Bitcoin price consolidates above the $84,600 on Sunday, April 20. Having closed eight consecutive sessions above the $80,000 mark, on-chain data trends suggest BTC market outlook for the week ahead remains bullish despite regulatory pressures on Coinbase.

Oregon State to Sue Coinbase as Bitcoin Price Holds Above $80,000 for Consecutive Days

Oregon Attorney General Dan Rayfield has filed a securities enforcement action against Coinbase, alleging that the exchange facilitated the sale of unregistered crypto assets, exposing investors to significant risk.

In the lawsuit, Oregon state alleges that Coinbase has encouraged the sale of unregistered cryptocurrencies to people in Oregon exposing residents to risk of pump-and-dump schemes and fraud.

“After building trust with Oregon consumers, Coinbase sold high risk investments without them being properly vetted to protect consumers Oregonians lost money, and we believe Coinbase should be held accountable and take steps to protect consumers.”

Rayfield said in a statement issued on April 18.

The complaint accuses Coinbase of misleading consumers in Oregon by offering high-risk digital assets without sufficient oversight.

In response, Coinbase’s Chief Legal Officer, Paul Grewal, called the suit a “desperate scheme” and “a giant leap backwards” in crypto policy progress.

Despite this legal headwind, Bitcoin has remained resilient. Following a sharp decline to $74,300 on April 9, triggered by China’s new tariffs on U.S. tech, BTC swiftly rebounded after the U.S. Consumer Price Index for March came in lower than expected.

Bitcoin price is trading at $84,500 at press time on April 20, having closed above $83,000 for eight consecutive trading sessions.

This steady uptrend, even in the face of a fresh regulatory attack, suggests that the market sees the lawsuit as isolated to Coinbase—not a major threat to Bitcoin’s near-term price prospects. With continued institutional interest and technical strength holding above key support, BTC price appears poised to maintain positive momentum in the week ahead

BTC Showing Resilience to U.S. Pressures

Bitcoin’s recent price action showcases strength relative to U.S. equities, particularly in the tech sector.

While flagship stocks such as NVIDIA and Microsoft grapple with declining investor sentiment, Bitcoin continues to draw inflows and sustain support.

NVIDIA shares dropped over 7% this week following a $5.5 billion charge related to China export compliance. The erasing billions in market capitalization for adjacent US tech stocks including Microsoft, Tesla, and Apple.

Against this backdrop, Bitcoin has appreciated nearly 12% since April 12.

More so, Lower-than-expected jobless claims last week increased pressure on the Fed to maintain a hawkish stance—yet BTC has continued its upward trajectory, bucking the risk-off trend.

This decoupling signals renewed investor conviction in Bitcoin as a long-term macro asset, especially as U.S. fiscal policy and central bank dynamics introduce heightened volatility to traditional markets.

Investors Pull 14,000 BTC from Exchanges in the Last 8 Days as BTC Sets Up Local Bottom

A critical on-chain indicators supporting the current BTC rally is the notable drop in exchange-held Bitcoin.

Data from CryptoQuant shows that more than 14,000 BTC have been withdrawn from centralized exchanges since April 12, aligning with the day Bitcoin reclaimed the $80,000 level.

These outflows suggest increasing long-term conviction among holders, reducing available supply for trading and heightening the potential for price appreciation. Historically, sustained withdrawal activity often marks local bottoms and preludes major bullish cycles.

The drop in exchange balances comes at a time of increased spot demand—especially with platforms like Charles Schwab signaling intentions to enter direct crypto spot trading.

As regulatory uncertainty begins to decouple from Bitcoin’s price performance, investors appear to be front-running the next wave of institutional participation.

In conclusion, while the Oregon lawsuit against Coinbase may create noise in the short term, Bitcoin’s structural and technical foundation remains intact. A continued consolidation above $83,000—paired with supply contraction and strong macro divergence—puts the $90,000 and $100,000 targets well within reach for Q2.

Bitcoin Technical Analysis Today: BTC Eyes $88K Breakout After Sideways Coil

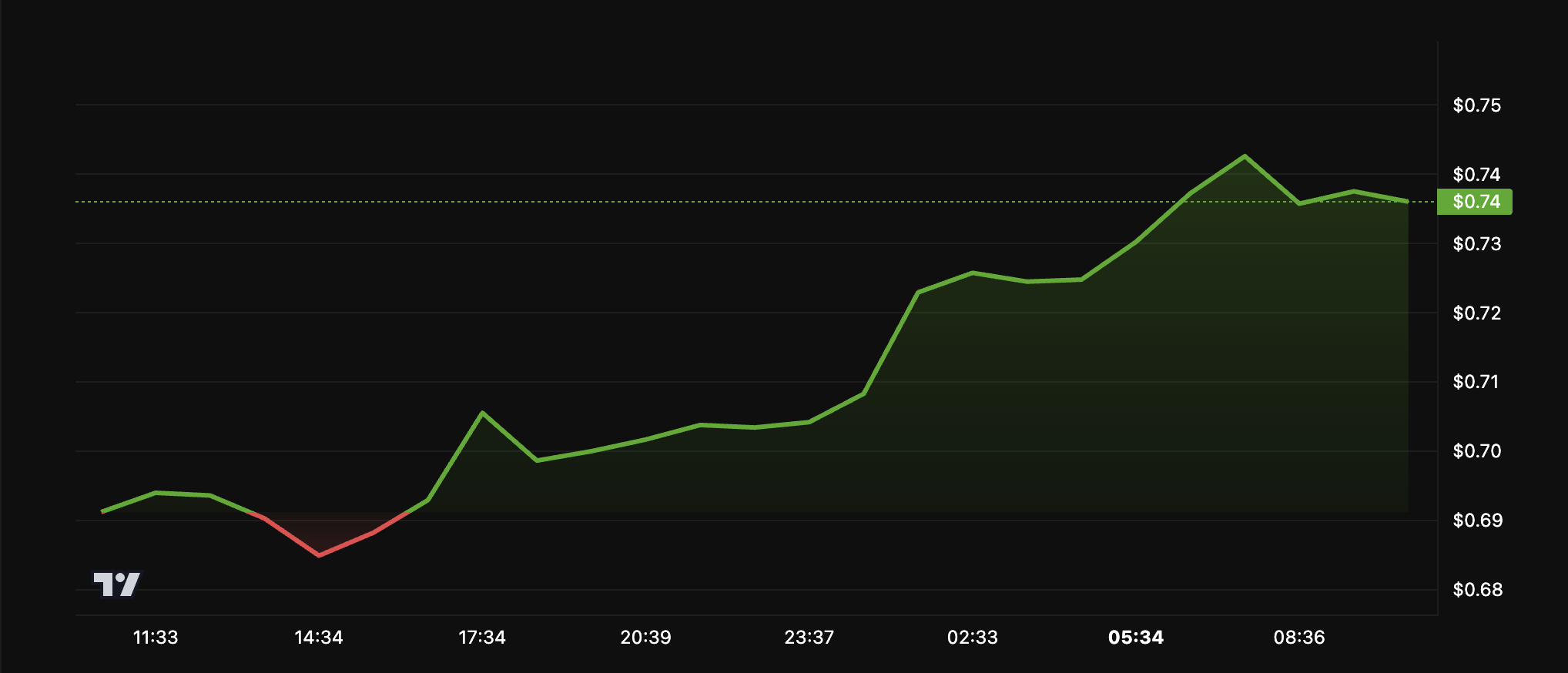

Bitcoin price is consolidating below a descending trendline resistance near $85,489, with short-term support from the 4-day SMA at $84,632. As see in the Bitcoin price forecast chart below, BTC has formed a coiling pattern with higher lows and marginally lower highs—often a prelude to a decisive breakout.

On April 20, BTC closed at $84,594, holding above the critical $84K level for the eighth consecutive session, suggesting persistent underlying demand.

The Average Daily Range (ADR) remains muted at 3.06, indicating consolidation but also priming BTC for a potential expansion in volatility.

Meanwhile, the bullish BBP (Buy Balance Power) reading at 1,553.76 reinforces near-term strength, showing that buying momentum is outpacing sell pressure. Volume has declined modestly, but the broader context of consistent closes above $83,000 reflects solid market absorption.

Bitcoin price forecast today leans bullish as the 4-day SMA trends above price, creating a compression zone between it and the 60-SMA. A daily candle close above $85,500 could confirm a breakout, targeting $88,000 short term. Failure to hold $84,000 would re-expose $82,300 as interim support.

The post Bitcoin Price Forecast: Oregon Attorney General Sues Coinbase, is BTC $100K Rally at Risk? appeared first on CoinGape.