Bitcoin critic and economist Peter Schiff has criticized the flagship crypto again, calling it a ‘scam.’ He also alluded to the recent BTC price surge and suggested that a crash is imminent. Meanwhile, Schiff’s favorite asset, gold, is again eyeing a new all-time high (ATH).

Peter Schiff Comes For Bitcoin Again

In an X post, Schiff asserted that BTC is a “total scam.” This came as he remarked that the Bitcoin price was only pumping due to the US government pumping the crypto asset. The economist also commented on gold’s price action, noting that it had enjoyed significant gains in the last 24 hours and claimed that a breakout was near.

In another post, the Bitcoin critic again stated that the flagship crypto is a “total fraud.” He added that the longer market participants take to figure this out, the more money they will lose. Schiff also commented on the US dollar’s decline and boldly affirmed that gold is the only monetary asset that can replace it as the global reserve currency.

The economist’s comments on the US pumping the Bitcoin price relate to the plans to create a Strategic Bitcoin Reserve. He recently criticized Donald Trump’s BTC plans and claimed they were a waste of resources on the flagship crypto.

The US is expected to move forward with the Reserve plans, with the US Treasury drawing up a comprehensive plan on how it will establish and manage this reserve using seized assets. Meanwhile, it is worth mentioning that New Hampshire became the first state to sign the Strategic Bitcoin Reserve bill into law today.

Bitcoin Reclaims The $95,000 Level

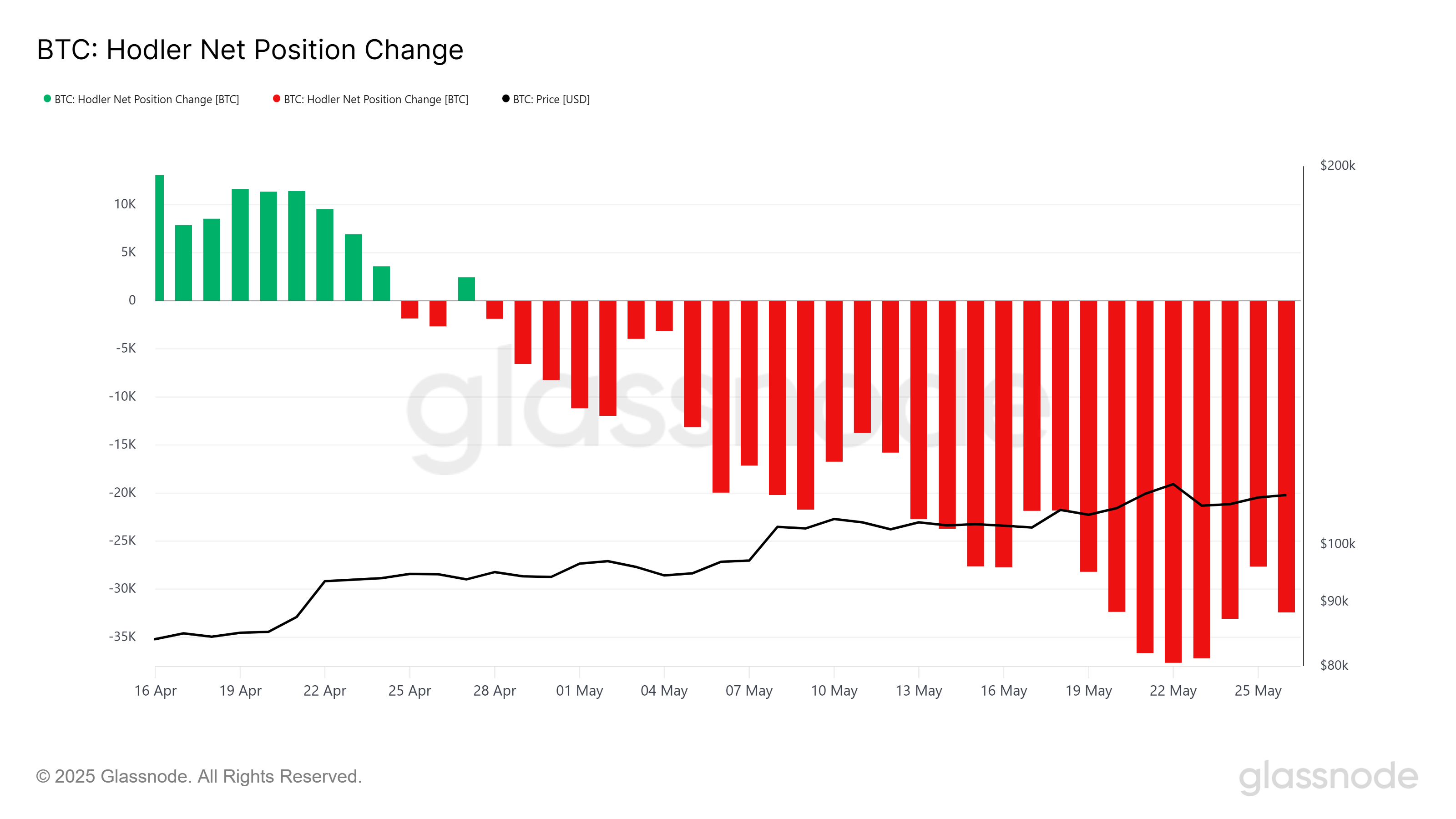

Amid Peter Schiff’s latest fraud comments, the Bitcoin price has again reclaimed the psychological $95,000 level. This also comes amid market uncertainty due to Trump’s tariffs, inflation, and recession concerns. Market participants seem to view the flagship crypto as a hedge against the current macro conditions.

Schiff’s favorite asset, gold, is also enjoying an upward trend at the moment. Its price surge has extended to almost $200 in two days and is now just 2.5% short of a new all-time high (ATH). The market commentator The Kobeissi Letter noted that this price surge isn’t normal, hinting at inflationary pressures in the market.

The post Gold Bug Peter Schiff Calls Bitcoin a ‘Total Scam’ Again appeared first on CoinGape.