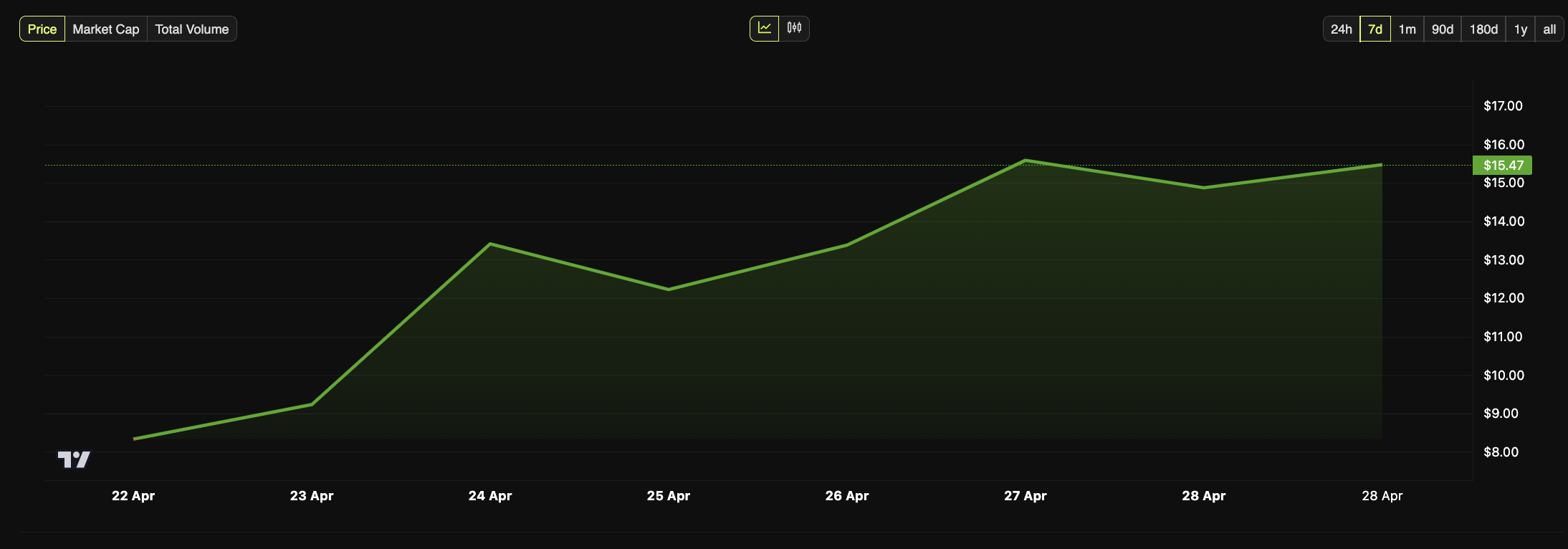

Ethereum (ETH) has recently faced a challenging market environment, shedding 14% in just five days and currently trading at $2,346. This downward trend has pushed ETH into a crucial support zone, potentially signaling a reversal and presenting an attractive buying opportunity for savvy investors. In this article, we’ll explore the factors driving Ethereum’s price action, the technical indicators at play, and the potential for a rally that could see ETH breach the $3,000 mark and revisit $3,500.

Technical Support And Buying Opportunities

From a technical perspective, Ethereum’s recent 14% crash has placed it firmly within the $2,440 to $2,252 demand zone, a key support structure. If ETH can close above the midpoint of this demand zone at $2,340 on a daily candlestick, it would suggest a strong absorption of selling pressure, driven by limit buy orders. Such a development could create an optimal environment for investors looking to enter long positions or accumulate ETH in anticipation of a bullish fourth quarter.

However, the path to recovery is not without obstacles. For Ethereum to gain momentum, Bitcoin (BTC) must stabilize in the $61,000 to $62,000 range. A steady Bitcoin price could provide the necessary lift for Ethereum and other top altcoins to surge higher.

Key Resistance Levels to Watch

As ETH attempts to bounce back from the demand zone, it will face several resistance hurdles. The first significant barrier is the range between $2,309 and $2,820, with the midpoint at $2,564. Overcoming this level is crucial for Ethereum to set its sights on the next resistance levels of $2,886 to $2,923.

Once ETH clears these resistance levels, the psychological barrier at $3,000 becomes the next target, followed by the potential to reach $3,500. Analysts agree that if ETH can conquer the $2,800 level, a rally towards these price points is highly feasible.

Supporting the bullish sentiment around Ethereum is a recent uptick in its Network Growth since September 21. This metric, which tracks new addresses joining the Ethereum blockchain, has shown promising signs, indicating renewed interest among investors. Concurrently, the number of daily active addresses has nearly doubled, rising from 350,000 to 520,000 over the past two weeks.

These on-chain metrics highlight a growing capital inflow and indicate that sidelined buyers are increasingly interested in Ethereum at the current price levels. This trend is a positive sign for the cryptocurrency’s future performance.

Risk Factors and Potential Downside

Despite the encouraging signs, there are risks involved. If Ethereum fails to maintain its position above the demand zone’s lower limit of $2,252, it could signal that selling pressure is outpacing buy orders, potentially pushing ETH down to the next key level of $2,000.

Prominent crypto trader and analyst Crypto Capo has suggested that Bitcoin may experience a drop of 10% to 20%, which could further impact Ethereum’s price negatively. In such a scenario, the forecasted target for Ethereum would be the $2,000 mark.

As Ethereum navigates this critical period, investors should closely monitor both technical indicators and on-chain metrics to identify potential buying opportunities. With significant resistance levels ahead and a bullish outlook contingent on Bitcoin’s stability, ETH could be poised for a resurgence. For those looking to enter the market, the current support zone offers an appealing risk-to-reward ratio, making it a potentially lucrative time to invest in Ethereum.

With its fundamental and technical factors aligning, Ethereum’s path towards reclaiming its previous highs could soon be realized—are you ready to capitalize on the opportunity?