TRUMP has seen a 7% rise in the last 24 hours, with the price trading at $10.34 at the time of writing. Despite this short-term recovery, the broader outlook for the altcoin remains bearish, influenced by ongoing market conditions.

The recent conflict between Elon Musk and Donald Trump has added further uncertainty, potentially deepening the bearish trend.

TRUMP Outflows Rise

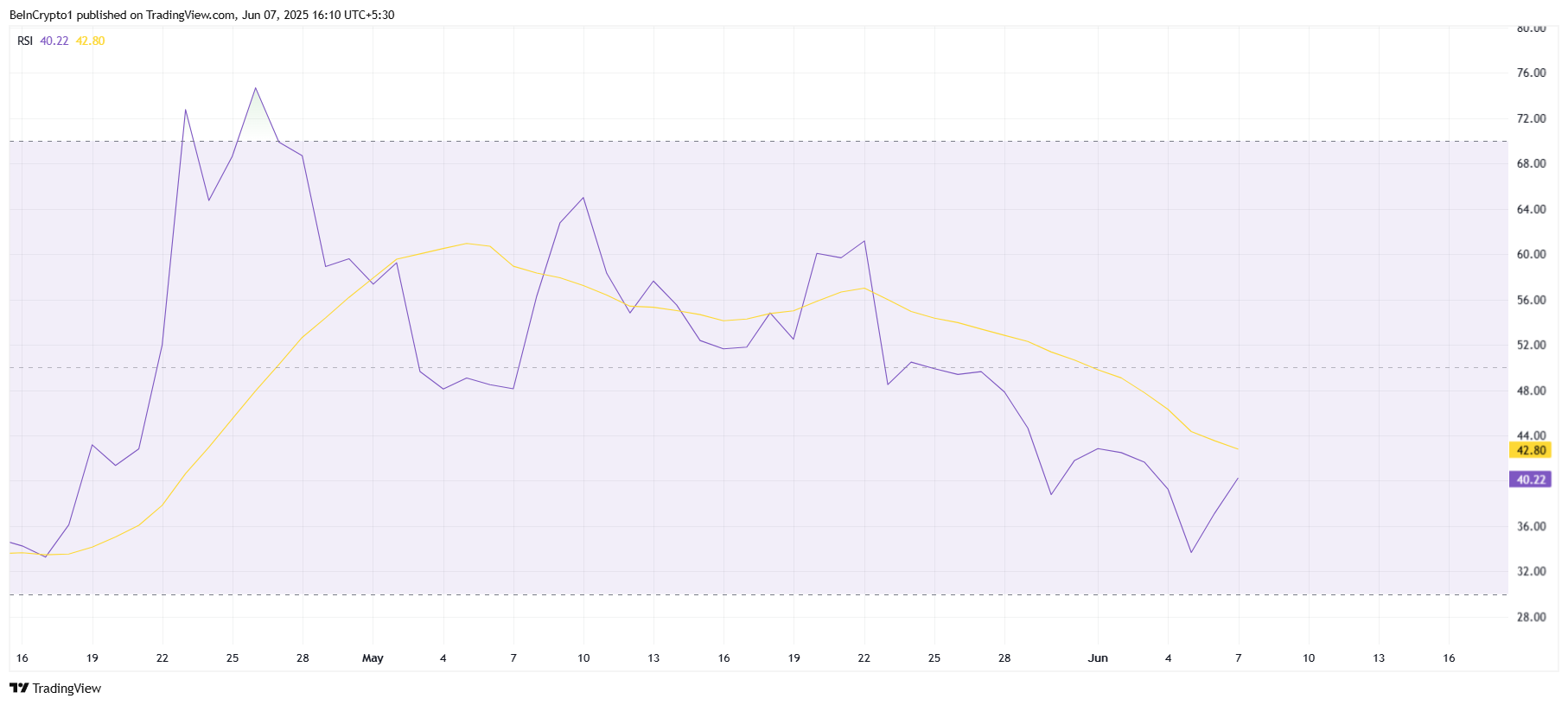

The Relative Strength Index (RSI) for TRUMP currently sits in the negative zone, below the neutral mark. This suggests that the broader market cues are bearish, presenting a significant challenge for TRUMP’s recovery.

A sustained period in the negative zone indicates that buying momentum is weak, and sellers continue to dominate the market.

The bearish sentiment is compounded by the recent market uncertainty surrounding the spat between Musk and Trump. The ongoing tensions between these two influential figures could further contribute to the lack of positive momentum for TRUMP.

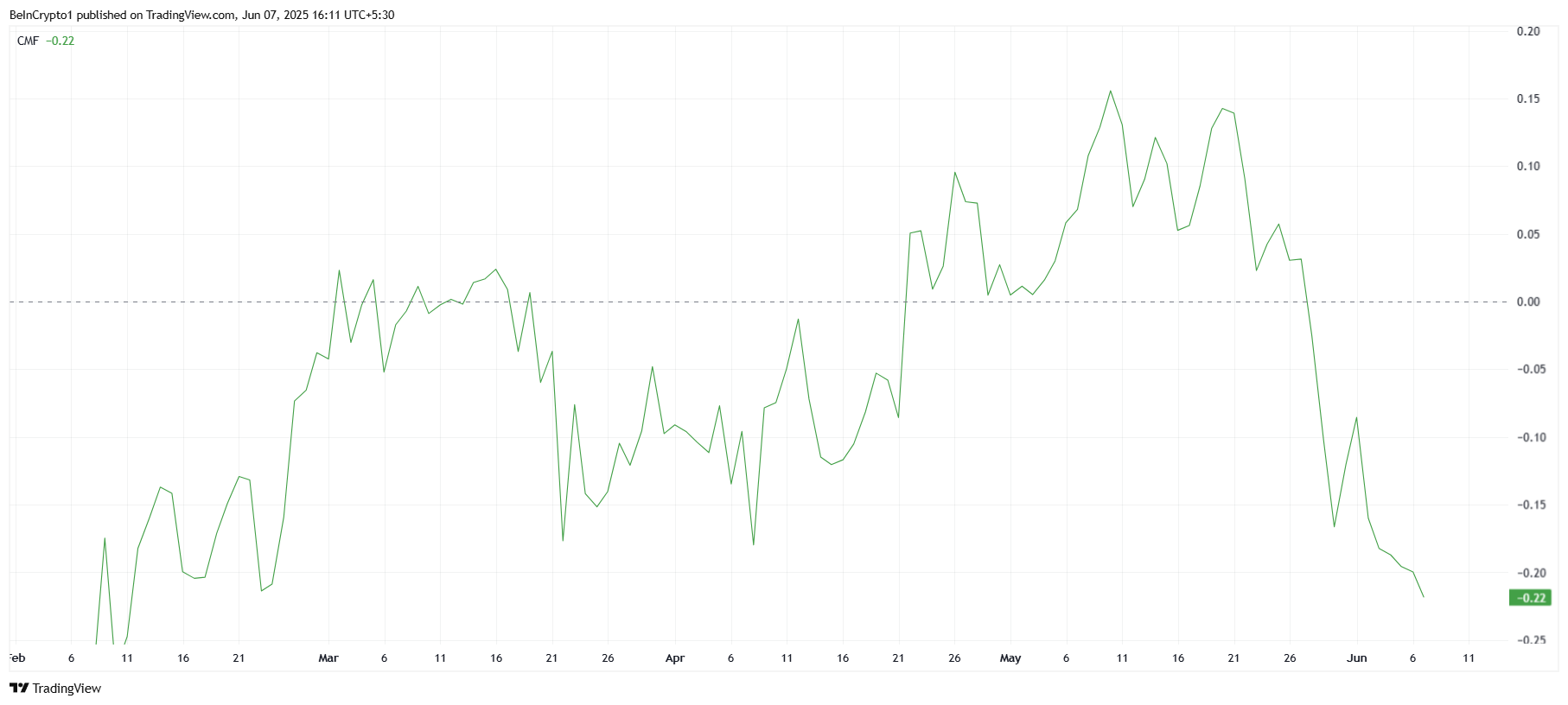

From a macro perspective, the Chaikin Money Flow (CMF) indicator highlights a dominant trend of outflows from TRUMP.

The CMF has recently dropped to its lowest level in more than three months, showing that there is little buying pressure to support the asset’s price. This indicates a growing lack of confidence among investors in TRUMP’s long-term value.

The market’s response to the Musk-Trump conflict could amplify these outflows.

According to Nic Puckrin, a crypto analyst and founder of The Coin Bureau, the tension between Musk and Trump could negatively impact the broader market.

“The public spat we’re seeing between Musk and Trump was nothing if not predictable. However, given their influence on the news cycle, the markets don’t like this at all, and it’s only likely to get worse as emotions escalate… It’s been a perfect storm for markets, and if this uncertainty, along with the Trump-Musk saga, continues into the weekend, the crypto market will bear the brunt, as it is still the only market that trades 24/7,” Puckrin said.

TRUMP Price Recovery May Be Difficult

TRUMP is currently trading at $10.48, having risen by 7.6% over the last 24 hours. However, the token is facing significant resistance at $10.97, a level that has proven difficult to breach in recent weeks.

Given the current market sentiment, it seems likely that TRUMP will struggle to push past this resistance, limiting its price movement in the short term.

Considering the current bearish factors and lack of strong buying momentum, TRUMP could remain consolidated between $10.97 and the support level of $9.68.

This consolidation could persist as the market grapples with the impact of outflows and investor uncertainty, making it difficult for TRUMP to make substantial gains.

If TRUMP’s supporters shift their outlook and turn more bullish, the token could breach the $10.97 resistance. Successfully flipping this level into support could trigger a move toward $12.18, invalidating the current bearish thesis.

The post Why the TRUMP Meme Coin is Unlikely to Recover Anytime Soon appeared first on BeInCrypto.