Tesla Bitcoin Holdings Remain Untouched Despite Slump in TLSA Stock and Q1 Earnings

The post Tesla Bitcoin Holdings Remain Untouched Despite Slump in TLSA Stock and Q1 Earnings appeared first on Coinpedia Fintech News

Tesla stock took a hit after the EV giant reported a 9% drop in total revenue for Q1 2025, down from $21.3 billion to $19.3 billion. But in a surprising move, Tesla Bitcoin holdings remained unchanged, signaling the company’s continued confidence in crypto despite market and operational headwinds.

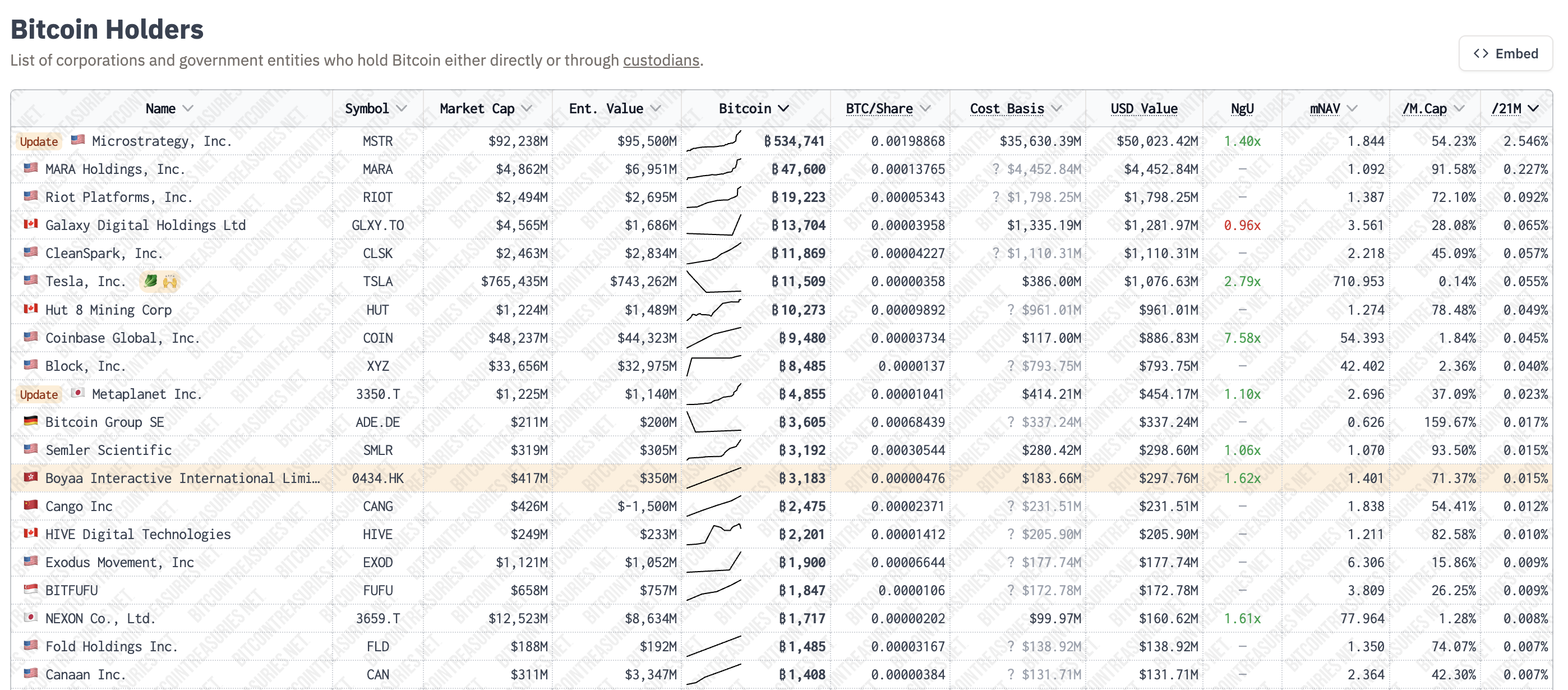

Tesla Holds 11,509 BTC Amid Market Turbulence

According to Bitcoin Treasuries, Tesla still holds 11,509 BTC, making it the fifth-largest public company with Bitcoin exposure. Competitors ahead include MicroStrategy (538,200 BTC), Marathon Digital (47,531 BTC), Riot Platforms (19,223 BTC), and CleanSpark (11,869 BTC).

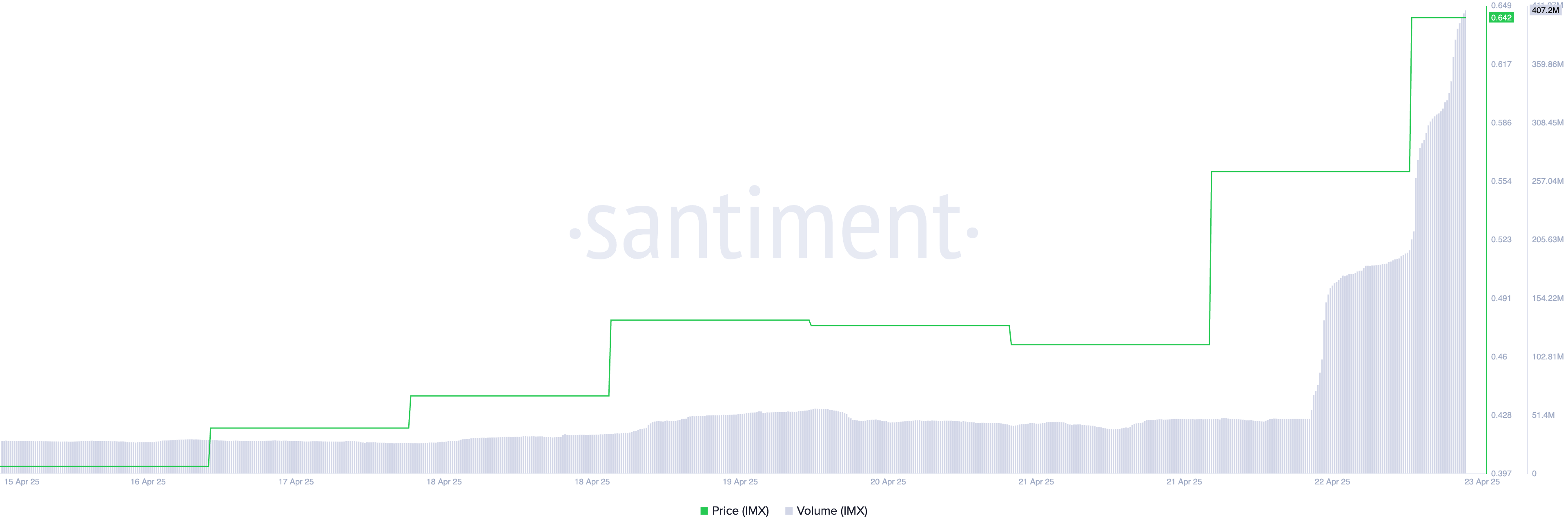

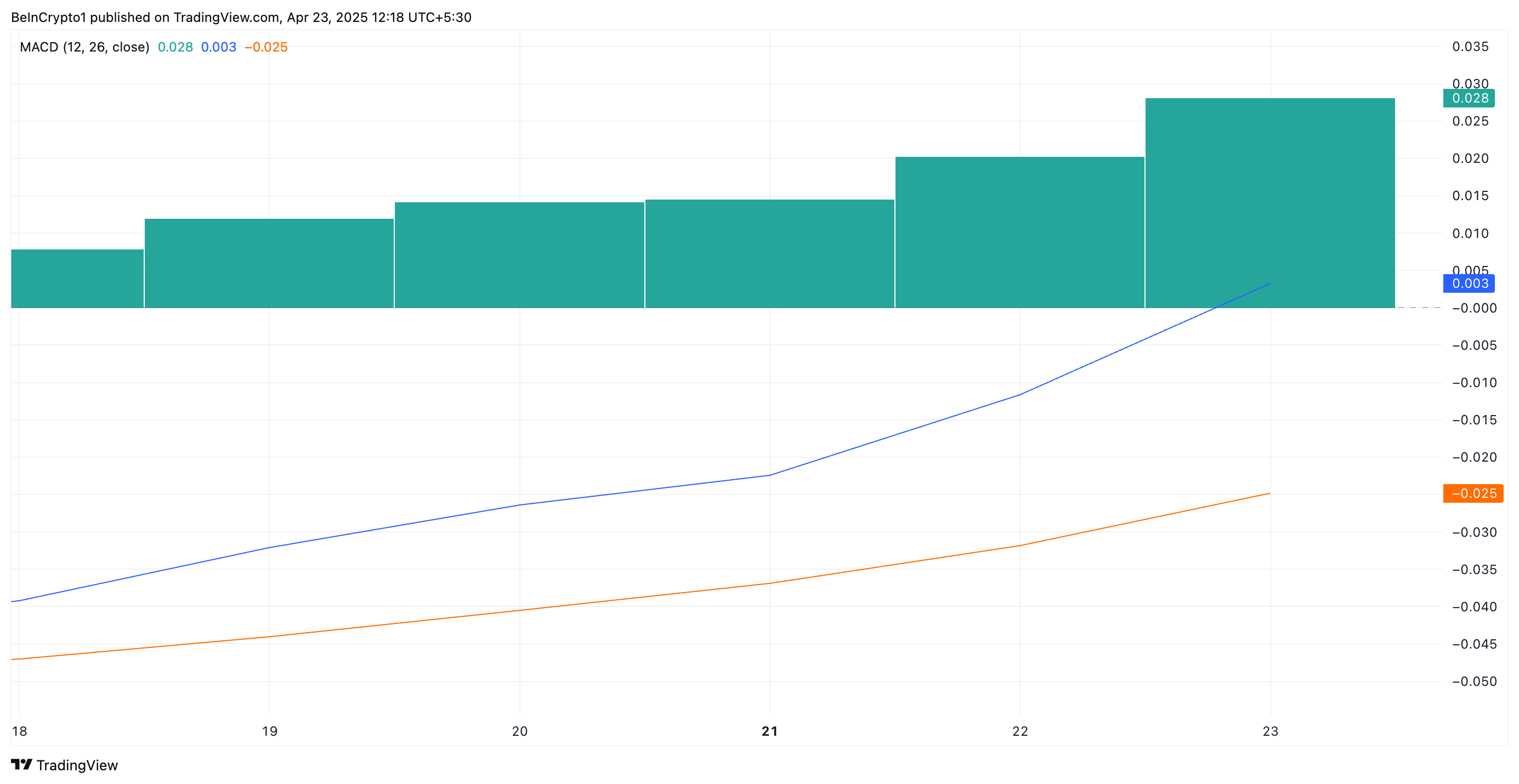

Despite Bitcoin’s 11.7% decline in Q1, Tesla did not liquidate any part of its crypto reserves. With new FASB rules now requiring firms to mark crypto assets at fair market value each quarter, Tesla’s holdings dropped from $1.076 billion to $951 million—but the company held firm.

- Also Read :

- Will Bitcoin Price Hit $100K This Week or Crash Again?

- ,

Tesla Earnings Hurt by Tariffs, Not Bitcoin

While Tesla earnings took a blow due to rising costs driven by Trump’s aggressive import tariffs on EV components, Bitcoin wasn’t to blame. Automotive revenue declined by over 20% year-over-year, while net income plunged to 12 cents per share from 41 cents.

Tesla’s decision to keep its Bitcoin stash intact highlights a long-term crypto strategy—one that contrasts sharply with the short-term volatility in both traditional and digital markets.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

The post Tesla Bitcoin Holdings Remain Untouched Despite Slump in TLSA Stock and Q1 Earnings appeared first on Coinpedia Fintech News

Tesla stock took a hit after the EV giant reported a 9% drop in total revenue for Q1 2025, down from $21.3 billion to $19.3 billion. But in a surprising move, Tesla Bitcoin holdings remained unchanged, signaling the company’s continued confidence in crypto despite market and operational headwinds. Tesla Holds 11,509 BTC Amid Market Turbulence …