The crypto market is seeing notable fluctuations as various factors influence the prices of major assets like Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and Dogecoin (DOGE). As of late April, new trends are emerging that have shifted the focus of traders and investors. These factors are affecting market sentiment and shaping expectations moving into May.

Donald Trump and Eric Trump Comments Impact

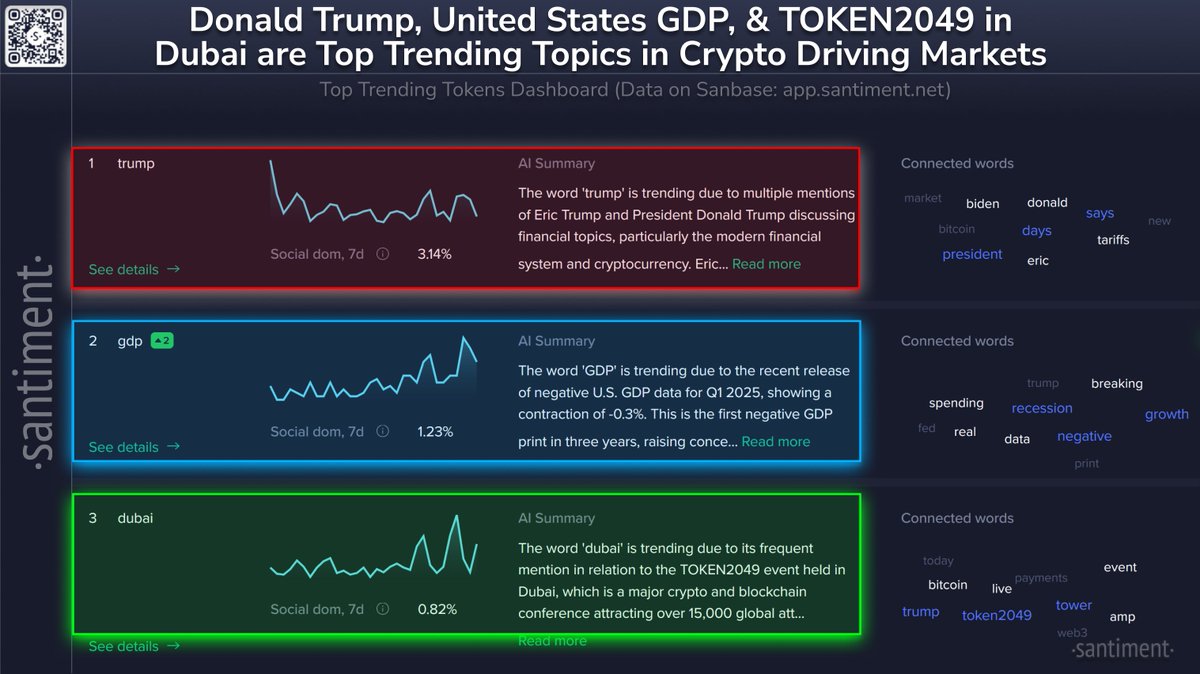

Accoding to Santiment, the discussions surrounding U.S. politics are having an impact on the crypto market, particularly with recent comments from President Donald Trump and his son, Eric Trump. Eric Trump recently emphasized the importance of cryptocurrencies, urging banks to adopt digital currencies or risk facing extinction.

He specifically pointed out Bitcoin as a solution to the current financial system’s flaws. His statements align with broader concerns over the financial infrastructure, and they have fueled conversations about the potential role of cryptocurrencies in the future.

President Donald Trump’s economic views, particularly his stance on tariffs, are also drawing attention. He has continued to advocate for high tariffs on foreign imports, a position that has led some to link his policies to broader economic challenges. However, the U.S. has taken the initiative to reach out to China through multiple channels in an attempt to open discussions regarding tariffs.

Investors have noted that his remarks about the stock market and the economy are often intertwined with his views on crypto. As a result, these political developments are contributing to ongoing market volatility, with some traders seeing them as signals of uncertainty that could influence both traditional and digital assets.

U.S. GDP and Economic Data Affecting Crypto Markets

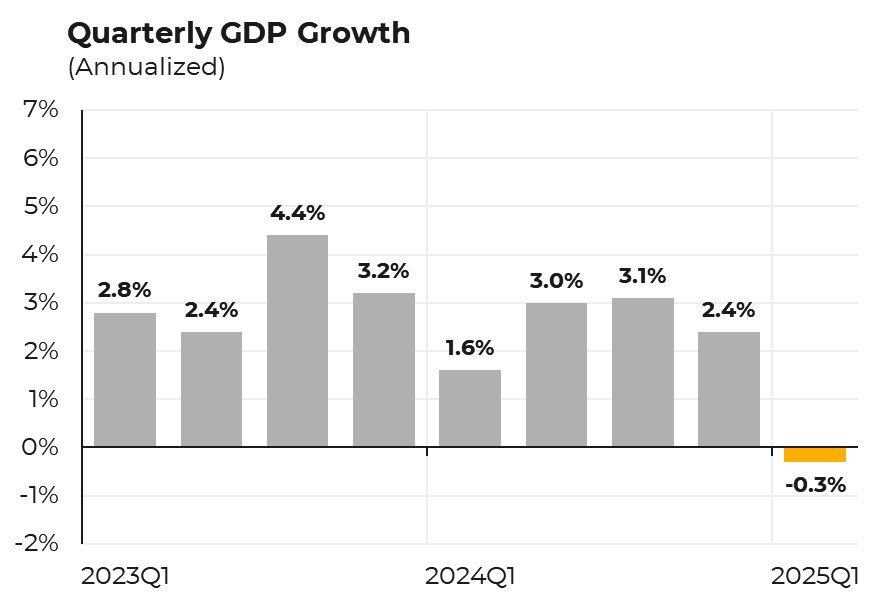

Recent economic data have also influenced the development of the crypto market. The first quarter results showed that the GDP of the US went into the negative territory for the first time in the next three years with a contraction of 0.3%. This has led to fears of a recession in the United States and slow economic growth in the country. The negative figure in GDP has however influenced market sentiment and many investors have had to adjust their positions in their portfolios.

Furthermore, the continued inflationary pressure remains a topic of concern. The Personal Consumption Expenditure (PCE) index for March showed a year-over-year inflation rate of 2.3%, slightly above the Federal Reserve’s 2% target.

This has left investors uneasy especially with regard to the Federal Reserve policy meeting that is due on May 7. Since there are rumors of a possible recession, traders are managing their investment portfolios, and some of them are seeking haven in cryptocurrencies, especially Bitcoin since some consider the crypto as a safe-haven.

TOKEN2049 and Crypto Developments in Dubai

The TOKEN2049 event in Dubai has brought attention to the region’s growing role in the global crypto space. The conference has had more than fifteen thousand participants including the best leaders in the field of blockchain and cryptocurrency. At TOKEN2049, many concerns have been raised concerning the future of the crypto market with individuals sharing their opinions on what could be next in the market.

Dubai’s growing significance in the crypto world is also evident in developments like the Trump Tower Dubai accepting cryptocurrency payments for luxury apartments.

These movements point to the fact that digital currencies have gradually been adopted in the global system of finance. This event and similar news brought more attention towards the region and Middle East as the potential hub for cryptocurrency, and investors are paying great attention to such possibilities as they impact the market.

Bitcoin and Altcoin Market Movements

Bitcoin has seen a strong rally over the past week, rising to the $94,000 to $96,000 range, only to experience a pullback in the last 24 hours. As Bitcoin’s price began to stabilize, traders shifted their attention to altcoins, resulting in a market-wide surge of over 10% in the past week.

Despite Bitcoin’s dominant position in the crypto market, altcoins like XRP, Ethereum, and meme coins like Dogecoin have seen increased trading volume as investors search for higher-risk, higher-reward opportunities. Ethereum price has followed the BTC price trend with ETH trading at $1,800, a 0.3% dip with bulls holding on despite the turbulance in the crypto market.

At press time, XRP price was trading at $2.20, a 4% decline from the intra-day high of $2.30 boosted by the postponing of an XRP ETF approval decision by the US SEC. Dogecoin price, due to a similar reason of DOGE ETF postponing and has as a result witnessed a 3% decline to $0.1730.

Meme coins, in particular, have seen a spike in discussion and interest as their prices rise. This has been a characteristic pattern, as retail investors often turn to these assets during bull markets, driven by the potential for quick gains. However, many traders have been cautious, recalling the losses from the previous bear market cycle.

The post Crypto Market Today: Top Trends Driving BTC, ETH, XRP & DOGE Prices appeared first on CoinGape.