Crypto exchange and motorsport collide as Bitget officially becomes the regional partner for selected Grand Prix events in 2025

Scarperia e San Piero, Italy, 21 June 2025—Bitget, the leading cryptocurrency exchange and Web3 company, is teaming up with MotoGP, the highest class of motorcycle road racing events, in a high-octane partnership that merges the breakneck speed of racing with the high-stakes precision of crypto trading. As the newly minted Regional Partner for select Grand Prix events across Europe and Southeast Asia, Bitget is bringing crypto onto the track, and into the fast lane.

Kicking off at the iconic Mugello Circuit during the Italian Grand Prix, the collaboration marks a new era where precision engineering meets algorithmic agility, and where every second, like every trade, has the power to make it count.

Bitget’s partnership will speed across multiple marquee MotoGP events in 2025, including Italy, Germany, Spain, and Indonesia, bringing together fans of motorsport and crypto under one roaring banner of performance, resilience, and speed.

“Racing is a sport of milliseconds; crypto is a market of micro-decisions. This partnership is our way of showing the world that success — on the track or on the charts — comes down to smart moves and fearless execution,” said Gracy Chen, CEO at Bitget. “We’re excited to join MotoGP in putting power, precision, and potential into the hands of every user and every fan.”

At the heart of the campaign is three-time MotoGP World Champion Jorge Lorenzo, whose relentless pursuit of perfection makes him a fitting icon for Bitget’s iconic “Make It Count” slogan.

“I’ve always believed that you win races not just on instinct — but by making every lap, every line, every second count. It’s the same mindset Bitget brings to trading, and I’m proud to be part of this story,” said Jorge Lorenzo. “The worlds of MotoGP and crypto aren’t as different as they seem — they both reward those who stay sharp and think fast.”

The campaign features trackside activations, exclusive VIP experiences, and a series of cross-platform digital initiatives. At Mugello, KOLs and media will get behind-the-scenes access to the paddock and rider interactions, blending all the high-octane energy of race weekend, wrapped in a sleek, Bitget-branded experience.

“MotoGP is built on precision, innovation, and high-speed decisions — values that align naturally with Bitget,” agreed MotoGP CCO, Dan Rossomondo.

This collaboration follows Bitget’s headline partnerships with Lionel Messi, Juventus, and LALIGA, reinforcing its track record in bridging the gap between crypto and culture. With over 120 million users globally and a daily trading volume topping $20 billion, Bitget continues to shift the narrative from volatility to victory.

About Bitget

Established in 2018, Bitget is the world’s leading cryptocurrency exchange and Web3 company. Serving over 120 million users in 150+ countries and regions, the Bitget exchange is committed to helping users trade smarter with its pioneering copy trading feature and other trading solutions, while offering real-time access to Bitcoin price, Ethereum price, and other cryptocurrency prices.

Formerly known as BitKeep, Bitget Wallet is a leading non-custodial crypto wallet supporting 130+ blockchains and millions of tokens. It offers multi-chain trading, staking, payments, and direct access to 20,000+ DApps, with advanced swaps and market insights built into a single platform.

Bitget is at the forefront of driving crypto adoption through strategic partnerships, such as its role as the Official Crypto Partner of the World’s Top Football League, LALIGA, in EASTERN, SEA and LATAM markets, as well as a global partner of Turkish National athletes Buse Tosun Çavuşoğlu (Wrestling world champion), Samet Gümüş (Boxing gold medalist) and İlkin Aydın (Volleyball national team), to inspire the global community to embrace the future of cryptocurrency.

For more information, visit: Website | Twitter | Telegram | LinkedIn | Discord | Bitget Wallet

Risk Warning: Digital asset prices are subject to fluctuation and may experience significant volatility. Investors are advised to only allocate funds they can afford to lose. The value of any investment may be impacted, and there is a possibility that financial objectives may not be met, nor the principal investment recovered. Independent financial advice should always be sought, and personal financial experience and standing carefully considered. Past performance is not a reliable indicator of future results. Bitget accepts no liability for any potential losses incurred. Nothing contained herein should be construed as financial advice. For further information, please refer to our Terms of Use.

About MotoGP

Faster. Forward. Fearless. Since 1949, MotoGP has grown into a global sports and entertainment brand with an incredible legacy and an even more exciting future. Each season, the greatest riders from across the globe come together to race the fastest prototype motorcycles on some of the world’s greatest racetracks – creating the most exciting sport on Earth.

has grown into a global sports and entertainment brand with an incredible legacy and an even more exciting future. Each season, the greatest riders from across the globe come together to race the fastest prototype motorcycles on some of the world’s greatest racetracks – creating the most exciting sport on Earth.

The post Bitget Partners with MotoGP for a High-Speed Collision of Tech and Speed appeared first on BeInCrypto.

has grown into a global sports and entertainment brand with an incredible legacy and an even more exciting future. Each season, the greatest riders from across the globe come together to race the fastest prototype motorcycles on some of the world’s greatest racetracks – creating the most exciting sport on Earth.

has grown into a global sports and entertainment brand with an incredible legacy and an even more exciting future. Each season, the greatest riders from across the globe come together to race the fastest prototype motorcycles on some of the world’s greatest racetracks – creating the most exciting sport on Earth.

LATEST:

LATEST:

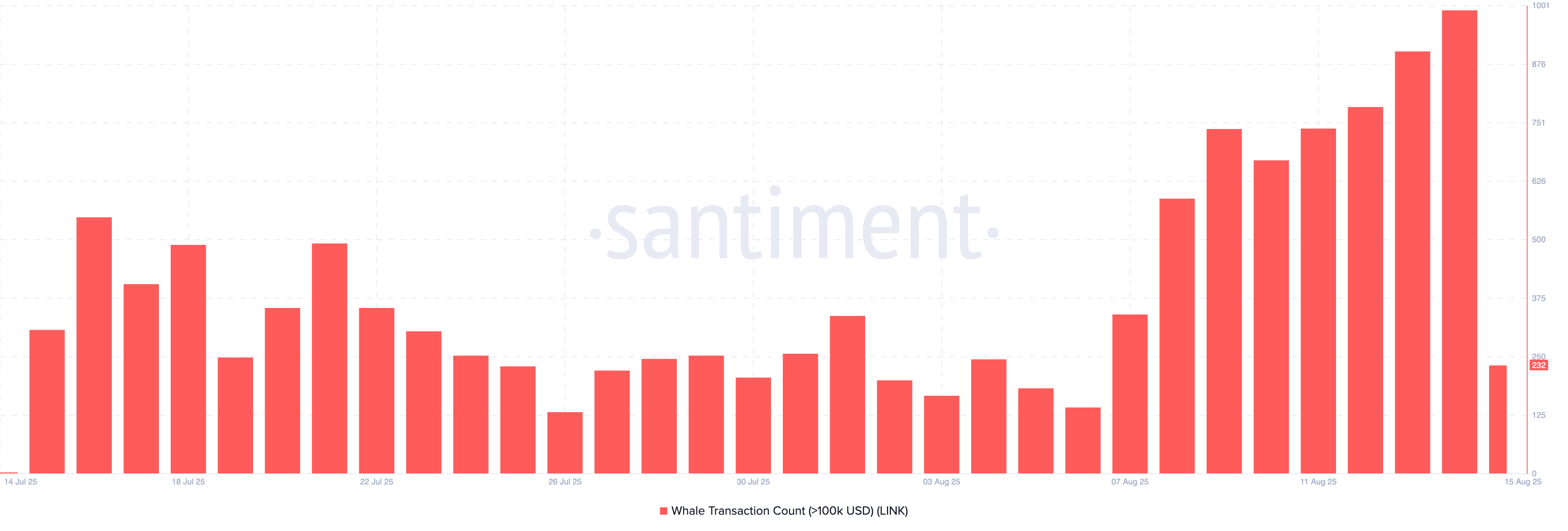

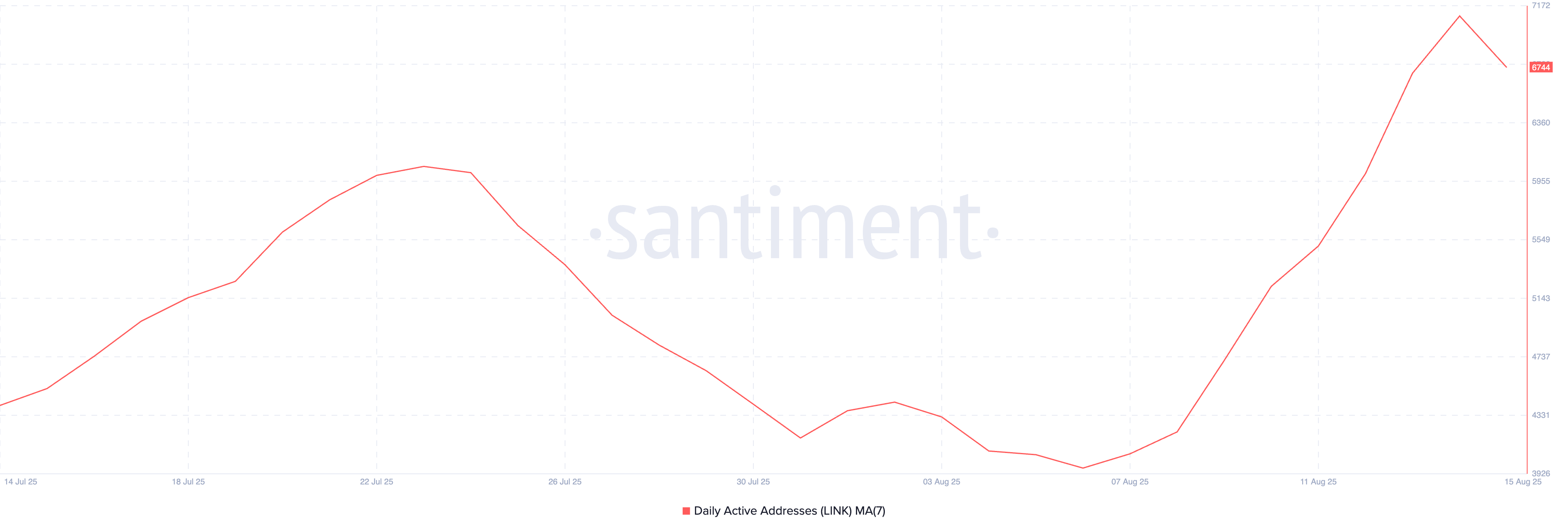

Whale transactions at their highest level in seven months, alongside profits not seen since late 2024.

Whale transactions at their highest level in seven months, alongside profits not seen since late 2024.