Ethereum has seen a period of consolidation under the resistance of $2,681 for the past month. Despite this, the price action has been relatively stable.

However, with significant investor accumulation, led by Consensys and others, Ethereum might experience a turning point, potentially signaling a rise in price.

Ethereum Finds Demand From Investors

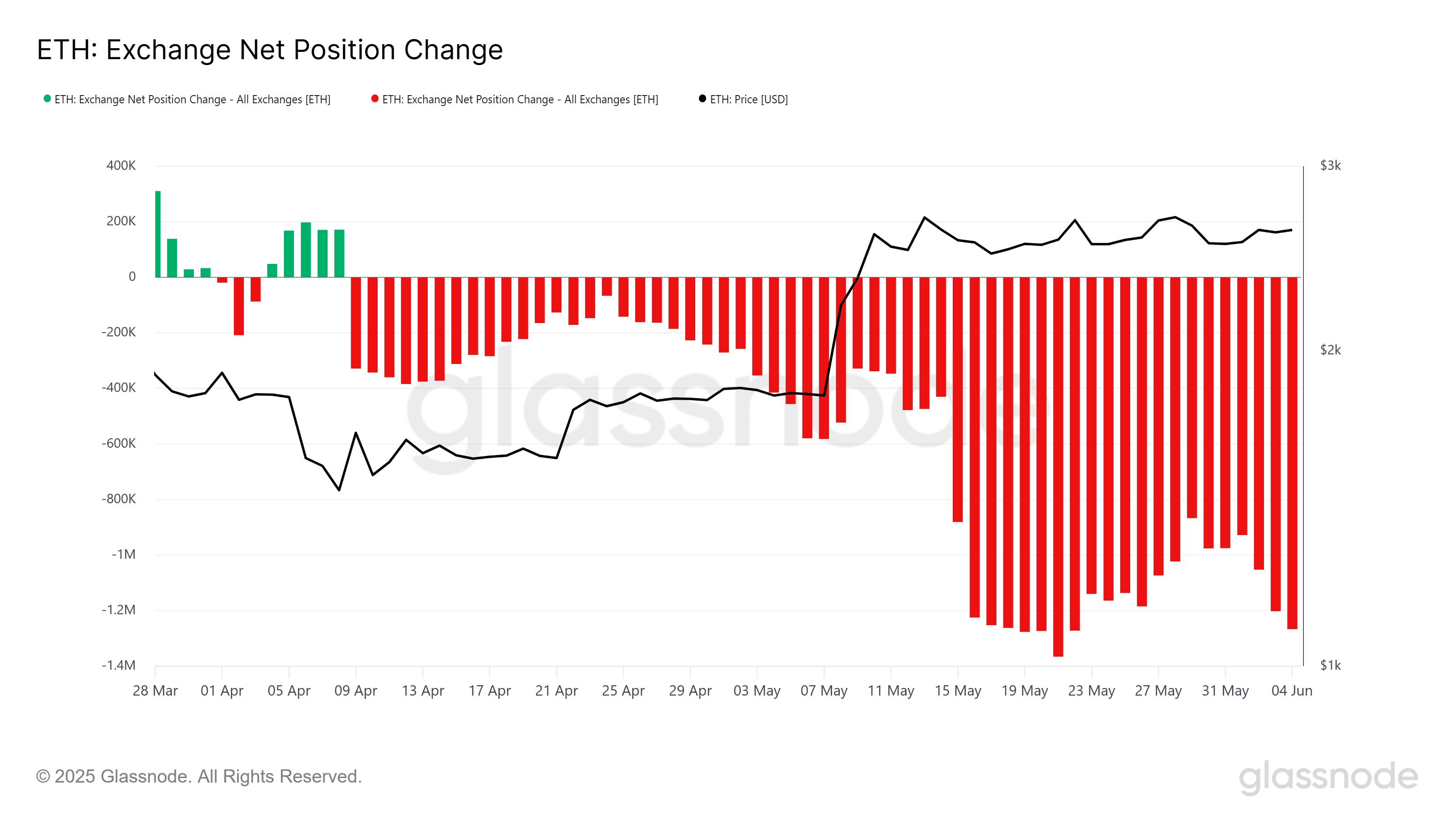

Investor sentiment has shifted in favor of Ethereum, with a noticeable uptick in accumulation since the beginning of June. After consistent selling toward the end of May, investors have bought over 300,000 ETH, amounting to $778 million since the beginning of June. This growing accumulation signals increased confidence in Ethereum’s future price potential.

One of the key players in this bullish sentiment is Consensys, which reportedly bought over $300 million worth of Ethereum from Galaxy Digital, according to Arkham. This move highlights rising conviction in Ethereum’s long-term value as large entities continue to secure their positions. As these institutional players show confidence in ETH, it could pave the way for broader investor trust.

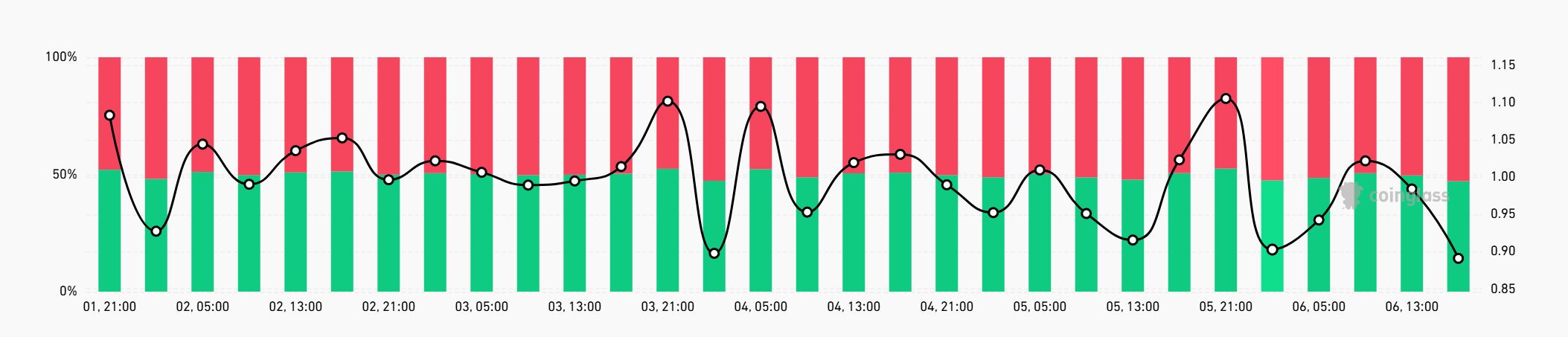

Looking at Ethereum’s macro momentum, the IOMAP indicator reveals a strong demand zone between $2,378 and $2,454. This zone holds over 65.11 million ETH, worth nearly $169 billion, making it unlikely for significant sell-offs to occur in the near future. This large accumulation provides stability and protection against sharp declines in Ethereum’s price, which is contributing to the growing bullish sentiment.

As Ethereum remains well-supported by these large investors, the accumulation pattern appears solid. The absence of selling pressure from holders in the demand zone reduces the risk of a drastic price correction, which could otherwise impact the price of ETH.

ETH Price Awaits Consolidation Breakout

Ethereum is currently trading at $2,611, still under the key resistance of $2,681. In order to break past this resistance, Ethereum will need further momentum, which could be driven by the ongoing accumulation and positive investor sentiment.

If the local support at $2,583 remains intact, ETH may successfully flip the $2,681 resistance level. Such a breakout would likely propel Ethereum toward the next resistance point at $2,814, extending its recent gains.

However, if broader market sentiment turns bearish or if selling pressure increases, Ethereum could see a dip to $2,500. A drop to this level would invalidate the bullish outlook and prolong the current period of consolidation, making it essential for ETH to maintain its support levels.

The post Consensys’ $300 Million Bet: Big Money Buys the Dip as Ethereum (ETH) Attempts Breakout appeared first on BeInCrypto.