Three Made in USA coins—Worldcoin (WLD), Jupiter (JUP), and EOS—are drawing renewed attention following Donald Trump’s latest post suggesting a 50% tariff on the European Union starting June 1.

WLD is leading the pack with a 37% surge after a $135 million token sale to a16z and Bain Capital Crypto. JUP is also outperforming the market, gaining nearly 7% amid key ecosystem announcements. Meanwhile, EOS is struggling to hold recent gains after a controversial $3 million purchase by World Liberty Financial sparked speculation across the crypto community.

Worldcoin (WLD)

Worldcoin surged 37% in the last two days, hitting a three-month high after raising $135 million through a direct token sale to a16z and Bain Capital Crypto. WLD became the best-performing token among Made in USA coins in the last few days.

The funding, which was not a traditional venture round but a market-priced token purchase, instantly boosted WLD’s circulating supply—reflected in a sudden $135 million spike in market cap moments before the announcement. The capital will be used to expand biometric identity operations in the U.S., following regulatory setbacks in Europe and Africa.

This suggests buying strength is present and accelerating, increasing the likelihood of WLD challenging the resistance at $1.64. If broken, WLD could push above $1.70 for the first time since late January.

However, traders should monitor the $1.36 support closely—if this floor fails, the token could retrace toward $1.17 or even $1.05 in a deeper correction.

Jupiter (JUP)

Jupiter is defying the broader market pullback, rising nearly 7% in the last 24 hours while most major tokens trend lower.

The rally comes during a high-activity week for the Jupiter ecosystem, marked by the launch of its mobile app, a strategic partnership with Moonpay, and the debut of Jupiter Lend.

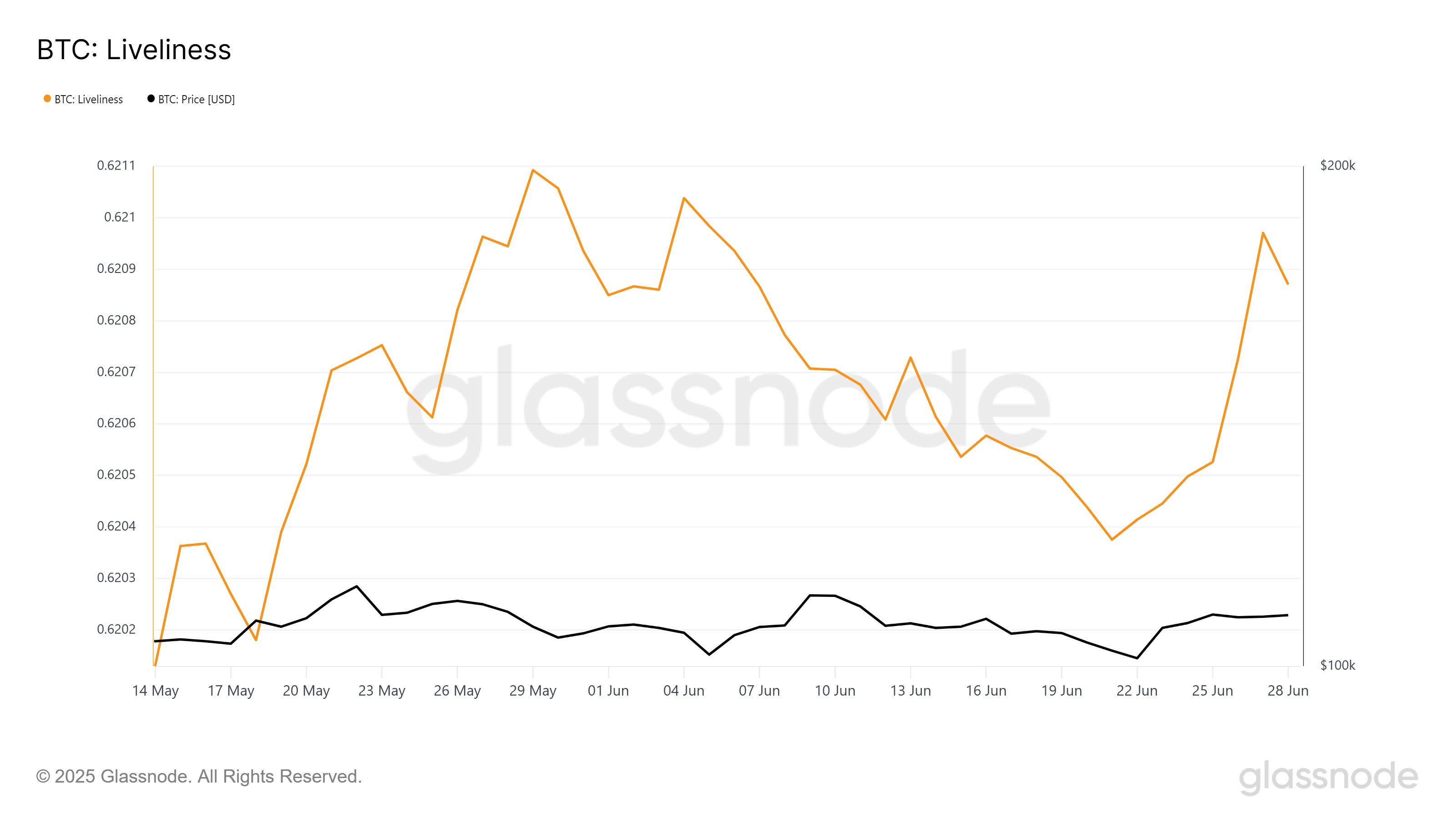

Technically, JUP remains below the key resistance at $0.635, which it recently failed to break.

A successful retest and breakout above that level could pave the way for a move toward $0.84, with a strong uptrend potentially pushing it to challenge the $1 mark for the first time since February.

However, if momentum fades and Jupiter (JUP) drops to test support at $0.52, losing that level could trigger a sharper decline to $0.465. In a deeper downturn scenario, the token could slide to $0.40, $0.348, or even $0.30, making the current breakout attempt a critical moment for bulls.

EOS

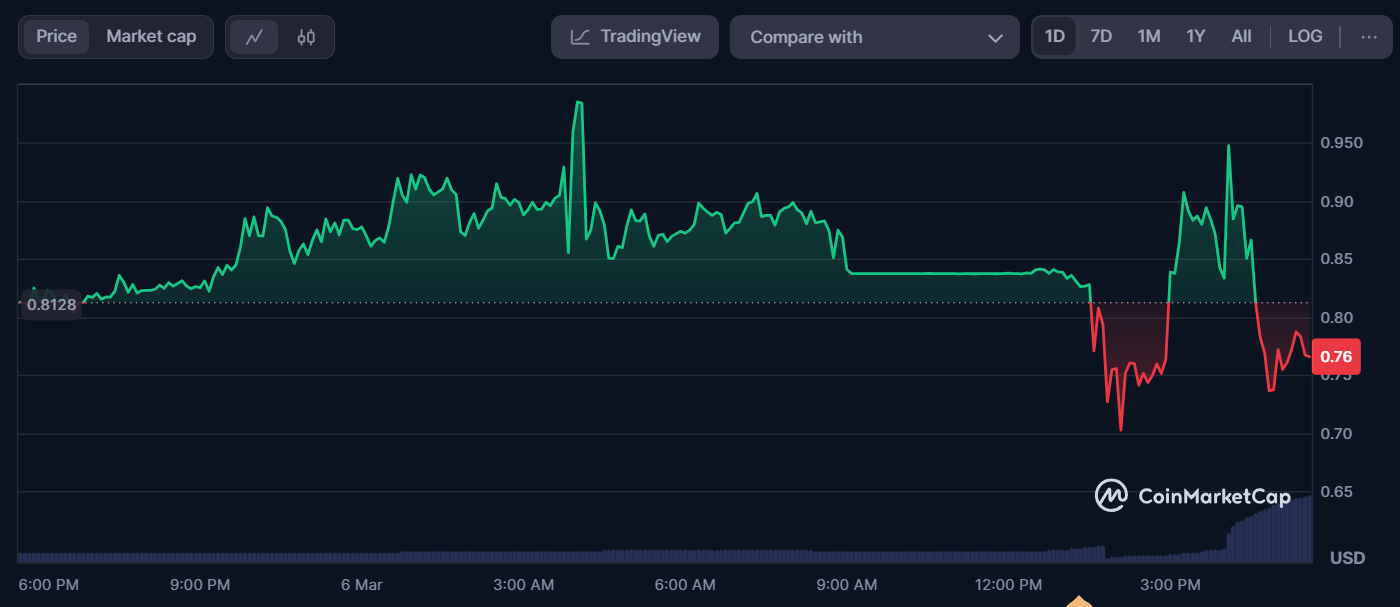

One week ago, World Liberty Financial (WLFI) sparked controversy in the crypto community after purchasing $3 million worth of EOS tokens, a move that immediately raised eyebrows.

The timing of the buy—following WLFI’s alleged $125 million loss from selling ETH at a three-month low—fueled speculation of possible market manipulation.

Despite skepticism, no concrete evidence of misconduct or insider trading has emerged. Interestingly, EOS rallied over 9% shortly after the purchase, intensifying the debate over whether WLFI’s actions were strategic or coincidental, making it an interesting player among Made in USA coins to watch.

Since then, however, EOS has struggled to maintain momentum and is now down nearly 10.5% over the last seven days. The token recently failed to break resistance at $0.79 and is now at risk of extending its decline.

If bearish pressure persists, EOS could test the support at $0.72; a break below this level may lead to deeper drops toward $0.652 and $0.583.

On the flip side, if momentum returns and EOS can reclaim $0.79, it may target higher levels at $0.869 and potentially $0.97—though a strong market reversal would be needed to support such a move.

The post 3 Made in USA Coins to Watch After Trump’s New EU Tariff appeared first on BeInCrypto.