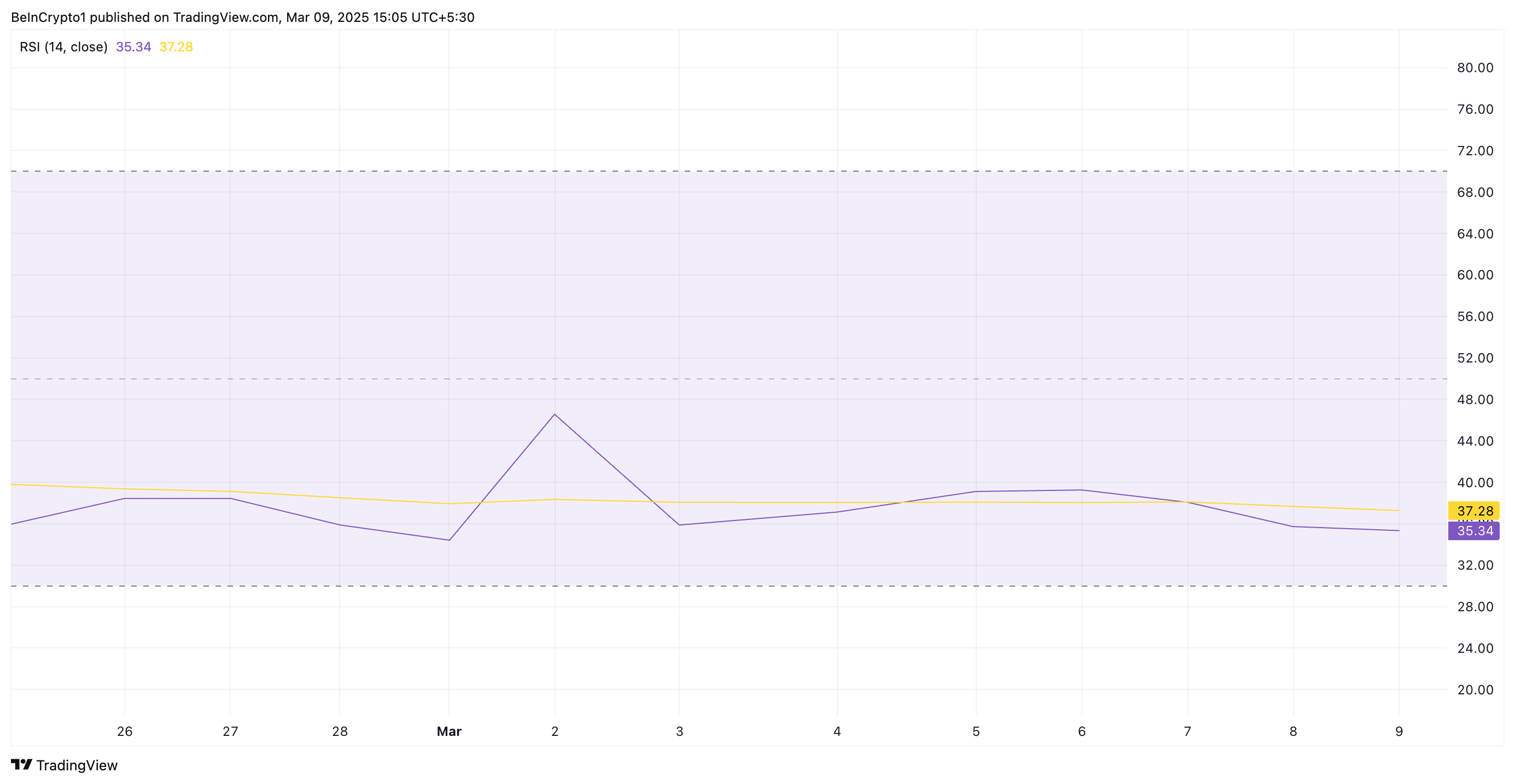

Bitcoin recently broke above the $111,000 mark, setting a new all-time high. However, data across major exchanges suggests that traders are growing increasingly wary of a sustained rally.

CoinGlass data indicate that over 53% of Bitcoin positions are currently short, meaning a majority of traders are betting on a price drop. By contrast, just 47.43% of active positions are long.

Most Traders Turn Bearish Despite Bitcoin’s Recent All-Time High

The pattern is mirrored on Binance, where short trades make up 54.05% of open interest, compared to 45.95% for longs.

This growing tilt toward shorts reflects mounting skepticism in the market, despite Bitcoin reaching new highs.

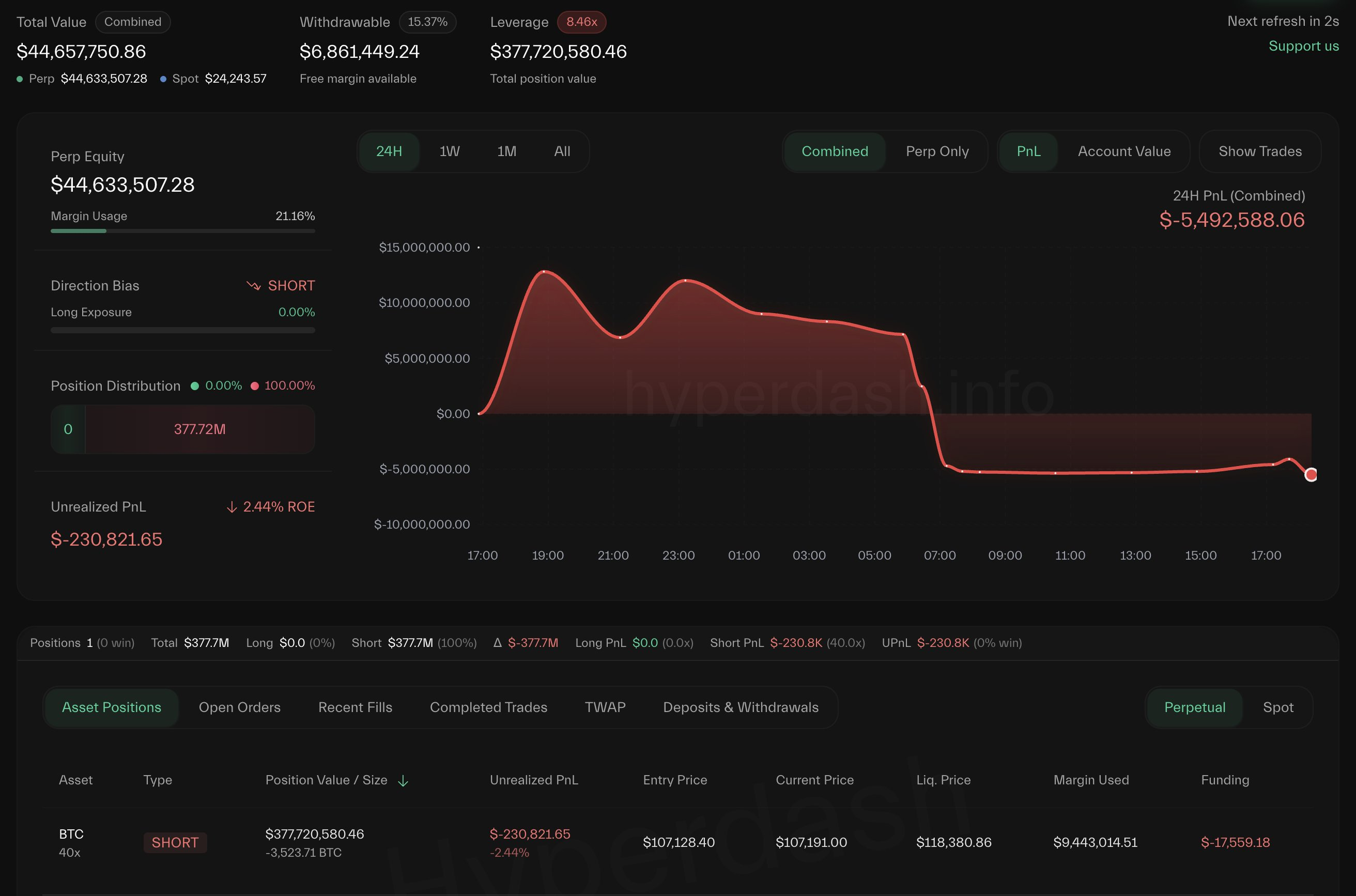

The sentiment shift is reinforced by the latest move from prominent crypto whale James Wynn, who reversed his bullish stance after a multi-million dollar loss.

Wynn had previously maintained an aggressively leveraged 40x long position worth around $1.25 billion but exited after Bitcoin’s price dipped from $109,000 to roughly $107,107.

The trader closed his long exposure at a loss of $13.39 million, with liquidation unfolding in under an hour on May 25.

He has since opened a short position of 3,523 BTC—valued at approximately $377 million—at an entry price of $107,128. The new trade carries a liquidation threshold near $118,380.

Market analysts have suggested that Wynn’s pivot reflects broader signs of exhaustion in the current bull cycle.

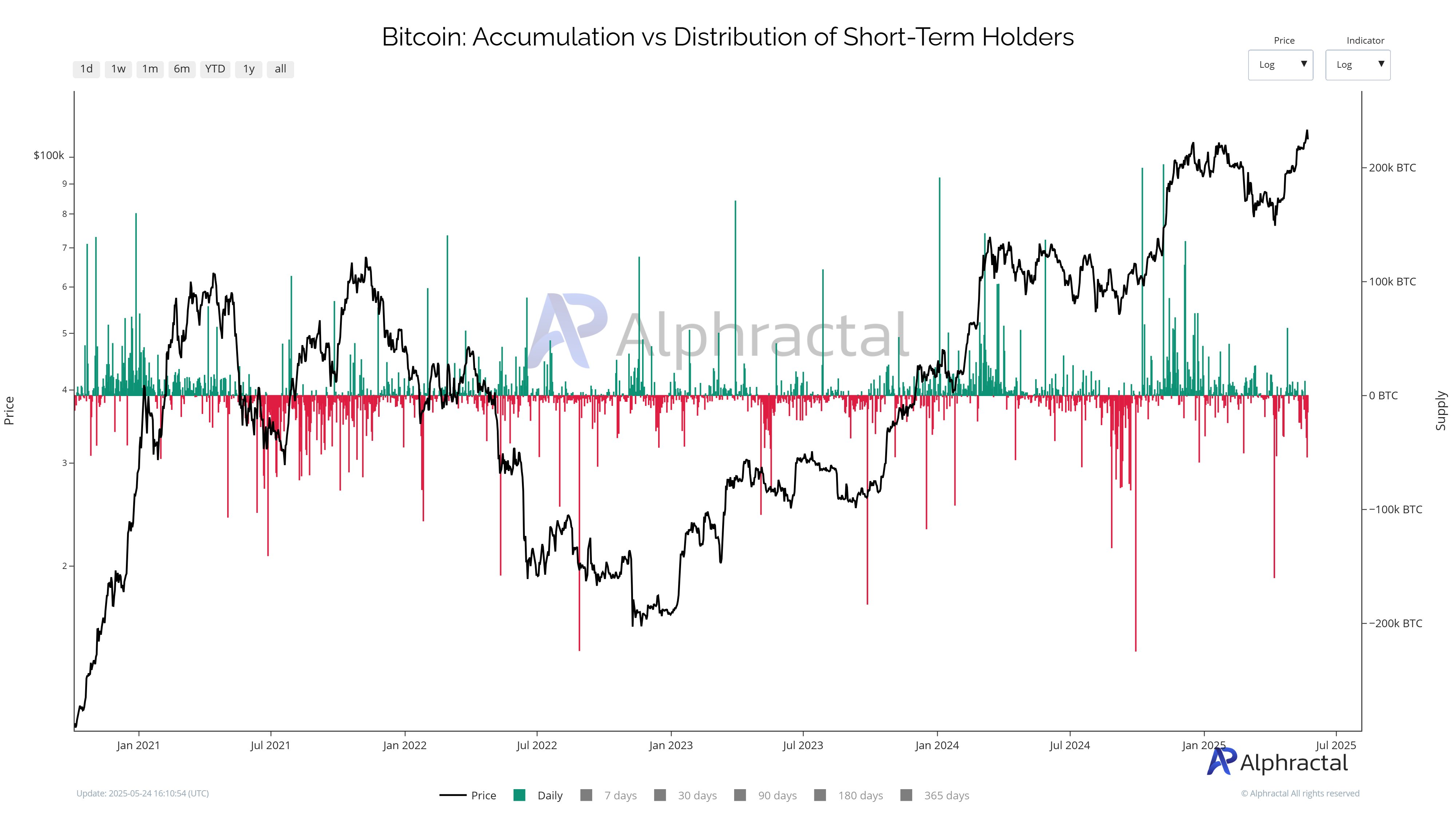

According to blockchain analytics firm Alhpractal, short-term holders (STHs) have begun distributing coins. Historically, a decline in STH supply often signals that Bitcoin is approaching a local top.

The firm noted that the Short-Term Holder Realized Price currently stands at $94,500, which is the last strong support before losses set in.

In contrast, long-term holders (LTHs) remain firm, with their realized price climbing to $33,000—highlighting a widening behavioral gap.

Alphractal stated that while Bitcoin previously hit record highs under similar conditions in 2021, it warned that the current cycle may be nearing exhaustion.

It added that several macro indicators and historical halving trends point to a possible correction after October 2025.

The post Bitcoin Short Positions Increase as Market Sentiment Shifts to Fear appeared first on BeInCrypto.