The post Solana Price Analysis: Key Insights and Updates appeared first on Coinpedia Fintech News

- Bullish momentum has been building up for Solana, amid a highly anticipated altseason before the end of 2025.

- The DeFi projects on Solana network have recorded significant growth in cash inflows, and on-chain activity.

The wider altcoin market, led by Solana (SOL), gradually gained bullish momentum in the past two weeks, as Bitcoin (BTC) price invalidated bearish sentiment after rebounding above $95k. Analysis on various on-chain metrics shows the crypto FOMO has crept back in the past week, as the trade wars weakens amid ongoing diplomatic negotiations.

The Bitcoin’s fear and greed index surged from 47 percent, representing neutral, to 63 percent, suggesting greed, in the past two days. Ethereum’s fear and greed index surged from 44 per to 61 percent in the past two days. The wider altcoin followed the top two digital assets in regards to the fear and greed index.

Solana Price Update and Midterm Targets

After gaining over 14 percent in the past week, SOL price is about to record its third consecutive bullish week. Consequently, the large-cap altcoin, with a fully diluted valuation of about $92 billion and a 24-hour average trading volume of about $5 billion, has approached a crucial resistance level around $159.

In the daily timeframe, SOL price is well positioned to rally above $180, if Bitcoin price continues with bullish momentum towards $99.4k. However, if Bitcoin price gets to retest the support level above $91k, SOL price will likely drop to the support range between $125 and $135.

From a technical analysis standpoint, SOL bulls have gained significant ground over the bears after the daily MACD line crossed above the zero line amid growing positive histogram bars. Additionally, the daily Relative Strength Index (RSI) has surged above 52 for the first time since the second inauguration of the U.S. President Donald Trump.

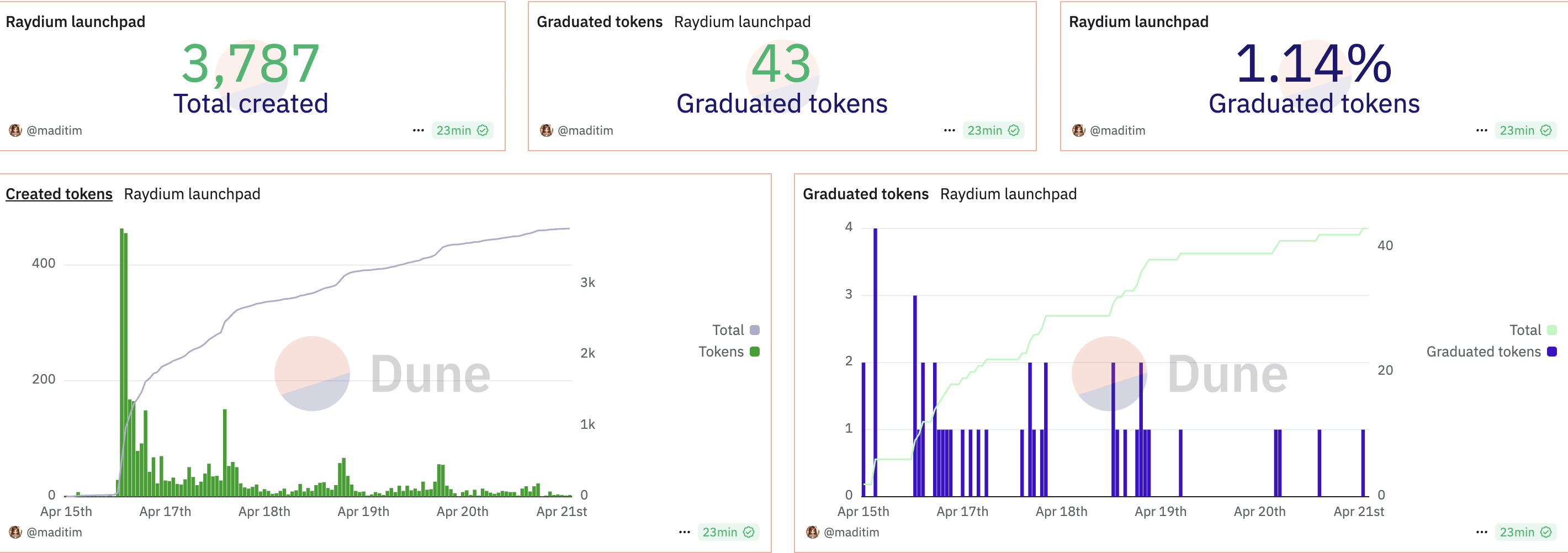

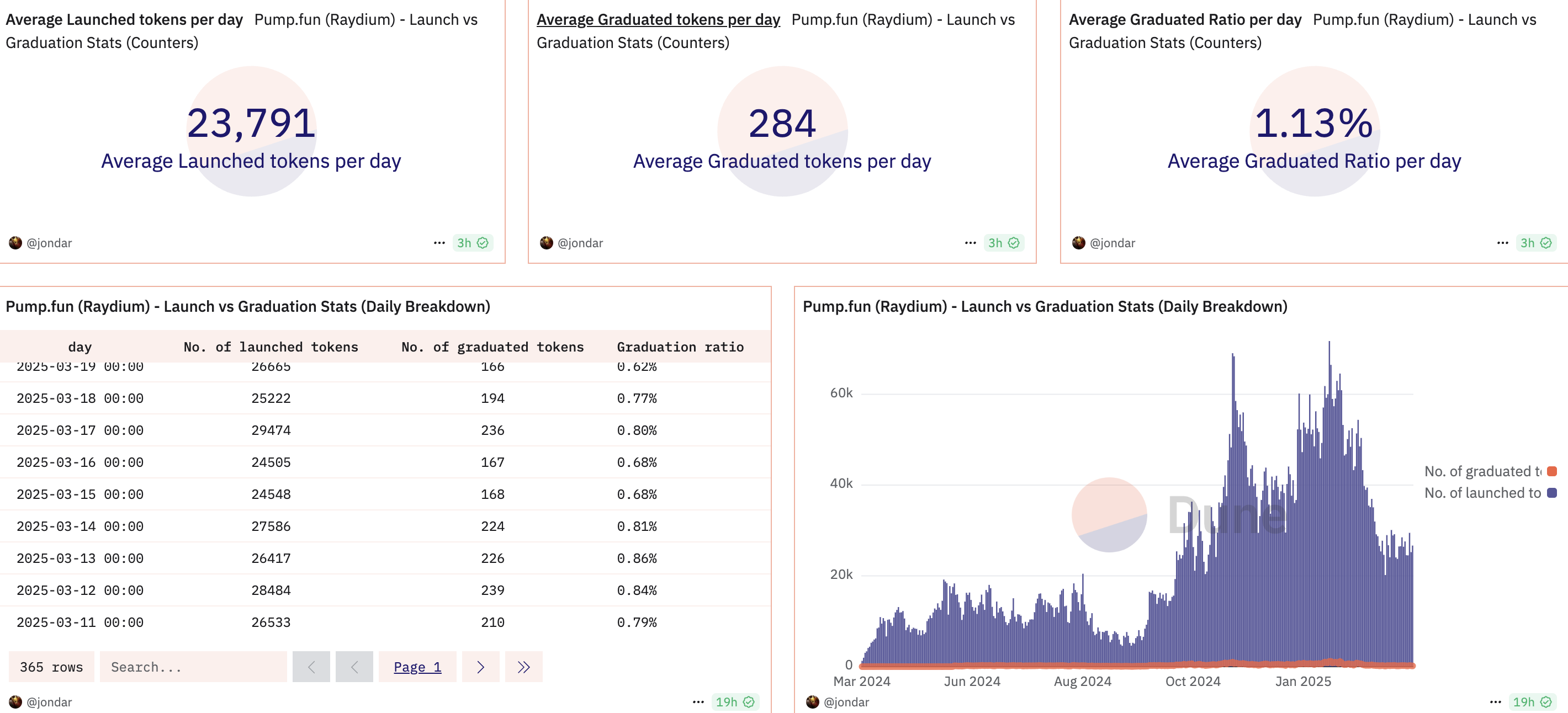

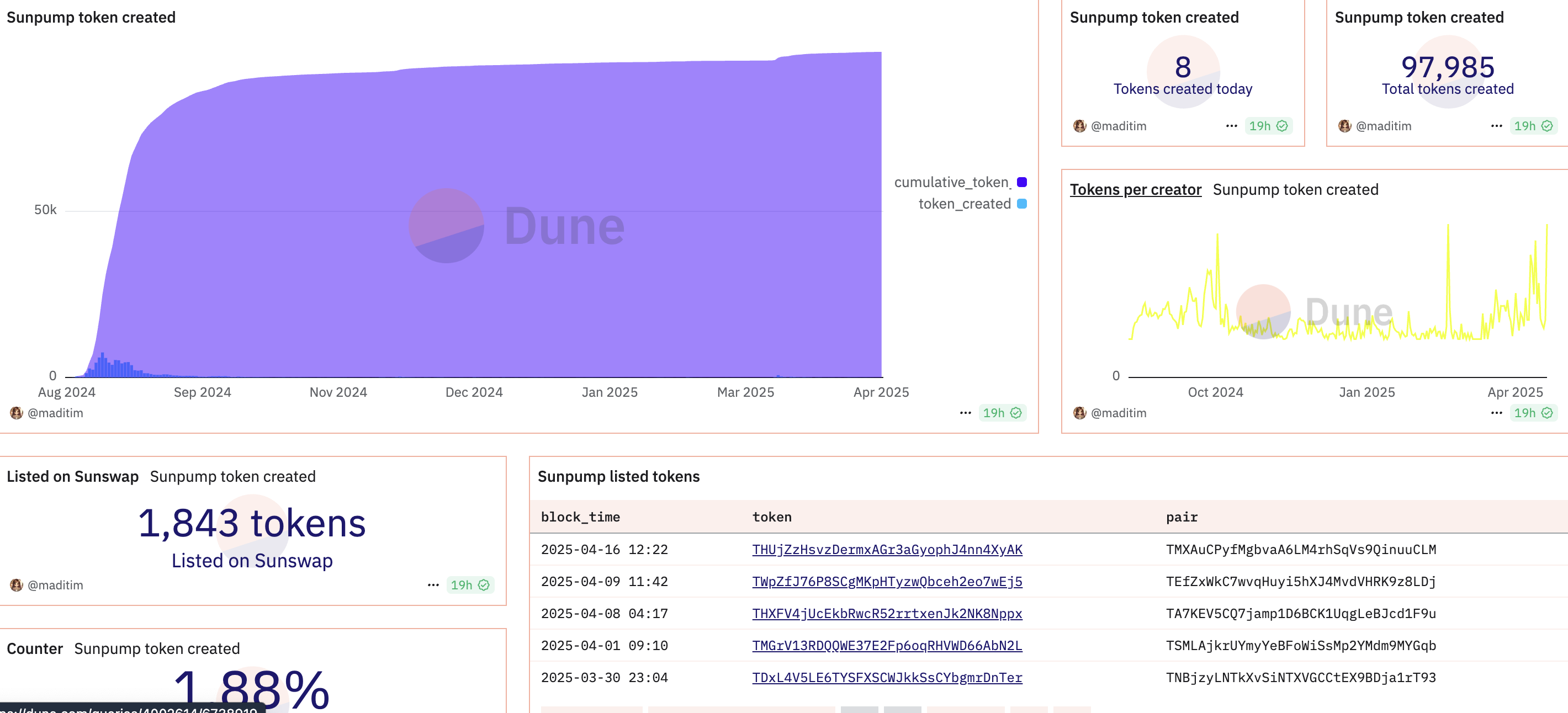

SOL Ecosystem Growth

The Solana ecosystem has grown significantly in the past year, bolstered by the validation from institutional investors and notable developments of its DeFi platforms. According to market data from Defillama, Solana network had a total value locked (TVL) of about $8 billion and a stablecoins market cap of around $12 billion, at the time of this writing.

Some of the latest developments in the Solana ecosystem includes Nous Research’s $50 million raise in Series A led by Paradigm VC.