The post Circle Payments Network Unveiled: Here is What You Need to Know appeared first on Coinpedia Fintech News

- The Circle Payments Network will leverage regulated stablecoins led by USDC and EURC.

- The CPN will connect global banks, and VASPs to outpace legacy systems like SWIFT.

Circle Internet Financial, a top-tier stablecoins issuer, announced the launch of Circle Payments Network (CPN), a blockchain-based platform to connect global financial institutions. Circle collaborated with BNY, Banco Santander, Deutsche Bank, Société Générale, and Standard Chartered Bank to ensure the successful launch of the CPN.

At launch, the CPN already has several working partners in global financial markets led by BCB Group, BVNK, CoinMENA, Coins.ph, Conduit, dLocal, dtcpay, Flutterwave, RedotPay, TazaPay, Transfero Group, Triple-A, Trubit, Unlimit, Yellow Card, Zepz, and Zodia Markets.

“Since our founding, Circle’s vision has been to make moving money as simple and efficient as sending an email. CPN is a significant step in making that vision a reality for businesses worldwide,” Jeremy Allaire, CEO of Circle, noted.

Market Impact of Circle Payment Network

The strategic launch of the CPN platform will play a crucial role in steering forward Circle’s business amid heightened competition in the stablecoins market. Through offering real-time settlements, the CPN will tap into regulated stablecoins led by the USDC and the EURC, among others.

“Circle Payments Network is a foundational layer for the always-on economy — enabling trusted institutions to move value across borders, instantly. With programmable infrastructure at its core, CPN makes it possible to embed value transfer into modern financial applications in ways that weren’t feasible before,” Nikhil Chandhok, Chief Product and Technology Officer at Circle noted.

The CPN aims at dethroning the legacy systems like SWIFT in enabling global money transfer. Moreover, the CPN is more cost-efficient as it supports blockchain technology, currently Ethereum (ETH) and Avalanche (AVAX).

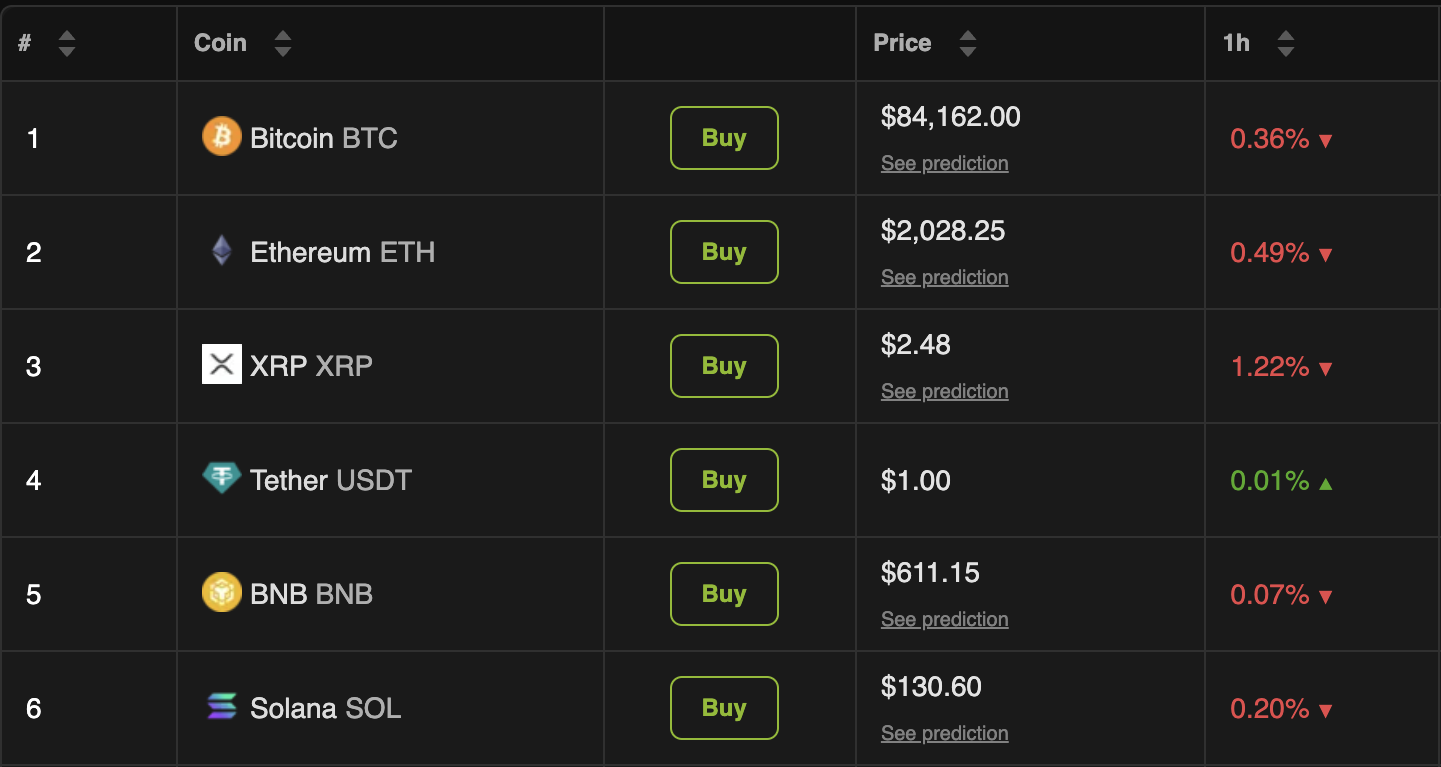

In the long haul, the launch of CPN will enable USDC’s market dominance to catch up with Tether USDT. As of this writing, Circle’s USDC had a market cap of about $60.9 billion and a 24-hour average trading volume of about $7.6 billion.