Sometimes the difference between security and compromise comes down to a single click – and a healthy dose of suspicion. And it’s because scammers are getting increasingly sophisticated with their phishing attempts. It’s to the point where even following standard security best practices isn’t enough to protect you. Case in point: last week’s near-successful phishing attack on Zach Latta.

Sometimes the difference between security and compromise comes down to a single click – and a healthy dose of suspicion. And it’s because scammers are getting increasingly sophisticated with their phishing attempts. It’s to the point where even following standard security best practices isn’t enough to protect you. Case in point: last week’s near-successful phishing attack on Zach Latta.

Related Posts

Top 3 AI Coins Smart Money Wallets Are Buying For the Last Week of April

AI coins like HOLLY, PROMPT, and DSYNC have seen notable Smart Money accumulation in recent weeks. Over the past few weeks, these three projects have stood out in on-chain activity.

Specifically, HOLLY brings visual storytelling to blockchain, PROMPT powers AI interactions across chains, and DSYNC focuses on AI and DePIN infrastructure. Despite contract risks flagged by GoPlus Security, these AI coins show rising adoption, strong trading activity, and expanding holder bases.

h011yw00d by Virtuals (HOLLY)

HOLLY, short for h011yw00d, is an AI-powered cinematic agent that turns internet conversations into short visual films. Unlike traditional formats, it tells stories without dialogue or captions, using only visuals to express emotion and narrative. As a result, the project offers a new way to interpret online interactions through AI filmmaking.

The team launched HOLLY four days ago on the Base chain. Since then, it has reached a market cap of $1.2 million and gathered over 48,000 holders.

According to Nansen, the number of Smart Money wallets holding HOLLY increased from 5 to 10 since April 18. Together, these wallets now hold around 13.4 million tokens. Additionally, the team launched the token via the Virtuals Protocol platform, one of the biggest players in the crypto AI agents space.

One of HOLLY’s top holders uses a wallet that Nansen, an on-chain analytics platform, labeled as linked to LongHash Ventures. Meanwhile, GoPlus Security, a crypto security firm, points out two key risks: the team can modify HOLLY’s tax, and they didn’t renounce ownership—both important factors for traders to monitor.

PROMPT

PROMPT is the native token of Wayfinder, an omni-chain tool designed to enable AI systems to operate across blockchain environments.

Wayfinder aims to create new methods for machine intelligence to interact with decentralized networks, facilitating more advanced on-chain AI integrations. PROMPT serves as the core asset within this ecosystem, supporting the platform’s operations and functionality.

Between April 9 and April 14, Smart Money wallets holding PROMPT jumped from zero to 20. That number has stayed the same for the past eight days.

PROMPT runs on the Ethereum blockchain. It has around 5,600 holders, a market cap of $53 million, and a daily trading volume of $706,000.

GoPlus Security flagged two risks. The team didn’t renounce ownership, and the contract allows new tokens to be minted. That could increase supply and push the price down.

Destra Network (DSYNC)

Among emerging AI coins, Destra Network positions itself as a decentralized solution for DePIN (Decentralized Physical Infrastructure Networks) and AI computing, aiming to streamline access to these technologies through a unified platform.

Currently, DSYNC has a market cap of $140 million and is held by over 48,000 wallets.

Since April 1, the number of Smart Money wallets holding DSYNC has grown from 41 to 44, and the token has seen a price increase of more than 13% in the past 24 hours. Over the same period, its trading volume reached $455,000.

According to GoPlus Security, DSYNC has two points of caution: the contract’s tax settings can be modified, and the token’s ownership has not been renounced—factors that could pose risks depending on future changes to the contract.

The post Top 3 AI Coins Smart Money Wallets Are Buying For the Last Week of April appeared first on BeInCrypto.

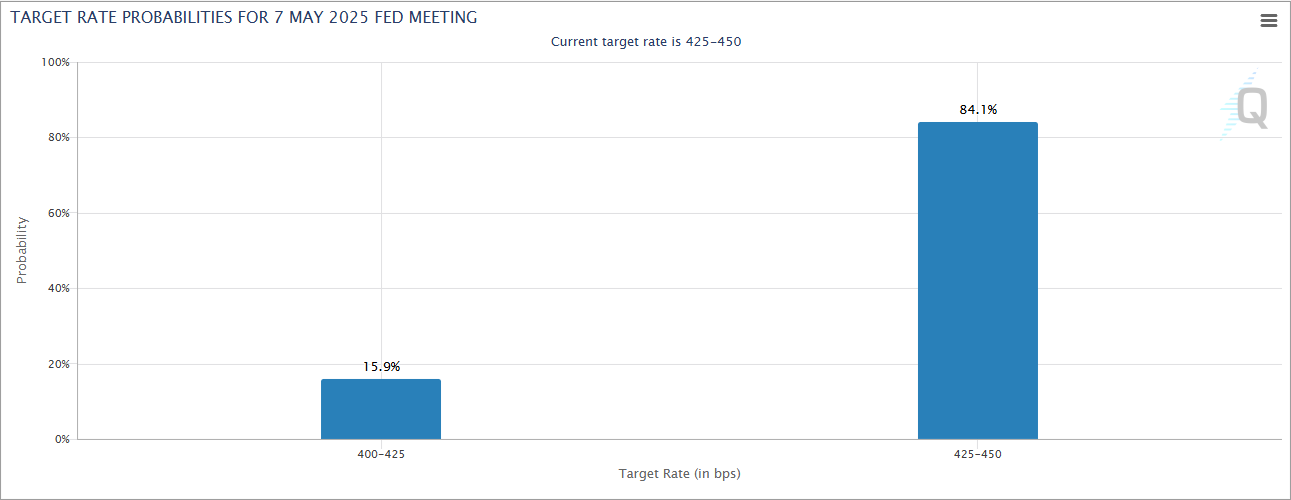

Fed Rate Cut Odds Collapse to 15% After Trump’s Tariff Pause

According to CME FedWatch data, the probability of a Federal Reserve interest rate cut in May has plunged from 57% to just 15%. This is due to President Trump’s 90-day tariff pause and newly released March FOMC minutes.

The March 18–19 FOMC minutes, released Tuesday, confirm that policymakers remain cautious on easing.

FOMC Minutes Reveal Hawkish Caution

While the Fed acknowledged solid economic growth and stable labor markets, officials noted that inflation is still running above the 2% target.

Many participants emphasized upside risks to inflation, particularly from broad-based tariff increases and potential supply chain disruptions.

Several Fed members observed that inflation prints for January and February came in higher than expected, and warned that the effects of new tariffs — particularly on core goods — may prove more persistent than anticipated.

Although participants supported maintaining current interest rates, they stressed that policy flexibility is essential as uncertainty surrounding trade, fiscal, and immigration policy clouds the outlook.

As of now, Trump’s decision to pause new tariffs for most countries for 90 days while raising Chinese tariffs to 125% has reduced fears of a full-blown trade war.

However, retaliatory action from China and elevated inflation expectations reinforce the Fed’s hawkish stance. So, policymakers are signaling they are in no rush to cut rates.

What It Means for Crypto

As we have seen lately, crypto markets are macro-sensitive assets. A more hawkish Fed stance and reduced odds of near-term rate cuts could lead to:

- Lower liquidity expectations, weighing on crypto asset prices.

- Stronger dollar pressure, potentially reducing Bitcoin’s appeal as an inflation hedge.

- Higher volatility, as macro uncertainty intensifies and rate cut hopes fade.

For now, the Fed’s message is clear: monetary policy remains data-dependent, but a pivot is off the table unless economic conditions deteriorate sharply.

The market is currently rallying after Trump’s 90-day Tariff pause. However, Crypto investors hoping for tailwinds from rate cuts may have to wait.

The post Fed Rate Cut Odds Collapse to 15% After Trump’s Tariff Pause appeared first on BeInCrypto.

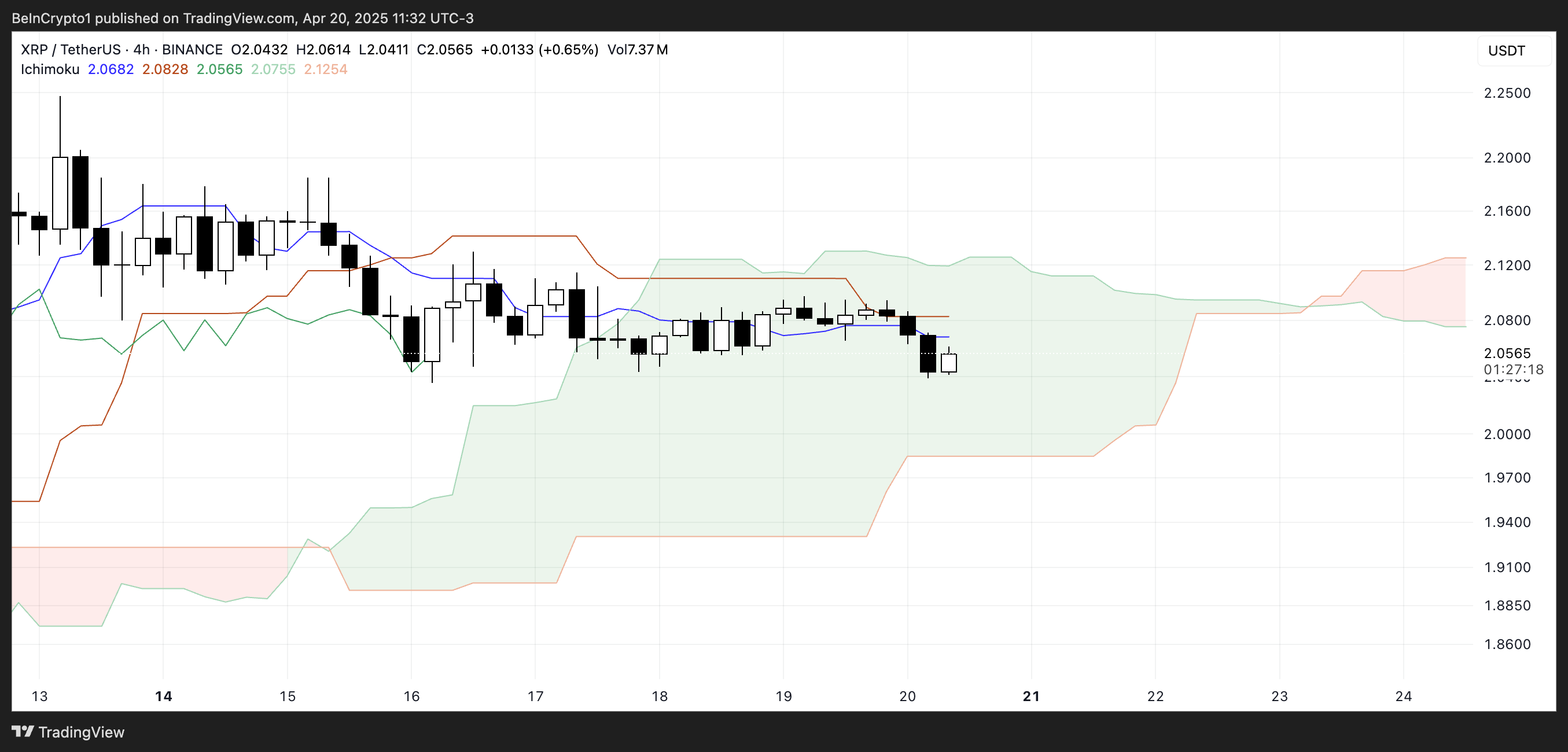

Will XRP Fall Below $2 Again?

XRP is down 5% over the past week, struggling to regain momentum as technical indicators flash mixed signals. Its Relative Strength Index (RSI) has dropped below 50, and the price remains stuck within a tight range between key support and resistance levels.

At the same time, the Ichimoku Cloud has shifted from green to red, with a thickening cloud ahead suggesting growing bearish pressure. With volatility compressing and momentum fading, XRP is nearing a critical point where a breakout—or breakdown—seems increasingly likely.

XRP Struggles to Regain Momentum as RSI Drops Below 50

XRP’s Relative Strength Index (RSI) is currently sitting at 44.54, after recovering from an intraday low of 40.67. Just yesterday, it was at 51.30, highlighting increased short-term volatility.

RSI is a momentum indicator that measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions.

Readings above 70 typically suggest an asset is overbought, while readings below 30 indicate it may be oversold.

With XRP’s RSI at 44.54, it’s currently in neutral territory, showing neither strong buying nor selling pressure.

However, the fact that it hasn’t crossed the overbought threshold of 70 since March 19—over a month ago—signals a lack of sustained bullish momentum. This could mean XRP is still in a consolidation phase, with the market waiting for a clearer direction.

If RSI continues to climb toward 50 and beyond, it may hint at building momentum, but without a breakout above 70, upside could remain limited.

XRP Faces Uncertainty as Bearish Trend Begins to Expand

XRP is currently trading inside the Ichimoku Cloud, signaling market indecision and a neutral trend.

The Tenkan-sen (blue line) has crossed below the Kijun-sen (red line), which is a bearish signal, but with the price still within the cloud, it lacks full confirmation.

The cloud itself acts as a zone of support and resistance, and XRP is now moving sideways within that zone.

Looking ahead, the cloud has shifted from green to red—a sign that bearish momentum may be building. Even more concerning is that the red cloud is widening, which suggests increasing downward pressure in the near future.

A thickening red Kumo often signals stronger resistance overhead and a potential continuation of a bearish trend if the price breaks below the cloud.

Until XRP breaks out decisively in either direction, the market remains in a wait-and-see phase, but the growing red cloud tilts the bias toward caution.

XRP Compression Zone: A Breakout Could Send Price to $2.50 — Or Much Lower

XRP price is currently trading within a tight range, caught between a key support level at $2.05 and resistance at $2.09. This narrow channel reflects short-term uncertainty, but a decisive move in either direction could set the tone for what’s next.

If the $2.05 support fails, the next level to watch is $1.96. A break below that could trigger a steep drop toward $1.61, which would mark the first close below $1.70 since November 2024—a bearish signal that could accelerate selling pressure.

Recently, veteran analyst Peter Brandt warned that a major correction could hit XRP soon.

On the flip side, if bulls regain control and push XRP above the $2.09 resistance, the next target lies at $2.17. A breakout beyond that could open the door to a move toward $2.50, a price level not seen since March 19.

For that to happen, XRP would need a clear resurgence in momentum and buying volume.

Until then, the price remains trapped in a narrow zone, with both upside and downside potential on the table.

The post Will XRP Fall Below $2 Again? appeared first on BeInCrypto.