XRP has faced significant volatility in recent weeks, with price action lacking clear momentum. Altcoin struggled to maintain upward momentum as broader market conditions remained bearish.

Despite attempts to recover, investor sentiment has remained weak, preventing any substantial movement. The result has been a lack of strong support, with many investors hesitant to make decisions.

XRP Is Losing Investor’s Interest

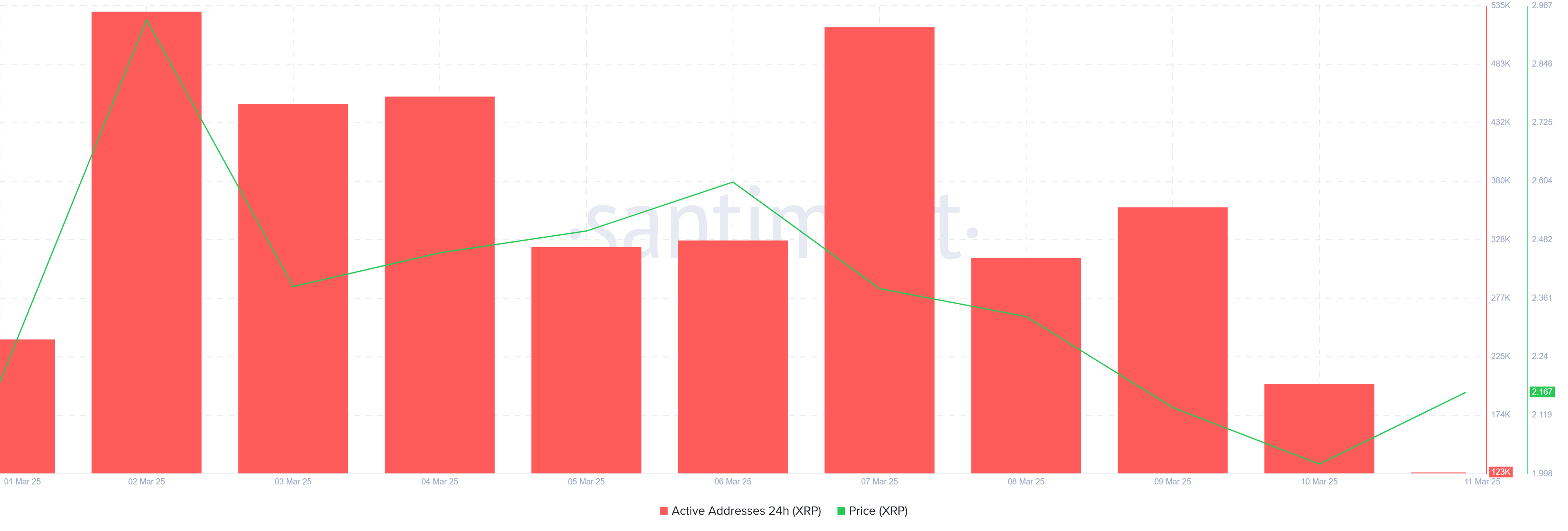

XRP’s market sentiment reflects the ongoing uncertainty, with active addresses showing a significant drop in participation. Over the past few days, investor conviction has been waning, largely due to bearish market cues. As a result, the number of active addresses has fallen from a recent high of 530,000 to just 123,000, indicating quickly declining interest in the altcoin.

The decline in participation highlights the reluctance of investors to fully engage with XRP. As investors pull back, liquidity becomes increasingly limited, which further dampens the potential for any substantial price rebound.

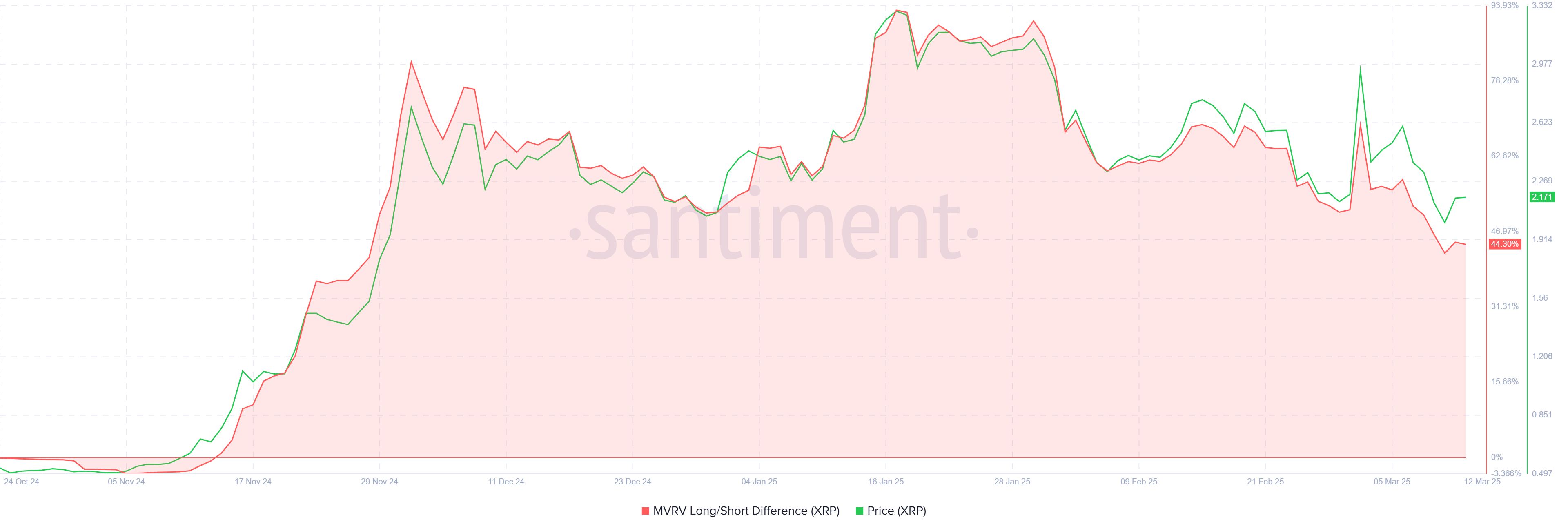

The macro momentum of XRP has also been affected by broader market conditions, although long-term holders (LTHs) remain a critical force in supporting the price. The MVRV Long/Short Difference shows that LTHs are sitting on considerable profits at the moment. These investors have been holding onto their positions rather than selling at low prices, providing support for XRP and preventing further price declines.

Their continued holding behavior has become crucial for maintaining the price above critical support levels. As the last line of defense for XRP, these LTHs are preventing a potential crash below $2.

XRP Price Aims At Recovery

XRP’s price currently stands at $2.17, holding above the support level of $2.14. Despite a 22% crash in recent weeks, the altcoin has managed to maintain its position above the critical $2.00 mark. While the current level is promising, breaching the $2.33 barrier may prove difficult due to the lack of strong bullish signals in the market.

Given the current market conditions and investor sentiment, XRP is likely to continue consolidating within the range of $2.33 and $2.14. A breakout in either direction will depend on the ability of the broader market to regain momentum. Until then, XRP may remain stuck in this narrow range.

However, if XRP falls below the support level of $2.14, the price could slide to $1.94. Such a decline would invalidate the neutral outlook, pushing the altcoin into a more bearish trend. A drop to $1.94 would signal a further loss of confidence, making a recovery even more challenging.

The post XRP Price Holds Above $2.00 Despite 22% Correction: Recovery Ahead? appeared first on BeInCrypto.