This morning, I came across some interesting news about Google’s updated site reputation abuse policies. Apparently, they’ve revised their main guidelines with some fresh updates.

This morning, I came across some interesting news about Google’s updated site reputation abuse policies. Apparently, they’ve revised their main guidelines with some fresh updates.

Related Posts

Coinbase CEO Calls the Bomb Squad for a Surprising Gift

Coinbase CEO Brian Armstrong triggered a bomb squad response this week after receiving a suspicious package at home.

The scare came amid a surge in crime targeting crypto investors and industry billionaires.

Crypto Kidnapping Cases Are Making CEOs Nervous

The Coinbase CEO shared the incident in a post on X (Twitter), reporting what would have otherwise added to the growing list of crimes targeting crypto billionaires.

A delivery to Brian Armstrong’s house alarmed his security guards as its packaging was rather suspicious.

“A white unmarked van pulled up to my house yesterday and dropped off a mysterious package,” Armstrong posted on X.

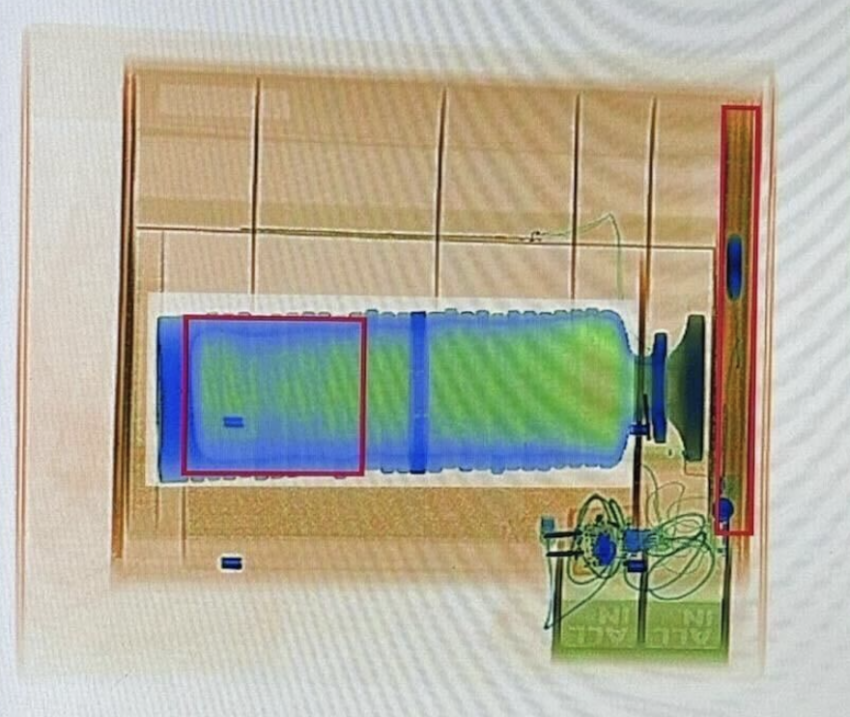

Armstrong was out of town at the time. However, as is expected for deliveries to high-profile individuals, his guards at the gate x-rayed the package, and the results prompted a security alert.

The X-ray reportedly showed that the package contained a battery, wires, and a cylinder, components typical of a bomb.

The means of delivery, a white unmarked van, likely added to the suspicion. What was meant to impress ended up alarming instead.

Based on this, the security team called the bomb squad to investigate, citing questionable packaging complete with electronics.

Given the rise in crypto-related crime, where bad actors target investors and billionaires holding digital assets, this was a legitimate concern from Armstrong’s security detail.

While the foresight was well-informed, the item was ultimately identified as a promotional bottle of tequila from The All-In Podcast, marking an interesting twist.

“In the end they discovered it was a gift from The All-In Podcast guys of their new tequila! I think I will be giving this bottle to my security team for keeping us safe every day,” Armstrong said.

Marketing or Full-Scale Bomb Scare?

Against this backdrop, Armstrong directed interested or prospective buyers to the sender’s website to place orders for a bottle of tequila whose packaging mimics the appearance of an improvised device.

Meanwhile, crypto Twitter reacted with shock, humor, and confusion as the unusual packaging turned heads.

“Genuinely terrifying until I got to the gift part. Glad you’re safe,” one user replied.

Others were more skeptical, calling for an explanation about the use and purpose of the battery and wires.

Are you going to tell us what the battery and wires were doing there?

— Dr. Syed Haider: (@DrSyedHaider) July 12, 2025

While ending on a light note, the incident highlights ongoing safety concerns within the crypto industry. Armstrong’s high-profile status undoubtedly makes him a potential target, and recent events serve as good precedent.

Barely a week ago, BeInCrypto reported that a crypto billionaire in Estonia fought off kidnappers, ultimately biting off one attacker’s finger during the attempted abduction.

Other incidents include the kidnapping of two Russian crypto entrepreneurs in Buenos Aires, with criminals demanding $43,000 in ransom paid in crypto.

The surge in threats, especially in regions like France, has triggered global concern. In Paris, security professionals warned that crypto’s increasing visibility is attracting organized crime at an alarming rate.

Elaborate scams, extortion attempts, and physical threats are potential dangers as the surge in crypto wealth increasingly makes industry leaders possible targets.

The All-In podcast has yet to comment on the packaging choice publicly.

The post Coinbase CEO Calls the Bomb Squad for a Surprising Gift appeared first on BeInCrypto.

XRP Bulls Are Rising Strongly, and FINDMINING Reports Increased User Interest Amid the XRP Trend

Recently, XRP has seen a strong rise. According to CoinDesk, the trading volume of $3 XRP call options has surged, showing that the market is confident that XRP will break through in the short term. Many technical analysts predict that XRP is expected to hit $3 in the short term, and even have a chance to challenge the $5 to $6.5 range by the end of the year.

What is even more exciting is that Ripple has recently officially obtained a national banking license approved by the Office of the Comptroller of the Currency (OCC) in the United States, and has successfully applied for access to the Federal Reserve’s master account. This means that XRP’s compliance path in the United States has become clearer, and mainstream financial institutions will greatly increase their trust in it.Brad Garlinghouse, CEO of Ripple, said:

“We are moving towards a more compliant and transparent banking system, which will greatly enhance the credibility of XRP in global mainstream finance.”

Boosted by the news, XRP prices rose by more than 4% on the day, and market sentiment continued to be high.

FINDMINING:The preferred cloud computing platform for global retail investors

At a time when XRP is at an unprecedented height of popularity, the leading cloud mining platform FINDMINING announced a major update on July 9: the official launch of a “zero threshold” free cloud mining service! New users can receive a $15-$100 bonus upon registration, and can start mining with a minimum of $100. It supports flexible switching between multiple currencies such as BTC, DOGE, and XRP, with daily settlement and withdrawals at any time.

Ibrahim Aydin, CEO of FINDMINING, said at the launch:

“FINDMINING is committed to providing the most profitable, secure and transparent cloud computing contracts for global retail and institutional investors. The strong performance of XRP and Bitcoin has attracted a large number of new users, but the high hardware investment and operation and maintenance costs often discourage retail investors. FINDMINING breaks down barriers through the “zero threshold” model, allowing global retail investors to easily share market dividends, and using bank-level custody to ensure the safety of funds throughout the process.”

FINDMINING claims users can receive daily rewards based on selected contracts.

For more contracts, please visit FINDMINING official website

Core advantages include:

AI computing power scheduling system: intelligently optimizes mining strategies in real time based on market difficulty and currency price fluctuations

AI computing power scheduling system: intelligently optimizes mining strategies in real time based on market difficulty and currency price fluctuations

Multi-node global deployment: Distributed servers cover the world to ensure efficient and stable operation of mining

Multi-node global deployment: Distributed servers cover the world to ensure efficient and stable operation of mining

Green energy drive: Use clean energy to reduce operating costs and make users more profitable

Green energy drive: Use clean energy to reduce operating costs and make users more profitable

Referral reward mechanism: Invite friends to enjoy up to 4.5% extra rebate, multiple benefits

Referral reward mechanism: Invite friends to enjoy up to 4.5% extra rebate, multiple benefits

Transparent and traceable income – all mining income and dividends can be viewed in real time, withdrawn at any time, and viewed on the dashboard at any time

Transparent and traceable income – all mining income and dividends can be viewed in real time, withdrawn at any time, and viewed on the dashboard at any time

XRP users around the world — mining easily without leaving home

Real user feedback also further verifies the popularity and reputation of FINDMINING:

A user from California shared: “The $15 free bonus allowed me to get started at zero cost. I only invested $100 and was able to withdraw stable profits every day. It was much less troublesome than setting up a mining machine myself.”

Another new user from Europe said: “I just switched to XRP mining when XRP skyrocketed. Now I can earn passive income every day through FINDMINING. The withdrawal is fast and the customer service is very professional.”

To encourage users to invite friends, FINDMINING also provides generous referral rewards – direct referrals can earn 3% commission, and indirect referrals can enjoy an additional 1.5% commission, further broadening the income channels.

FINDMINING positions itself as a mining platform for XRP-focused users during this growth phase.

As XRP bullish sentiment continues to heat up, the official approval of Ripple’s banking license and the Federal Reserve’s main account has brought a clear compliance and mainstream path to XRP, greatly enhancing market confidence. FINDMINING has taken advantage of the trend and has become the first choice for countless retail investors around the world to mine XRP and easily earn passive income with its “zero threshold” model and transparent operation.

Register for FINDMINING now to receive a $15 new mining reward, use the mobile app to mine anytime, anywhere, and seize the next wealth of XRP!

Official website: https://findmining.com

Official APP Google Store one-click download

Company email: info@findmining.com

Disclaimer:

This article is for informational purposes only and does not constitute investment advice. All claims are based on statements provided by the company.

The post XRP Bulls Are Rising Strongly, and FINDMINING Reports Increased User Interest Amid the XRP Trend appeared first on BeInCrypto.

Street Style in 2017 vs. 2023

Now that spring is finally here, it’s time to start transitioning your wardrobe from winter into the current season. That…