Ethereum (ETH) is steadily inching close to the psychological $4,000 level, but the milestone remains elusive as selling pressure clouds bullish euphoria.

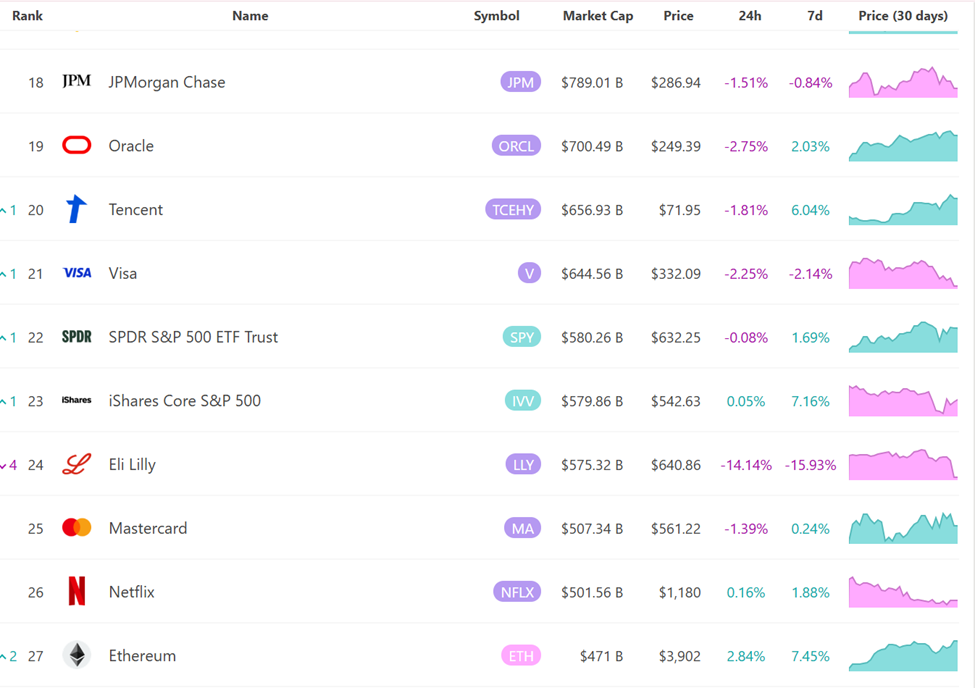

Nevertheless, the recent institutional frenzy for Ethereum has propelled the largest altcoin on market cap metrics to the 27th position among global assets.

Whales Are Selling Ethereum into Strength — But Why Now?

Ethereum’s market capitalization surged to $471 billion, overtaking major global corporations to rank 27th among all assets.

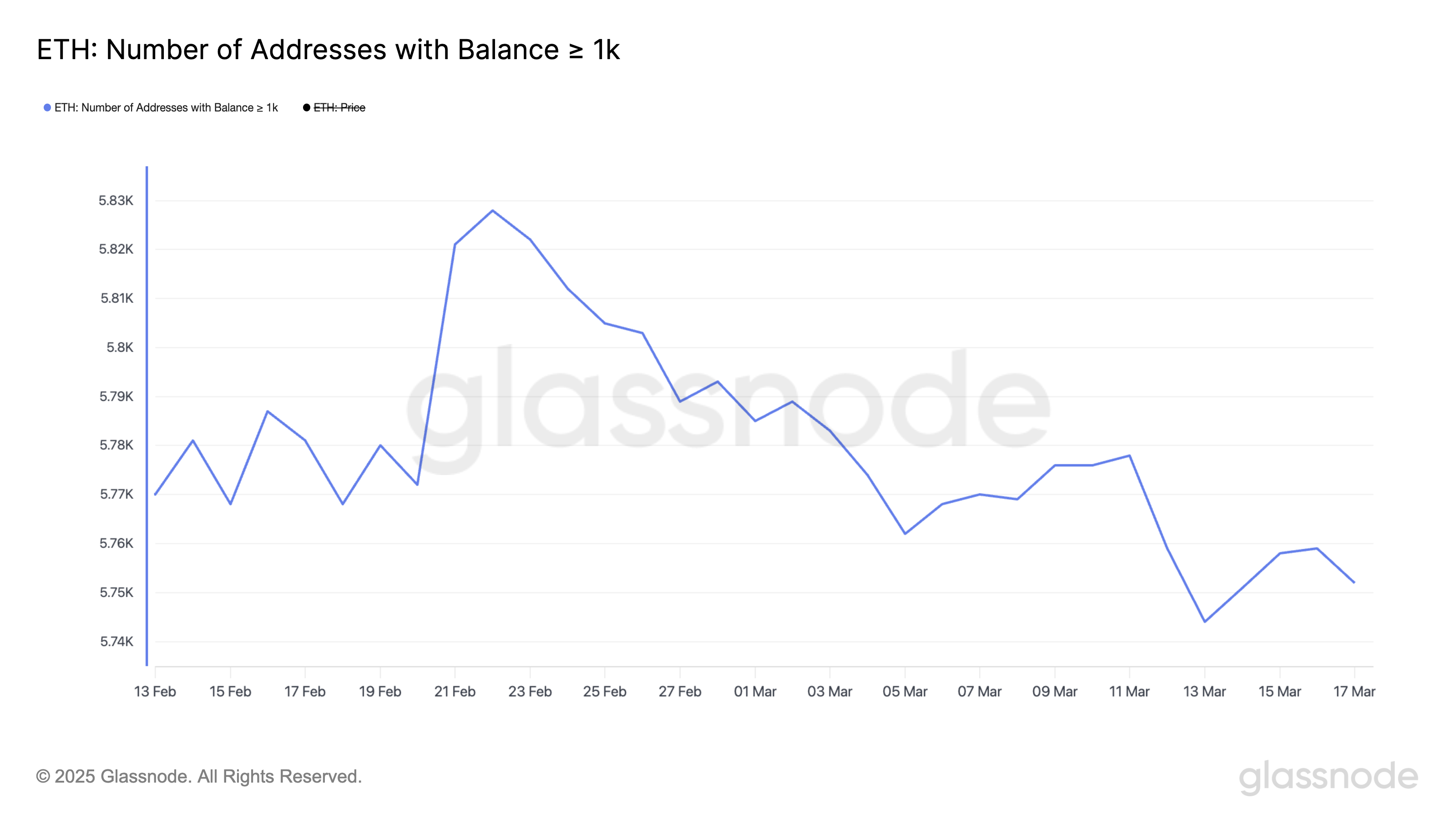

Meanwhile, amidst the surge, there is another force pulling in the opposite direction. Traders, whales, and watchdogs are raising red flags about major sell-offs and alleged market manipulation.

This counteractive force is coming right when ETH appears poised to reclaim its all-time high.

According to analysts and on-chain data, whales are exiting large positions, with the Binance exchange presenting as the common denominator.

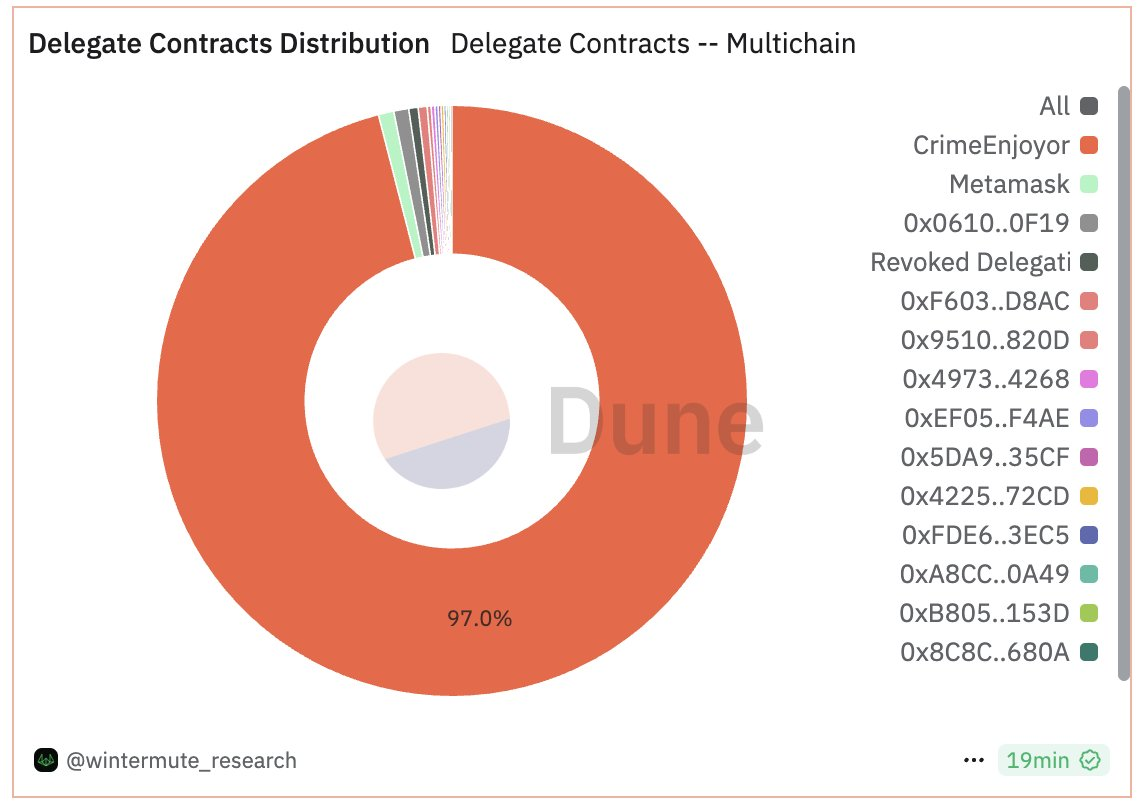

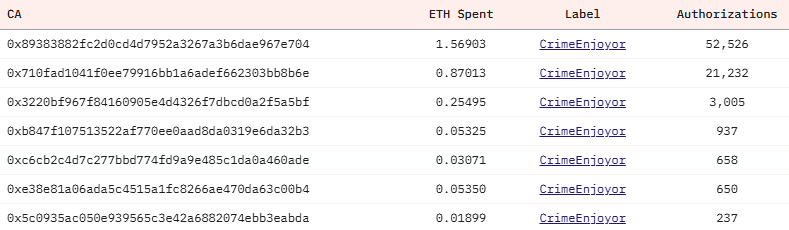

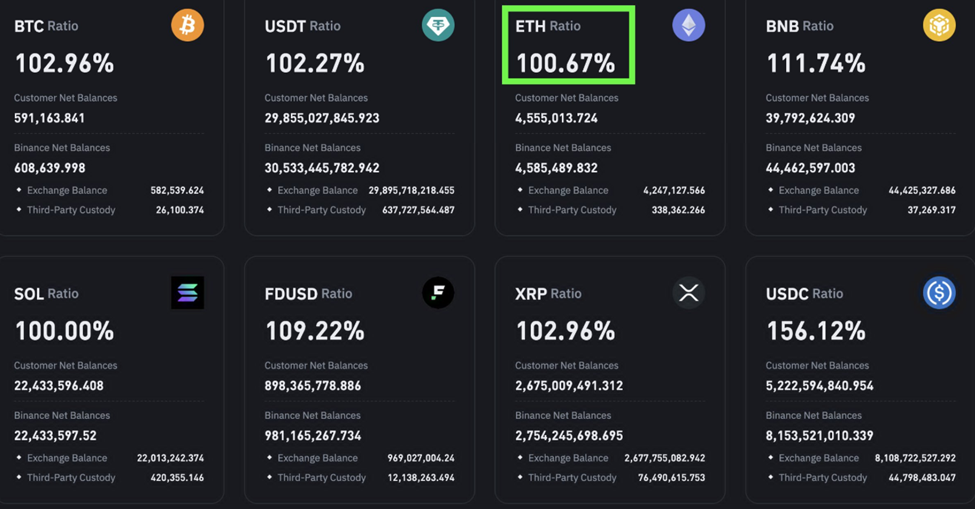

Ted Pillows, an investor and KOL on X (Twitter), alleges that Binance is manipulating the price of Ethereum by dumping millions of ETH into it.

In a follow-up post, Ted claims that Binance is moving ETH to multiple market-making accounts, despite holding no known extra ETH beyond customer deposits.

“I hate to say it, but Binance is manipulating ETH and the entire altcoin market…How can they transfer so much Ethereum to these accounts when they have no extra ETH, only customer funds?” he wrote.

These assertions suggest orchestrated sell pressure may be undercutting institutional demand. Meanwhile, Binance did not immediately respond to BeInCrypto’s request for comment.

The exchange has not publicly responded to the allegations at press time.

Major on-chain events support these concerns, unfolding with the recent Ethereum price climb.

One address, 0x219…C3c4F, sold 3,000 ETH worth $11.74 million, finally breaking even after holding since the 2021 bull run. On-chain analyst Ai reveals that the wallet had accumulated ETH at an average of $3,500 and endured a 70% drawdown before exiting at a $1.24 million profit.

Another whale, dormant for eight months, deposited 1,383 ETH tokens into MEXC, netting $4.32 million. The address still holds 1,384 ETH tokens valued at $5.39 million.

This highlights a broader pattern of profit-taking now that the Ethereum price approaches a psychologically critical level.

Not Everyone Buys the Binance Manipulation Theory

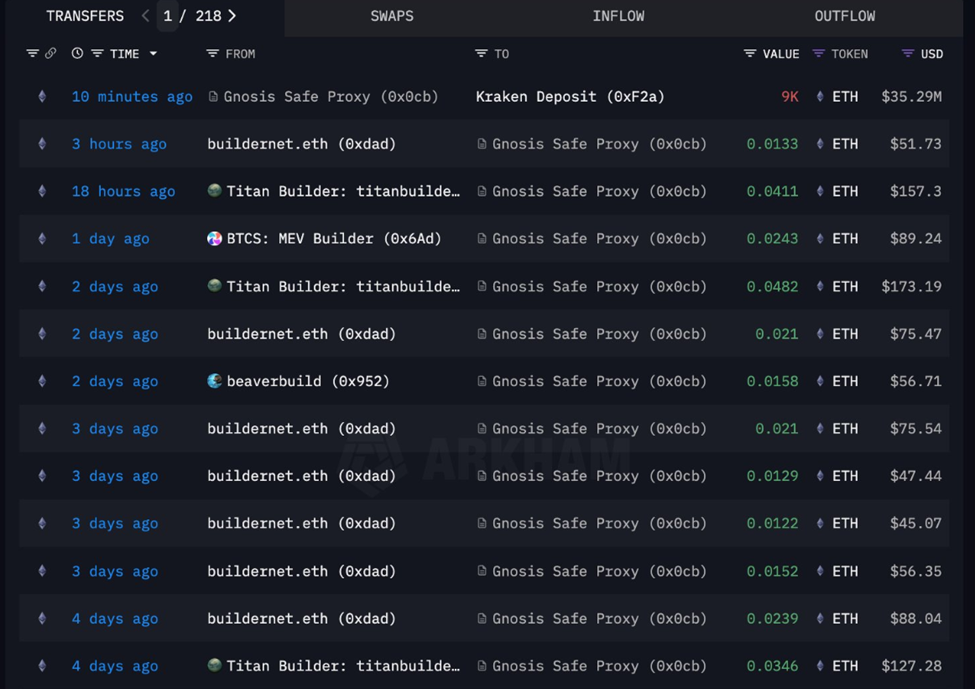

Notwithstanding, the largest red flag may be a multi-signature wallet (0x0cb…E07e4) that recently deposited 9,000 ETH, worth approximately $35 million, to the Kraken exchange.

The address is reportedly linked to high-frequency block builders Beaver Builder and Titan Builder. According to the analyst, it still holds over 18,000 ETH, worth more than $70 million, with most still staked.

On-chain analysts suggest this is not a coincidence, with the selling wave likely reflecting sophisticated players exiting into liquidity. If this is true, they may be using CEXs (centralized exchanges) like Binance and Kraken as exit ramps.

One whale trader has reportedly concluded a fourth major swing trade after offloading 5,000 ETH at $3,895, worth $19.47 million.

It is unclear whether these profits were booked in anticipation of a pullback or as part of larger market coordination.

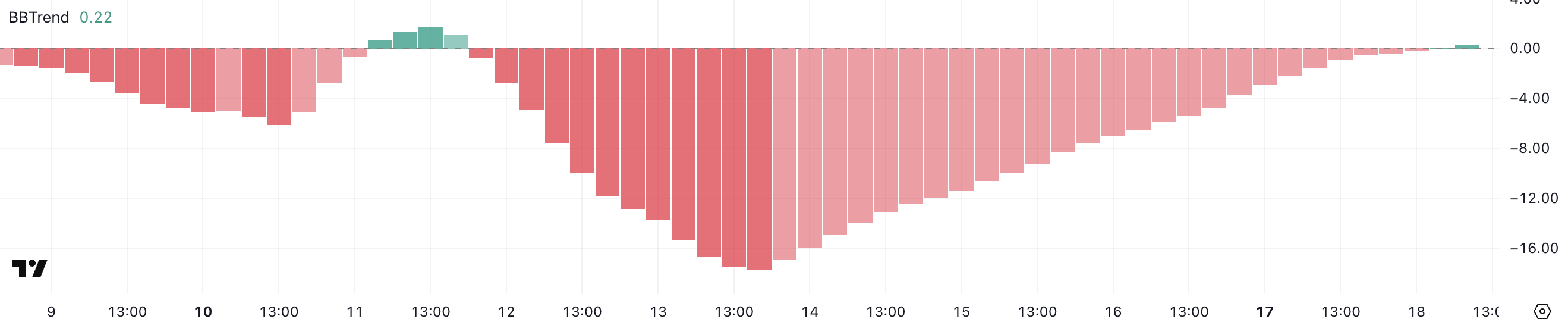

While Ethereum’s technicals remain strong and institutional demand is rising, the shadow of coordinated selling now clouds the rally.

As of this writing, Ethereum was trading for $3,906. But the big question is whether the price is being held down just as it nears the $4,000 milestone.

The post Ethereum Nears $4,000—But Whale Dumping and Binance Allegations Stir Uncertainty appeared first on BeInCrypto.