, as PI coin price stands on the verge of a key pattern breakout. Favoring the upside chances, whale accumulation and adoption surge hint at a near 100% rally this week in Pi Network’s coin price.

3 Reasons Why Pi Coin Price Will Give a 2x Rally

The cryptocurrency market is rising again and tokens like PI are capitalizing on increased momentum. Between May 8 and 9, Pi Network’s token price formed two bullish engulfing candles, marking the 30% rally. At present, the Pi coin price aims to reclaim $1 as multiple factors support optimistic Pi Network forecasts. So, let’s a closer look at the three reasons why Pi’s token price could jump 100% this week.

Adam and Eve Pattern Breakout Targets $1.54

Pi Network’s coin price tumbled 86% from $2.99 to $0.40 between Feb 26 and April 5, marking a strong bottom. Signaling a stronger return, PI price action forms an Adam and Eve pattern in the 4-hour price chart. The V-shaped reversal in Pi’s coin price from $0.40 to $0.77 is known as Adam and follows the rounding reversal as Eve. The neckline remains constant at $0.77, acting as the key immediate hurdle.

Based on technical analysis, the breakout target is evaluated by adding the V-shaped reversal’s depth to the breakout level. Aligning with the broader market Pi Network price prediction, a near 100% price surge is possible to $1.54.

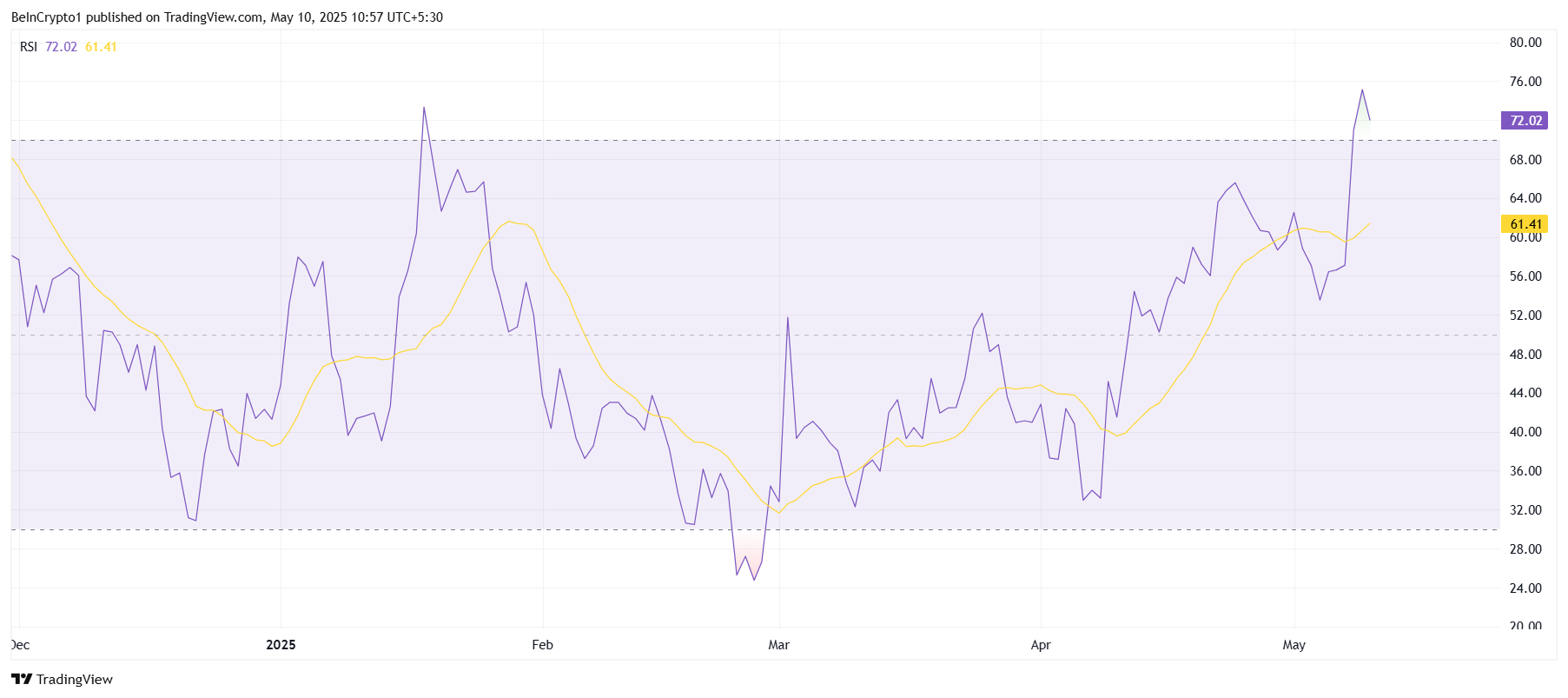

A positive crossover between 50 and 100 Exponential Moving Averages (EMA) triggers a bull signal. Further, the 4-hour Relative Strength Index (RSI) has crossed into the overbought territory, signaling solid underlying bullishness. Hence, the technical indicators bolster the breakout forecast.

Conversely, a bullish failure to surpass the overhead $0.70 zone might drop Pi’s coin price to the 200 EMA at $0.69. Additionally, a breakdown under $0.69 will nullify the bullish pattern and could retest the 50 EMA at $0.6414.

Is Binance Acquiring PI Coins Ahead of Pi Network Listing?

Amid the rising PI price trend, a single wallet holds 155 million PI coins, surpassing holdings of major CEXs such as Gate.io and OKX. A recent 70M Pi coin withdrawal from OKX in a single transaction reflects the whale’s strong confidence. With the high-value withdrawal, the community anticipates the wallet possibly belonging to Binance, ahead of the listing rumor. Until confirmation, it makes the whale wallet the largest non-listed CEX holder of Pi tokens. As of the last update, Binance might consider listing Pi Network under the new token listing criteria.

HTX Exchange Listing Rumors Resurface

HTX (formerly Huobi) has posted Pi Network’s logo on X three times, teasing PI investors with listing chances. HTX is one of the top-tier exchanges, and a listing of Pi coin will push it to the mainstream CEX ecosystems. As of now, the exchange has yet to confirm the listing, but multiple hints fuel optimism among investors.

Hence, with the rising rumors and large withdrawals, the factors support strong breakout chances reclaiming the $1 mark.

The post 3 Reasons Why Pi Coin Price Will Skyrocket 100% This Week appeared first on CoinGape.