Animoca Brands co-founder and executive chairman Yat Siu expects continued growth through 2025 due to a more crypto-friendly regime in the US.

Dig Deeper, Invest Smarter

Animoca Brands co-founder and executive chairman Yat Siu expects continued growth through 2025 due to a more crypto-friendly regime in the US.

Kraken has launched perpetual futures contracts for Pi Network’s native token, PI, allowing traders to take long or short positions with up to 20x leverage.

The move gives traders a new way to speculate on PI’s price without holding the asset itself. It also marks PI’s debut on a major derivatives platform, despite the token still lacking listings on top spot exchanges like Binance or Coinbase.

Perpetual futures are derivative contracts with no expiration date. Traders can open positions that track the price of PI and settle profits or losses based on price movements over time.

On Kraken Pro, users can access these contracts with over 40 collateral options and across more than 360 markets.

This flexibility allows both hedging and speculative strategies. Traders bullish on Pi Network can go long, while skeptics can short the token—betting that its price will fall.

$PI @PiCoreTeam perpetual futures now live with up to 20x leverage

Why choose Kraken Pro futures:

40+ collateral options

360+ markets

Open PI perp

https://t.co/NHHpKobugb

*geo restrictions apply pic.twitter.com/aiJrJRbxW4

— Kraken Pro (@krakenpro) May 23, 2025

With 20x leverage, small price swings can lead to outsized gains or losses.

Meanwhile, after a brief rally to $1.57 earlier this month, PI has dropped 10% this week. Despite the ongoing bullish cycle in the market, the altcoin has shown extreme volatility and underperformed expectations.

The listing introduces more liquidity into the PI market. Greater trading activity could reduce volatility in the long term. However, in the short term, leverage may amplify price swings.

Market sentiment around PI is already fragile. Concerns over centralization—60% of the token supply remains under core team control.

Also, as BeInCrypto reported previously, a high concentration of nodes in Vietnam has triggered doubts about the project’s stability. Vietnam’s tightening crypto laws add further pressure.

With futures now in play, bearish traders may open leveraged shorts, potentially accelerating PI’s downward momentum.

Meanwhile, increased volatility could trigger liquidations on both sides, causing sudden price spikes or crashes.

While the futures listing opens new opportunities, it also raises the stakes. Traders should monitor funding rates and open interest to gauge the strength of directional bets.

Overall, Kraken’s move brings new visibility to Pi Network. But for now, there is a lot of skepticism regarding the altcoin’s direction in the spot market.

The post Pi Network Makes Derivatives Debut as Kraken Lists PI Perpetual Futures appeared first on BeInCrypto.

YZi Labs (formerly Binance Labs) has announced its investment in Plume Network (PLUME). It is a fully integrated modular blockchain designed for the rapid adoption and integration of real-world assets (RWAs).

The investment marks a significant step in advancing blockchain infrastructure that seamlessly bridges traditional finance with decentralized finance (DeFi), further expanding the Real World Asset Finance (RWAfi) ecosystem.

In a press release shared with BeInCrypto, YZi Labs’ Investment Director Max Coniglio emphasized the strategic importance of the investment. He highlighted Plume’s potential to revolutionize RWA adoption.

“At YZi Labs, we invest in projects that harness blockchain technology to create real-world impact and Plume is a prime example—they are bringing real-world assets on-chain to unlock new capital, expand access, and drive adoption. By making RWAs as seamless as any other digital asset, Plume is bridging traditional finance and DeFi, paving the way for broader adoption,” Coniglio told BeInCrypto.

Notably, Plume Network provides an Ethereum Virtual Machine (EVM)-compatible environment that facilitates onboarding a wide range of assets. These include financial instruments, carbon credits, GPUs, and collectibles. Additionally, it seamlessly integrates these assets into a composable RWAfi ecosystem, enhancing their utility and enabling broader financial interactions.

Through its composable ecosystem, Plume enables users to earn rewards, trade, borrow, lend, swap, and engage in market speculation. By integrating real-world assets on-chain, Plume ensures they are as accessible and user-friendly as traditional crypto tokens.

Meanwhile, Chris Yin, co-founder and CEO of Plume, stressed that the platform aims to address the longstanding infrastructure gap that has hindered the widespread adoption of RWAs in the crypto space.

“Although stablecoins, the original RWA, have successfully proven to onboard new users into crypto, the rest of RWAs have struggled to achieve the same traction. With Plume, asset issuers of all kinds can become Web3 builders, seamlessly connecting to our community, ecosystem, and liquidity,” Yin said.

YZi Labs’ investment comes at a time when RWAs have emerged as one of the fastest-growing sectors in crypto. According to the data from DefiLlama, RWA’s total value locked (TVL) reached an all-time high of $9.9 billion last week.

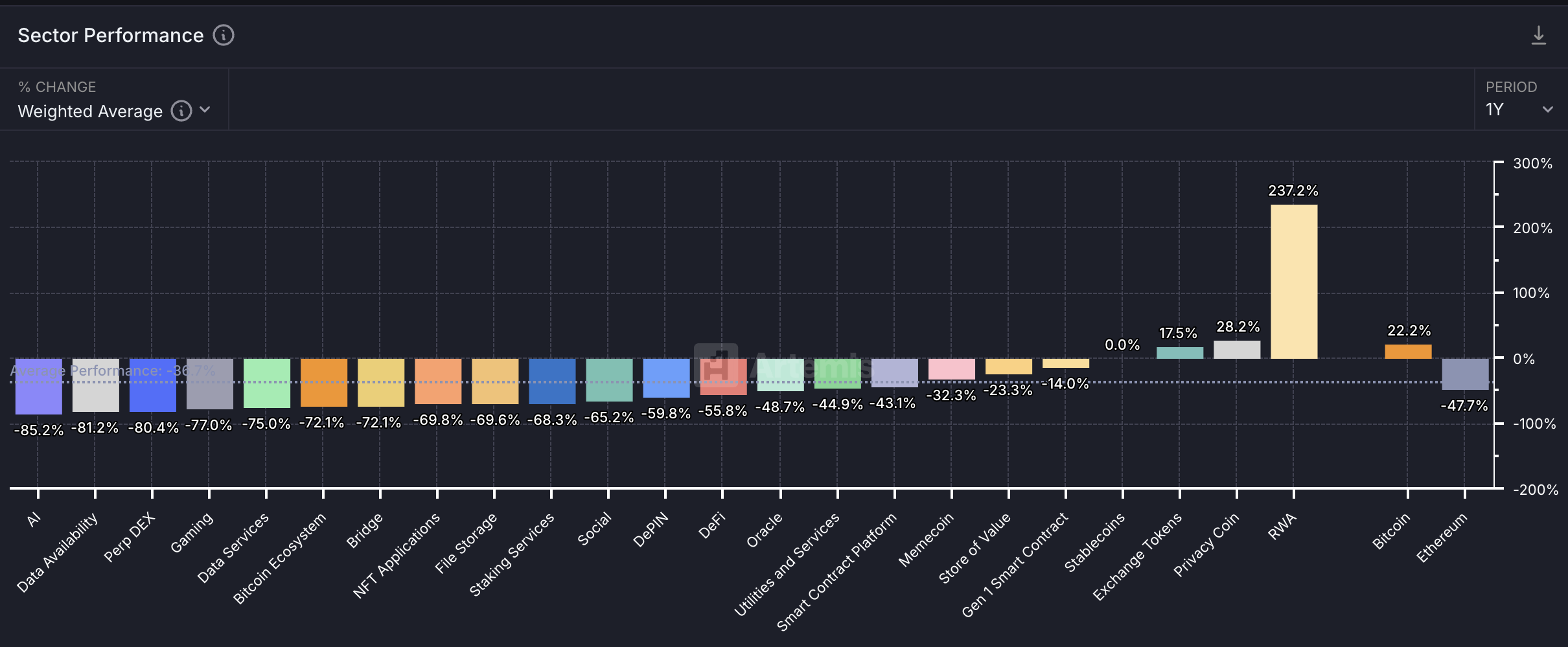

Moreover, the RWA sector has emerged as the best-performing category over the past year, surging by an impressive 237.2%.

In contrast, the broader crypto market has experienced mixed results, with some sectors suffering deep losses. While Bitcoin (BTC) has gained 22.2% and privacy coins have risen by 28.2%, their growth pales in comparison to the explosive rise of real-world assets. Meanwhile, Ethereum (ETH) has dropped by 47.7%, and the decentralized finance (DeFi) sector has struggled even more with a 55.8% decline.

Despite its strong yearly performance, the RWA has faced a recent pullback. Month-to-date (MTD) sector performance data shows a -12.1% decline, suggesting a correction following its rapid growth. Bitcoin and Ethereum also posted losses, indicating a broader market downturn rather than an RWA-specific issue.

The post Plume Network Lands YZi Labs’ Investment Amid Unprecedented RWA Growth appeared first on BeInCrypto.

Crypto trading, often associated with substantial volatility and risks, has created a new class of millionaires and billionaires who have made their fortune through strategic investments. While their success stories dominate headlines, the ways these individuals deploy their digital fortunes reveal a spectrum of ambition, extravagance, and eccentricity.

From extravagant art purchases that defy logic to massive investments in cars and real estate, these individuals are redefining what it means to spend big. Here’s a look at some of the ways crypto millionaires have splashed their digital cash.

TRON founder Justin Sun has grabbed global attention multiple times for his high-profile acquisitions. In November 2024, Sun spent $6.2 million on a banana.

Well, specifically, a banana duct-taped to a wall. He acquired the artwork, titled ‘Comedian’ by Italian artist Maurizio Cattelan, at a Sotheby’s auction in New York.

Originally purchased for 35 cents from Shah Alam, a 74-year-old Bangladeshi immigrant working near Sotheby’s, the banana’s value surged through Cattelan’s conceptual art.

Sun, whose net worth is $8.5 billion according to Forbes, didn’t just buy the piece for show. He later ate the banana during a press conference in Hong Kong.

“Many friends have asked me about the taste of the banana. To be honest, for a banana with such a back story, the taste is naturally different from an ordinary one,” Sun wrote on X.

Moreover, in March 2021, he purchased a Beeple non-fungible token (NFT) for $6 million. Later that year, in November 2021, Sun bought the Alberto Giacometti sculpture Le Nez at Sotheby’s for $78 million.

However, this acquisition became embroiled in a heated legal dispute. In February 2025, Sun sued media mogul David Geffen, alleging his former employee stole and sold the sculpture to Geffen for $65.5 million without his consent. Meanwhile, in April 2025, Geffen’s countersuit labeled Sun’s claims a “sham” tied to crypto market woes.

Sun’s spending extends beyond art. In December 2021, he outbid competitors by paying $28 million for a seat on Blue Origin’s first spaceflight, owned by Jeff Bezos. Despite winning the bid, which benefited space-related charities, scheduling conflicts prevented Sun from participating in the launch.

Carl Runefelt, widely recognized by his online alias Carl Moon, is a Swedish crypto investor and social media influencer. He rose from being a supermarket cashier to a multi-millionaire crypto influencer in Dubai.

Runefelt publicly documents his millionaire crypto lifestyle, sharing it with his 1.5 million followers on X, around 245,000 followers on Instagram, and 360,000 subscribers on YouTube. His social media presence is dominated by displays of luxury, including hypercars, private jets, and high-end watches, making him a poster boy for the “crypto bro” lifestyle.

Among his notable acquisitions is a Bugatti Veyron, which he reportedly purchased for $2 million.

“I quit my supermarket job as a cashier back In November 2018. Now, 3 years later I’m driving a Bugatti Veyron in Dubai. What’s the next car I should buy?” Runefelt wrote in a 2022 post on Instagram.

In January 2024, Runefelt added a $300,000 G-Wagon to his car collection. In September that year, he splurged $800,000 on a Ferrari. Moreover, in February 2025, he expanded his car investments with four more Ferraris worth $4 million.

Runefelt also owns a custom $1 million Jacob & Co. watch and a $140,000 Patek Philippe Nautilus, among other expensive acquisitions. These purchases reflect his affluent lifestyle, fueled by his cryptocurrency success, and form part of his strategy to inspire followers through visible wealth.

Ed Craven is an Australian billionaire and co-founder of Stake.com, a cryptocurrency-based online casino, and Kick, a live-streaming platform. He has a net worth of $2.4 billion, mainly from Stake’s success.

The platform, launched in 2017 with Bijan Tehrani, is now one of the world’s largest offshore crypto casinos. Notably, in 2025, Craven appeared on Forbes’ list of the youngest billionaires. He is one of only two self-made billionaires under 30.

Craven has used his cryptocurrency wealth for lavish yet smart purchases. He owns one of Australia’s most expensive homes on St George’s Road, Toorak, which he purchased for $80 million. He also bought a $38.5 million property on Orrong Road and owns multimillion-dollar homes in Southbank and Mount Macedon.

Craven’s spending also extends to sports. He committed $100 million to rename the Alfa Romeo Formula One team as the “Stake F1 Team Kick Sauber.”

While real estate dominates his portfolio, his sports investments highlight a strategic use of wealth to elevate personal and corporate prestige, aligning with his entrepreneurial vision.

The post Bananas, Bugattis, and Lavish Mansions: How Crypto Millionaires Spend Their Fortunes appeared first on BeInCrypto.