The post Altcoin Season 2025 Has Arrived, Santiment Data Shows appeared first on Coinpedia Fintech News

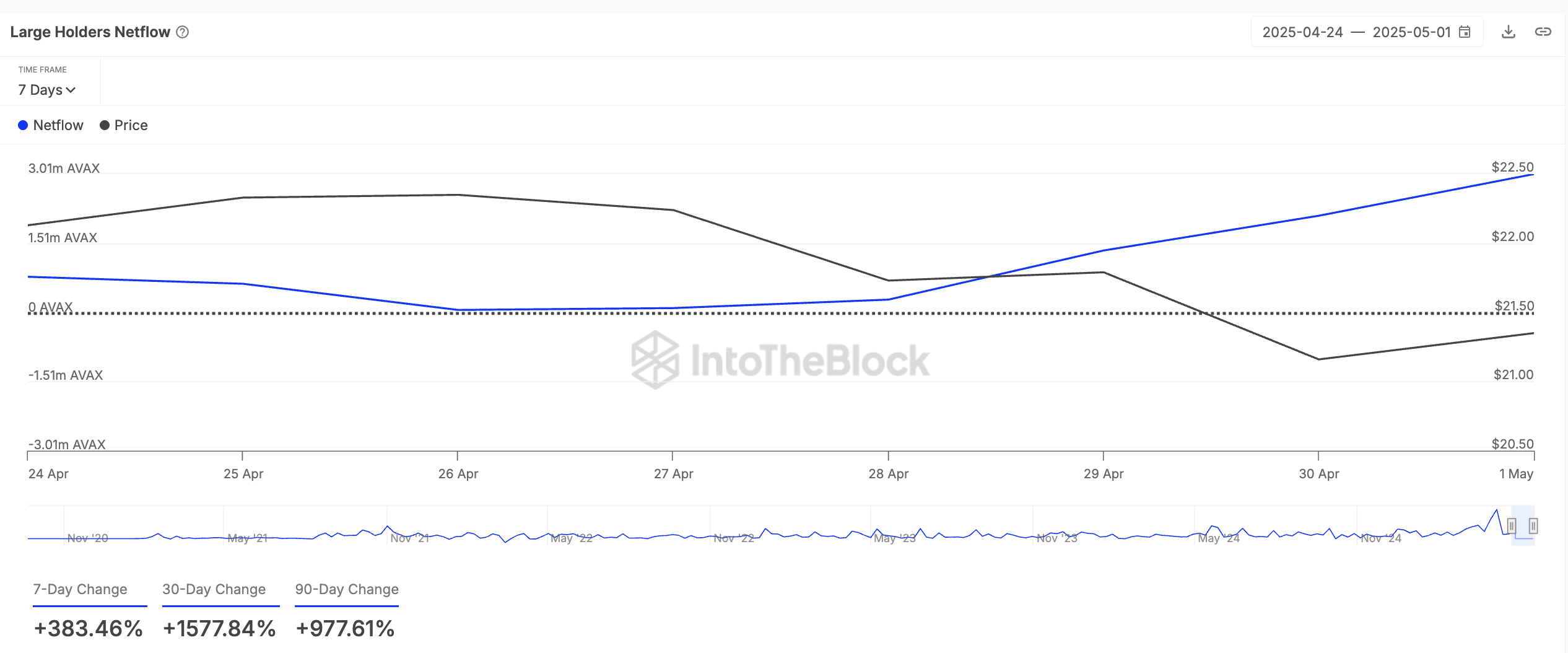

Traders are convinced the altseason is either here or just about to explode. After Bitcoin’s massive surge last week, profits are flooding into riskier assets, setting the stage for altcoins to take the spotlight.

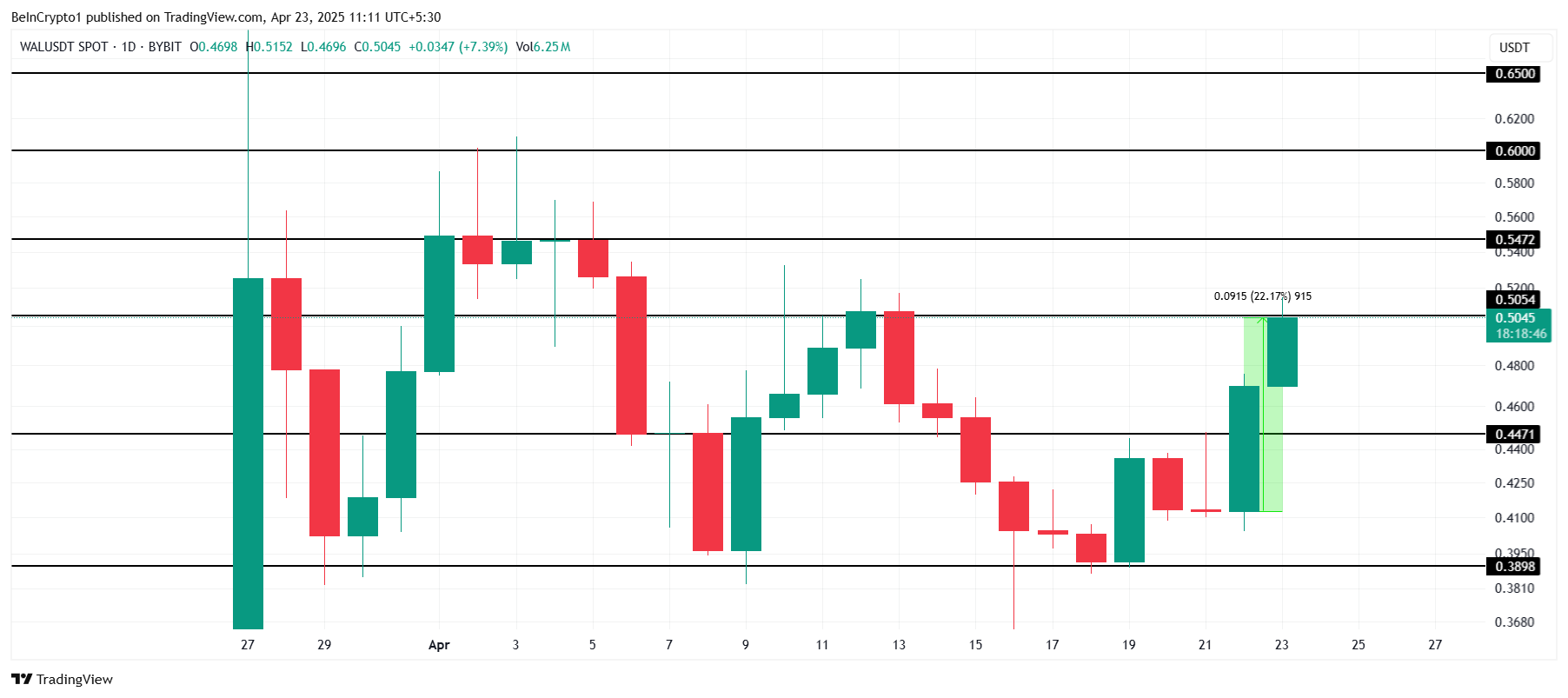

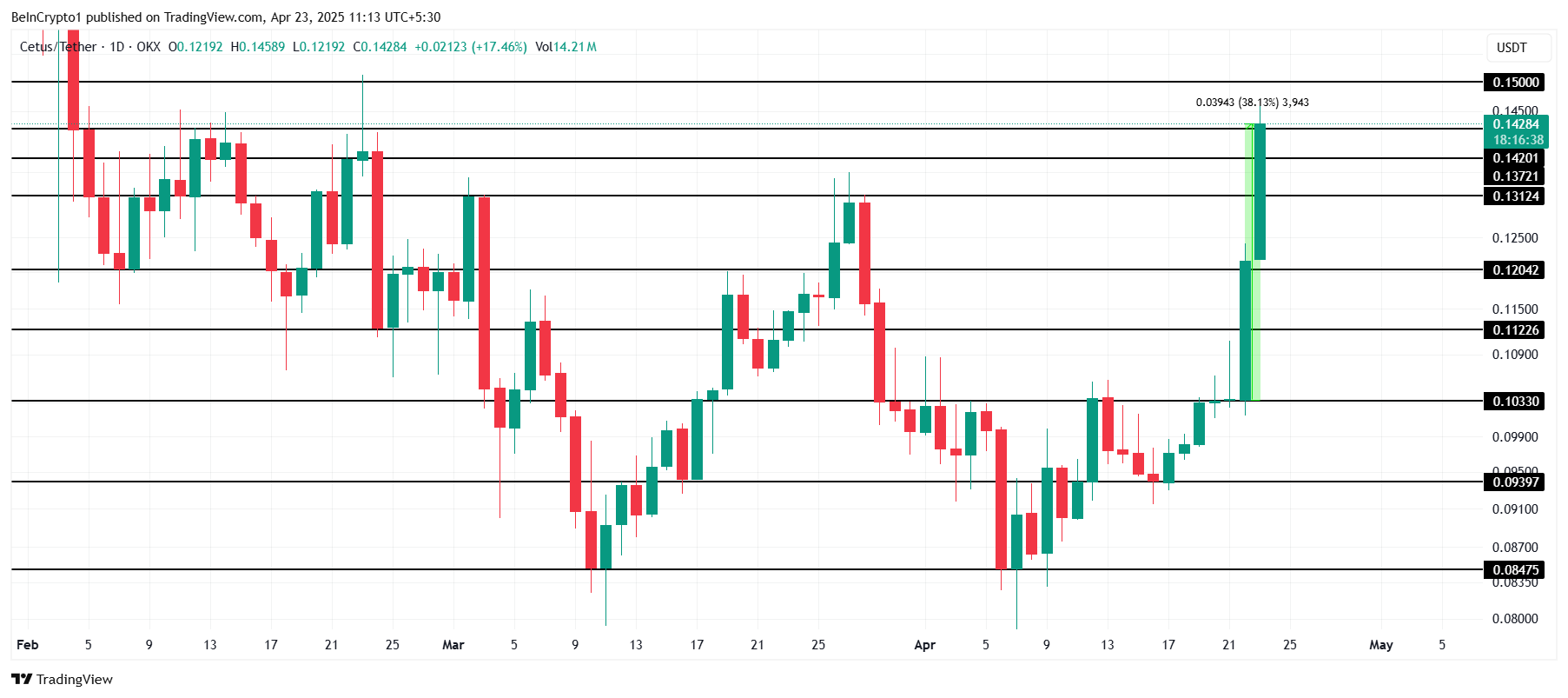

Bitcoin has held strong above $94,000 despite macro uncertainty. While altcoins have remained relatively neutral today, they have posted gains of 5-13% over the past week.

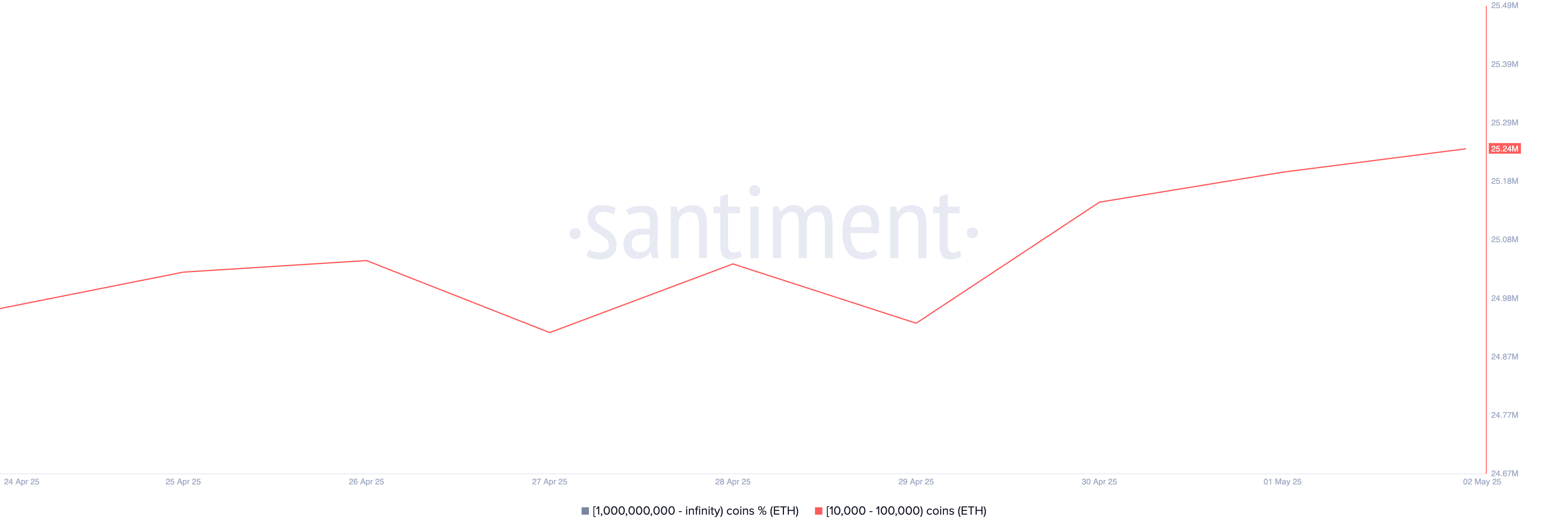

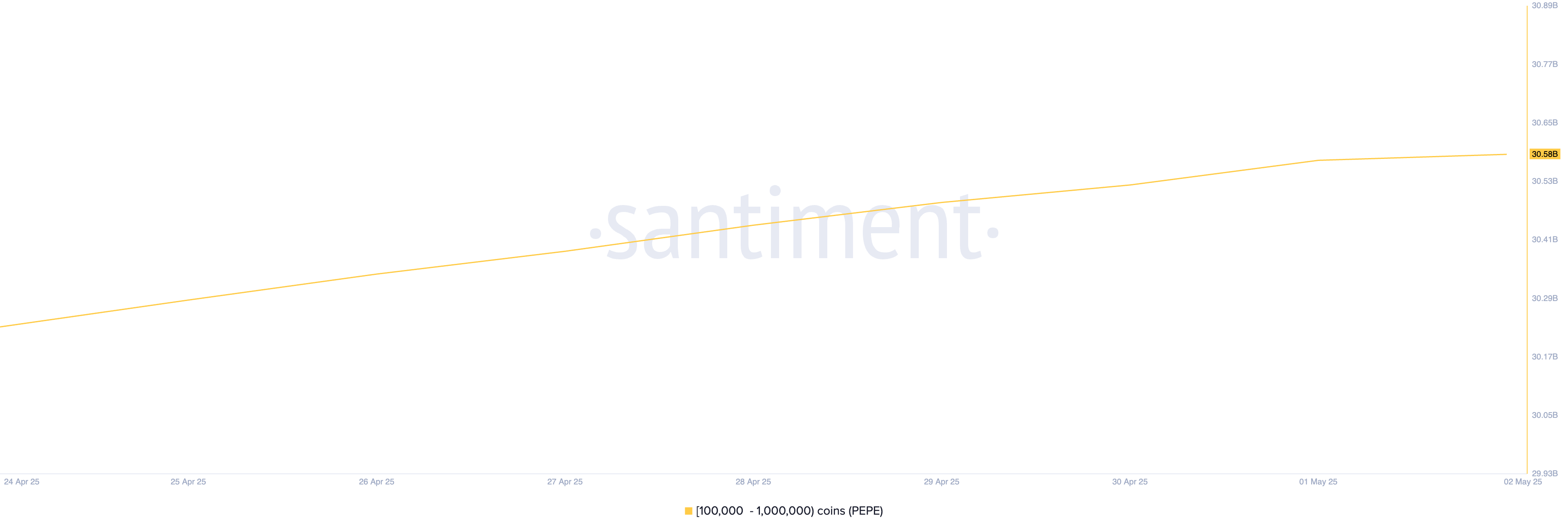

The latest Santiment analysis shows a rise in both price action and the social media volume across the crypto market in the past week. Bitcoin leads the way with a 23.21% rise in social volume, followed by Ethereum, XRP, and meme coins like TRUMP and PEPE seeing notable attention.

Wrapped TRON, TRUMP Tokens Surge 150%

On the price side, several altcoins outperformed, with Wrapped TRON and Trump-themed tokens posting massive gains of over 150%. Sui, UGold, and PEPE were among the top gainers. The total market cap grew over 10% to $3.81 trillion, and the trading volume surged 21.38%, which shows growing momentum in the market.

The TRUMP token spiked both in price and social volume around April 23, driven by strong community hype before slightly cooling off. There has been a rising interest in altcoins over the past month. The increase in social volume and BTC price strongly hints at an upcoming altseason.

Altcoins Gain Attention as Social Volume Peaks

The social volume for altcoins has also steadily increased, peaking around April 23-26. Altcoins’ share of total discussions rose after April 17, which shows that market participants are shifting focus to higher-risk, higher-reward assets.

Bitcoin’s price has also been rising, which creates a favorable condition for an altcoin rally. Although there was a slight pullback in volume and dominance, it could be a temporary sign to stay cautious in the short term. It is also important to note that there has been a big jump in discussions around memecoins like Doge.

Analyst Ash Crypto, in his recent X post, warned users against selling altcoins at a 50% loss, suggesting that holding them could lead to gains (5x-20x) in the next year. Despite the challenges of the 2022 bear market and the possible future crash due to tariffs, he believes that trillions in new crypto investments will flow in 2025 through Quantitative Easing.