Bitcoin’s decisive break above the psychological $95,000 barrier has reignited bullish momentum across the crypto market. As market sentiment becomes increasingly positive, crypto whales are buying several differentiating altcoins this week.

Among the top picks are Avalanche (AVAX), Ethereum (ETH), and meme-coin Pepe (PEPE), all of which have seen significant whale inflows this week.

Avalanche (AVAX)

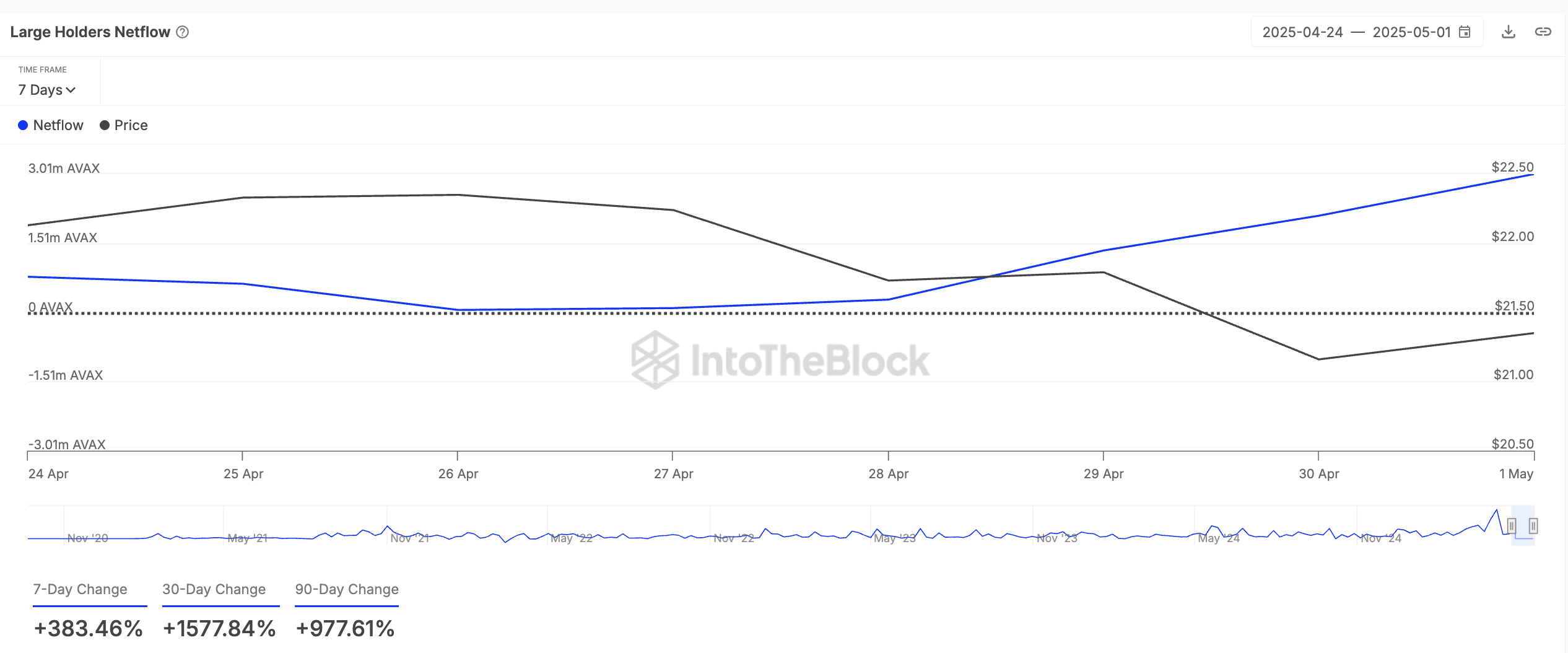

Layer-1 (L1) coin AVAX has seen increased whale attention this week, reflected by the spike in its large holders’ netflow. According to IntoTheBlock, this has rocketed over 380% in the past seven days.

A large holder is a wallet address holding over 0.1% of an asset’s circulating supply. The large holders’ netflow tracks these investors’ buying and selling activity.

When it rises, crypto whales buy more tokens. This bullish signal often prompts retail investors to increase their holdings.

If AVAX’s accumulation trend persists, its price could breach the resistance at $24.28 and rally toward $30.23.

Conversely, if demand wanes, AVAX could fall to $14.66.

Ethereum (ETH)

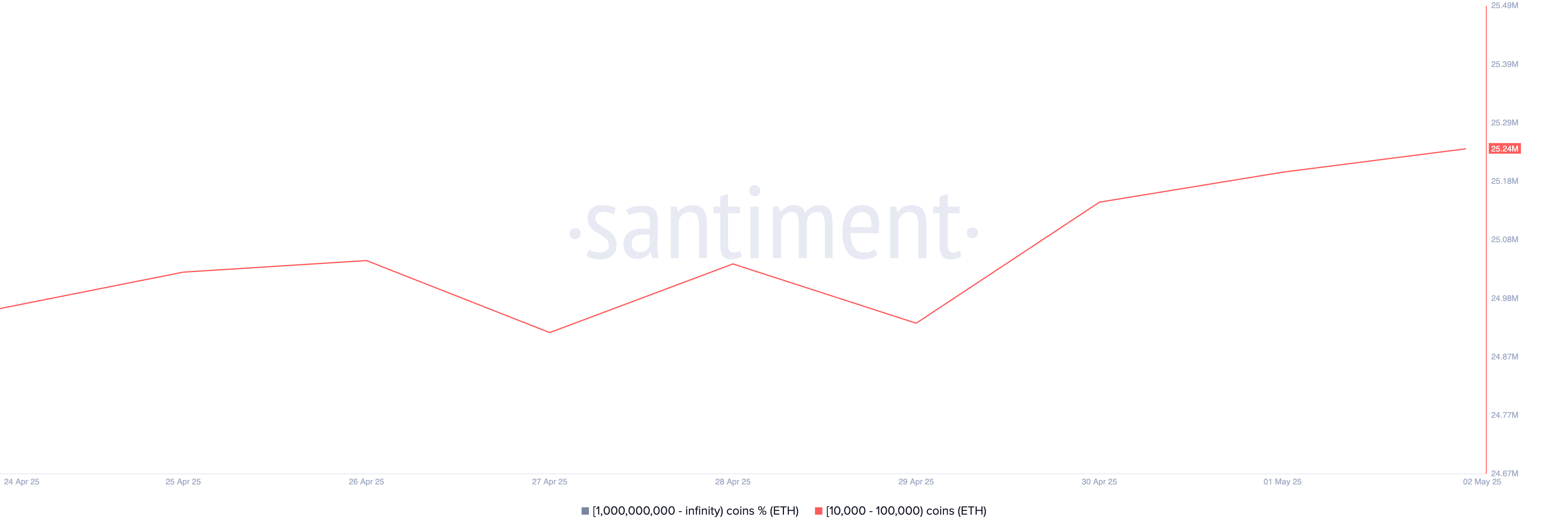

Amid the recent broader market rally, ETH has recorded a modest 3% price uptick in the past seven days, buoyed by steady whale accumulation.

According to Santiment, during that period, whale addresses holding between 10,000 and 100,000 coins have acquired 280,000 ETH valued at over $510 million at current market prices.

As of this writing, this cohort of ETH whales controls 25.24 million ETH, their highest holding in the past month. ETH’s price could be driven above the psychological $2,000 mark if whale accumulation persists.

However, if the bears regain dominance, they could push the coin’s price to $1,733.

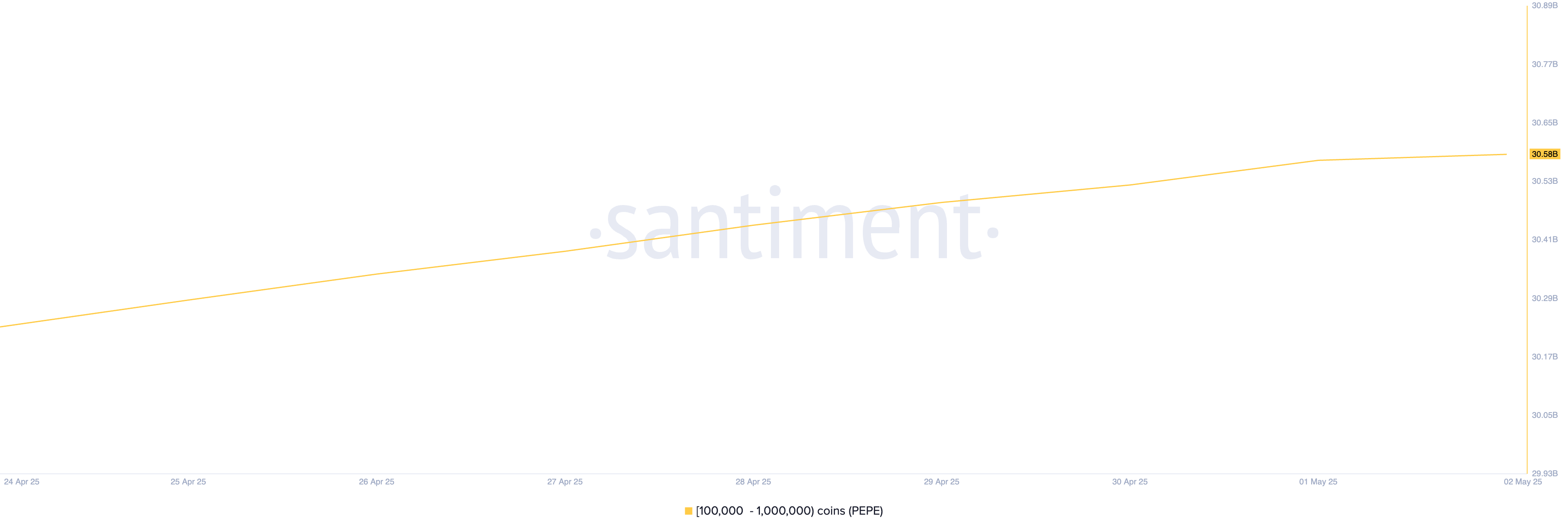

Pepe (PEPE)

Popular meme coin PEPE is another asset that has seen a surge in crypto whale accumulation this week. Per Santiment, wallet addresses that hold between 100,000 and 1 million tokens have bought 350 million PEPE in the past seven days.

At press time, the meme coin trades at $0.0000086. If whale accumulation persists, PEPE could reverse its current downtrend and break above the resistance at $0.0000010.

On the other hand, if sellofs continue, the token’s price could drop to $0.0000052.

The post 3 Altcoins Crypto Whales Bought in the First Week of May 2025 appeared first on BeInCrypto.