Multisig cold wallets are highly secure but not immune to attacks, as demonstrated by incidents like the February 2025 Bybit hack, emphasizing the need for additional precautions.

Dig Deeper, Invest Smarter

Multisig cold wallets are highly secure but not immune to attacks, as demonstrated by incidents like the February 2025 Bybit hack, emphasizing the need for additional precautions.

XRP has recently struggled to break through key resistance at $2.56, a level that the crypto token’s price has failed to surpass twice this month. This barrier remains the final hurdle on its path to $3.00.

However, despite showing some positive movement, the altcoin’s failure to break this resistance could signal a continued consolidation phase, especially given the current market conditions.

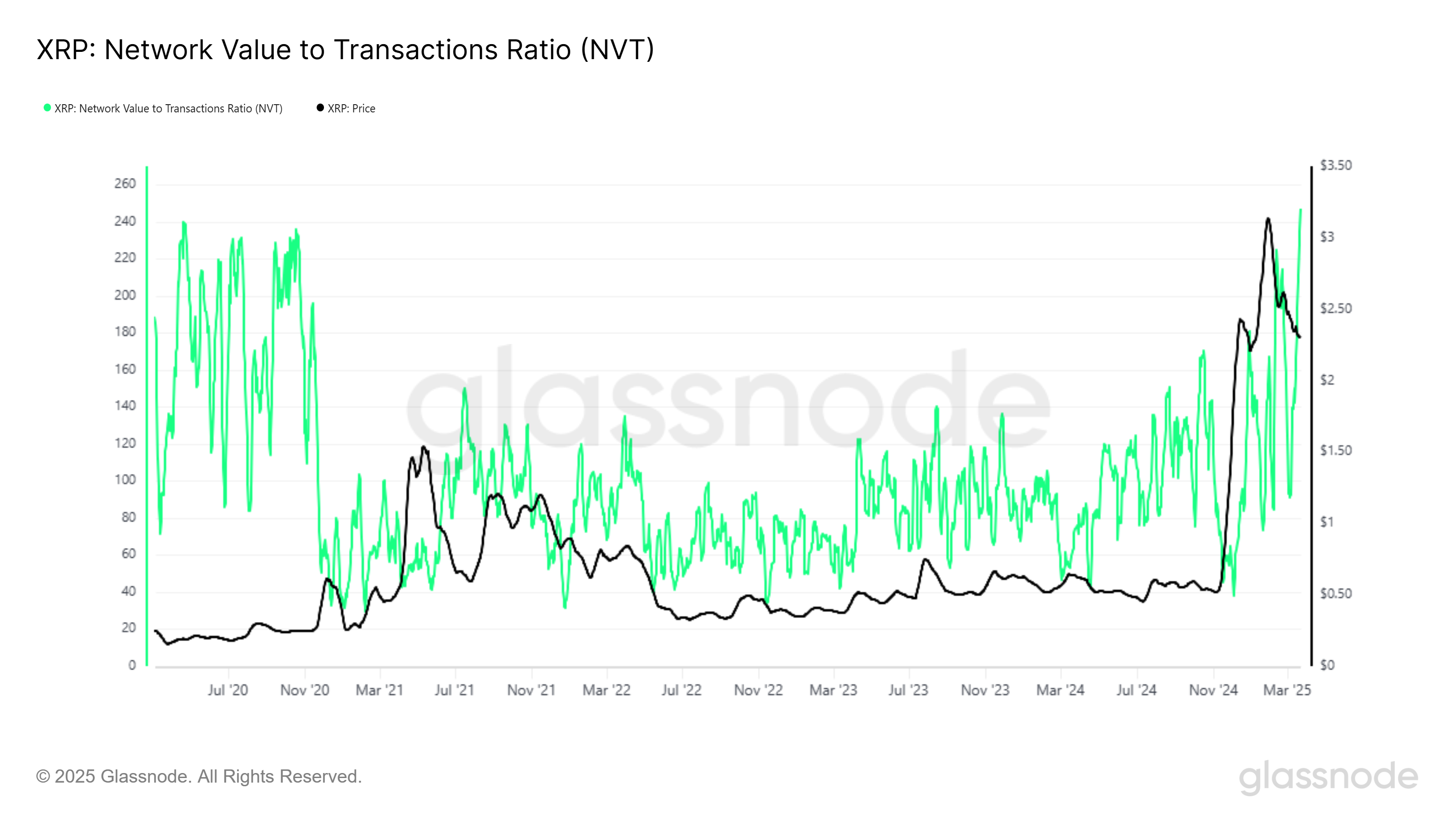

The Network Value to Transaction (NVT) Ratio for XRP has reached a five-year high, a level not seen since January 2020. This metric compares a cryptocurrency’s market capitalization to the volume of transactions conducted on its network.

A high NVT ratio indicates that while investors are bullish, their optimism is not translating into actual growth or usage of the network. This disparity typically signals an overheated market, which often corrects as the excitement cools off.

The current NVT ratio suggests that XRP’s value is outpacing its transaction activity, which is a bearish signal. As the market cools, this imbalance could lead to a price correction, further hindering XRP’s attempts to break through key resistance levels.

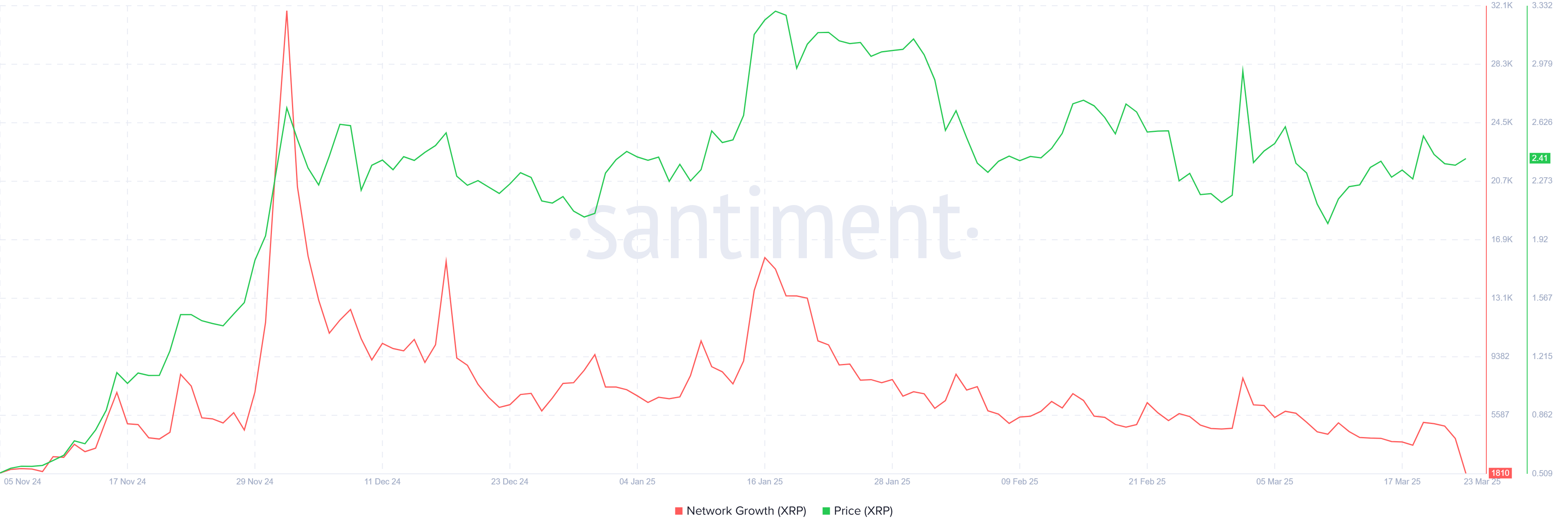

XRP’s macro momentum is also showing signs of strain. The network’s growth is currently at a four-month low, reflecting a decline in the rate at which new addresses are created.

This is a critical metric for assessing a cryptocurrency’s traction in the market, as a growing number of active addresses usually indicates increased adoption.

In XRP’s case, the lack of new address creation suggests that the altcoin is struggling to attract new investors. The lack of incentive for new investors to join the network further dampens XRP’s outlook.

XRP is currently trading at $2.40, just below the resistance of $2.56. This level has proven to be a strong barrier, with XRP failing to breach it twice this month.

As a result, the altcoin is likely to continue consolidating between the $2.27 and $2.56 range. This period of consolidation may persist if the market conditions remain unchanged.

Should bearish conditions worsen, XRP could slide below its support at $2.27. In this case, the price may fall to $2.14 or lower, erasing much of the recent recovery from the $2.00 level.

The continuation of this downward movement would reinforce the bearish outlook.

However, if XRP can breach the $2.56 resistance and flip it into support, the bearish thesis would be invalidated. A successful breakout could push XRP toward $2.95 and, ultimately, the $3.00 mark.

This would require strong support from investors and a more favorable market environment to sustain the upward momentum.

The post XRP New Investor Rate Falls to 4-Month Low, Price Recovery Challenged appeared first on BeInCrypto.

After a year marked by skepticism, JPMorgan analysts are signaling a dramatic shift in their outlook for the cryptocurrency market.…

Unstoppable Domains, a global leader in Web3 digital identity, and XYO, a leader in infrastructure layer for the DEPIN economy, today announced the launch of two groundbreaking top-level domains, .DEPIN and .XYO. Designed to accelerate the growth of the rapidly emerging DePIN (Decentralized Physical Infrastructure Network) sector, these domains offer users verified, onchain identities tied directly to real-world infrastructure and data systems.

The launch coincides with a major inflection point for the DePIN industry, which has reached a total market capitalization of approximately $18.8 billion. These networks reward individuals with cryptocurrency for contributing resources like storage, bandwidth, or location data, enabling decentralized alternatives to traditional infrastructure models.

Markus Levin, Co-founder of XYO, emphasized the shift toward utility-driven crypto models: “The next wave of crypto innovation won’t be driven by hype or complexity — but by real-world utility. With DePIN, blockchain fades into the background while data and decentralized resources become the new gold. .DEPIN and .XYO domains give people a verified onchain identity to actively shape the future of decentralized infrastructure.”

As the first DePIN operating system, XYO already empowers millions to contribute verifiable location data via XYO Nodes. The new .XYO domain will give users a direct gateway to the XYO ecosystem, while .DEPIN provides a broader foundation for builders and contributors across the entire DePIN category.

Sandy Carter, COO of Unstoppable Domains, added: “With .DEPIN and .XYO, we’re making onchain participation intuitive, secure, and personal. These domains allow people to own their identity within the growing decentralized infrastructure stack. Our next step — taking these domains to ICANN — reflects our commitment to bridging the gap between Web2 and Web3 naming systems.”

By moving to take both .DEPIN and .XYO through the ICANN application process, Unstoppable Domains and XYO aim to bring decentralized digital identity into the global domain name system — laying the groundwork for mainstream adoption.

For more information or to claim your domain, visit the Unstoppable Domains official website.

Launched in 2018, Unstoppable Domains is an ICANN-accredited registrar and leading digital identity platform dedicated to onboarding the world onto DNS and Web3. Unstoppable Domains provides Web3 domains minted on the blockchain, empowering individuals with full ownership and complete control over their digital identities, with no renewal fees. Users can replace lengthy alphanumeric crypto wallet addresses with easy-to-remember human-readable domain names, streamlining their interactions with apps, wallets, exchanges, and marketplaces. Recognized by Forbes as one of America’s Best Startup Employers for four consecutive years—2022, 2023, 2024, and 2025—Unstoppable Domains has rapidly grown, boasting over 4.2 million registered domains.

Founded in 2018, XYO is the first DePIN and one of the largest, with over 10 million nodes. XYO collects and validates real-world data, connecting Web3, Web2, and industries like AI and geolocation. Their Proof of Location and Proof of Origin technologies power real-world asset tracking, DePIN solutions, and interactive gaming experiences. XYO created the COIN app to drive network growth, and their XYO token is listed on major exchanges like Coinbase. In addition to the XYO Foundation, they founded XY Labs Inc., the first crypto company in the U.S. to gain SEC approval for a Regulation A offering, allowing both accredited and non-accredited investors. XY Labs is also one of the first to tokenize and list its shares, trading under $XYLB on tZERO ATS, leading the charge in the RWA wave.

The post .DePIN and .XYO Domains Launch to Anchor $18.8B Market and First DePIN Operating System appeared first on BeInCrypto.