Ethereum (ETH) has been showing signs of renewed strength, gaining 14% over the past seven days. Despite the recent rally, Ethereum has been trading below the $1,900 mark since April 2, highlighting the importance of key resistance levels ahead.

Whether Ethereum can reclaim higher ground or faces renewed selling pressure will likely depend on its next moves around major support and resistance zones.

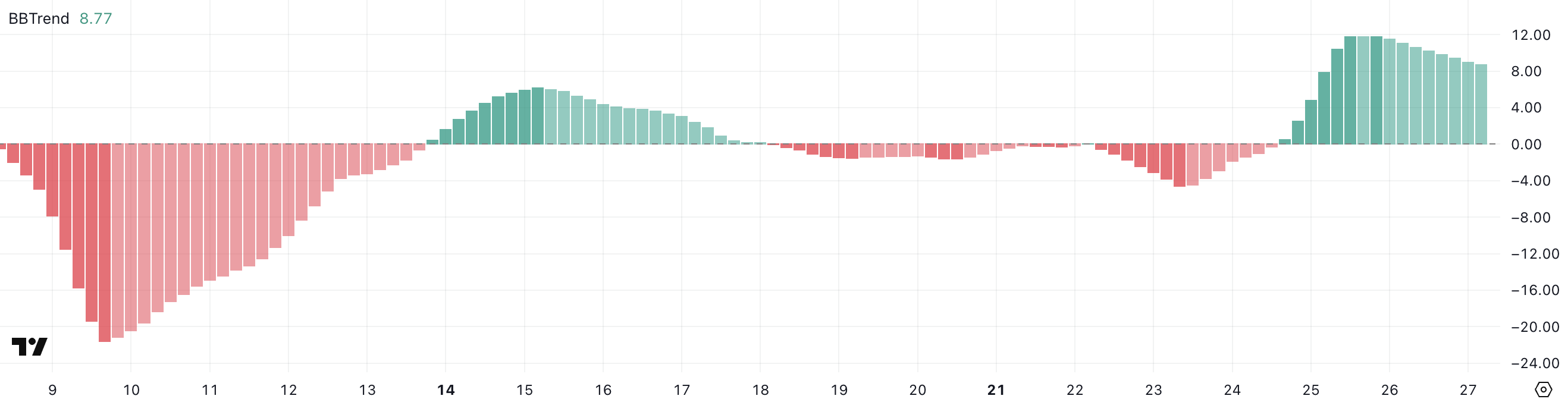

Ethereum’s BBTrend Cools: What It Signals Next

Ethereum’s BBTrend currently sits at 8.77, marking a noticeable decline from 11.83 two days ago.

Despite the drop, the indicator has remained positive for the past three days, suggesting that Ethereum has maintained an underlying bullish structure even as momentum cools off.

This shift could signal the early stages of a potential consolidation phase, during which the market takes a breather before deciding on its next major move.

BBTrend, or Bollinger Band Trend, is a technical indicator that measures the strength of a trend by analyzing how price behaves relative to the Bollinger Bands.

When BBTrend values are high and positive, they generally signal a strong uptrend; when they are negative, they point to a downtrend. Ethereum’s BBTrend, now at 8.77, indicates that while the uptrend is still present, its strength is fading.

Buyers failing to reassert control could lead to increased volatility, potential pullbacks, or sideways movement.

Ethereum Whales Hold Steady: What It Means for Price

The number of Ethereum whales — wallets holding between 1,000 and 10,000 ETH — currently stands at 5,458.

This figure rose slightly from 5,442 on April 21 to 5,457 on April 23, and has remained stable around this level for the past four days.

The recent stabilization suggests a pause in accumulation or distribution activity among large holders, offering a potential signal that the market could be waiting for a catalyst before making its next significant move.

Tracking Ethereum whales is critical because these large holders can have an outsized impact on price movements. When whale numbers rise, it often signals confidence and potential accumulation, which can be bullish for price.

Conversely, a declining whale count might suggest selling pressure ahead.

With the number of Ethereum whales holding steady around 5,458, it could imply a neutral stance among major players — neither aggressively buying nor selling — potentially leading to reduced volatility and range-bound price action until a clearer trend emerges.

Ethereum’s Battle Around $1,828: Breakout or Breakdown?

Ethereum’s EMA (Exponential Moving Average) lines are currently aligned in a bullish formation, with the short-term EMAs positioned above the long-term ones — a classic sign of upward momentum.

Over the past few days, ETH attempted to break through the resistance zone around $1,828 but was unsuccessful. If Ethereum tests this level again and successfully breaks above it, the next upside targets would be the $1,954 resistance, followed by a potential move to $2,104.

A break above $2,000 would be significant, marking the first time ETH trades above this psychological level since March 27.

However, Ethereum price could fall back to test the support at $1,749 if the bullish momentum fades and the trend reverses. Losing this level could expose ETH to further declines toward $1,689.

Should selling pressure intensify, deeper support levels at $1,537 and even $1,385 could come into play.

The post Ethereum (ETH) Whale Stability Signals Calm Before Potential Major Move appeared first on BeInCrypto.