The post Dogecoin Price Prediction for May 2025—Can it Make it to $0.2? appeared first on Coinpedia Fintech News

Most of the altcoins are trying hard to make a strong comeback after the latest pullback from their respective local highs. Meanwhile, the Dogecoin price continues to maintain a strong descending trend after the rejection from the local resistance zone close to $0.2. While Bitcoin & Ethereum prices are closely consolidating within a narrow range, aiming to trigger a rebound above the bearish range, DOGE price seems to be losing its grip over the rally. The token is about to erase the gains incurred in the past 30 days, which hints towards the resurgence of a fresh bearish trend.

This raises concerns about whether Dogecoin has a future. Will the cost of 1 Dogecoin reach $0.5 in 2025?

The DOGE price is maintaining a horizontal trade without displaying any strong possibility of a trend reversal. As a result, enough liquidity is accumulated on either side, which suggests the token has entered a decisive phase.

The DOGE price has triggered a rebound before reaching the liquidating zone around $0.164, where the liquidation leverage has surpassed $500 million. Therefore, to reclaim the higher levels, the price is required to liquidate the leverage within this range by plunging below the range. This could squeeze out all the shorts, enabling a significant rebound and a continued upswing. Still, the question remains: Will this help the DOGE price reach $0.2?

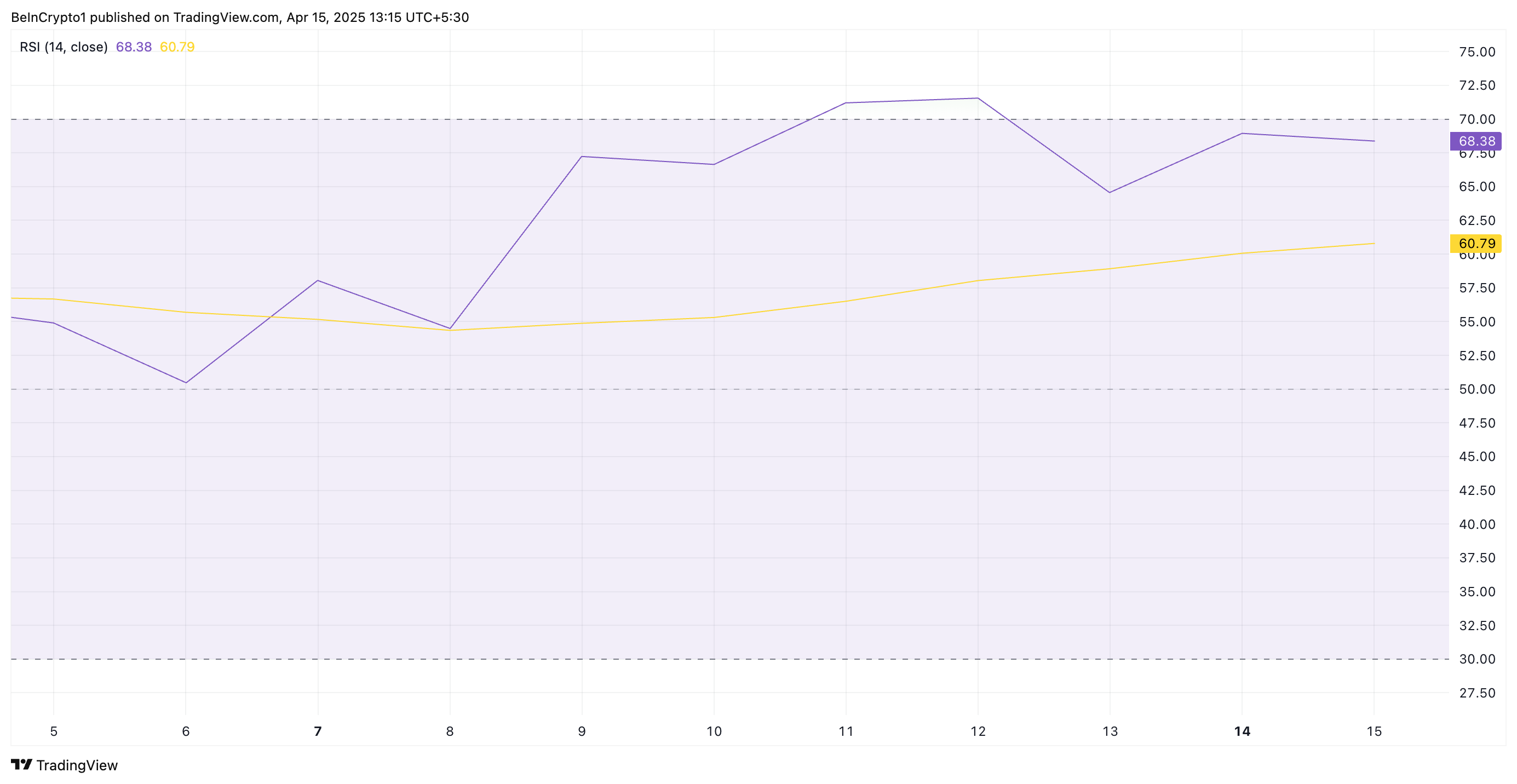

The short-term price action of DOGE suggests the price is experiencing tremendous upward pressure after failing to hold above the ascending trend line. The conversion line of the Ichimoku cloud is acting as a strong resistance, without displaying any chance of a bullish crossover. On the other hand, the Stochastic RSI faced a pullback after testing the average range, hinting at the growing dominance of the bears.

Therefore, the Dogecoin (DOGE) price is expected to test the local support at $0.162, which is below the liquidation level at $0.164. This move is expected to cause a short liquidation and trigger a strong upswing towards higher targets, probably at $0.18 initially and later at $0.2.