In the latest XRP news, Ripple has recently moved 200 million coins, fueling speculations in the market. Meanwhile, this comes as the crypto holds the $2 support despite recent volatile trading. Besides, amid the ongoing speculations, a renowned analyst has predicted a potential rally for the token ahead to $19, especially amid the soaring buzz after the recent successful US ETF launch.

XRP News: Ripple’s 200 Million Move Fuels Speculations

Leading on-chain transaction tracker Whale Alert reported that Ripple shifted 200 million XRP recently, worth around $402.78 million, to an unknown address. The transaction was made from Ripple’s wallet, identified by the wallet address “rBg2F…1o91m”, and was sent to an unknown recipient address “rP4X2…sKxv3”.

Meanwhile, such high-volume transfers typically fuel investor concerns and curiosity. Some speculate Ripple could be preparing for strategic positioning in anticipation of regulatory clarity. Others suggest the transfer might be linked to OTC trades or internal wallet management. However, there are no official comments on this latest XRP news.

However, the timing of this move also coincides with recent legal developments in the Ripple vs. SEC lawsuit, adding another layer of speculation to the event.

Ripple Vs SEC Case Update

In another latest XRP news, Ripple and the US SEC have submitted a joint legal filing. As per the filing, both parties have requested the US Court of Appeals for the Second Circuit to pause the ongoing proceedings.

This comes after the settlement of the major parts of the XRP lawsuit. If granted, the motion could give Ripple more flexibility and time to navigate its next legal and business steps. The request to keep the appeal “in abeyance” indicates both parties are aiming for a smoother closure pending final court approval. Notably, this move may also influence institutional sentiment, especially following the recent ETF-related excitement.

XRP ETF Success Aids In Price Surge: Rally To Sustain?

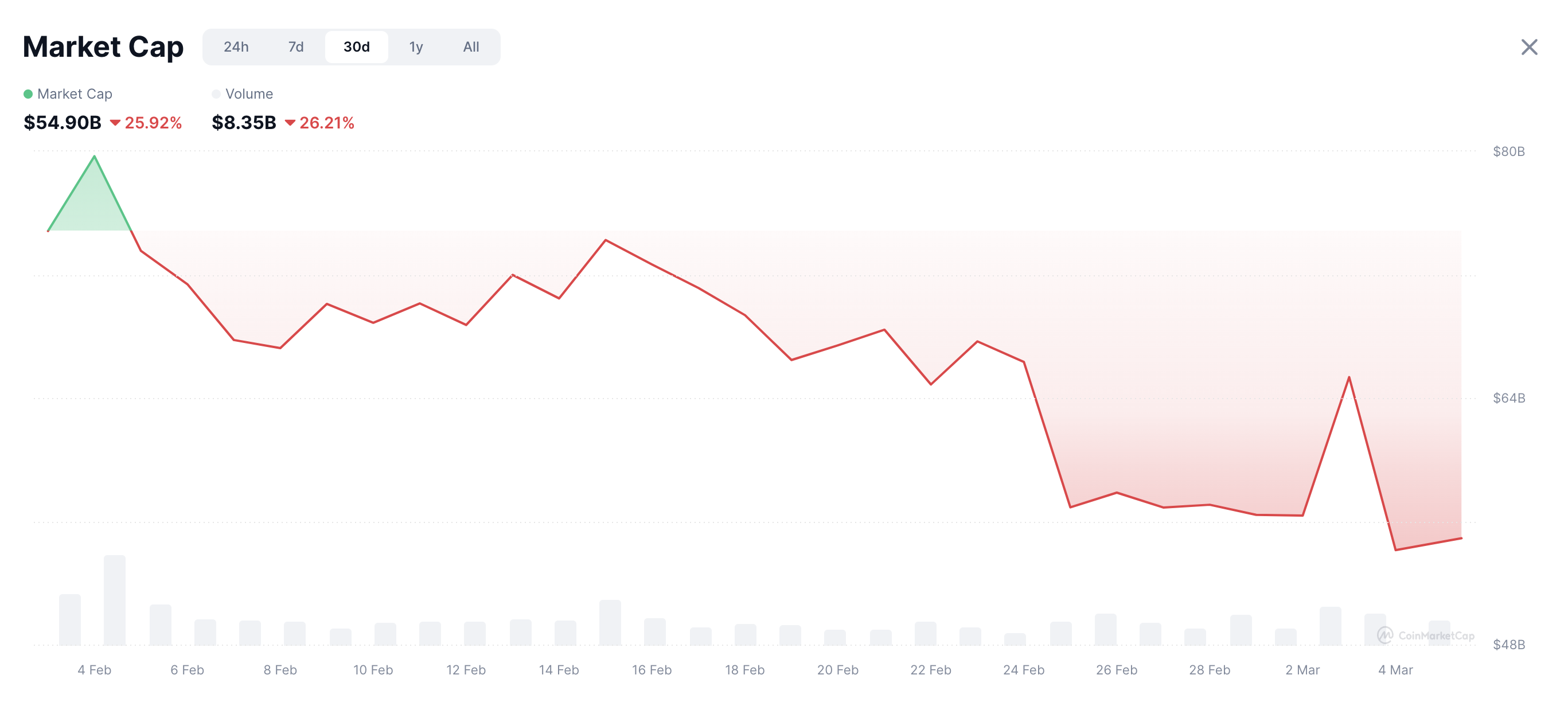

The first XRP ETF has noted a successful launch in the US this week, which has sparked market optimism. Amid this, XRP price has jumped about 1% in the last 24 hours to reach $2.01. Notably, the crypto has touched a 24-hour high and low of $2.03 and $1.93, respectively, reflecting the volatile scenario in the market.

Besides, the active addresses holding Ripple’s native asset has also touched a new high recently. This indicates that more investors are shifting their attention towards the asset.

What’s Next?

However, amid this, renowned expert EGRAG CRYPTO said that the XRP price may hit $19 or even $45, citing historical trends. According to the expert, if XRP mimics the 2017 or 2021 cycle, it can rally by 2700% or 1,050% to hit $45 or $19, respectively.

This also comes after the expert highlighted the XRP/BTC chart and said that the crypto could hit $22 if BTC rallies to a new ATH ahead.

The post XRP News: Ripple Moves 200M Coins As Price Holds $2 Support, What’s Happening? appeared first on CoinGape.