A large XRP transfer worth over $64 million by a Ripple whale has caught market attention as analysts suggest a possible bullish breakout. The transaction involved 29,532,534 XRP moving from an unknown wallet to Coinbase, hinting at renewed activity among large holders.

As XRP continues to trade above key support levels, traders are watching the market closely. Technical signals and whale movements are adding to speculation about a potential rally in the coming days.

Ripple Whale Activity Increases Ahead of Market Move

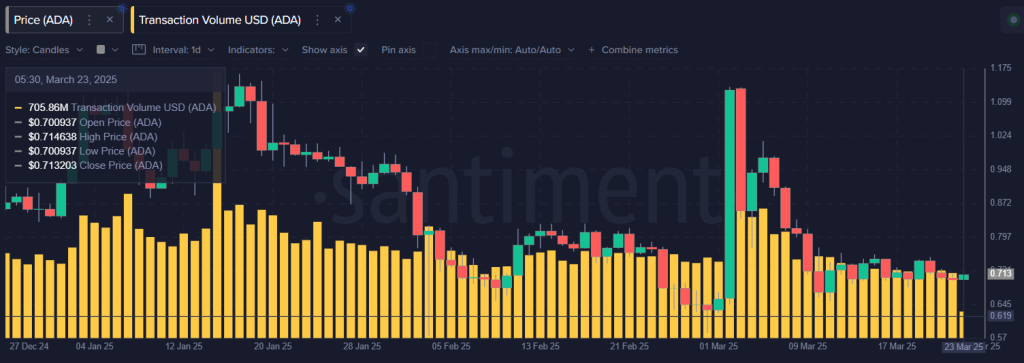

On-chain data has confirmed that Ripple whales have increased their positions. According to Santiment, wallets with 10 million to 100 million XRP tokens added over 200 million XRP last week.

This rise in accumulation by Ripple whales is seen as a possible move by institutional investors preparing for a price shift. At the same time, 23% of U.S. crypto investors now hold XRP, making it one of the most recognized tokens in the country.

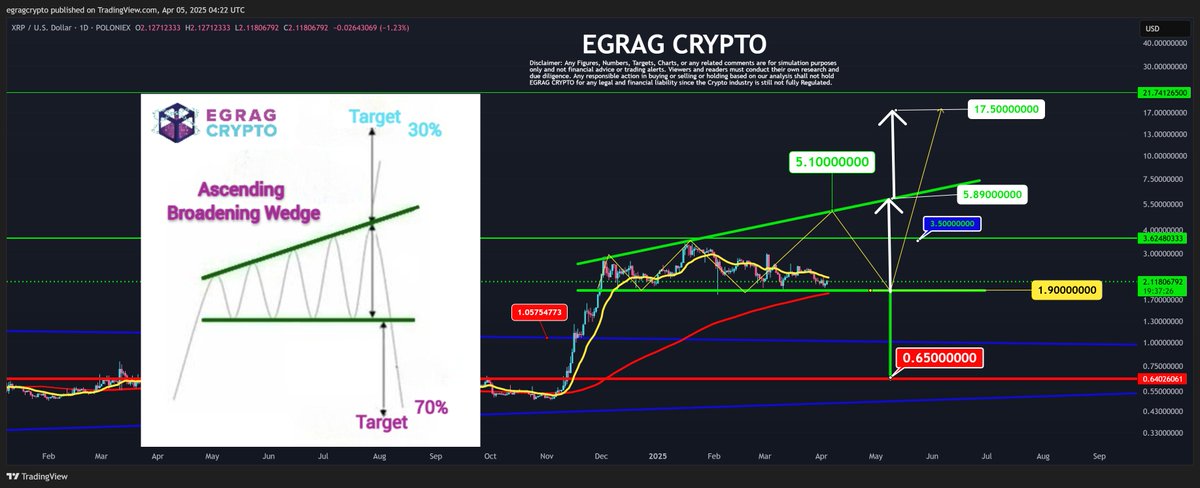

Moreover, with the XRP ETF approval odds rising to 80% according to Polymarket, investor interest is rising. In addition, the Proshares XRP ETFs are supposed to launch on May 14 has boosted optimism of XRP price reclaiming $3.

The recent $64 million transfer into Coinbase has added to this outlook. Some analysts believe this move signals confidence by whales, who often act ahead of broad market trends. If true, the token could be preparing for a breakout toward key resistance zones.

XRP Price Action Signals Bullish Outlook

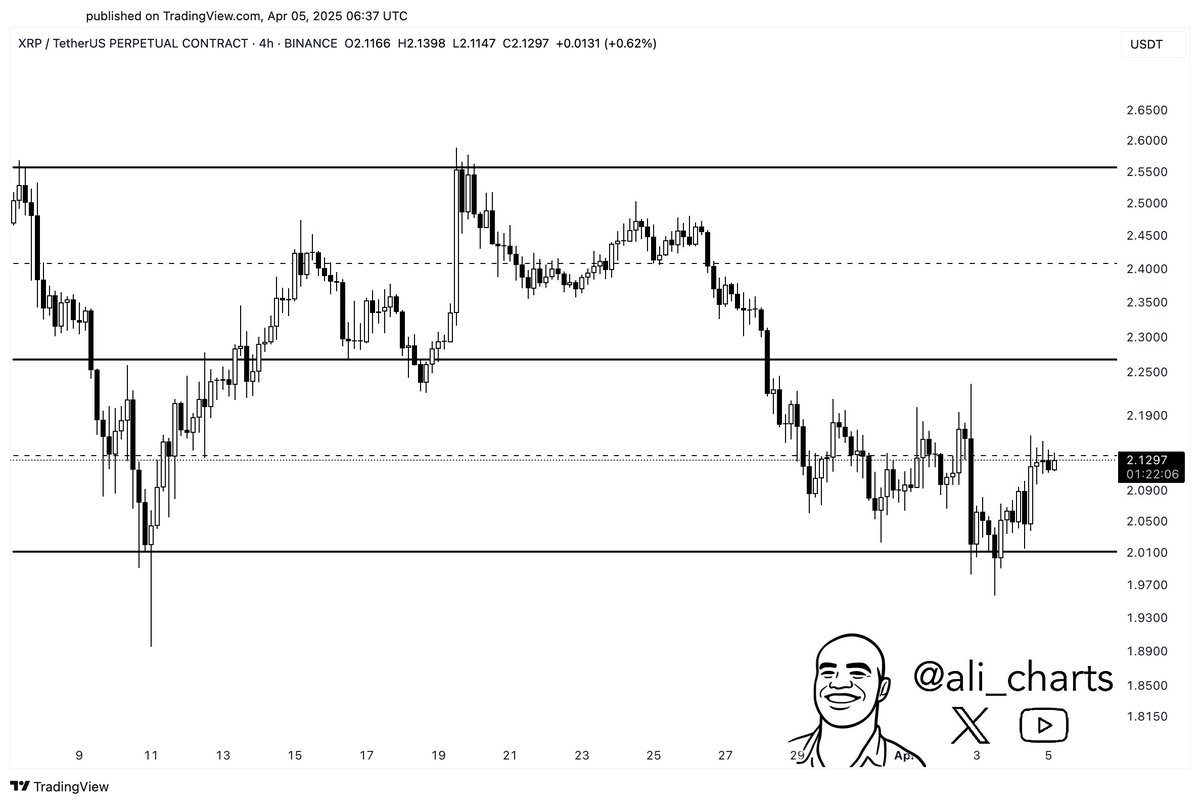

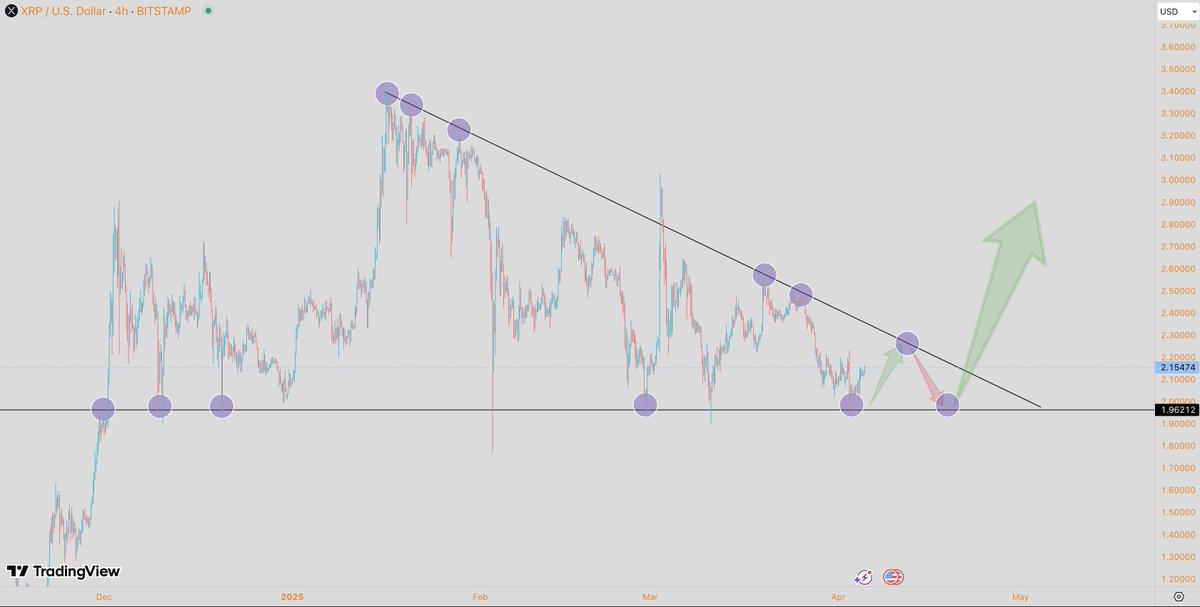

XRP is currently trading around $2.20 after recovering from a recent dip to $2.15. The price dropped on April 30, which triggered $13.9 million in long liquidations compared to just $1.49 million in short liquidations.

Crypto analyst Javon Marks commented on the situation, noting, “With lower timeframes confirming bull signals, another upside move can be in the works for XRP.”

Following the drop, the token’s futures open interest declined by about 4%, which may show traders adjusting their risk. Despite this, XRP price remains above its 20-day simple moving average (SMA), which is now seen as an important support level at $2.1677.

The upper Bollinger Band at $2.3082 is now a key resistance. If XRP price closes above this level with high volume, a push toward $2.50 or $2.80 is likely.

Momentum Indicators Show Mixed Signals

The Relative Strength Index (RSI) is currently at 52.44. It remains in the neutral zone but is slowly increasing, which may suggest building buying interest. The RSI average is at 54.08, and the small divergence between these levels is being monitored closely.

The Chaikin Money Flow (CMF) is at -0.13, indicating some capital outflows, but it remains near the neutral line of 0.00. If the CMF moves into positive territory, it would signal a return of buyer strength in XRP price.

The Bollinger Bands have also narrowed, which often suggests a breakout could happen soon. Traders are now watching for price movement above $2.31 with rising volume, which would support the bullish scenario.

The post Ripple Whale Moves $64M As Analyst Predicts XRP Price Bullish Breakout appeared first on CoinGape.