Solana (SOL) has made significant strides in recent weeks, reaching a monthly high after a steady incline in its price action. Currently trading at $139, the altcoin has encountered resistance at the $148 level, which it failed to breach previously.

However, further rally from this point could set the stage for a move beyond $150, contingent upon investor support.

Solana Investors Are Optimistic

Solana’s recent uptick has been fueled by growing investor participation. Active addresses have surged to a two-month high, signaling renewed interest and confidence in the blockchain.

This rise in activity, combined with the price increase, is providing a strong buy signal. With more investors entering the market, there’s a higher likelihood that Solana will maintain its bullish momentum.

Increased participation in the network is often a strong indicator of investor confidence. The higher the number of active addresses, the more likely it is that the price will continue to rise. If these trends persist, Solana could build enough momentum to break through the $148 resistance and target $150.

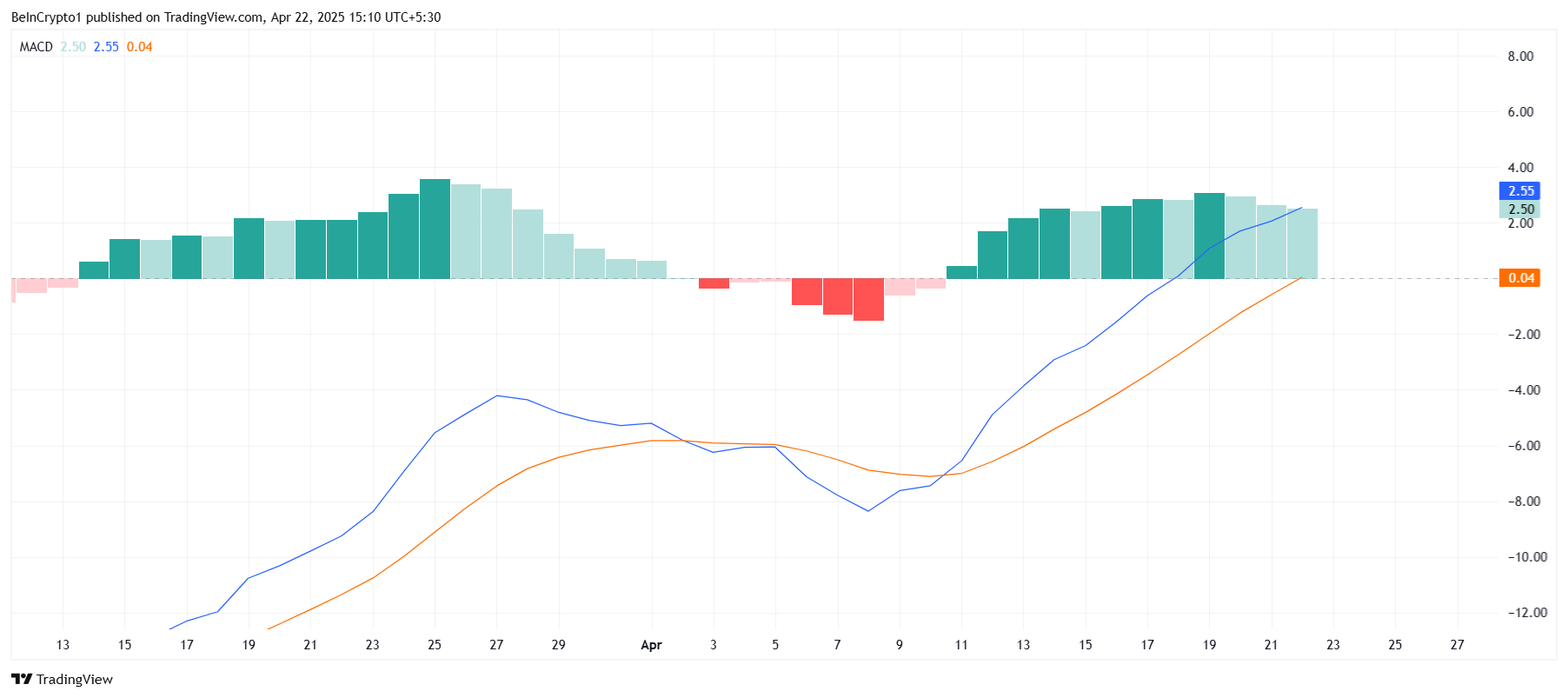

Despite the strong market sentiment, technical indicators such as the MACD suggest that Solana’s bullish momentum is showing some signs of slowing. The MACD histogram has begun to display declining bars, which could indicate that the intensity of the buying pressure is diminishing. While this decline is still mild, it’s worth watching closely for any signs of a shift in momentum.

However, it’s important to note that these fluctuations are part of the typical market cycle. The lack of a significant slowdown in the MACD at this point suggests that Solana has room to grow further, especially if market conditions remain favorable. A consistent rise in price could prompt a renewed surge in demand from investors.

SOL Price Needs A Boost

Solana is currently trading at $139, with support holding firm at $136. This has helped the altcoin maintain stability despite facing resistance at $148. The price has tested this barrier multiple times in the past six weeks but has failed to breach it, signaling a crucial point for its future direction.

If Solana can overcome the $148 resistance with sustained investor support, it could see a substantial increase, potentially reaching $150 in the coming weeks. Positive market sentiment and increasing active addresses are likely to play a role in helping SOL achieve this target.

However, if the altcoin fails to breach $148 once again, it could see a correction toward $123. If this happens, Solana will likely consolidate at that level, and any further drop could invalidate the current bullish outlook.

The post Solana Price Aims At Crossing $150 As Investors’ Activity Hits 2-Month High appeared first on BeInCrypto.