XRP has experienced significant price movements recently, especially with the massive accumulation by whales. Over the past week, large holders have been quietly stacking up XRP, potentially positioning the altcoin for a significant price boost.

Their actions, combined with a resilient market, present an optimistic outlook for the altcoin’s future.

XRP Investors Are Betting on Recovery

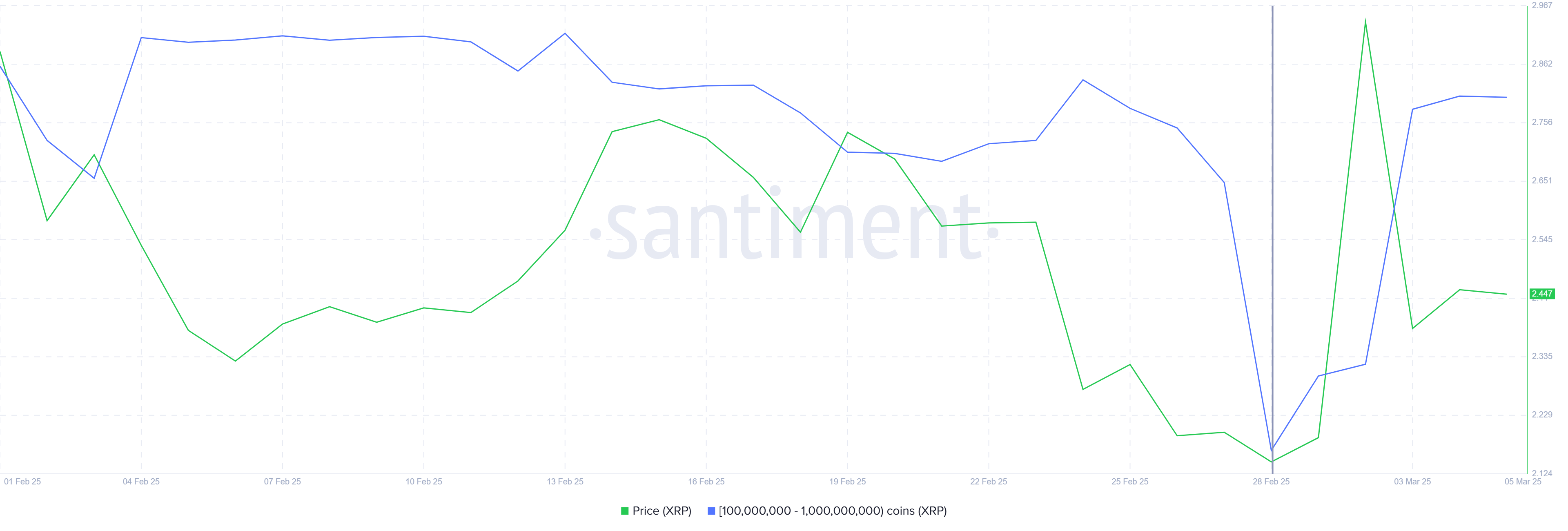

Whale addresses holding between 100 million and 1 billion XRP have added 1.34 billion XRP worth over $3.26 billion in the past week. While some speculated this accumulation was linked to XRP’s inclusion in the US Crypto Reserve, it appears the whales were primarily buying at low prices.

This indicates that these large holders anticipate further gains. Despite XRP’s 18% crash on Monday, the whales did not sell, suggesting they are confident in the asset’s long-term potential.

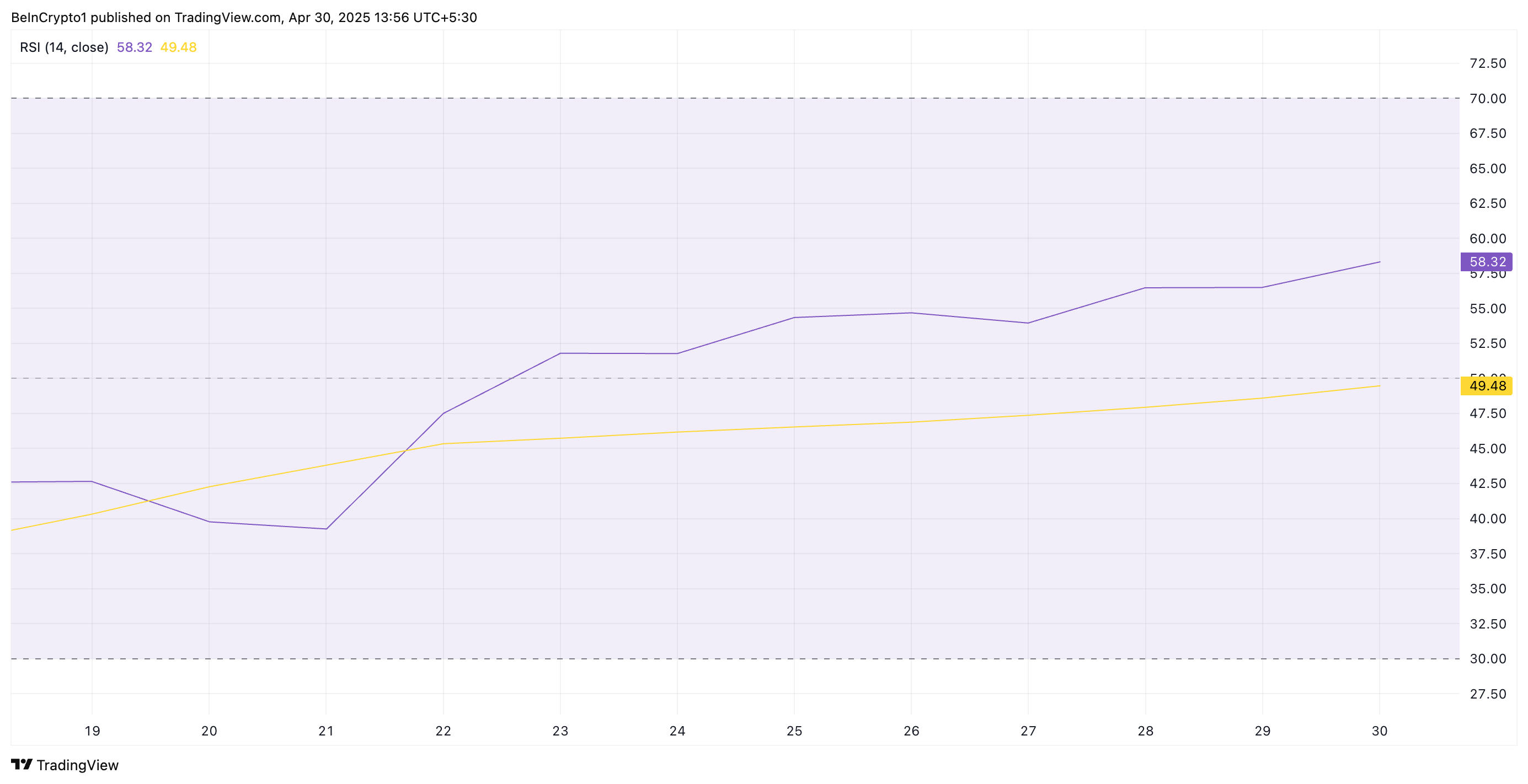

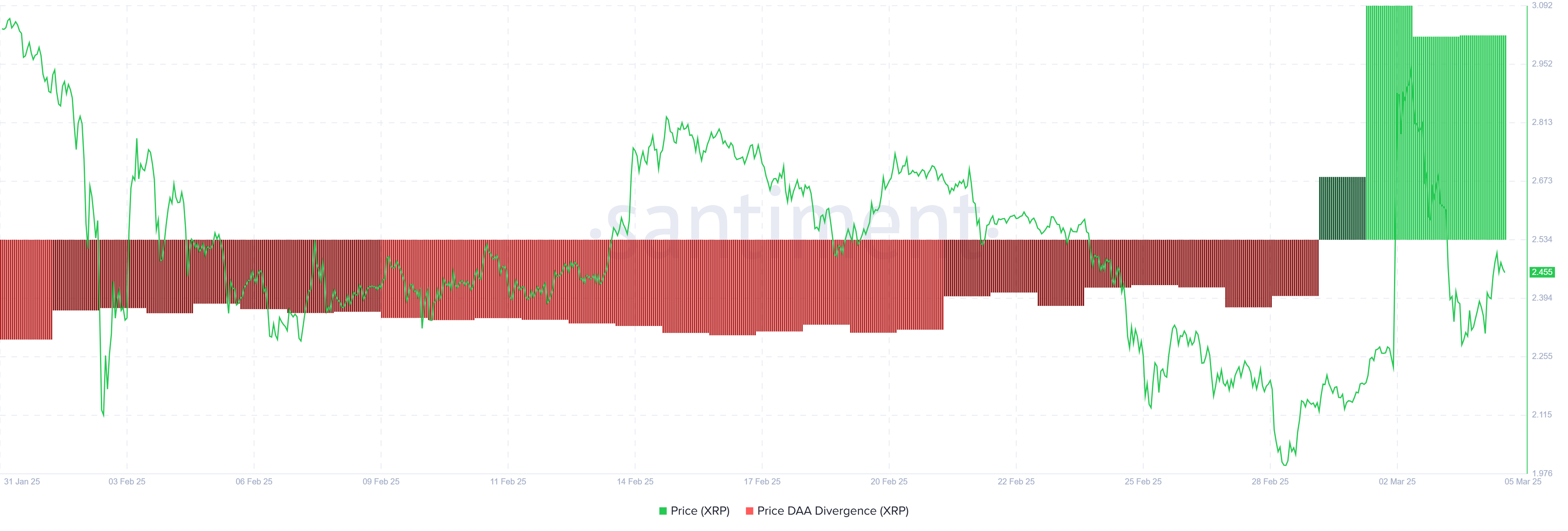

The price DAA Divergence is currently flashing a buy signal for XRP as investors demonstrate resilience amid challenging market conditions. This divergence indicates that, while the broader market has experienced volatility, XRP is showing strength. With more investors holding onto their positions and fewer opting to sell, the sentiment is clearly turning bullish.

As market conditions improve, investors’ buying pressure could continue to push XRP’s price higher. This would support the possibility of a sustained rally backed by both retail and whale participation.

XRP Price is Holding Above Support

XRP is trading at $2.45, holding steady above the critical support level of $2.33. After facing considerable volatility over the weekend, the altcoin managed to stabilize, posting a 37% price increase. This move suggests that XRP could have the momentum needed for further gains if the bullish trend continues.

However, despite the positive signals, XRP still failed to secure $2.70 as support on Sunday, which prevented the altcoin from pushing higher. If XRP can manage to flip $2.70 into support, it could break through the $2.95 resistance, bringing it closer to its previous highs.

If the altcoin fails to breach $2.70, XRP could experience consolidation above $2.33, as seen in previous price action. This could delay the bullish outlook and may prevent any immediate upward movement, resulting in a temporary stagnation until the market provides more clarity.

The post XRP Whales’ $3.2 Billion Accumulation Could Set Price Up For Rally appeared first on BeInCrypto.