ZORA launched its airdrop today, distributing tokens to early users. The rollout caused confusion, as no official claim site was provided. Users had to check their allocations manually through the smart contract. While the Content Coin narrative boosted coin creation and new users, trading volume dropped sharply from its initial peak.

ZORA’s price fell around 50% in the first two hours after the airdrop. It is now trying to recover, but momentum remains uncertain. The market is still reacting to the airdrop and overall token distribution.

Content Coin Narrative Boosts Zora Usage

The Zora airdrop officially launched today, distributing tokens to early users based on two snapshot periods—but it was met with confusion. Base founder, Jesse Pollak, addresses some of these points in an exclusive interview with BeInCrypto.

Many users were unclear on how to check their eligibility, as no official claim site or checker was provided. Instead, allocations had to be verified manually via the smart contract, leading to mixed reactions across the community.

While 10% of the total 10 billion supply was reserved for early adopters, the decision to allocate 65% of tokens to insiders (team, treasury, and contributors) raised questions about the distribution model.

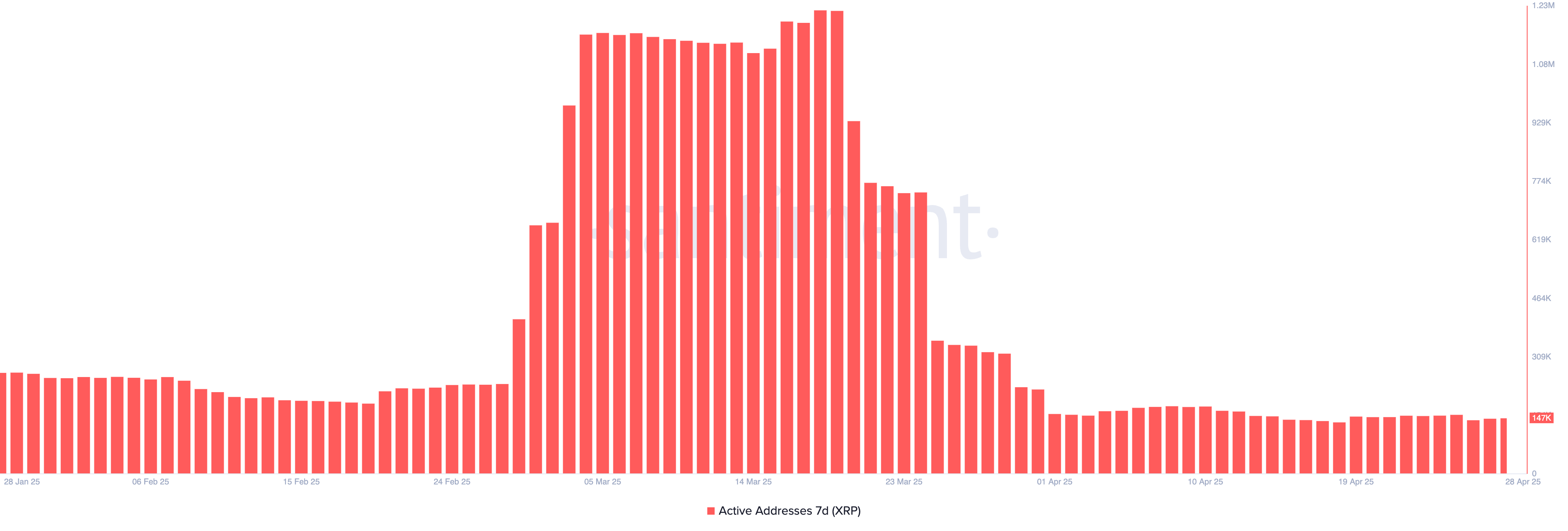

Since Base chain began promoting the idea of Content Coins, activity on Zora has noticeably increased. The number of newly created coins has remained above 20,000 since April 17, reaching nearly 28,000 yesterday.

Meanwhile, unique creators on the platform grew from 3,683 on April 16 to 6,206 by April 22.

While this growth suggests rising interest, it also reflects a trend still in early development, with questions remaining around long-term sustainability and utility.

Zora Volume Peaked at $31 Million—Now It’s Down Over 70%

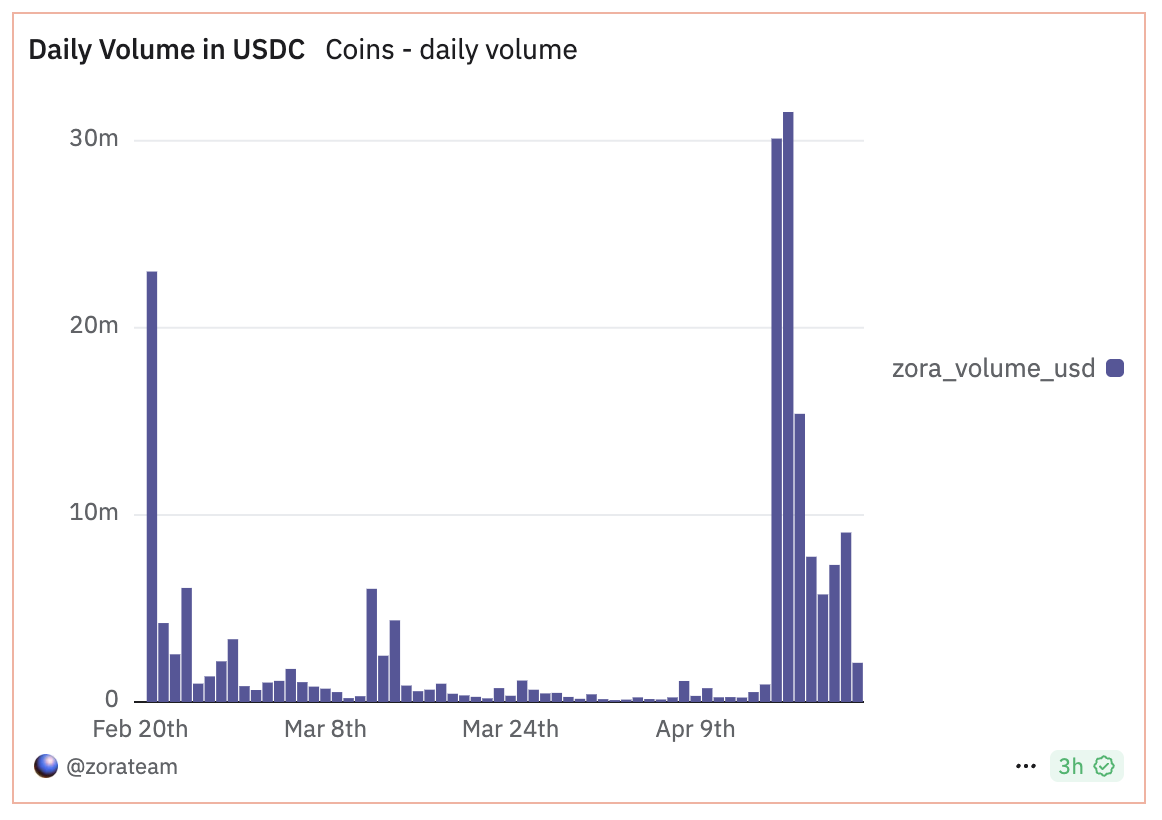

Zora’s trading volume in USDC surged sharply with the rise of the Content Coin narrative, hitting $30 million on April 16 and peaking at $31 million on April 17.

This initial spike reflected a strong wave of early interest and speculative momentum around the new use case for content on-chain. a

The increase aligned with Base’s push to promote content coins as a fresh alternative to traditional meme tokens, drawing attention from creators and traders alike.

However, despite the number of coins created continuing to climb, Zora’s volume fell significantly to just $9 million by April 22.

This divergence suggests that while more users are experimenting with the platform—launching and minting coins—actual trading activity has not kept pace.

The drop in volume may indicate fading speculative interest, uncertainty around the airdrop, or early profit-taking following the initial hype.

ZORA Price Dives After Airdrop, Now Eyes Recovery

ZORA’s price experienced a sharp selloff immediately following its airdrop, dropping roughly 50% within the first two hours of launch.

Such volatility is not uncommon for newly airdropped tokens, as early recipients often rush to secure profits, adding intense short-term selling pressure.

Since then, ZORA has shown signs of recovery, attempting to stabilize and build upward momentum. If it can break above the $0.023 level, it could move to test resistance at $0.0289, with a potential extension toward $0.034 if buying strength returns.

However, the recovery remains uncertain. If ZORA fails to hold current levels and bullish momentum fades, it may retest support at $0.019.

A break below that could lead to further downside, with the next key level around $0.0165.

This price action reflects a typical post-airdrop pattern—initial volatility, followed by a battle between early profit-takers and potential long-term holders looking to establish positions.

The post ZORA Price Battles Intense Selling Pressure After Airdrop appeared first on BeInCrypto.